Regime Change

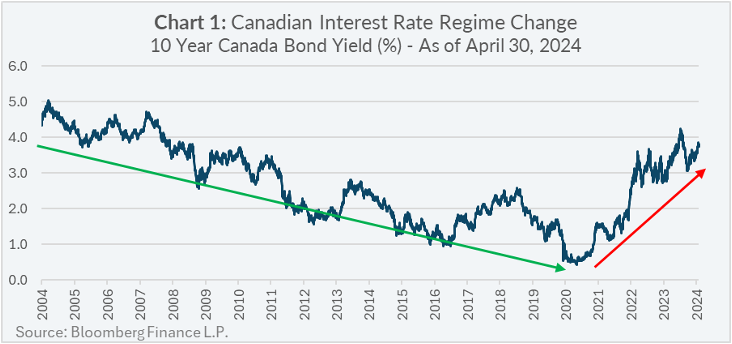

For many years it could have been said that bond investing was “easy money”, as the long-term trend in falling interest rates boosted returns of passive bond indexes above their indicated coupon yields through capital gains – interest rates and bond prices have an inverse relationship (i.e. when interest rates fall, bond prices rise, and vice versa).

Today, the falling interest rate tailwind for bonds is arguably behind us.

Chart 1 illustrates how over the past twenty years, the 10 Year Canada bond yield declined from a high of 5.05% in 2004 to a low of 0.43% in 2020; then subsequently rose to a recent high of 4.12% in 2023, and as of April 30, 2024, was at a level of 3.82%.

Many investors view fixed income as “safe money” within their investment portfolios, and the regime change in the trend of the 10 Year Canada bond yield has had a troubling impact on the performance of the broad Canadian bond market – indicated by the FTSE Canada Universe Bond Index (“the Index”).

As of April 30, 2024, the Index produced negative total returns over the time periods year-to-date (“YTD”), 3-Year annualized, and 5-Year annualized (see Table 1).

Active or Passive

When it comes to choosing the management style of a mutual fund or ETF investment, investors are faced with the decision to either go “active” or “passive”. Passive management refers to investment funds that aim to mimic a reference index (also referred to as a “benchmark”), whereas active management refers to investment strategies that aim to outperform a reference index.

Active management has its fair share of naysayers, who often point out that most active managers don’t beat their passive benchmarks. However, given the recent trend in Canadian interest rates, there is a better opportunity for active managers to outperform the Index.

Limitations of Passive Index Construction

In fixed income, broad market index construction aims to replicate the universe of total bonds outstanding. The specifics of replication methods can be complex; however, a key takeaway is they tend to have an overweight bias to corporate issuers that issue the most debt!

Companies that issue a lot of debt try to optimize their cost of capital over the longest possible time periods, thus they tend to issue bonds at multiple tenors1. For passive broad marked bond indexes, it means their average composition tends to be limited to mid-tenor-high-credit-quality bonds.

A key implication of this positioning is that passive broad market bond indexes also tend to have moderate-to-high levels of duration2.

