The New Normal

The “new normal” is a term that has been used to describe the post-2008 financial crisis era, in part because economic policies that were uncommon, such as zero interest rate policy and quantitative easing, suddenly became commonplace. The goal of these policies was to provide ample liquidity to the marketplace by lowering interest rates to facilitate growth in the overall economy. As the thinking goes, if a company can borrow money cheap enough, it could increase its spending on capital projects to grow its core business and in-turn stimulate economic growth. However, the availability of cheap capital does not guarantee that the money will be put towards capital projects, and cheap capital also makes another type of investment more attractive to companies – their stock!

The Great Stock Buyback Frenzy

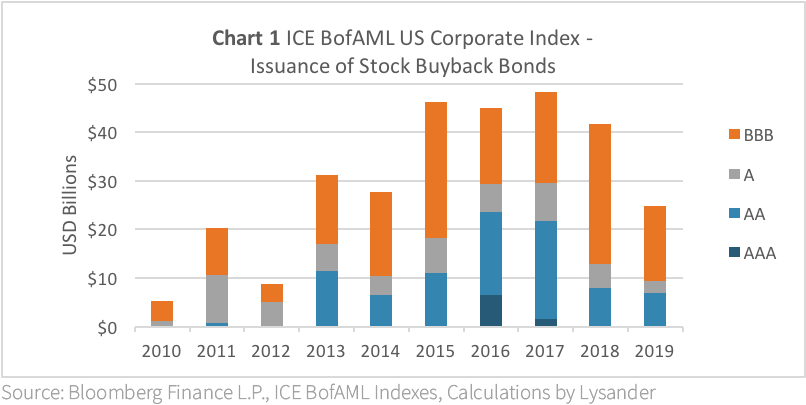

Over the past decade, US corporations have been on a stock buyback frenzy in part financed with “buyback debt” – debt issued by companies for the sole purpose of buying back their stock. This buyback debt has increasingly been incorporated in the ICE BofAML US Corporate Index (“US corporate bond index”). In total over the past decade approximately USD$299 billion of buyback debt was issued and included in the US corporate bond index, with over half of the issuance ($156 billion) rated BBB (Chart 1).

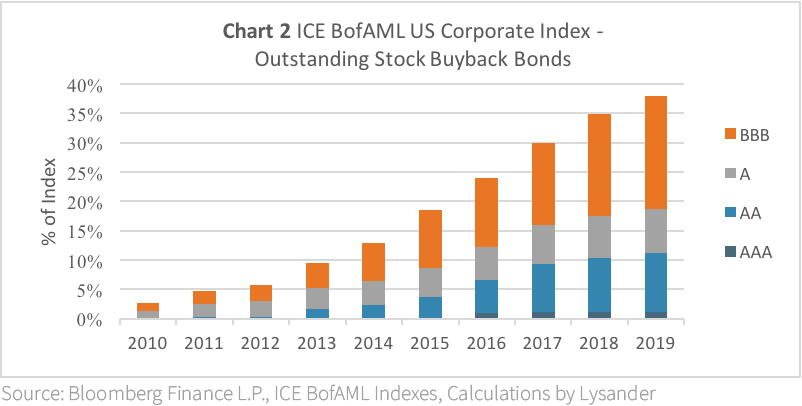

The effect of this issuance on the overall index has been profound. Buyback debt issuance went from representing only 2.7% of the US corporate bond index in 2010 to 37.9% in 2019, with the majority of the outstanding issuance in 2019 (19.3%) being rated BBB (Chart 2).

