We apologize that we haven’t published a Market Observer since May 2021.

We were waiting for the markets to settle down and obviously, they haven’t. Frankly, most of our tardiness stems from our astonishment at the present madness in the financial markets.

Foolish Speculations

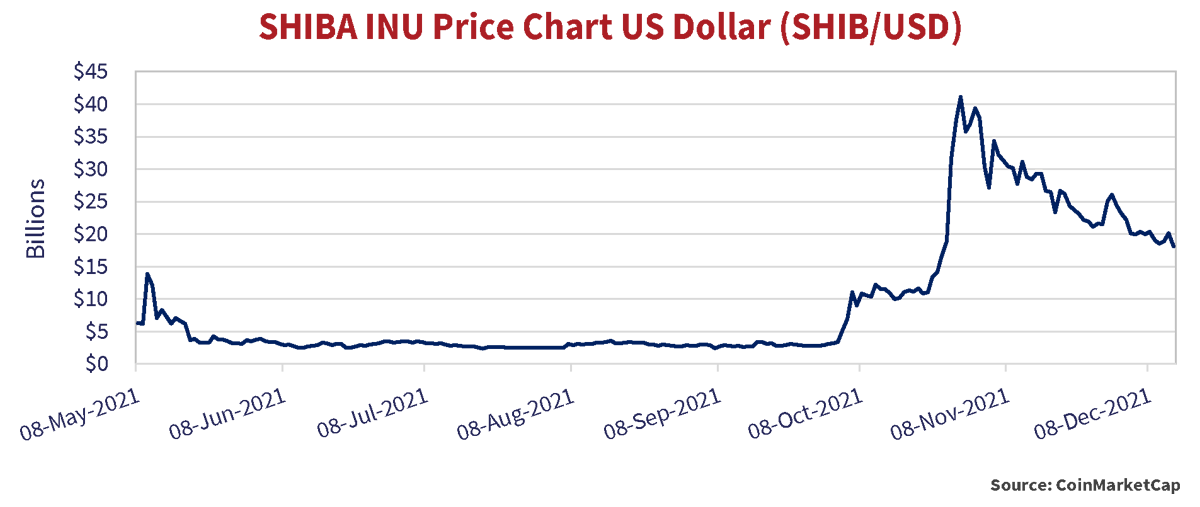

We have found it very hard to make sense of what we are seeing in financial asset price inflation. It is an axiom of Canso that too much money and credit creation inevitably leads to investors wasting their capital on what our great grandparents would have called “foolish speculations”. And foolish financial behaviour is certainly what we are seeing now. The chart below shows a wonderful example of how distorted things have become due to the massive amount of money injected into the financial system by central banks to battle the economic effects of the COVID pandemic.

A Market of Dogs

Some argue that there is scarcity value attached to the new investment “asset class” of digital coins but we beg to differ. This novel “financial asset” does not promise to pay anything and bears no claim to the cashflows of an operating business. It has no value other than its sale to the “greater fool” of investment lore. Shiba Inu, the digital coin named for a dog and created as a joke, now has a market capitalization of $20 billion of not-very-scarce U.S. dollars after it peaked much higher at a market capitalization of USD $40 billion!

At its peak valuation, the market value of the Shibas in circulation was the same as the market value of cellular telephone company Vodafone, technology company Hewlett Packard, social media company Twitter and insurer The Travelers Companies. At the lower current USD $20 billion valuation it is as “valuable” as brokerage firm Raymond James, media conglomerate Fox Corporation, chemical and pharmaceutical company Akzo Nobel, car manufacturer Nissan, consumer appliance manufacturer LG Electronics and Domino’s Pizza. It is also worth more than the $16 billion of Canadian high yield bonds outstanding and almost double the $12 billion outstanding Province of Nova Scotia bonds.

We must admit that a market valuation simply takes the latest price and multiplies it by the outstanding amount of the security. It is incredible to us that actual companies that make real products like cars, smart appliances and pizza are valued the same as a digital coin named after a dog as a joke. That’s testament to how cheap capital has become. We think that Domino’s Pizza will still be making pizza when the greater fools are on to a new digital coin. The joke will be on the greater fools still holding their Shibas.

Financial Lemmings

Regulators, fund companies and banks alike are now rushing to be “digitally cool”. The financial lemmings’ instinct to be fashionable and up-to-date with their financial knowledge and product offerings is as irresistible as the urge of their small rodent cousins to throw themselves over a cliff. The kicker is not just the typical fawning of the financial class over something that seems to be “gold in them thar hills” , their naked career ambition and/or their greed taking hold. It is their complete lack of understanding of what these “financial assets” really are. “Crypto Currency” or “Digital Coin” sounds mysterious and advanced. Take Bitcoin, which is based on computers “mining” or solving advanced mathematical problems to earn a coin. People could solve Rubik’s Cubes to get newly issued “Rubik Coins,” but that would just seem plain stupid and pedestrian. Dress up the problem-solving as “Crypto” by computers and the financial hangers-on can’t be dislodged from their mania.

