Bank Hedging

On June 5th, the Bank of Canada (BOC) officially ended its rate hiking cycle that began 27 months prior, stating:

“With continued evidence that underlying inflation is easing, Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points. Recent data has increased our confidence that inflation will continue to move towards the 2% target.”1

Confidence, followed by a hedge.

“Nonetheless, risks to the inflation outlook remain.”1

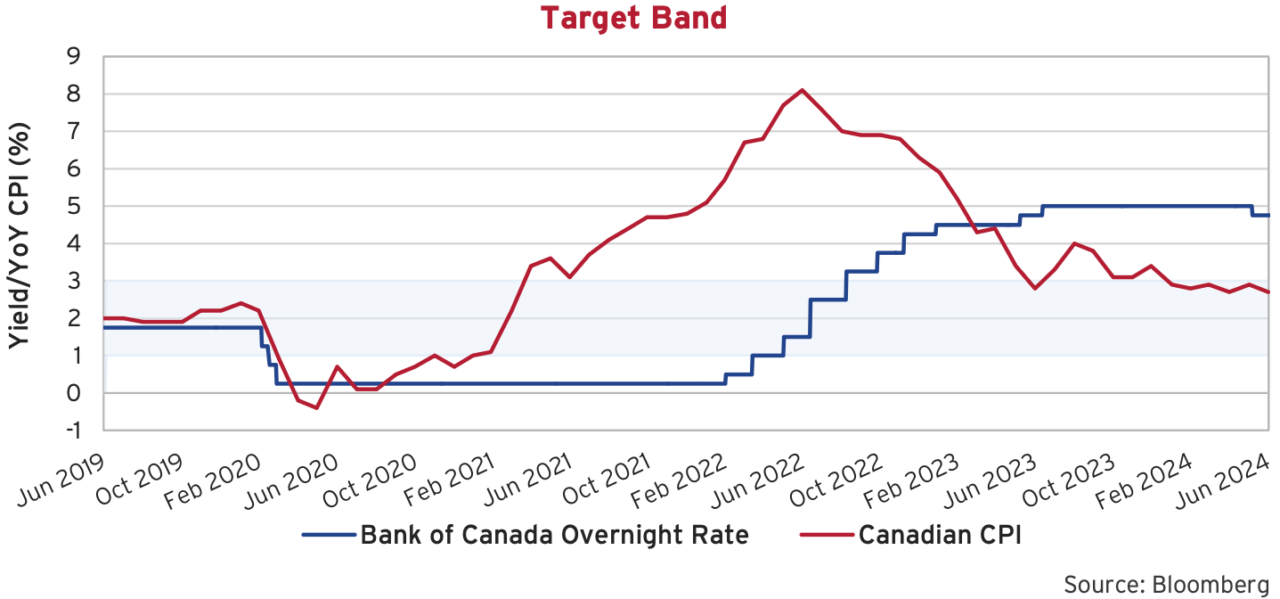

I’m With The Band

The market’s next question: Has inflation been defeated or is it merely in hiding? Indeed, headline CPI in Canada has dropped back inside the Bank’s 1% to 3% target band after spending 32 months above the range. In each of the first six months of 2024, reported inflation in Canada has measured below the 3% upper band despite remaining above 3% south of the border. As we can see from the graph below, the BOC increased its overnight rate from a floor of 0.25% in March 2022 to a peak of 5% in July 2023. Over the same period, inflation touched 8.1% before steadily falling to where it rests today. Have central bankers been successful in their “Command and Control” approach or will wage gains and accommodative fiscal policy cause higher inflation to be sticky?

O Canada!

Where inflation is undoubtedly on the rise is in our national pride! Canada Soccer’s Men’s National Team is coming off a successful campaign at their Copa America debut, falling in the semi-finals to Lionel Messi’s world number 1 ranked Argentina. We are hoping the team takes this positive momentum forward as they ready to co-host the World Cup in 2 year’s time. Meanwhile, the Women’s National Team looks to defend their Olympic gold medal at the Paris Olympics. Wishing all of our Canadian athletes positive performances in France.

On the infrastructure front, Canada successfully completed the Trans Mountain Pipeline expansion. The $34 billion project will ship an additional 590,000 bbls/day of Albertan oil to Burnaby on the southern BC coast, where it can then be exported to global markets. The pipeline provides Alberta producers significant relief in getting oil to market and should help Canadian oil prices close the gap on international benchmarks. In northern BC, another significant infrastructure project is progressing as LNG Canada is nearing completion of their export facility in Kitimat, with commercial operation targeted for 2025. The Coastal GasLink pipeline, which will feed the processing facility, achieved mechanical operation after overcoming many hurdles.

Finally, with a deal that caught us at Canso by surprise, Quebec-based National Bank is looking to acquire Alberta-based Canadian Western Bank for $5 billion. This would see the 6th and 8th largest banks in Canada come together. Culturally, Quebec and Alberta tend to have strong, and often opposing, views on domestic issues – wishing them all the best on a potential integration!