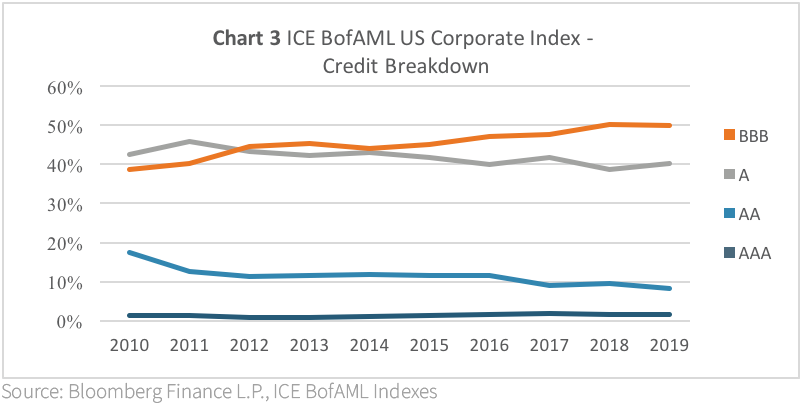

Buyback debt issuance has also had a knock-on effect to the overall credit quality of the US corporate bond index, which has deteriorated over the past decade. The BBB rated composition of the index went from representing 35% of the index in 2010 to 50% in 2019 (Chart 3).

Under the Hood of Stock Buybacks

Stock buybacks are a tool used to return cash to shareholders that companies can’t reasonably reinvest back into their businesses and are typically financed with the free cash flow generated from their operating businesses. When stock buybacks are financed from issuing debt, it can be problematic because it does not support the growth of the operating business, and the added debt burden has to be serviced through regular interest payments and the original principal must be repaid either from a later debt financing or from accumulated free cash flow.

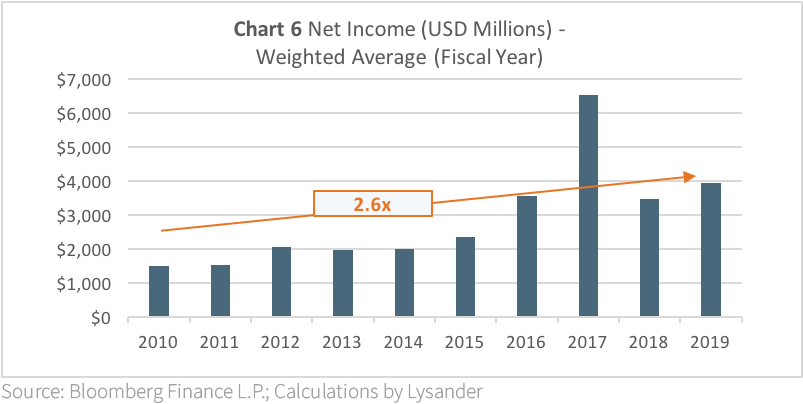

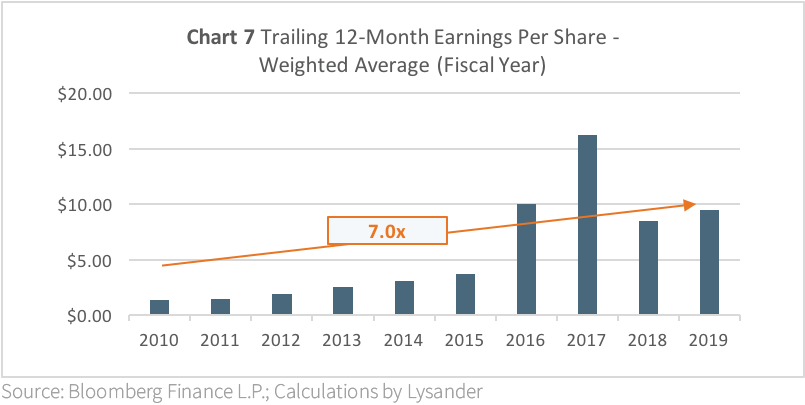

As investors tend to focus on earnings per share as a gauge of a company’s earnings growth rather than net income on the income statement, it incentivises companies to pursue stock buybacks to increase earnings per share because it generally supports a higher stock price. Essentially, issuing buyback debt can be viewed as potentially sacrificing the long-term health of a business to benefit shareholders in the short-term.