Markets Spiked by Omicron

The mass financial hysteria of way too much money floating around has been subsumed by real fear in the financial markets over the past few weeks. The news of a potentially more transmissible and dangerous new COVID variant created international medical concern just when it looked like there was light at the end of the COVID tunnel. This Omicron variant sparked a financial market “flight to safety” on the day after U.S. Thanksgiving.

Government bond yields plunged, and risk assets sold off in the illiquid markets before the U.S. holiday weekend. The financial media was calling this the “Black Friday” stock sell off. Black Friday sounds like the ominous Black Monday of financial lore and brings a few more eyeballs to articles in our digital age. It is nothing compared to the “Black Monday” stock slaughter of 1929 and 1987 where the equity markets plunged nearly 30%. Even the ominous reference to the colour black is actually not bad. Printed financial statements used to show losses in red and profits in black. The Friday after U.S. Thanksgiving was historically the day when retailers actually “went into the black” or made profits on a year-to-date basis as Christmas shopping kicked in. An ominous Black Friday has nothing to do with financial sell-offs, but it attracts more eyeballs than “The Day Retailers Make Money” .

A Grand Reopening Delayed

It now looks to us that things are not going to be settled pandemically for some time, maybe even forever, as some experts are now saying. The Omicron variant has evolved its ugly molecular spike with 36 mutations in South Africa, while COVID cases and deaths are worsening in even many highly vaccinated countries. That is not welcome news to all of us tired of lockdowns and social distancing. The efficacy of current and future COVID vaccines against the Omicron variant is now being debated by the medical experts while the rest of us follow their pronouncements and worry. It is now increasingly clear, even to politicians wanting to lead the “Grand Economic Reopening”, that a decisive victory over COVID is as elusive as victory in a Middle East war.

Travel bans are being reinstituted by health authorities and politicians, just after many were loosened or removed entirely. This continued medical uncertainty and the resulting economic upheaval means that we’re going to have to press on with our current thoughts. These will probably be stale dated by the time you read them, but such is the life of any financial prognosticator!

Bubbling Fame and Fortune

Alan Greenspan famously said that it was very hard to see a bubble when you were in it. This bubble is so huge that it is hard to conceive of where its edges actually are. This was very wise counsel from Greenspan but he was the person responsible for making the creation of bubbles and the subsequent financial rescues the singular goal of the central banking bureaucracy. Why be a boring financial bureaucrat when you can be a central banking superhero?

That’s why our central bankers are now financial bubble blowers extraordinaire. They need bursting bubbles to further their career ambitions. It’s a bit like a fireman arsonist lighting fires to put out, but what the heck, it turns boring bureaucrats into financial saviours with lots of Twitter followers. The promise of lucrative book deals and high-end consulting contracts puts a fame and fortune shine on life after retirement from the financial bureaucracy.

The Proper Path to Power

Now it seems like central banks are also stopping point for political ambition. Janet Yellen was Chair of the U.S. Federal Reserve and is now Treasury Secretary of the Biden Administration. Mario Draghi was President of the European Central Bank (ECB) and became the Prime Minister of Italy. Christine Lagarde rose from a lowly corporate lawyer at the Paris office Baker MacKenzie to head this global law powerhouse. This consummate bureaucrat and political insider is now the President of the ECB after her stint as Managing Director of the International Monetary Fund. As her official ECB biography reads, “The Number two on Forbes’ list of The World’s 100 Most Powerful Women” knows a thing or two about the proper path to power, fame and fortune.

Hot Air and Global Warming

It’s getting so bad that we now have financial hot air at global warming conferences. The financial chattering class used to hang out at the annual Davos conference to exude their power and connect with their rarified peers. Now they attend global climate conferences to show their solidarity with the state of the planet. As Gillain Tett of the Financial Times pointed out, the recent COP26 climate conference in Glasgow attracted the apparatchiks of finance: “Back in 2015, when a COP produced the Paris climate accords, the tribe was dominated by environment ministers, scientists and activists. Now business leaders, financiers and monetary officials are on the stage.”