No, Room To Grow

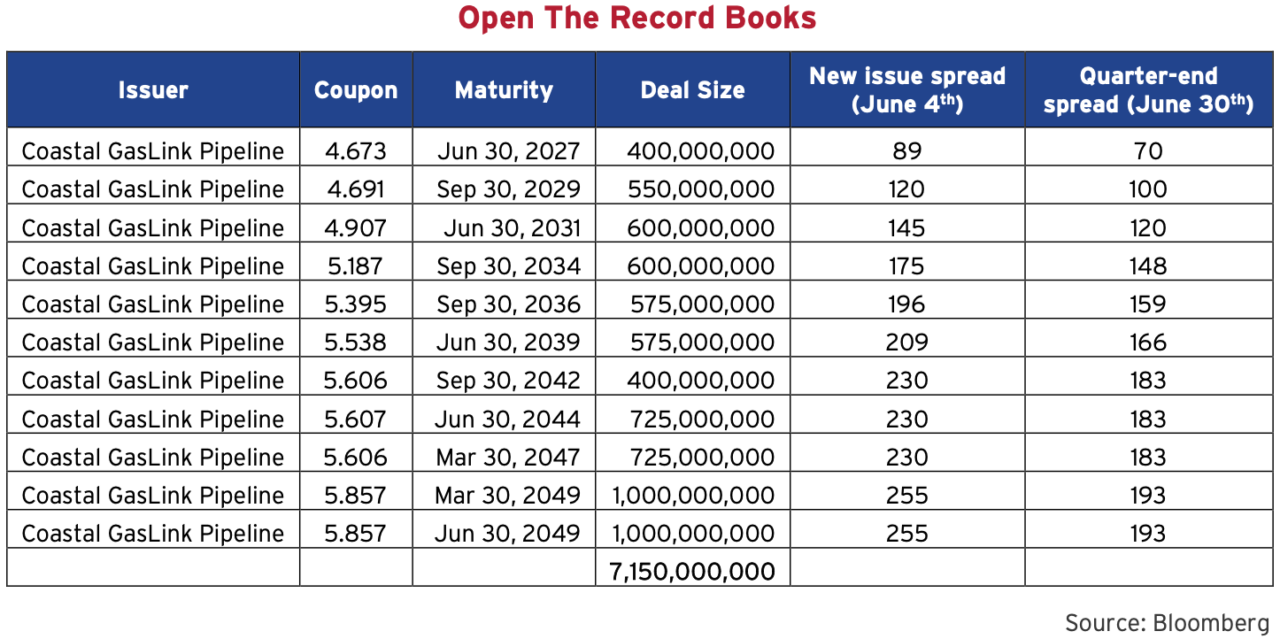

Corporate bond deals in Canada and the U.S. are often marketed with the moniker “No Room To Grow”, indicating that an issuer is looking to sell a set amount of bonds and is not interested in increasing this amount, regardless of investor demand. In the case of the recent Coastal GasLink secured bond deal, investment bankers were happy to add a comma, “No, Room To Grow”.

Initially marketed as a $3 billion offering with a maximum size of $4 billion, the deal quickly expanded in response to investor demand. Bank underwriters leading the deal were happy to increase the amount (and their fees) while existing lenders (a syndicate of banks) were happy to offload more of their exposure to bondholders. When the dust settled, Coastal GasLink issued $7.15 billion across 11 tranches of debt: a record deal in Canadian corporate history. Not only was the deal considerably upsized, but investor appetite persisted post-issuance. Spreads tightened meaningfully in the weeks following the issue date as investors who were “cut back” on allocations scrambled to add to positions in the secondary market.

Coastal GasLink is an ambitious 670 km natural gas pipeline that will deliver gas from the Montney Basin of northern BC/Alberta to the LNG Canada export facility in Kitimat. The project has been plagued with cost overruns, ultimately costing more than double initial projections. Although TC Energy will remain operator of the pipeline, the company sold a majority stake of the equity to AIMCo and KKR/National Pension Service of Korea. The pipeline is structured as a cost of service, take-or-pay contract and ensures no volume risk for CGL. Investors expect predictable cash flows from this critical infrastructure project.

The Bottom Line

It was a relatively subdued period for credit markets in the second quarter of 2024. In Canada, the front end of the yield curve rallied as interest rates fell in anticipation of the Bank of Canada’s cut in early June. Maturities further out the curve were modestly higher while corporate credit spreads remained constant. As a result, bond market performance in Canada was largely a result of running yield. In the U.S., interest rates ticked up across the government curve, leaving overall returns of high-grade markets only slightly positive. Higher yields and shorter durations of the below investment grade bond and loan markets resulted in strong quarter-to-date and year-to-date returns. Equity markets in the U.S. continued their ascent, led by investor enthusiasm surrounding artificial intelligence. The Canadian market was left behind as financials and industrials underperformed in the period.

