Back to Basics

Bonds are fundamentally simple securities – they are loans, where a lender (“bondholder”) provides cash to a borrower (“bond issuer”) in exchange for regular interest payments (“coupons”), and at the end of the bond’s term the bond issuer returns the initial cash to the bondholder. As bonds are loans that are “securitized”, it gives the bondholder the freedom to sell bonds to other parties at a market price that can go up and down based on market forces such as changes in government bond yields or based on supply and demand dynamics for any given bond issue. Therefore, the total return a bondholder receives from owning a bond is the coupon yield plus any bond price appreciation or depreciation.

While this could be construed as stating the obvious, highlighting basic bond principles can give helpful context on why, unlike any other time in the history of the bond market, that in present times yield matters in a bond portfolio.

Long-Term Investors – Yield Matters

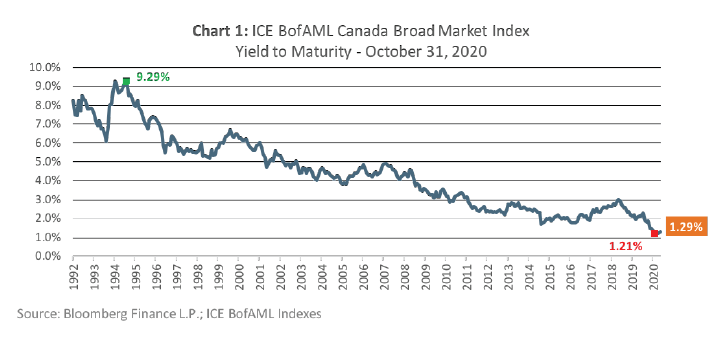

For almost 40-years, bond investors have been riding a tailwind of falling government bond yields – as bond yields and bond prices have an inverse relationship, a declining yield indicates a rising price and vice versa. As illustrated in Chart 1, the Canadian bond market (represented by the ICE BofAML Canada Broad Market Index) yield to maturity went from a high of 9.29% in January 1995, to 1.29% as of October 31, 2020 (its all-time low yield to maturity was 1.21%).

While falling interest rates are generally good news for bondholders, there is in fact a subtle dichotomy at play in terms of what party benefits and what party does not. When interest rates fall, already issued bonds experience price appreciation, which in-turn benefits existing bondholders. However, lower interest rates also mean that newly issued bonds are issued at lower coupon rates, which disadvantages both new and existing bondholders. Again, as there is an inverse relationship between bond yields and bond prices, the opposite is true when interest rates rise – existing bondholders are the ones disadvantaged by price depreciation of existing bonds, while new and existing bondholders benefit from a higher coupon yield from newly issued bonds.

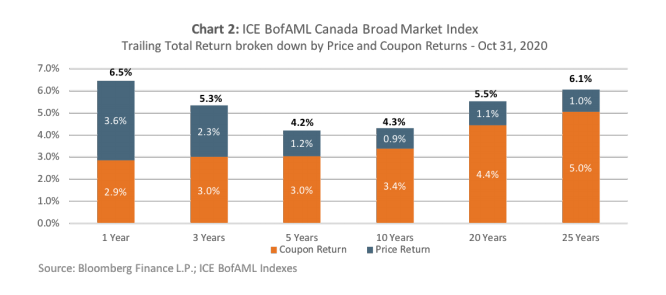

With that in mind, a natural question could be, “what return factor has had the largest impact on bond performance over time?” The answer can be found in Chart 2, which shows the trailing returns of the ICE BofAML Canada Broad Market Index, broken down by price return and the coupon return. The chart shows that over longer periods of time, coupon return has made up the largest component of the Canadian bond market’s total return. In short, for long-term bond investors – yield matters!

Short-Term Investors – Yield Matters

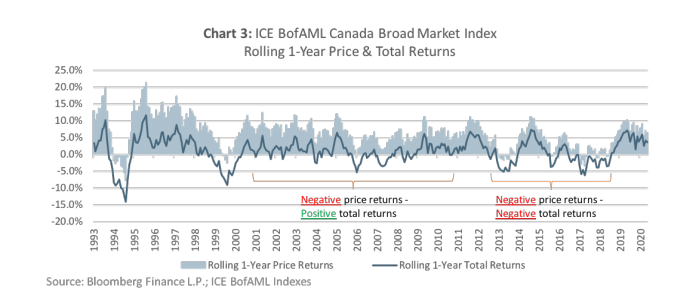

While the price return of bonds has shown to have a smaller impact on the Canadian bond market’s total return over the long-term, the opposite is true in the short-term – where price returns have shown to have a greater impact on the Canadian bond market’s total return, as illustrated in both Chart 2 and Chart 3. Chart 3 shows the rolling 1-year price returns and the rolling 1-year total returns for the ICE BofAML Canada Broad Market Index.

The takeaways from Chart 3 are two-fold. First, over the short-term, bond prices in the Canadian bond market can be volatile, both to the upside and to the downside. Second, it highlights the impact coupon return has had on the short-term total returns of the Canadian bond market over time. As annotated in Chart 3, between the years 2000 and 2010, there were multiple periods where the bond market experienced negative 1-year price returns, while still experiencing positive 1-year total returns. However, over time as the yield of the Canadian bond market declined, similar negative price returns between the years 2013 and 2018 produced negative total returns. In short, for short-term bond investors – yield matters!

Conclusion

The yield of a bond portfolio matters in two major ways:

- It provides the primary source of return to investors over the long-term

- It protects investors against price fluctuations in the short-term

For investors wondering how to increase the yield of their bond portfolio, it could be done in at least two ways:

- Increase term – buy longer dated bonds rather than similar shorter dated bonds

- Decrease credit quality – buy bonds with a higher chance of default

It should be emphasised that while each of these options has the potential to increase bond portfolio yield, they also each come with their own trade-offs in terms of risk and implications for short-term price volatility. Striking the appropriate mix between government bonds, investment grade corporate bonds, high yield corporate bonds and other fixed income securities is something that each investor must determine based on their own circumstances. It is a decision that could also be aided in consultation with a professional Investment Advisor or Portfolio Manager.