Money in Motion

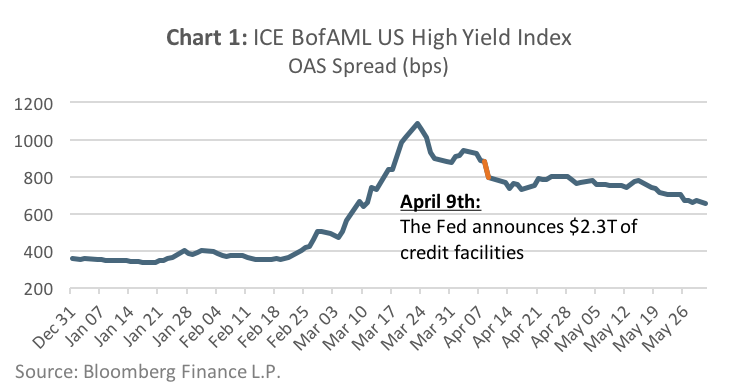

It is a good time for active bond managers to add value in 2020. The US high yield bond market1 quickly shifted from a borrower’s market to a lender’s market, as the OAS spread widened by 749bps from near record low levels as a result of the COVID-19 pandemic2 (Chart 1). As well as widening credit spreads, the COVID-19 pandemic is testing the viability of businesses that were once considered safe, or investment grade. As the viability of these businesses decline, their debt may be downgraded by credit rating agencies to sub-investment grade, indicating a higher probability the company will not be able to pay the interest and/or principal on its bonds – these companies are known as “fallen angels”.

One of the core objectives of active investment managers is to identify mispriced securities, and for bond managers, fallen angels are a category rife with mispricing opportunities. As the thinking goes, if a bond is downgraded below investment grade it incites a certain level of fear amongst some of the holders of that bond, which might cause them to sell; or if an institutional investor holds the bond on behalf of a client with strict instructions not to hold any sub-investment grade bonds, the manager may be forced to sell the bond. Both actions are catalysts to drive the price of the bond lower and create a buying opportunity for an active bond manager.

Fall From Grace

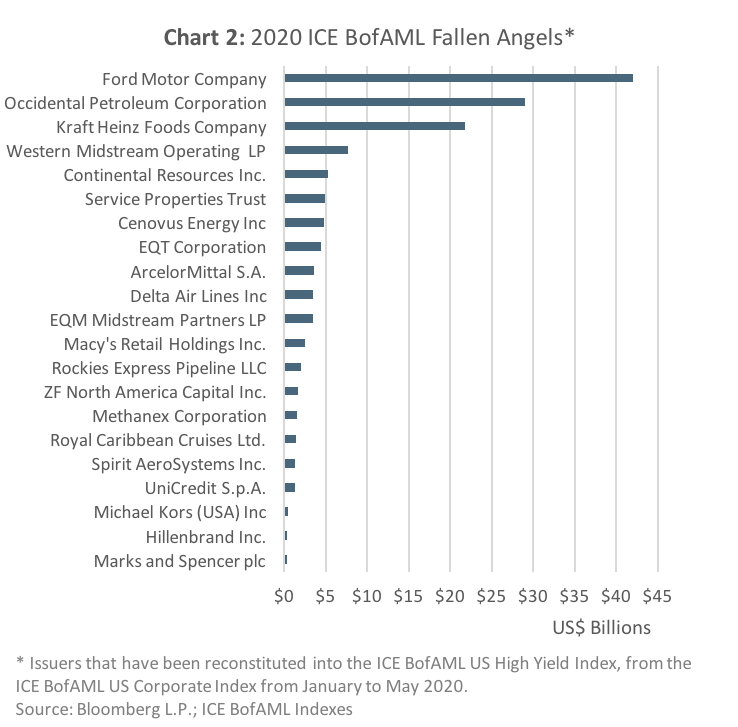

Year-to-date as of May 31st, 2020 (“YTD”), as illustrated in Chart 2, there were 21 issuers representing USD$143.7 billion (par value) of bonds that were reconstituted into the ICE BofAML US High Yield Index from the ICE BofAML US Corporate Index. The top-3 downgraded issuers – Ford, Occidental and Kraft Heinz – accounted for 65% of the total downgraded fallen angel issuance, YTD in 2020.