Corporate Action

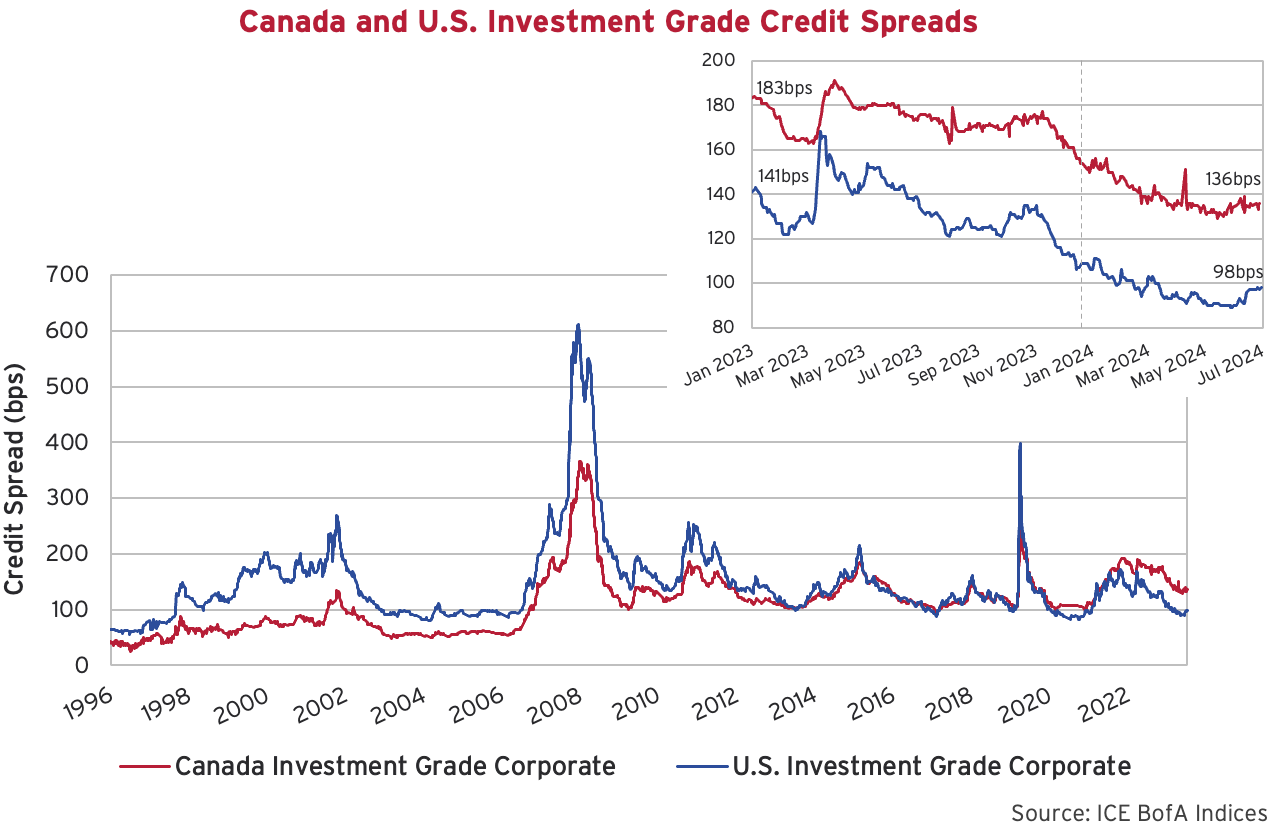

Movement in investment grade credit spreads was relatively muted this past quarter. Inflation numbers caused government bond yields to spike in the second week of April. This volatility carried to Canadian spreads, though not for long, as those valuations were quickly bought back up. Spreads subsequently hit fresh cycle tights in May before relenting into quarter end to finish about where they started.

Through the first half of the year, spreads in Canada and the U.S. remain tighter. Spreads in the Canadian market have tightened 19 basis points (bps) versus only 10 bps in the U.S. this year. Canadian financial issuers have made a bit of a comeback after selling off in 2022, and this is a key factor in the spread performance between the markets this year. Even though the U.S. is lagging, the index hit a cycle tight of 89 bps in May. It is impossible to say if this is the bottom, but either way, the U.S. market continues to be expensive in absolute and relative terms.

Investment grade bonds continued to see a steady stream of new issues in the second quarter. After a final deal from Pembina Pipeline, the month of June brought $21.3 billion in new issue volumes, the second highest monthly total behind only March 2022. The tally for the first half of 2024 was just under $81 billion, which is up from the same period last year by 45%.