This recent fixation of central bankers on non-monetary policy action seems to us to suggest the halcyon days of central bankers simply adjusting money supply are well over. Saving the financial planet is what monetary Superheroes do to get their fame and possibly fortune. Now they want to save the actual planet and take action on social equity. Perhaps it’s a good thing for society, but it should be a concern for bond investors.

Moving the Goal Line

Even boring old and formerly financially prudent Canada is seeing change in its central bank’s policy preferences. Its recent non-monetary policies range from Climate Change to Indigenous Inclusion. As Terence Corcoran commented in a Financial Post opinion article:

The Bank of Canada and the Canadian Government announced the maintenance of their inflation targeting regime for another 5 years just as we were going to press. While this was expected, their joint statement added a commitment to “maximum sustainable employment” and suggested more than a little leeway in how “price stability” would be maintained:

More Than a Little Wiggle Room

There would have been many Canadian and international bond investors selling their Canadian Government Bonds if the BOC’s inflation targeting mandate had been abandoned completely. The statement above has such “wiggle room” that perhaps the parties issuing it consulted the Australian children’s singing group The Wiggles . Let’s see, we will focus on price stability while taking into account another goal that is “not directly measurable” and changes over time. This is to be judged by an organization that is committed to non-monetary policies to create “a diverse economy” magically immune to inflationary pressures.

A Target on Inflation Targeting??

Things have sure changed from monetarist economists bending central banks to their policy will. The Reserve Bank of New Zealand even got a constitutional amendment in the 1990s to assure its only goal was maintaining low inflation and a stable currency. “Inflation Targeting” became the fashion and most developed Western economies adopted this monetary fashion for their central banks in the 1990s.

Nobel Monetarists

Milton Friedman and his monetarist Chicago School believed that “Inflation is always and everywhere a monetary phenomenon.” They believed that controlling inflation should be the only goal of monetary policy. This contrasted with Keynesians, who believed governments should have a very active role in both monetary and fiscal policy.

Friedman won the Nobel prize in Economics in 1976 for his work. It is quite interesting and a tad quaint in our days of activist central banks to now look back on the Nobel presentation speech for Friedman’s award by Professor Erik Lundberg of the Swedish Royal Academy of Sciences. It shows how far we have strayed from Friedman’s monetarist ideas at central banks:

In the Dustbin of Outmoded Ideas

“Only money matters” for a central bank? Wow, it is a good thing that Friedman isn’t alive to see how thoroughly his economic prescriptions have been violated by today’s central bankers and politicians. It is rare indeed that an economist who “gained such direct and indirect influence” over monetary policy has been thrown so completely on the dustbin of outmoded ideas. There is another “reconsideration of monetary policy” going on and it isn’t stating that “only money matters.” It is very hard to think of a central bank or government presently not now talking fashionably of what are actually Keyensian stimulation and deficits.

Subjecting Fashionistas

When the human idea pendulum swings, it tends to hit the extremes in the opposite direction. With economic ideas, as in most human fashions, a trend is established among the subject fashionistas and it takes hold over the popular imagination. Most new adherents don’t know the origins of their new fashion, but they “wear it” to be fashionable. As the great economist John Maynard Keynes said: “Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist”.

Evil Keynesians versus Good Monetarists

Our readers know that we think that Keynes was arguably the greatest economist of all time. He was also a legendary investor with phenomenal results for the Cambridge endowment fund that he managed. His ground-breaking book The General Theory of Employment, Interest and Money departed from classical economic theory and postulated that governments had to step in with fiscal policy through debt-financed government spending when private sector demand could not be stimulated by “pushing on the string” of low interest rates through monetary policy.

When Friedman and his monetarist fan club took hold of the popular economics imagination, as evidenced in the Nobel speech cited above, Keynes’ theories took the brunt of the changing of the guard. Inflation and most economic ills were attributed to the evil “Keynesians” and their cabal of pro-government interventionist followers. A CFA candidate in the 1980s had to divide the economic world into evil “Keyensians” and good “Monetarists” to pass the Economics section of the CFA exams.

Indeed, Keynes’ theories became associated with government intervention and spending. This was despite his prescription of paying off government debt accumulated through recessionary stimulus by raising taxes in good times to reduce aggregate demand. As we say at Canso, more money is always more politically popular than less money so the politicians of the 1960s and 1970s kept up their deficit spending even in good times. The reaction came when Prime Minister Margaret Thatcher in Britain and President Ronald Reagan in the U.S. rode the political wave of less interventionist government and sounder finances to power.

Keynes Becomes Populist

Now we have the interesting juxtaposition of big spending and protectionist populist Donald Trump still holding sway over the formerly fiscally conservative Republican party of Ronald Reagan. Populist and economic interventionist Boris Johnson must be due for a Christmas visit from the ghost of Margaret Thatcher (aka The Milk Snatcher) clanking her free market chains.