Active Management in Fixed Income Rising

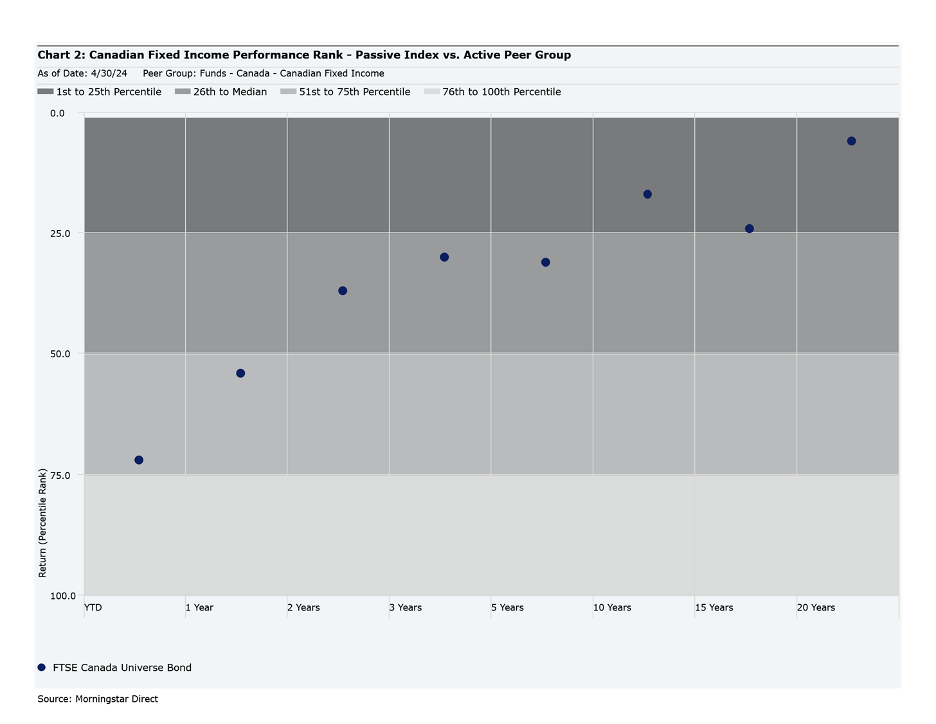

In the recent past it has become increasingly likely that actively managed mutual funds outperformed the passive in Canadian Fixed Income, as indicated by Chart 2.

Chart 2 illustrates how the Index performed over different trailing time periods relative to actively managed mutual funds in the Canadian Fixed Income peer group (by percentile), according to Morningstar.

A key observation is the declining trend of the Index outperformance relative to actively managed Canadian fixed income mutual funds over the past twenty years, and that the Index performed below the 50th percentile over a 1 Year basis, and around the 75th percentile on a YTD basis as of April 30, 20243.

Inflated Volatility in Canadian Interest Rates

The main culprit behind the regime change of the 10 Year Canada bond yield was the increase in Canadian inflation. Inflation is intrinsically linked to Canada bond yields, as investors want to be compensated for future expected inflation that erodes the purchasing power of fixed coupon payments from bonds.

In 2022, Canadian inflation, measured by the Consumer Price Index (“CPI”), peaked at a year-over-year reading of 8.1%. Canadian CPI has declined from its peak in 2022, however it remains elevated at a year-over-year reading of 2.9% as of March 2024, which is above the 2.0% target set by the Bank of Canada.

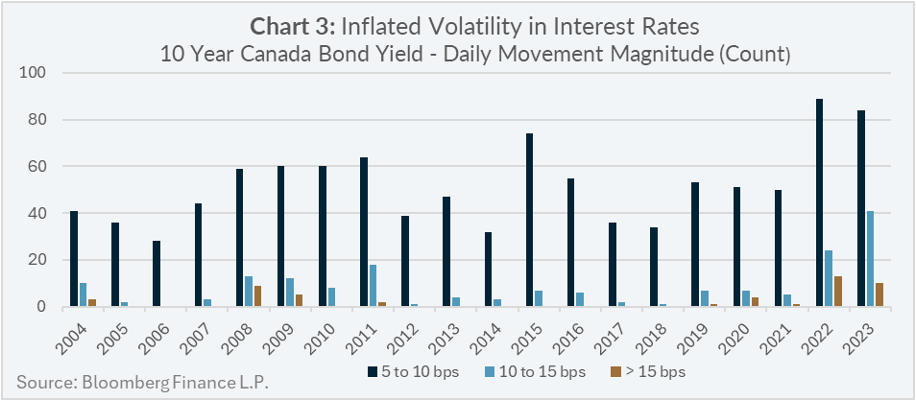

In addition to the directional change of the 10 Year Canada bond yield, its day-to-day volatility has also increased.

Chart 3 illustrates the number of days the 10 Year Canada bond yield moved by different orders of magnitude, where 2022 and 2023 stood out as years with significantly greater volatility compared to the previous eighteen years.

Continued uncertainty over the path of inflation will likely lead continued volatility of Canadian interest rates and performance volatility of the broad Canadian bond market.