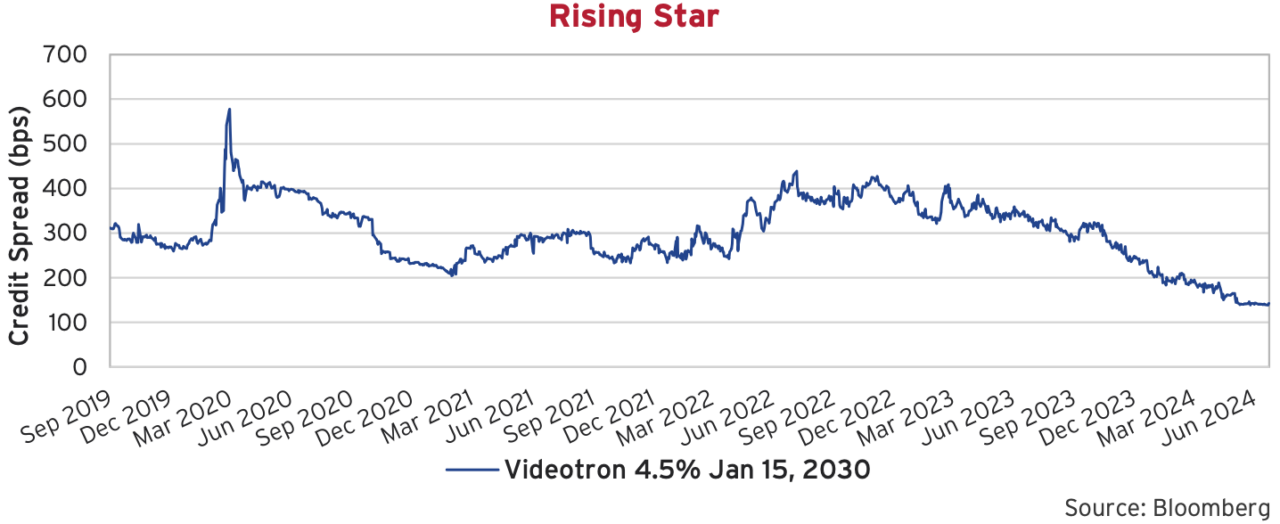

Don’t Forget

In May, Videotron Ltd was upgraded to BBB- by both S&P and Moody’s. This saw the company regain the “Investment Grade” label it lost back in 2001. The road to recovery can be long and winding but once you get back, as those who have watched Season 2 of Welcome to Wrexham will know, “Don’t forget to sing when you win”. Videotron wasted no time before celebrating, selling $1 billion of bonds in June at slender investment grade levels. The company issued two bonds, a 5-year and a 10-year, at credit spreads of 143 bps and 175 bps, respectively, above Canadas. We can see from the chart below that only 18 months ago, comparable debt issued by Videotron was trading at credit spreads north of 400 bps! For those keeping score at home, interest cost savings of 250 basis points on $1 billion of debt is $25 million per year.