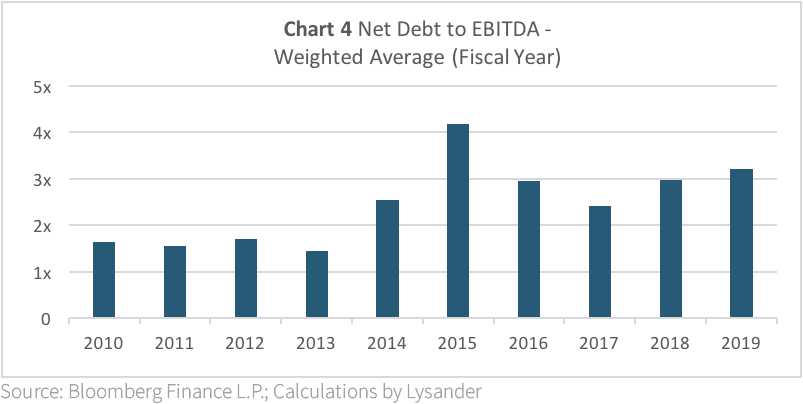

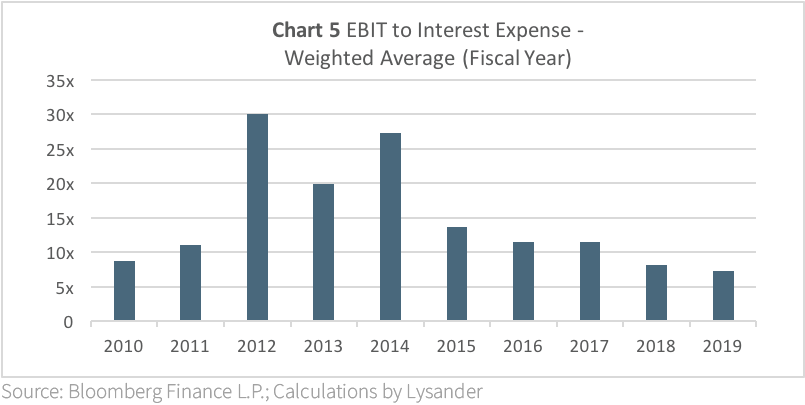

To help illustrate the potential risk of buyback debt in the US corporate bond index, refer to Chart 4 and Chart 5 which shows the weighted average net debt to EBITDA and weighted average EBIT to Interest Expense of the top 10 BBB rated issuers in the US corporate bond index, respectively.1 The key takeaways are over the past decade, the amount of corporate debt relative to profitability has increased (Chart 4), and the level of profitability relative to the level of interest payments to service the debt has decreased (Chart 5). Both trends suggest a general decline in financial health.

Furthermore, to illustrate the incentive that companies have to pursue stock buybacks, refer to Chart 6 and Chart 7 which shows the weighted average net income and the weighted average trailing 12-month earnings per share of the top 10 BBB rated issuers in the US corporate bond index, respectively. The key takeaways here are that over the past decade while net income increased by 2.6x, earnings per share increased by 7x – the power of stock buybacks in action!

Conclusion

Over the past decade corporate stock buyback debt issuance has swelled, and a significant amount of it is reflected in the US corporate bond index, especially in the BBB rating category. As we get later in the current market cycle, investors should be more skeptical of corporate earnings per share growth and whether it is being driven from earnings growth from the core business or from stock buybacks reducing the number of shares outstanding. The extent to which stock buyback debt issuance affects companies’ long-term health should also be considered. The risk of stock buyback debt issuance can be likened to a game of musical chairs, where buyback debt issuance represents the players and market liquidity represents the number of chairs; if chairs are taken away and the number of players keeps growing, it could get ugly when everyone tries to find a seat when the music stops playing.

1 The weighted average top 10 BBB rated issuers in the ICE BofAML US Corporate Index were as of December 31, 2019, and comprised of: Charter Communications Inc. (29.4%), Union Pacific Corp. (19.0%), AbbVie Inc. (16.7%), Starbucks Corp. (6.6%), ViacomCBS Inc. (6.4%), Biogen Inc. (5.4%), FedEx Corp. (4.7%), Northrop Grumman Corp. (4.5%), VMware Inc. (3.6%), Discovery Communications Inc. (3.5%).