Part-Bond-Part-Preferred Share

On July 28th, 2020, the Royal Bank of Canada (“RBC”) introduced the first Limited Recourse Capital Note (“LRCN”) to the Canadian marketplace. Nearly two years later (as of the time of writing), the LRCN market has grown to approximately CAD$19.0 billion, with additional LRCN issuances from Canadian banks, insurance companies and select non-financial issuers.

LRCNs are unique securities as they are effectively preferred shares dressed up as bonds. On one hand, they are officially categorized as bonds and pay interest to investors – this is attractive for issuers as the interest paid to investors is tax-deductible, thus it increases their earnings. There is an added sweetener for Canadian bank issuers, as LRCNs may count towards their Tier-1 equity up to a prescribed limit, which is why LRCNs are also known as Alternative Tier-1 (AT1) capital.

On the other hand, the term, coupon structure and credit quality of LRCNs more resemble that of Canadian preferred shares1. LRCNs are issued with very long maturities (approximately 60-year tenors) and their coupons typically reset every 5 years based on a fixed spread over the prevailing 5-year Government of Canada yield.

In terms of credit quality, LRCNs rank at the same level as preferred shares because in the event of default, the LRCN converts to a preferred share.

Given their relative novelty and hybrid part-bond-part-preferred-share structure, it is no wonder so many find LRCNs confusing. While the full scope of the relationship between LRCNs and other asset classes is complex, here we will highlight some of the high-level value drivers of LRCNs relative to preferred shares and traditional fixed income investments.