As for the financial markets and their resident experts, they cheer the serial monetary expansions and government interventions as “Modern Monetary Theory”. They probably don’t even realize that this harkens back to the roundly discredited managed economies of socialist Europe and Britain in their heydays of the 1970s.

It seems to us that central bankers and policy makers are now making choices that are popular with politicians and their voters, rather than focusing on Monetarist or even Keynesian policies. The lure of fame and fortune trumps (pun intended) the implementation of sound policy. With the U.S. mid-term elections in 2022 and the Presidential campaign in 2024 looming, we think politicians on both right and left hoping to be elected will be on the side of more money and more economic intervention. The soaring markets of “Command and Control” economics has true believers aplenty in the financial markets. This is despite the fact a “soft landing” through the eventual monetary policy tightening has seldom been finessed.

High on Inflation

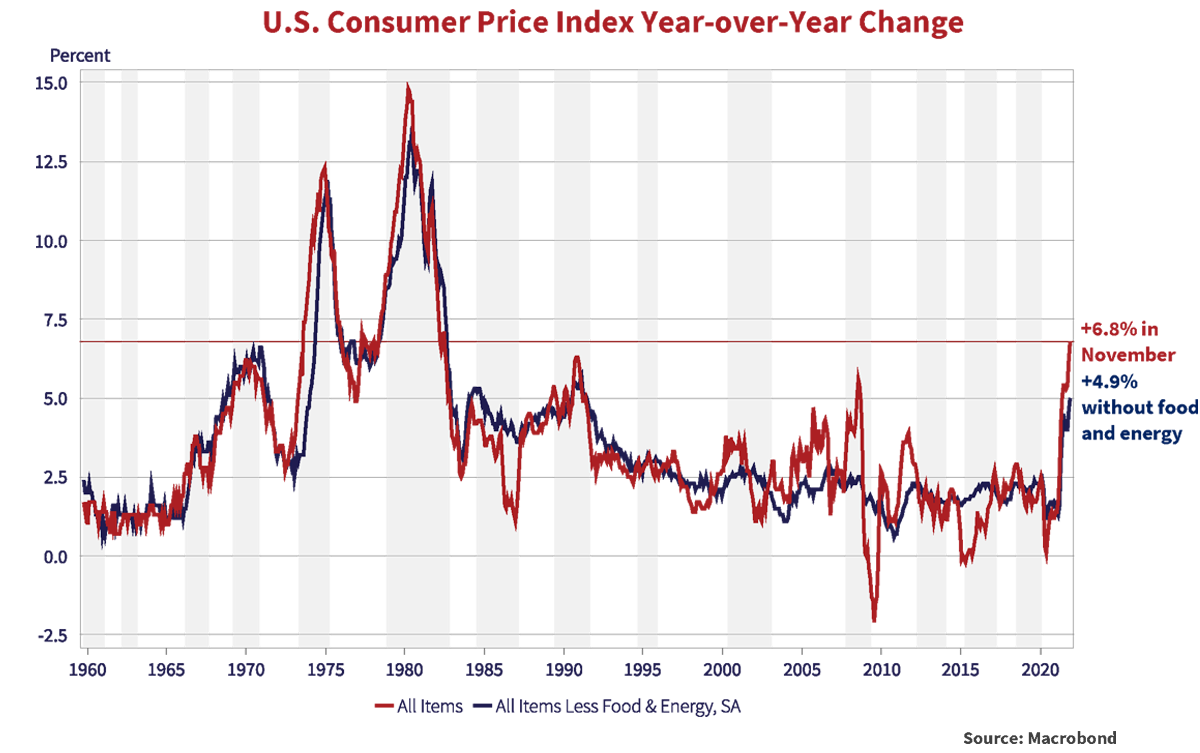

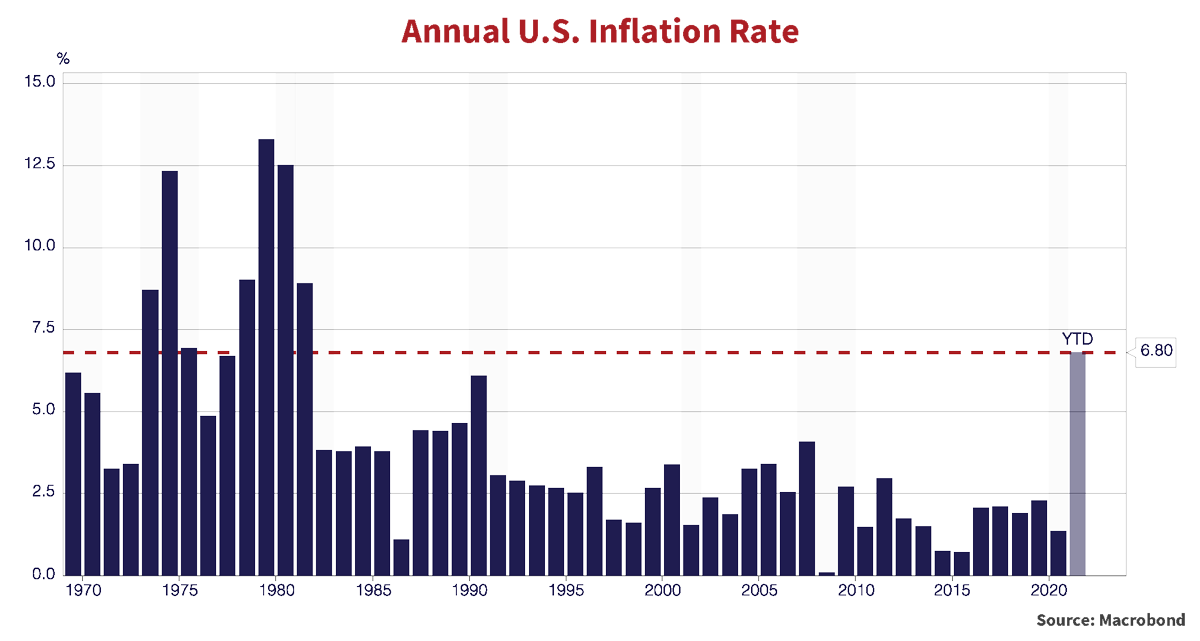

The problem is inflation. The very loose monetary and fiscal policy in most Western countries has been a boon to consumers and the financial markets. The problem comes from price inflation from strong consumer demand compounded by “supply chain disruptions”. Fixed or reduced supply in the face of vastly increased demand has obviously led to quickly rising prices. This has put inflation at levels not seen since the highly inflationary 1970s, as you can see from the chart below.

Transiting From Transitory