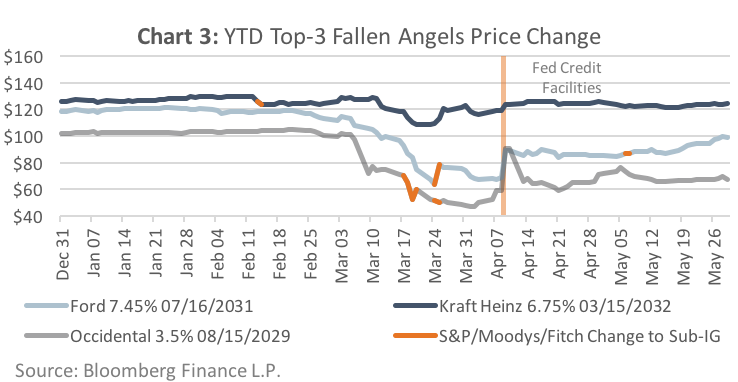

Chart 3 illustrates the YTD price action of individual bonds issued by each of the top-3 fallen angel issuers with emphasis placed on the dates the issuers were downgraded to sub-investment grade by any one of the big three rating agencies (S&P, Moody’s or Fitch). It is evident that the market was generally efficient at pricing-in the credit rating downgrades before they happened, such was the case with Ford and Occidental. And for all three issues, their price declines persisted after being downgraded, which supports the thesis that a downgrade to fallen angel status does instill a general motivation to sell amongst the existing bond holders. However, it is also evident that the term “don’t fight the Fed” rings true, as there was a simultaneous price increase for all three fallen angel issues on the day the Fed announced the USD$2.3 trillion of credit facilities – the proverbial “rising tide lifting all boats”.

Knocking on Heaven’s Doors

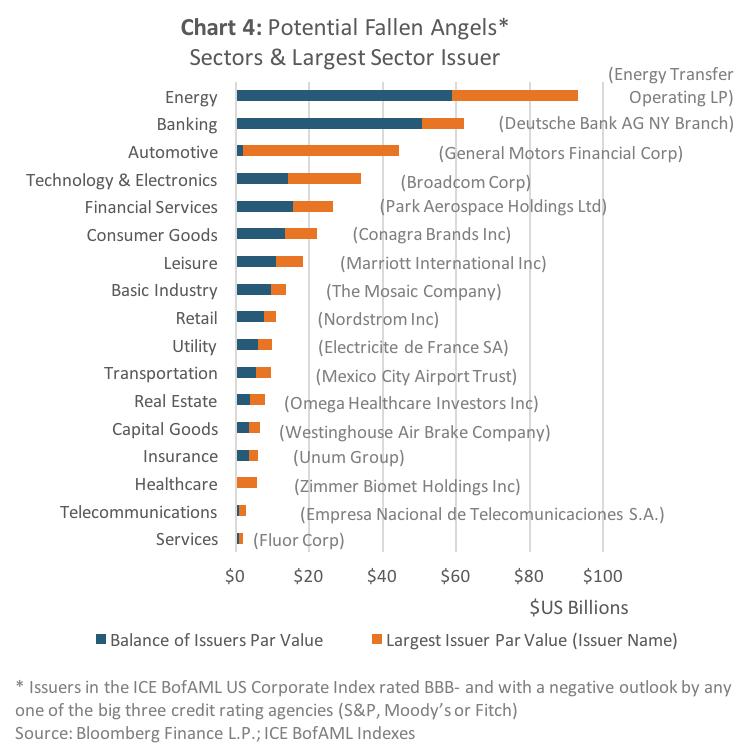

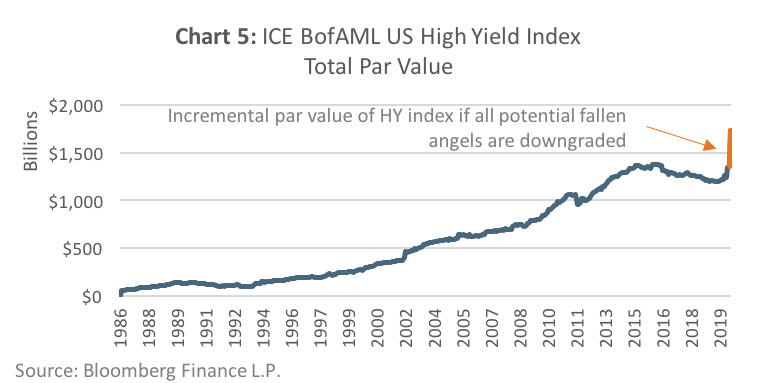

While the emergency liquidity provided by the Fed has stabilized the credit markets for now, temporary liquidity is not a long-term solution for companies with underlying solvency issues. To get a sense of the potential for future fallen angels, the ICE BofAML US Corporate Index was looked at for issuers rated BBB- and with a negative outlook from any one of the big three credit rating agencies. Chart 4 summarizes the analysis, showing the par value breakdown by sector and top sector contributor of potential fallen angels, which found as of May 31st, 2020, there were 121 issuers representing USD$375.8 billion at risk of being downgraded to sub-investment grade.

For context, that amount represented approximately 28% of the par value of the ICE BofAML US High Yield Index as of May 31st, 2020, and if all the potential fallen angels were to be downgraded, it would push the par value of the high yield index to an all-time 33-year high (Chart 5 – the orange line represents hypothetical asset growth).

Conclusion

As the fallout from the COVID-19 pandemic progresses, further asset price volatility and fallen angel bonds could be expected. While new fallen angel bonds may represent a buying opportunity, it is important to remember that not all are created equal. Separating the value opportunities from the value traps in the fallen angel space becomes much more difficult in the current environment where high yield bond prices are broadly supported by massive liquidity measures from the Fed. To help navigate this environment, investors could benefit from the advice of a professional investment advisor or portfolio manager.

1 Using ICE BofAML US High Yield Index as proxy.

2 Source: Bloomberg Finance L.P.