The Active Toolbox for Fixed Income

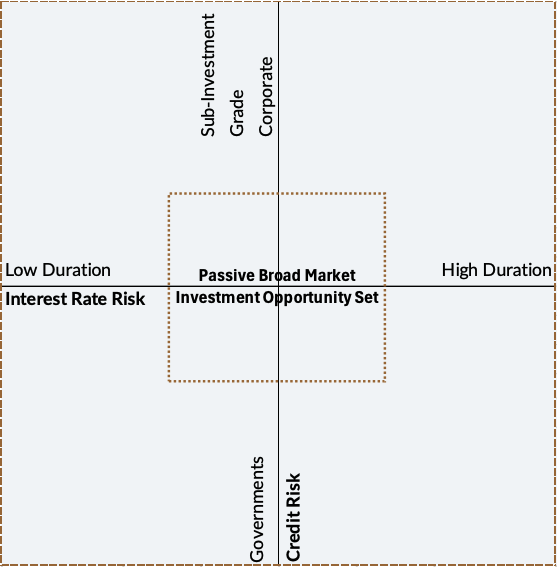

The current environment is conducive for active managers in Canadian Fixed Income to outperform the passive broad market index because active managers generally have greater flexibility to allocate capital across the two primary spectrums of risk that contribute to fixed income returns – 1) interest rate risk; and 2) credit risk.

Chart 4 provides an illustration that gives a general sense of the active manager investment opportunity set in fixed income across the two risk spectrums.

As passive broad market fixed income indexes follow rules-based construction methods, it limits their ability to modify portfolio duration, or allocate to different parts of the credit risk spectrum.

Chart 4: Active Manager Investment Opportunity Set in Fixed Income (For Illustration Purposes Only)

Conclusion

For investors wanting to reduce volatility associated with changing interest rates within their bond portfolio, they may want to consider an active bond manager.

Savvy bond managers are equipped to adapt to environments of greater interest rate volatility by allocating capital to the parts of the interest rate risk spectrum that the bond manager sees as offering better value (i.e. lower-tenor-high-quality securities, given an inverted yield curve4).

Active managers may also add value to bond portfolios by opportunistically allocating the different parts of the credit risk spectrum that could increase portfolio yield and limit additional exposure to interest rate risk.

Lysander Funds Active Management

Lysander Funds offers a suite of actively managed mutual funds and ETFs, including fixed income funds managed by Canso Investment Counsel Ltd. (“Canso”) and Fulcra Asset Management Inc. (“Fulcra”). Both portfolio managers have unconstrained investment mandates with the ability to invest across both spectrums of interest rate risk and credit risk.

The fund at Lysander Funds with the largest assets under management from each of Canso and Fulcra is Lysander-Canso Corporate Value Bond Fund and Lysander-Fulcra Corporate Securities Fund, respectively. Series F units of each fund have demonstrated abilities to outperform passive broad market indexes over multiple timeframes (see Table 1).

To learn more about how bond funds from Lysander Funds can help investors, please visit www.lysanderfunds.com.

FTSE indexes data source: Morningstar Direct

The FTSE Canada All Corporate Bond Index is comprised of investment grade Canadian dollar corporate bonds. The FTSE Canada Universe Bond Index is comprised of Canadian government bonds and investment grade Canadian dollar corporate bonds. The indexes are presented for broad-based market comparison.

- “Tenor” refers to the amount of time to maturity for a bond. ↩︎

- “Duration” is a common bond metric that links bond price sensitivity to changes in interest rates. The greater the duration, the greater the bond price sensitivity to changes in interest rates. The duration of a fixed-coupon bond is correlated with its tenor. ↩︎

- The number of funds in the Canadian Fixed Income peer group in each of the trailing timer periods, as of April 30, 2024, are noted in brackets as follows: YTD (529); 1 Year (514); 2 Years (502); 3 Years (479); 5 Years (431); 10 Years (280); 15 Years (127); 20 Years (76). ↩︎

- “Yield curve inversion” refers to a situation where short-term interest rates are higher than long-term interest rates. ↩︎