1) LRCNs Typically Offer Better Yields than Traditional Bonds

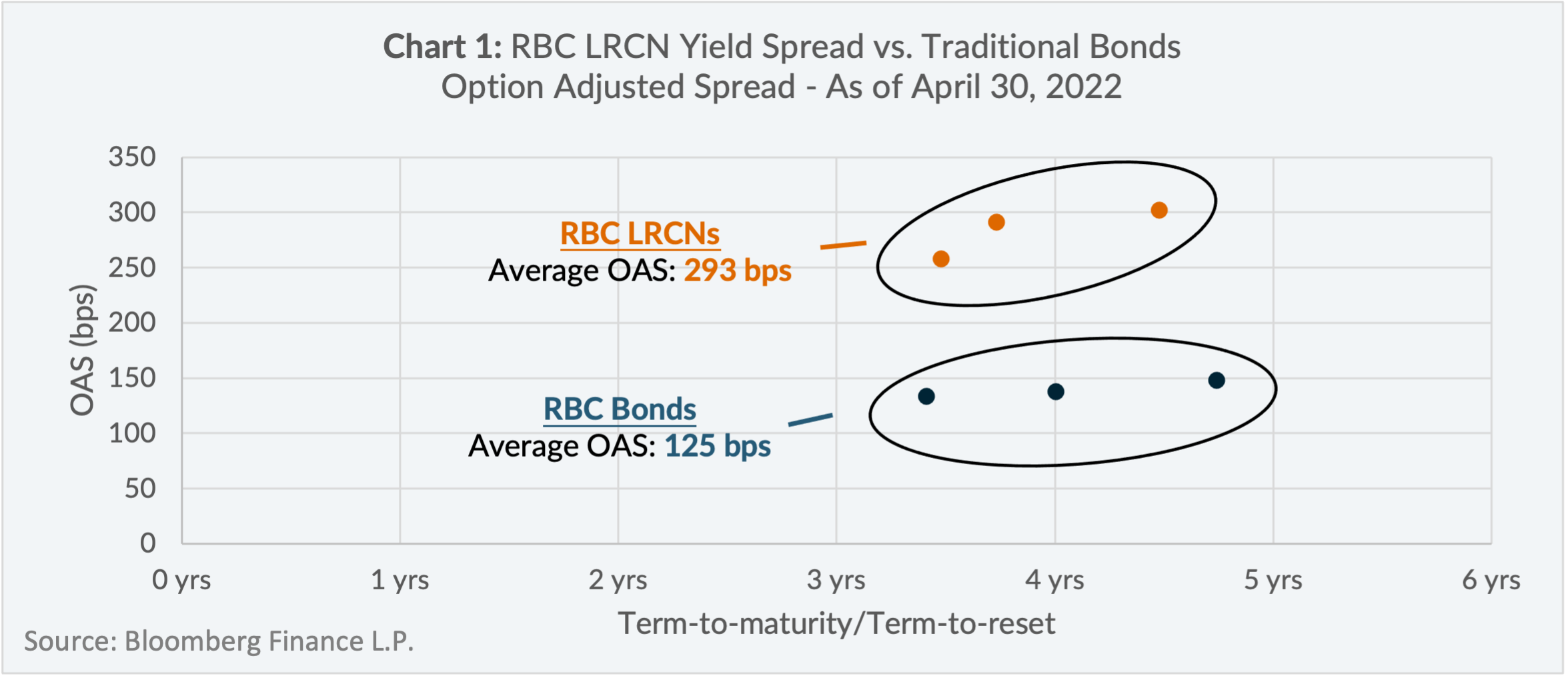

Chart 1 plots the yield spread and term-to-reset of three LRCN issues outstanding from RBC compared to three traditional bonds issued by RBC at comparable tenors2. As Chart 1 shows, the average yield spread advantage of the RBC LRCNs was 168 bps above the traditional bonds issued by RBC.

2) How Volatile are LRCNs Relative to Preferred Shares? Their Reset Spreads May Offer a Clue