High Yield Still Expensive

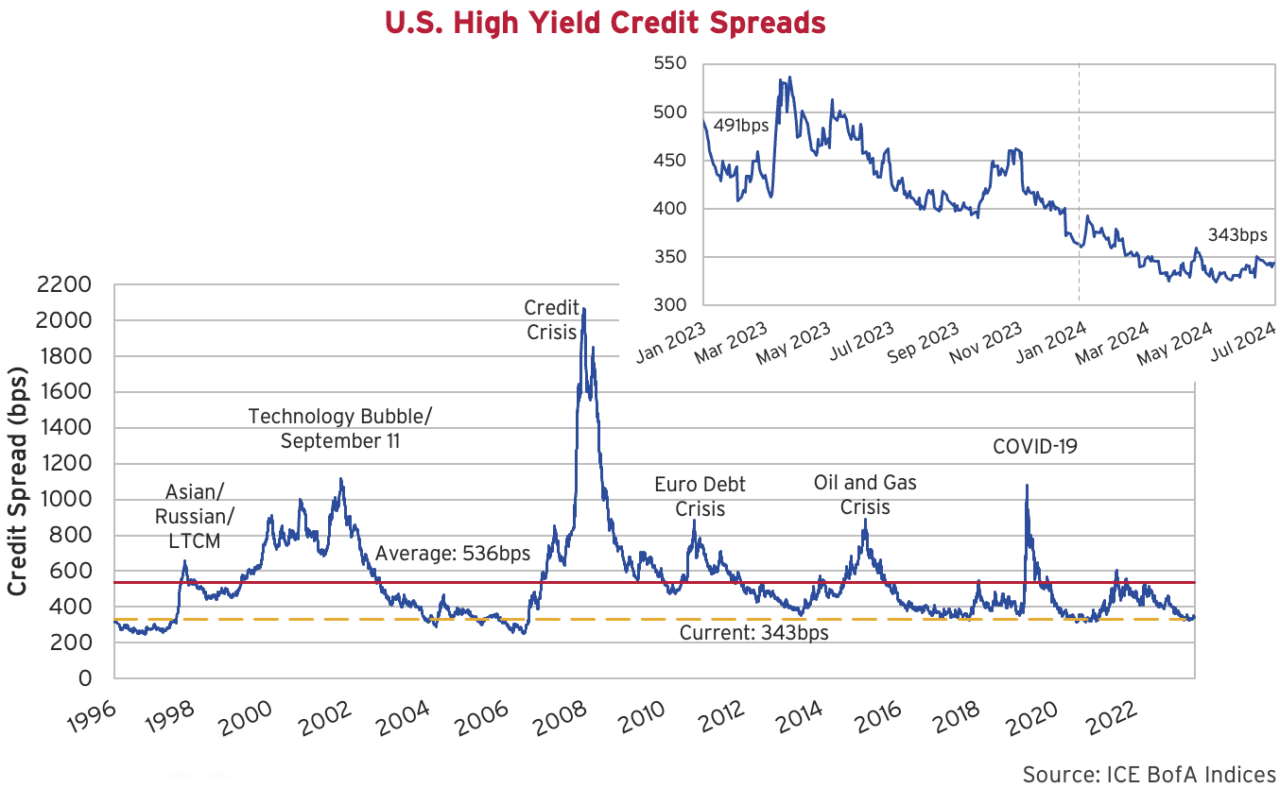

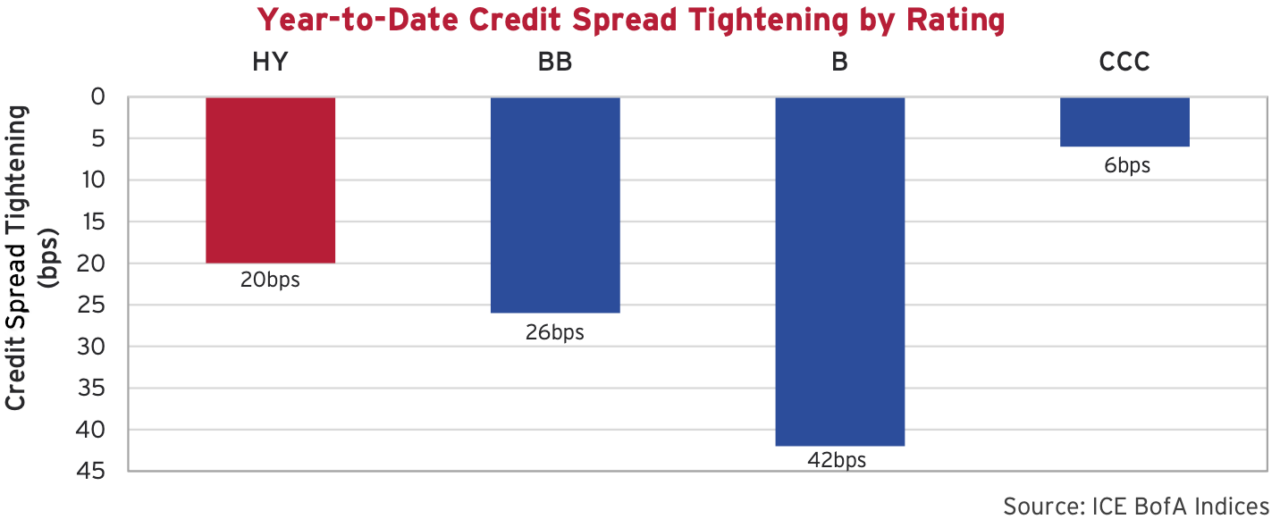

Credit spreads in the U.S. high yield market also experienced a macro-induced speed bump in April on the way to an eventual cycle tight of 324 bps in May. Spreads relented soon after, but the U.S. High Yield Index finished the second quarter at a very expensive 343 bps. High yield spreads are 20 bps tighter through the first half of the year, adding modest gains to the accumulated yield that has more than offset the impact of higher yields. At current valuations, we continue to believe there is little upside for most high yield credit beyond its running yield.

Queen B

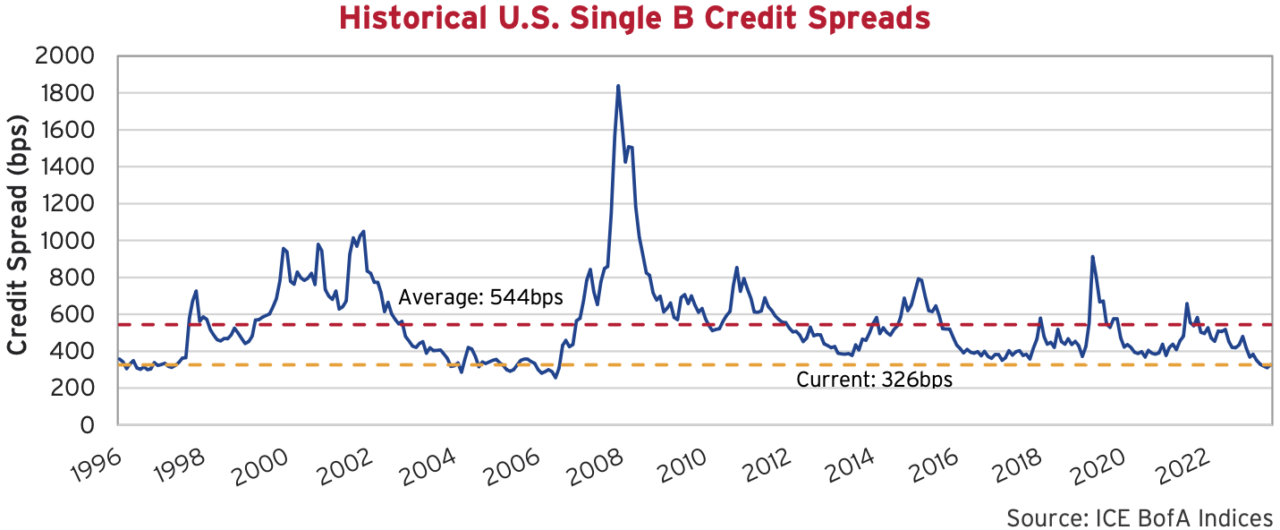

The 20 bps of tightening in the high yield market this year has been dominated by single B issuers. We can see from the chart below that single B spreads have narrowed 42 bps on the year whereas the CCC cohort is tighter by only 6 bps.

Zooming out for context, single B spreads hit 310 bps at the end of May before finishing the quarter at 326 bps. This represents the tightest levels for the category since the eve of the Great Financial Crisis back in early 2007.

