Sublime

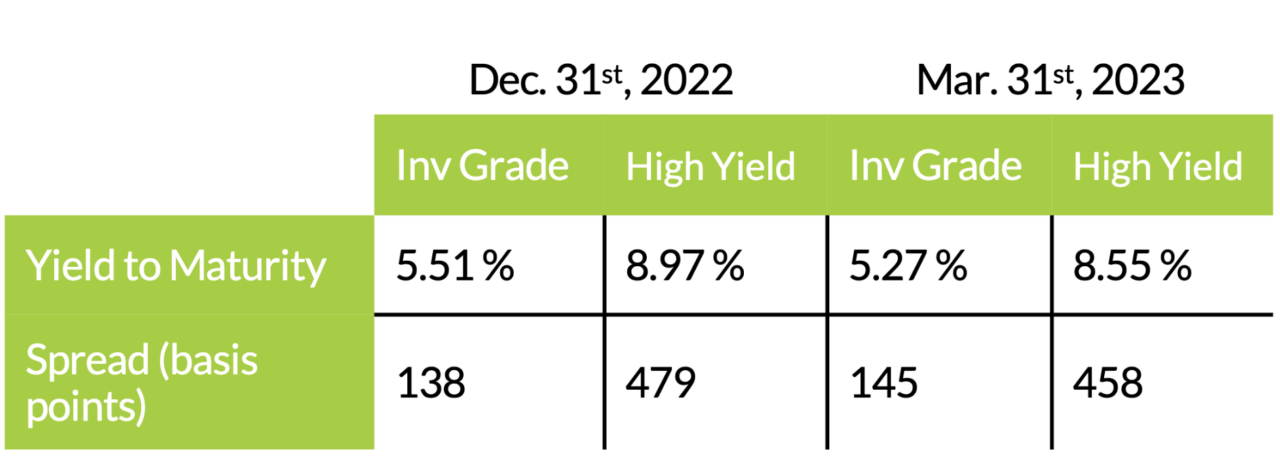

Comparing yields of US corporate bonds (Investment Grade (“IG”) and High Yield (“HY”)) at the end of last year to the end of March 2023, an investor could not be faulted for thinking much had happened in the world. During the first quarter of the year, the yield-to-maturity on IG and HY corporate bonds decreased slightly.

Ironically, the first quarter of 2023 was far from sublime.

Nevertheless, apart from ChatGPT hitting over 100 million users in January, the first two months of the year were subdued compared to the interest rate driven volatility of last year.

The VIX Index, which measures the expected volatility of the S&P 500 Index, averaged 25.6 points last year but didn’t reach this level in 2023 until the second week of March as the result of a couple of bank failures (Silicon Valley Bank (“SVB”) and Signature Bank), a bank liquidation (Silvergate Bank), and a regulator-brokered sale of Credit Suisse to UBS. Nonchalantly highlight this as the market has seemingly brushed off these bank failure worries as the VIX has continued to fall in recent weeks.

Bank failures in the US are not as uncommon as you might think. Since 2007, there have only been three years (2022, 2021, and 2018) where we didn’t see at least one bank fail. However, the failure of SVB was the largest since September 2008 when Washington Mutual, under the guidance of the Federal Deposit Insurance Corporation (FDIC), was acquired by JP Morgan.