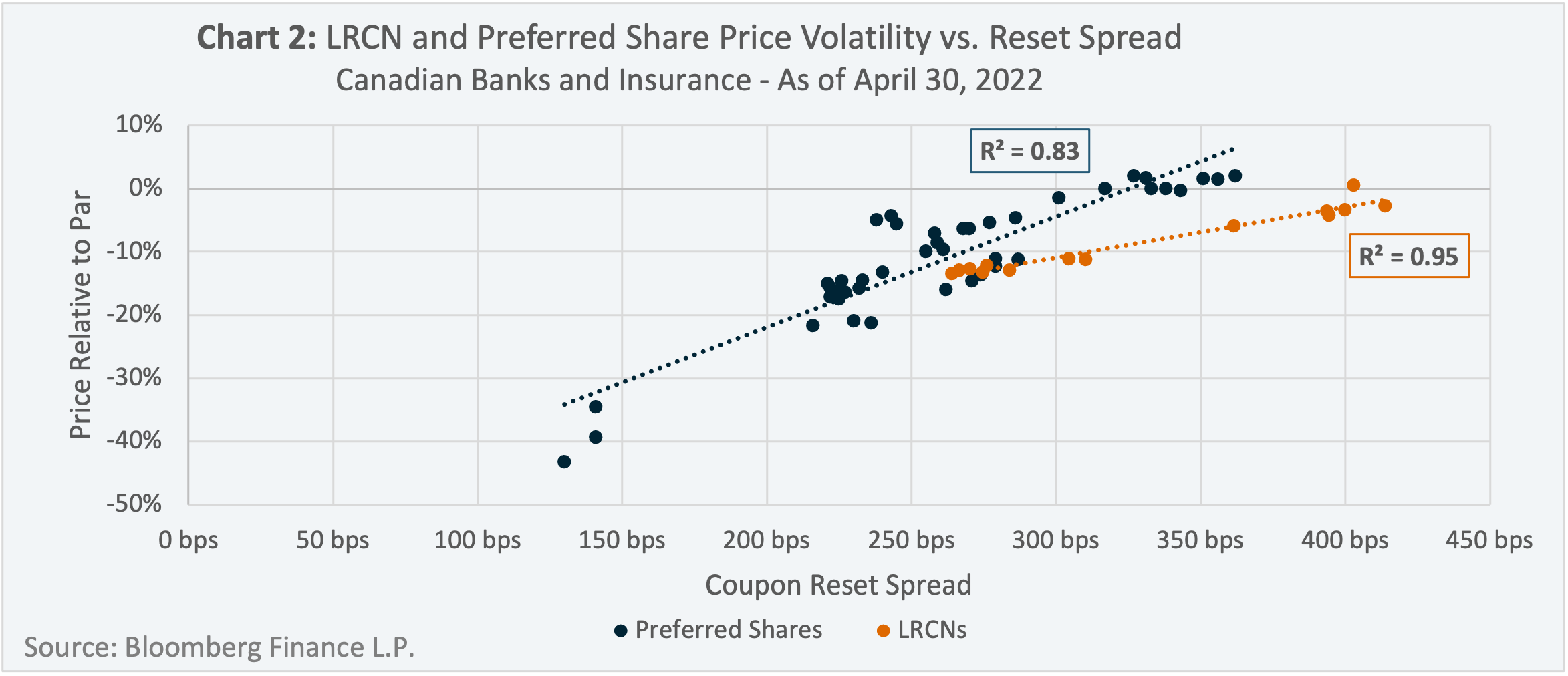

Chart 2 plots the outstanding LRCN and preferred share issues from the Big Six Canadian banks3, Manulife Financial and Great-West Life, based on their price relative to par (y-axis) and coupon reset spread (x-axis)4.

A key takeaway from Chart 2 is that a higher reset spread generally indicates lower volatility, while a lower reset spread generally indicates higher volatility. This relationship is supported by the R2 values of 0.95 and 0.83 for the LRCN and preferred share data sets, respectively5.