Re-Priced For Perfection

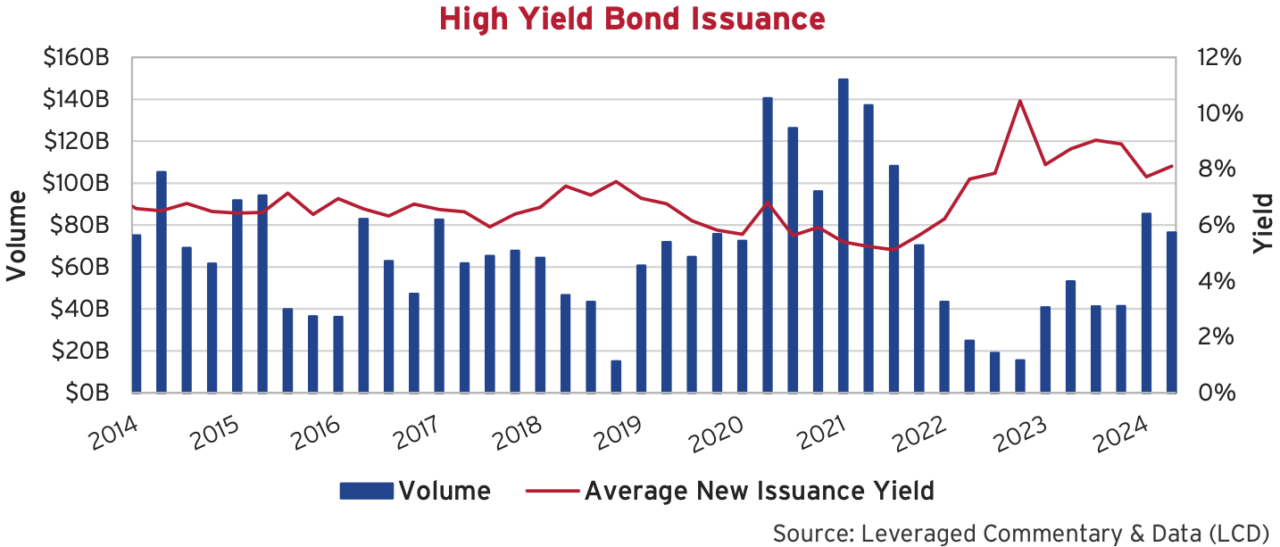

High yield issuers continued to take advantage of favourable new issue conditions to refinance their debt at the attractive risk premiums investors are prepared to offer. As the graph below illustrates, new issue volumes remained relatively strong in the second quarter at US$76 billion and carried an average coupon of around 8%. According to Pitchbook LCD, refinancing activity accounted for a remarkable 85% of that total. This means that net new supply of bonds has been quite modest and managers with an index benchmark have had little choice but to participate. With each successive deal, we see more and more bonds being priced for perfection. In this environment, we believe it is important for investors to be discriminate and ensure they are paid the credit risk they are assuming.

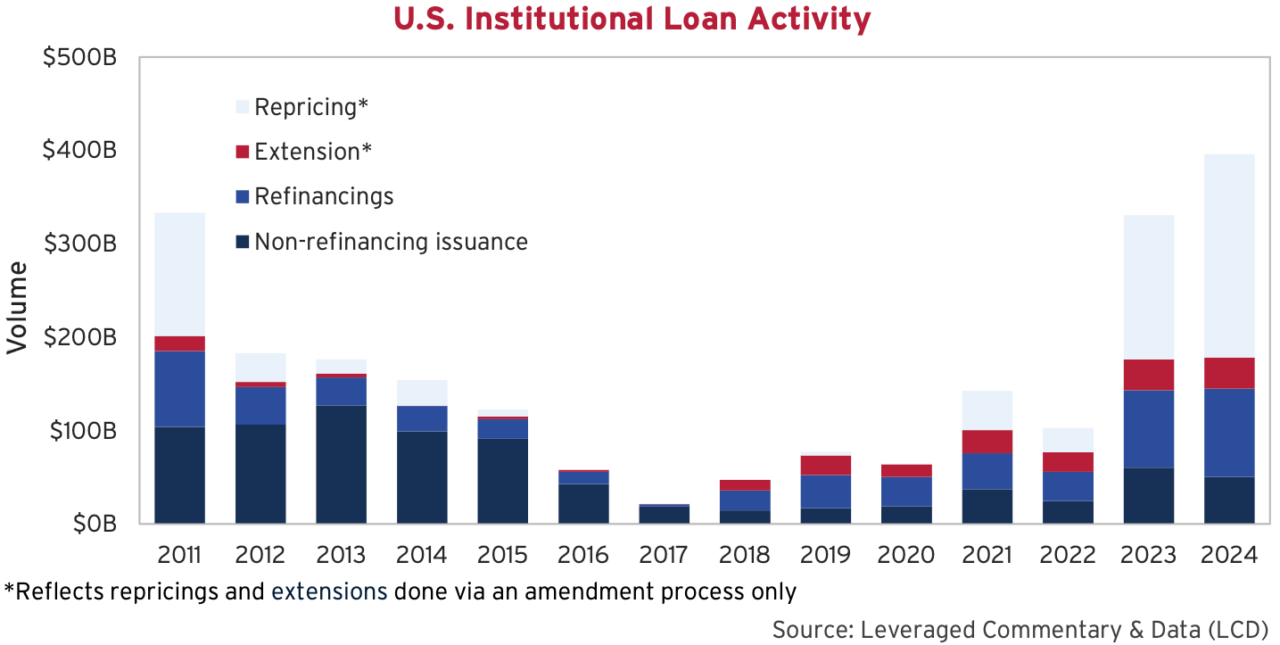

Refinancing and repricing activity has also dominated primary markets within the leveraged loan segment. Loan issuers are opportunistically addressing near term maturities, reducing the cost of their outstanding debt, or both. According to Pitchbook LCD, U.S. companies have reduced the borrowing spread on US$390 billion worth of levered loans this year, saving 54 bps on average. That total translates to 29% of the US$1.4 trillion Morningstar LSTA US Leveraged Loan Index having repriced this year. Much of the impact is being absorbed by a record pace of new Collateralized Loan Obligation (CLO) origination and from renewed fund flows into the asset class this year. This demand has allowed more and more lower quality B rated companies to get in on the act this year.