At 6.8% year-over-year, the CPI in the United States is the highest since 1983. It equals levels only seen in 1979, 1976 and the oil price shock year of 1973. The monetarist central bankers of the 1990s would have attributed the current high level of inflation to excess money supply as “only money matters”. Our current central bankers believed the current inflation is “transitory” due to COVID pandemic disruptions and have been waiting for it to fall back to more comfortable levels. Federal Reserve Chair Jerome Powell seems to recently have had a change of heart as Bloomberg reported:

Now Powell, who lowered interest rates after a lengthy Twitter beating from President Trump, wants us to believe that politics has nothing to do with his decisions. His new “hawkish policy tilt” is completely happenstance and had nothing to do with his appointment as Fed Chair for a second term:

The fact is that politics do matter to central bankers like Powell, who is notably a lawyer by trade. Now personal popularity matters to the people who set interest rates, given their future career ambitions. The market sure doesn’t seem to think Powell will reprise Volcker’s “Whatever it Takes” interest rate policy. The market’s Fed Fund forecast moved from two hikes of .25% to three and a half hikes by Q1 2023. At that rate it should take some time to get to Volcker’s 14%!!

Politically Costly

The current high level of inflation is not popular with voters and is fast becoming a political issue. That puts the Federal Reserve in a tough spot. Possibly the only thing less popular than high inflation is high interest rates. Jimmy Carter nominated Paul Volcker to Federal Reserve Chair in 1979. Carter supported Volcker’s monetary tightening in 1980 which culminated with short term interest rates at 14%. It defeated inflation by causing a severe recession but cost Carter the Presidential election of 1980.