3) Other Factors that Differentiate LRCNs and Preferred Shares

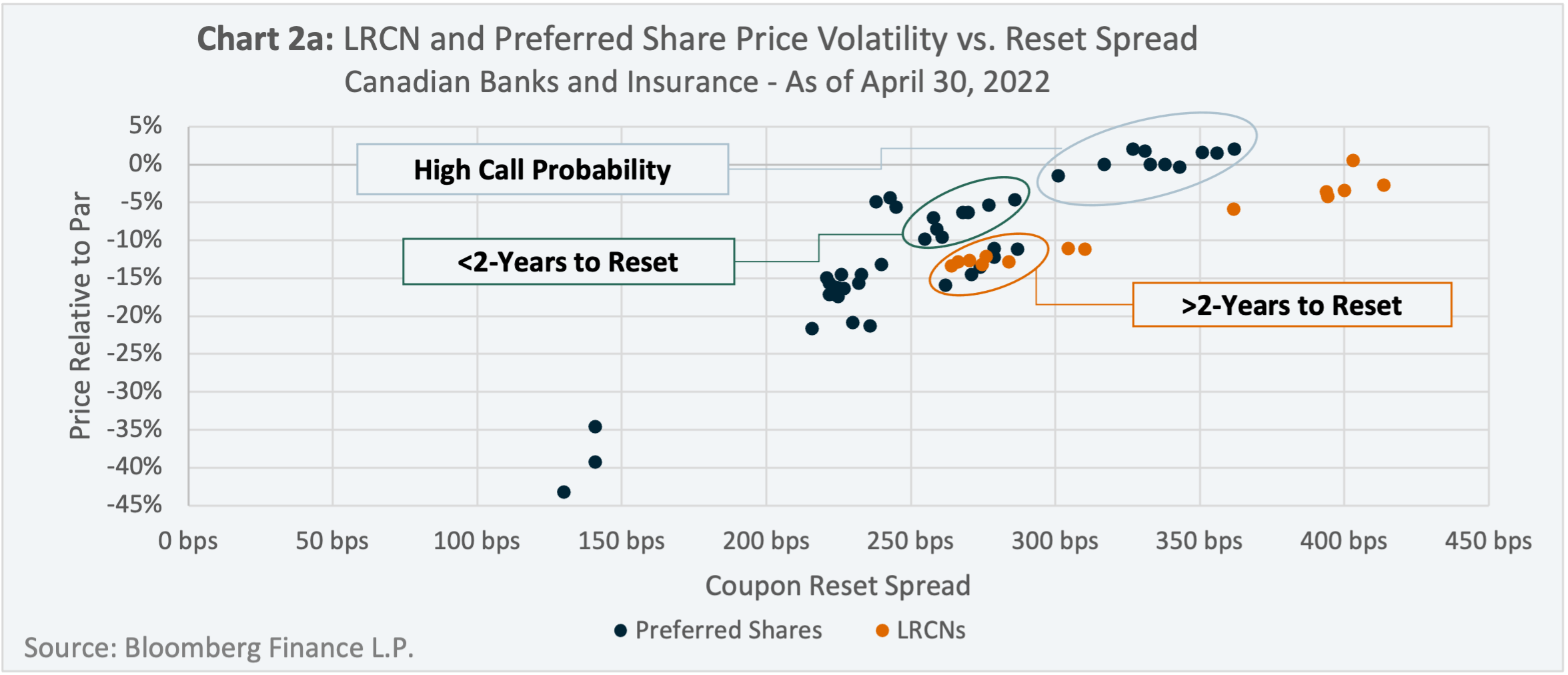

Chart 2a plots the same data points as Chart 2, however it has been annotated to highlight other factors that appear to influence the prices of LRCNs and preferred shares.

The cluster annotated as “High Call Probability” is comprised of preferred shares that are trading above or near their par values and thus are likely to be called at their next call dates – the likely reason for this is their high reset spreads.

Since LRCNs have the same coupon structure as preferred shares, issuers can benefit from calling a preferred share with a high reset spread and issuing an LRCN with a lower reset spread in its place – this could save the issuer money in two ways:

- reduced financing costs courtesy of the lower reset spread and

- tax-deductible interest payments for LRCNs vs. the non-tax-deductible dividend payments of preferred shares.

The cluster annotated as “<2-Years to Reset” is comprised of preferred shares with similar reset spreads (250-300bps) and reset dates less than two years from April 30, 2022. The cluster annotated as “>2-Years to Reset” are LRCNs and preferred shares with similar reset spreads (250-300bps) and reset dates greater than two years from April 30, 2022.

A key observation between the two clusters is that the <2-Years to Reset cluster is trading at higher prices relative to the >2-Years to Reset cluster, when both clusters have similar reset spreads and credit quality.

One explanation for this could be the recent rising interest rate environment. Preferred shares with shorter time horizons to coupon reset would sooner benefit from having their coupons reset at higher yields, which would justify higher prices over preferred shares with longer time horizons to coupon reset.

Another key observation is that the >2-Years to Reset cluster is tightly distributed in terms of the underlying securities prices relative to par and coupon reset spreads. Said differently, LRCNs and preferred shares appear to have identical volatility profiles, if they have similar coupon reset spreads, terms-to-reset and credit quality.

Conclusion

LRCNs are still relatively new securities whose market continues to develop in size and investor comprehension.

Three factors that appear to differentiate the value of LRCNs, preferred shares and traditional bonds are as follows:

- LRCNs typically offer greater yields spread compared to comparable traditional bonds.

- LRCNs and preferred shares of similar credit quality are not created equal – those with lower reset spreads have tended to have greater price volatility, while those with higher reset spreads have tended to have lower price volatility.

- The term-to-reset of LRCNs and preferred shares could affect their prices depending on the environment – in a rising interest rate environment, the prices of LRCNs and preferred shares trading closer to their reset dates might benefit more relative to those with longer reset dates.

It should be emphasised that the characteristics of the asset classes discussed in this paper may change depending on the prevailing market environment, and any decision by an investor to invest in LRCNs, preferred shares or traditional bonds should be made in consultation with a professional investment advisor.

3 The Big Six Canadian banks are: Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Royal Bank of Canada, Toronto-Dominion Bank, and National Bank.

4This sample set was used because these issuers share similar credit quality.

5 R2 is also known as the coefficient of determination, which is a statistical measurement that examines how differences in one variable can be explained by the difference in a second variable, when predicting the outcome of a given event (Investopedia: https://www.investopedia.com/terms/c/coefficient-of-determination.asp#:~:text=The%20coefficient%20of%20determination%20is,outcome%20of%20a%20given%20event.).