March 2023 was an interesting month for credit investors. The effect of higher interest rates finally found a casualty in a surprising place as Silicon Valley Bank and Signature Bank of New York collapsed within days of each other. While defaults are on the rise and stresses face the banking sector, the overall price of risk has not moved significantly to reflect this new environment. This has created an environment where credit may appear cheap, but a look under the hood shows a potentially different story. Meanwhile, panicked money has left the banking sector which has the potential to create a re-pricing in the $10 trillion US Investment Grade (“IG”) corporate bond market, as represented by the ICE BofA US Corporate Index (the “Corporate Index”)1.

1. RISK PREMIUMS ARE AT ALL TIME LOWS.

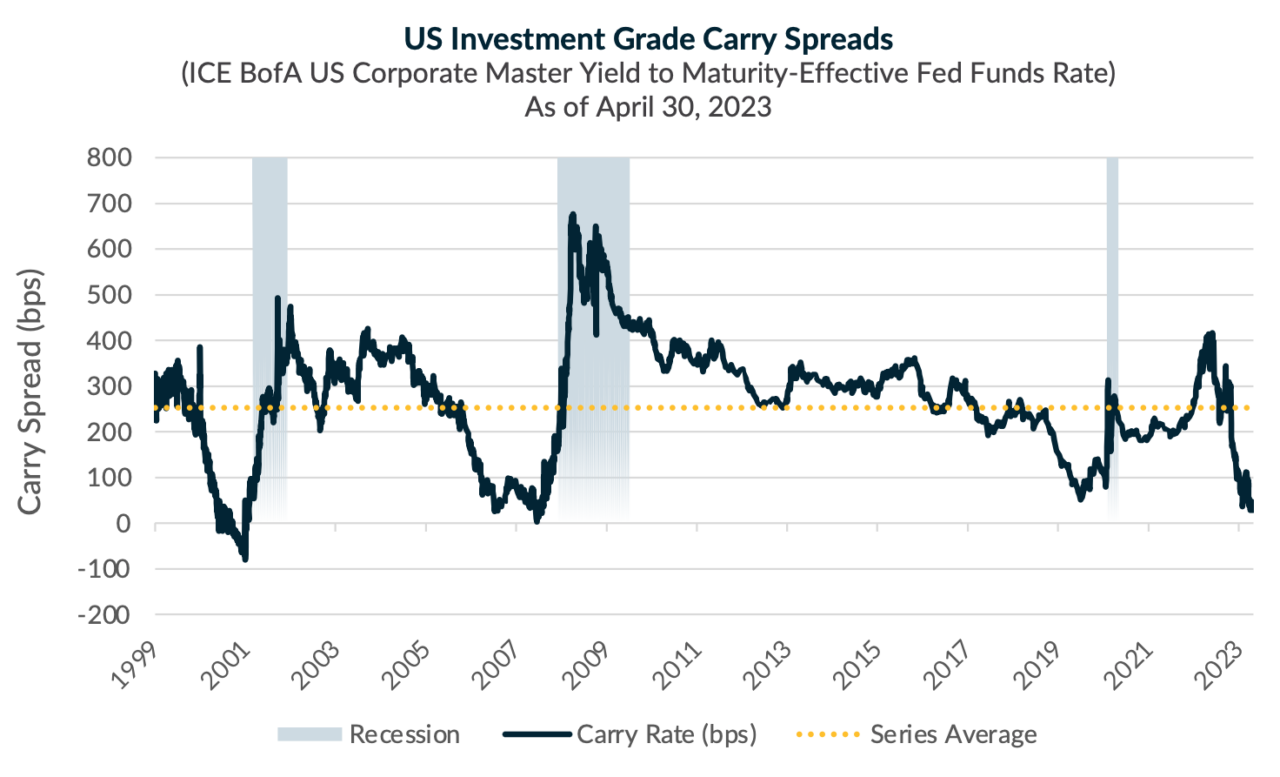

2022 was a historically bad year for bonds as administered rates moved significantly higher and severely depressed bond prices in higher quality bonds like those in the US IG corporate bond market. Higher interest rates should increase risk premiums as operating and capital costs rise. However, the risk premiums to invest in the US IG corporate bond market have been falling for the last 9 months and are now at levels not seen since 2007. As seen in the chart below, the incremental yield of the US IG corporate bond market over the Effective Fed Funds rate (“Carry Spread”) was dropped to 27bps as of April 7, 2023, which means that an investor is receiving a little more than a quarter of a percent in incremental yield investing in the Corporate Index, which includes BBB issuers and longer dated tenors, over an overnight facility backstopped by the Federal Reserve. When Carry Spreads have been at this level over the past 23 years, it has historically been a precursor to a recession and a negative repricing of the credit market2.

2. TRADITIONAL BANKING MODEL IS BROKEN.

The traditional bank model is to borrow short and lend long, a model that works well when the yield curve is positively sloped, as it allows the bank to pickup a positive spread. With overnight rates in the US floating at around 4.8%, while 10-year US Treasury yields sit at 3.6%, banks are less incentivised to loan their money out. Furthermore, generally tight credit spreads are not compensating banks enough to allow for the inverted yield curve. As administered rates rose quickly in 2022, long loans were severely depressed in price creating unrealized losses in some bank capital structures. After the failure of Silicon Valley Bank, depositors started to pull their money out of the banking system, putting pressure on the main source of funding for banks. $470 billion dollars left the US banking system in March, a drop in the bucket relative to the $17 trillion overall but substantial enough to create headaches in asset liability matching. Banks will have to monetize their assets to meet the deposit outflow and maintain their strict capital requirements which will strain available credit in the market.

THE OVERALL EFFECT ON CREDIT.

Banks are not typically large investors in the corporate bond market, but they play an important role in facilitating trades and providing liquidity for other investors and funds. To perform this role, they need to have available cash and more importantly, regulatory capital which is becoming more scarce and more expensive to keep. The pricing of credit is ultimately determined by the forces of supply and demand. When a buyer exits a market, there needs to be an incremental buyer to fill in; otherwise prices will fall. If banks are hindered in their ability to facilitate liquidity in the credit market, prices should fall to reflect the new level of demand. To bring back deposits, banks will have to pay higher levels of interest, which stress their margins and could have the effect of increasing the yield on their debt as well as the rest of the market. However, looking at this from an issuer perspective, no one wants to be the first domino to fall in the issuance of corporate credit. It would appear there is currently an impasse between the borrowers and the suppliers of money. However, a catalyst for a negative credit repricing could be from forced refinancing at higher interest rates when previously issued bonds approach their maturities.

CONCLUSION

Bond prices fell as interest rates rose in 2022, but they could fall further. The issues facing banks globally, the low level of yield on offer for risk, and the overall impact of higher interest rates could all be catalysts for negative repricing of credit risk. There is a disconnect between price and value in the bond market today as prices appear cheap, but in reality credit has rarely been more expensive relative to risk free measures. Buying a broad index could lead to pain down the road as the bond market re-prices itself. A skilled active manager could help navigate these conditions to find value in individual issuers whose prices reflects the risks being assumed.

1 ICE BofA US Corporate Index (USD)

2 Bloomberg LP