Creditor on Creditor Violence

In our previous newsletters, we have talked about the increase of “Distressed Exchanges” or “Liability Management Transactions” (LMT) in the market. These transactions typically involve moving assets and collateral to different subsidiaries or introducing new ranking levels within a company’s capital structure. They may be the lever of last resort

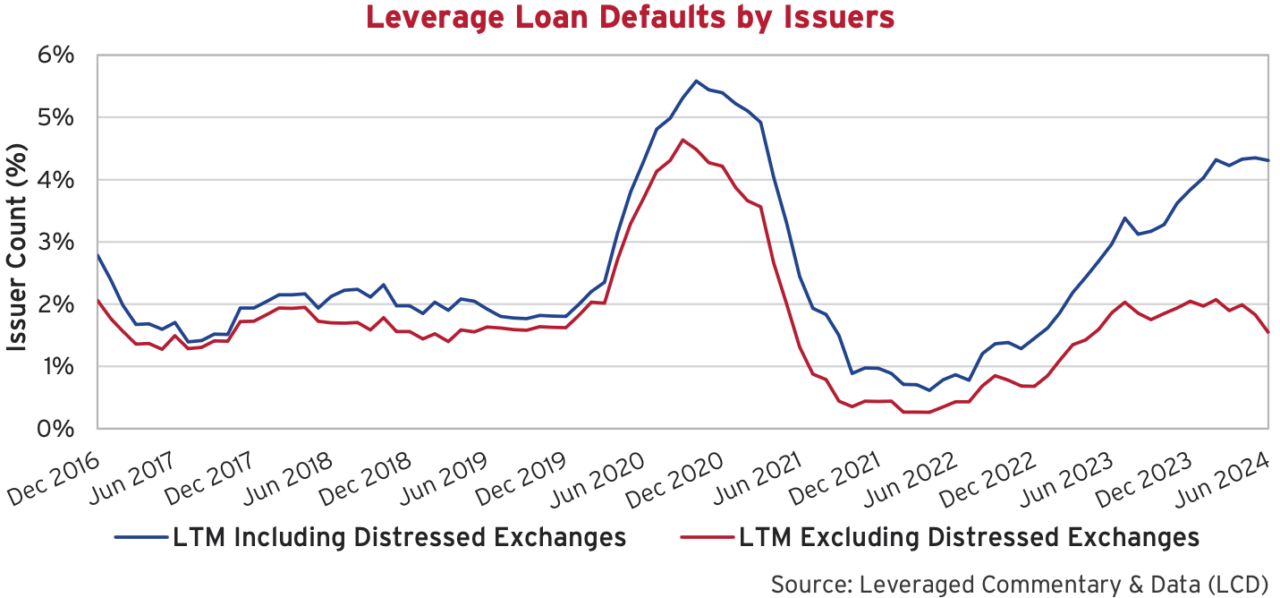

for companies unable to raise new money or unwilling to accept punitive terms. We can see from the graph below that while defaults have risen modestly, and have more recently fallen off, distressed exchanges continue to be on the rise.

We believe that it is critically important for investors to roll up their sleeves and have a thorough understanding of the risks in an investment as well as be prepared to actively engage after purchase. The risk of “creditor on creditor violence”, where an improvement for one lender comes at the expense of another, is higher than ever.