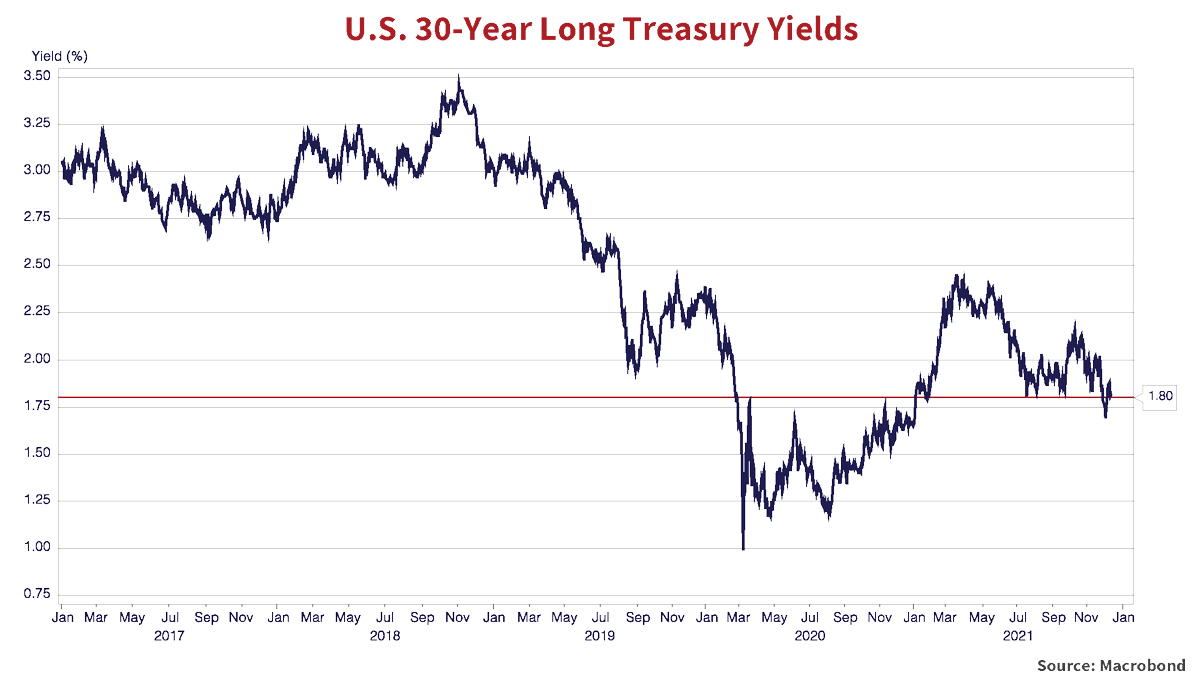

The Problem for Bonds

The problem for the bond market is that the current level of interest rates is well below inflation due to monetary policy. The chart below shows that U.S. long Treasury bond yields have recovered from their pandemic lows, but they are not anywhere near where they were before. Taking the current 6.8% inflation into account, the buyer of a 30-year Treasury bond at 1.8% has a “real yield” of -5% so clearly people believe inflation will fall. Even if the supply side disruption goes away and inflation falls to 2% again, the Treasury buyer still locks in a -.2% real yield.

Only Money Matters

Even Keynes thought that money mattered, and so do we. Since interest rates are the price of money, negative “real interest rates” encourage borrowing and “financial speculations”. So, there’s not much to talk about other than the prospects for monetary policy and whether it will eventually be tightened. The current negative real interest rate reflects the cheapness of money and credit. If central banks are forced to act in the face of sustained and rising inflation, then all bets are off.