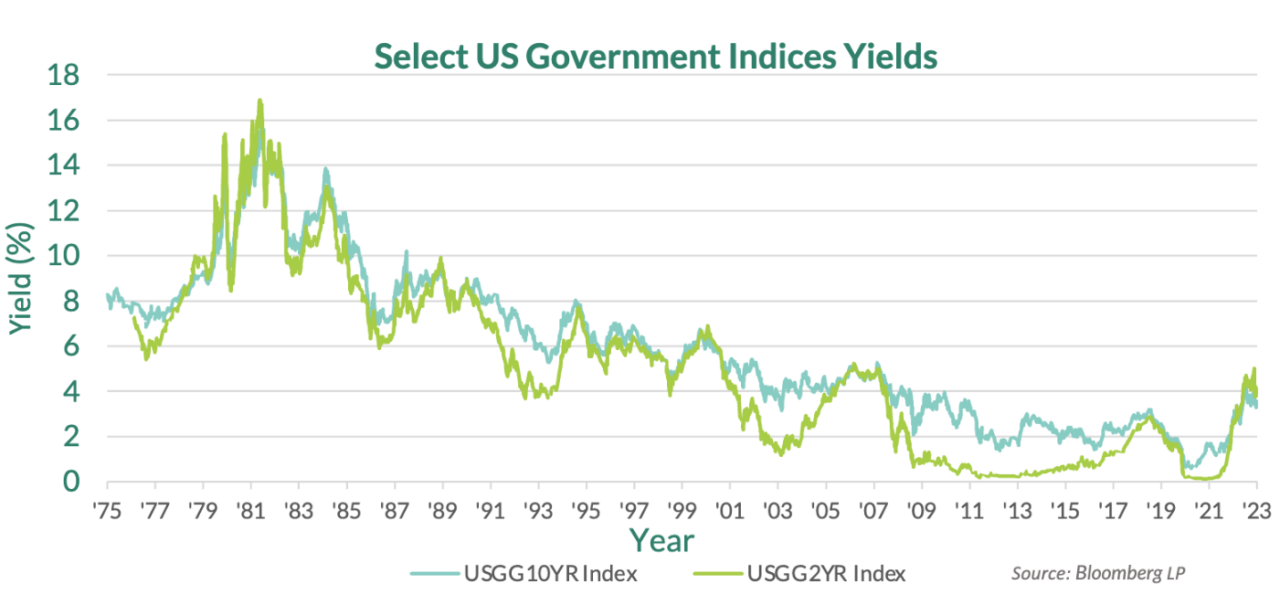

The dramatic rise in interest rates has been blamed as a cause of SVB’s collapse. As many of its large technology-focused corporate depositors made withdrawals to fund layoffs or invest in higher yielding investments, the bank was put in a position to sell its liquid government bonds. Unfortunately, these bonds had dropped in value over the course of the last twelve months due to the rise in interest rates. As confidence rapidly deteriorated, SVB didn’t have the liquidity to fund accelerating withdrawals. Cue the bank run.

To be clear, the SVB collapse arose due to a lack of liquidity and not because of poor credit underwriting. Yes, they were heavily exposed to the technology sector (software, IT, and healthcare, etc.) and had many loans out to these same businesses that held deposits at the bank. While an asset, these loans aren’t as easily marketable as its government bonds and, as a results, could not be relied on to generate the short-term liquidity needed to fund customer withdrawals.

While management could be faulted for not diversifying its customer base, SVB was founded in 1983 and did successfully overcome many tough periods, including the Great Financial Crisis (“GFC”) of 2008/2009. However, management made a critical mistake letting interest rate hedges put in place at the end of 2021 to expire through last year1.

SVB wasn’t the upstart firm that its name might imply but the decision management made in 2022 was rank amateur. While the speed of the interest rate increases last year, the quickest since the early 1980s, caught SVB management by surprise, the impact it is having on the economy is still playing out in eerily silence (i.e. VIX low). Not to suggest that the SVB failure is analogous to New Century Financial’s bankruptcy2 in April 2007 that portended the GFC. However, the low-interest rate in the past three years was driven lower due to the economic shock of the pandemic may shake out more trouble from companies whose business models are built around leverage to generate cashflow.

At the same time, with US Treasury yields at levels not seen since 2006, the opportunity for investing in credit hasn’t been this attractive for almost 20 years. To be sure, risks are plentiful with inflation and geopolitical issues having the ability to completely upset the global apple cart. As serious as these two risks are, however, they are known. The unknown risks, as hard as they are to predict, are what investors need to try to prepare for. While interest rates haven’t been this high for a couple of decades, the speed of this recent rise is unlike anything since the early 1980s.

Due to the unknown impact this “new” level of interest rates will have on the economy, one of the better absolute return places to currently invest, in our opinion, is short duration high quality (investment grade) corporate bonds. The graph below is the yield-to-maturity on investment grade corporate bonds that are due in 1 – 3 years and have a rating between BBB and A. The spikes in yields-to-maturity during the pandemic (and the GFC) were due primarily to risk aversion and the dramatic jump in spreads – unlike today where heightened yields have largely been a result of rising government yields. Unlike the previous two spikes in yield, today it is possible to find lots of bonds to buy.

Another area of the market we find compelling, with attractive total return opportunities, are bonds in companies that historically have been recession resilient businesses that have yet to fully recover from the pandemic. It’s easy to paint a broad brush and write-off those companies that haven’t bounced back to their pre-pandemic performance. Many businesses in different sectors are still being negatively impacted by supply chain challenges. In some cases, this has created an attractive risk-reward investment opportunity. Furthermore, some companies could be forced into a restructuring if their debt loads can’t be serviced with operating cashflows that are taking longer to bounce back and/or the maturities of their loans and bonds are quickly approaching.

As at the end of March 2023, Lysander-Fulcra Corporate Securities Fund (“Fund”) held positions in two companies (approximately 2.7 percent of the Fund) going through a restructuring process. These positions aren’t included in the yield or duration calculation of the Fund but possess the prospect of upside through capital appreciation.