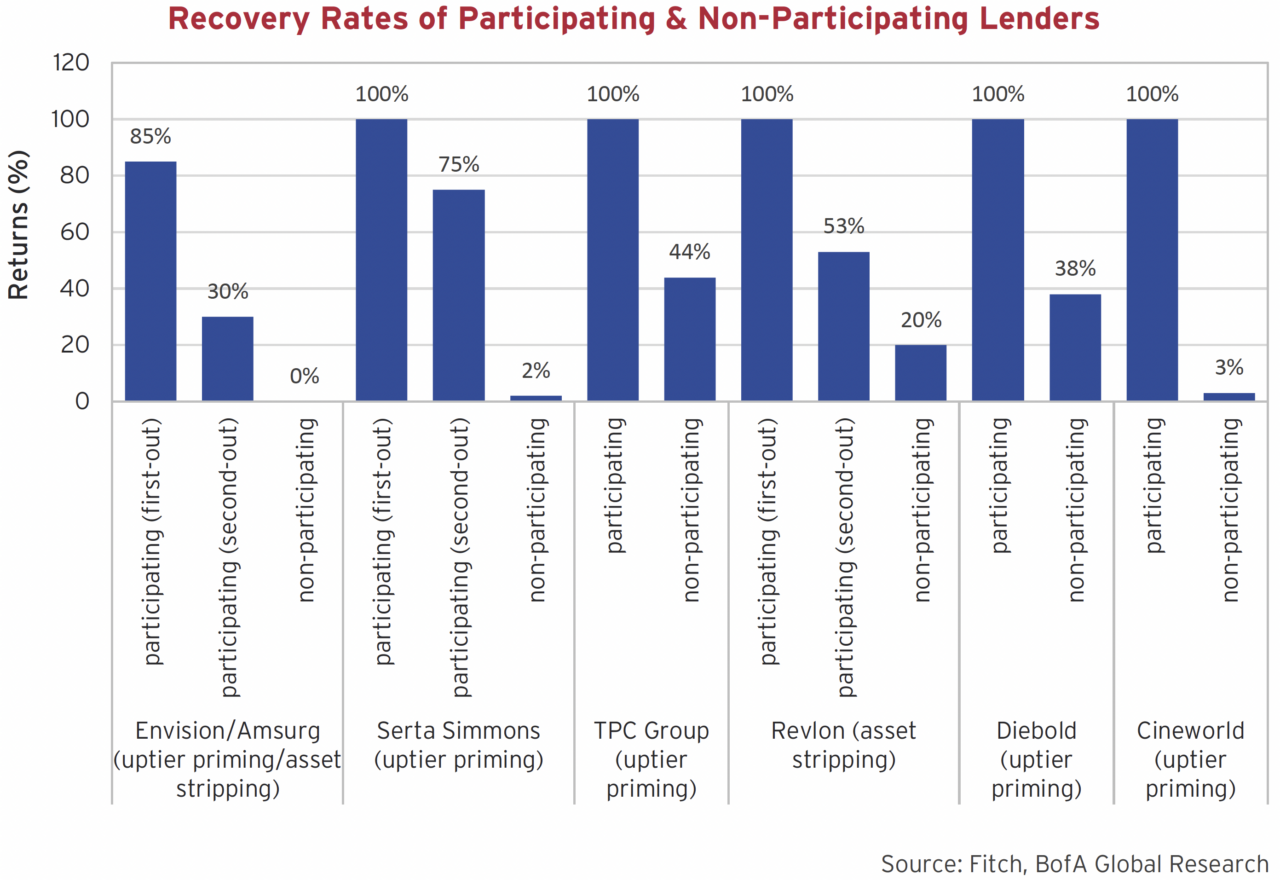

Game of Loans

A recent report from BofA Global Research aptly describes this creditor violence as a Game of Loans. Their research substantiates our assertion that there can be a large dispersion in recovery rates, which is underappreciated in aggregate metrics. This can mean a much lower experienced recovery than expected. The report notes that with the proliferation of LMTs, many CLOs have been excluded from high recoveries. This is because aggressive investors may come into the lender group, which might be CLO heavy, and restructure new debt in a way that comes at the expense of any non-participating borrowers. In other cases, if permitted by the lending agreement, borrowers can move assets to an unrestricted subsidiary, which may be used to secure new debt and will leave existing lenders with reduced collateral. The graph below illustrates the sharp difference in recovery in recent some examples.

Preferred Shares Surge

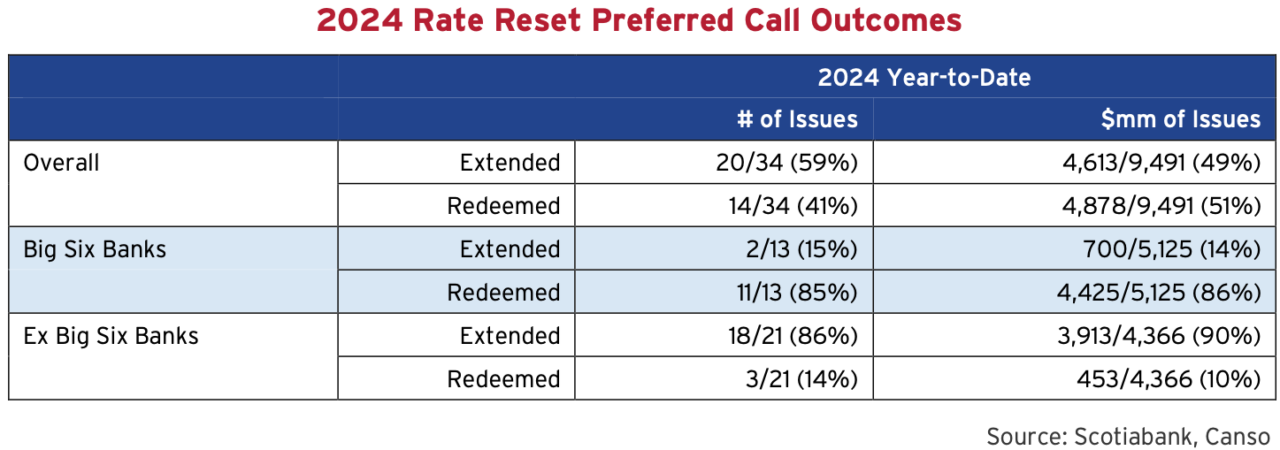

We last checked in on the Canadian retail preferred share market in October 2023 and spoke about how quiet the market has become. This year we have seen a continuation of many of the same trends. There continues to be almost no new issuance while many existing issues have been redeemed by financial institutions and refinanced with other AT1 securities. In late December, BNS surprised the market by calling their last remaining rate reset preferred share issue, given its relatively low reset spread. The market responded by repricing similar issues of the other banks closer to par on the assumption that they too would be called. This year, Royal Bank, TD Bank, BMO and CIBC have all called rate reset issues at varying spreads. The surge in price for Canadian bank preferred share issues has delivered investors a 14.2% return on the asset class.

The table below outlines the difference in outcomes based on whether the preferred share was issued by a Big Six Canadian bank. The Big Six have redeemed 85% of their issues this year, taking investors out at par. Meanwhile, the inverse is true for non-Big Six issues, with 86% being extended. There are only 3 preferred share issues from Canadian banks that have reset dates during the second half of this year, which should help to level prices. That said, investors will likely continue to crowd into the outstanding issues remaining in the market.

Emerging Credit Opportunities

We continue to believe that current valuations offer little compensation for risk in our portfolios. While credit spreads have lifted off the bottom, it is hard to say if we have passed the tights for this cycle. Either way, we are starting to see more and more credit opportunities emerging. Even though default rates remain relatively low, the increase in distressed transactions points to increasing stress among highly levered companies as interest rates remain higher for longer. For many, these distressed transactions may just be a temporary lifeline, a chance to kick the “restructuring can” down road. In a key sign of distress, there were also a handful of issues completed this quarter with yields above 12%. The opportunity lies in rolling up your sleeves, doing the credit work, and identifying the deals that are well structured for lenders versus the ones that are not – a challenge our investment team is eager to take on.