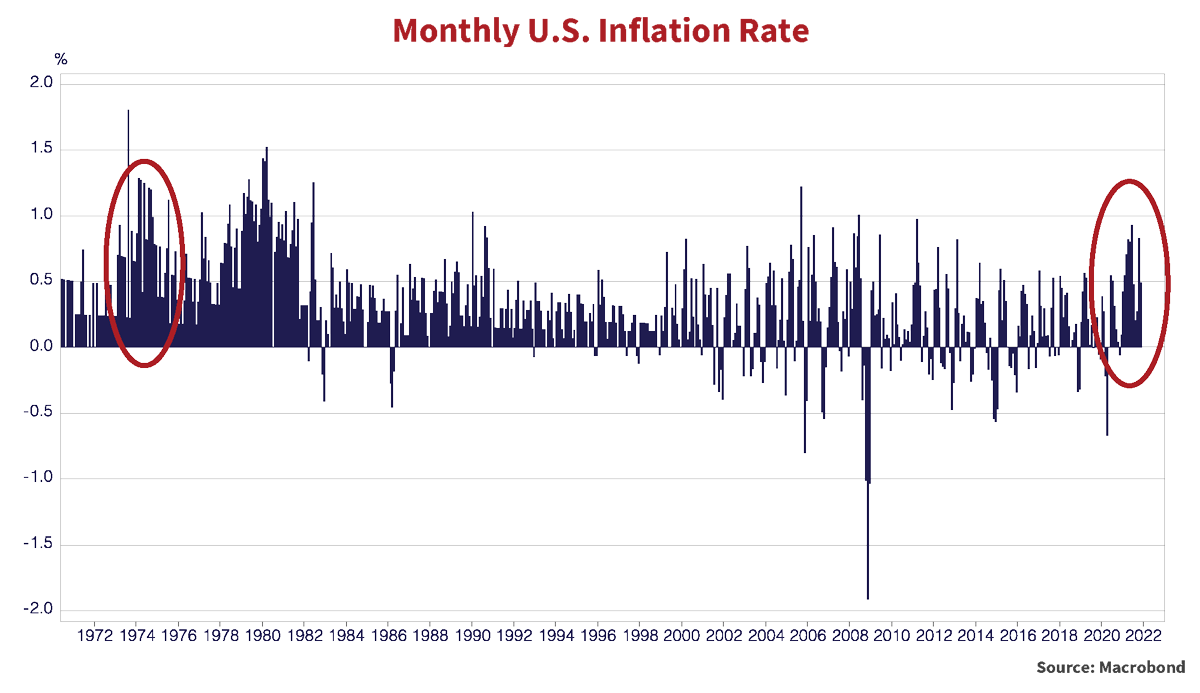

Record Breaking Inflation Gains

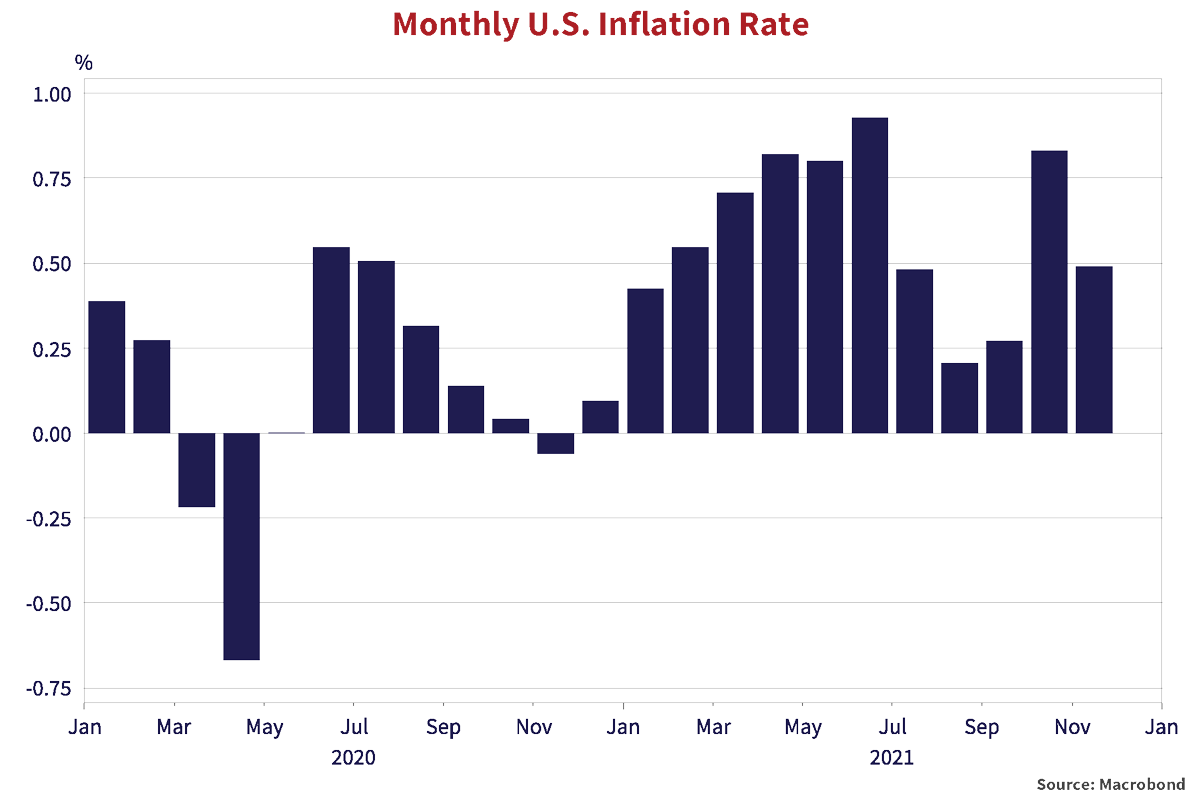

So, what can we say about inflation? It is not only the financial markets that have been making gains. The experts have been dead wrong that inflation is transitory as the chart below shows. During the first part of the Pandemic Recession of 2020, the U.S. CPI dropped from +.4% for the month of January to -0.6% in the month of April. The market and financial experts were very certain a dire and potentially long recession was at hand.

Then all the monetary and fiscal stimulus kicked in and we started seeing substantial gains in inflation which quickly morphed from very negative to very positive. The summer of 2020 saw a return to +.5% for July. Inflation seemed to then moderate until 2021. But the huge positive inflation numbers in 2021 would have been impressive if they weren’t so terrifying for a bunch of bond investors like us. The +.4% in January saw a steady monthly increase to +.9% in June. Even though things have moderated, we’re still running at +.8% for October and +.5% for November. That puts us up a cumulative 6.5% year-to-date for 2021 with a month to go.

A Cautionary Inflation Tale

Inflation could be indeed transitory, but a true monetarist who believed that “only money matters” would differ. It takes very loose money and credit to spark price increases and inflation. A longer-term chart of monthly U.S. CPI back to 1970 tells an interesting tale.

The current spike upwards in inflation looks uncomfortably like monthly CPI from the Arab Oil Embargo in 1973 to its eventual decline in 1981. From the .2% level, the monthly CPI increased to over 1%, peaking at 1.5% in 1980.

History seldom exactly repeats but this gives us cause for concern. As the chart below shows, these strong monthly increases in inflation moved the annual CPI from 3.4% in 1972 to 8.7% in 1973. As we showed above, unless the U.S. has a negative monthly CPI in December, we will probably have annual CPI above 7% for 2021 which is an eerie historical parallel.

The loose monetary and fiscal policy helped to avoid a recession in 1973 but 1974 saw 12.3% annual inflation. The Federal Reserve responded with tighter monetary policy and a recession then brought the CPI back to 6.9% in 1975 and 4.9% in 1976 when Milton Friedman won his Nobel Prize in Economics. As they said in the 1970s, it was hard to keep the “Inflation Genie in the Bottle” and CPI soared eventually to 13.3% in 1979. Paul Volcker was appointed Fed Chair by President Jimmy Carter in 1979 to defeat inflation. He tightened monetary policy which caused a severe recession in 1980. That defeated inflation but cost Carter the Presidential election.

Bonds Will Yield to Inflation

Our view is that monetary policy will eventually have to be tightened, but that will be only after bond investors throw in the towel and cause longer term yields to soar. Long bond yields have reacted to the negatives of COVID rather than the huge increases in money and credit. Bond investors will rush for the exits when inflation seems to not be “transitory” and yields will make up for their tepid response by gapping up violently. Higher bond yields mean costlier capital across the investment spectrum and today’s heady prices of financial assets will be under huge pressure as the “get me in” bid turns to the “get me out” forced sales.

As we said in these pages before the Credit Crisis implosion of 2008, too much money eventually plants the seeds of its own doom. All manner of financial speculations of the most ridiculous sort are on offer at very high prices in very plentiful U.S. dollars.

Greed is Not Good for the Markets

Today’s frothy market can’t only be blamed on a digital coin named after a dog as a joke. Special Purpose Acquisition Companies (SPACs) or “Blank Cheque” companies raise money without investors knowing what they will buy. The prices of SPACs are based on the financial coolness of their promoters and are bid into the price stratosphere on their first day of trading. The “Investment Trusts” of the Roaring 1920s were much the same. That stock market boom ended with the Black Monday of 1929.

Self-interest rules our markets. The fictional Gordon Gekko who shouted “Greed is Good” in the movie Wall Street would approve. Even the most shameless self-promoter of all time, Donald J. Trump, has got into the act to fund his own right-wing media empire via a SPAC. The private markets are seeing money stuffed into illiquid assets and “Idea Companies” are being bid up by eager venture investors trying to get their portfolios invested.

Dear Money

What happens when interest rates go up and money becomes dearer? As our loyal readers know, liquidation of “speculative balances” means that people sell their formerly prized financial possessions as panic sets in during the proverbial “rush for the exits”. Many asset values will get crushed as lenders liquidate portfolios to pay margin debt. There won’t be enough cold hard cash to go around when everyone wants to sell. That means digital coin and SPAC prices will have to fall and probably precipitously.

Good investments will be liquidated with the bad as borrowers struggle to make their margin calls. There won’t be a lot of buyers. Buying on the dips works unless the dips are too deep or too long for a banker’s risk management tastes.

The good news is that it will take some time for central banks to even gingerly start raising interest rates. The bad news is that the speculation has been so bad this time around that the downside will be almost as powerful as the upside we have experienced.

Big Dippers

At Canso, we buy on the dips, as evidenced by our activities in the pandemic markets of 2020. Unfortunately, there must be potential cash flows from the underlying investment to justify what we are paying. That means the dip needs to be substantial to get our attention and there’s not much value on offer in today’s market. That’s why we are tightening up our portfolios and happy to be accused of being conservative. There are still some investments that look attractive to us, but we are passing on most.

Have a great holiday season and keep you and your family safe in our COVID times!