Shades of the 2008 Financial Crisis

A relatively new type of security with ties to the 2008 financial crisis is shaking up the Canadian preferred share market. The security goes by different names depending on where it is issued, and in Canada it is known as Limited Recourse Capital Note (“LRCN”), and in the US it is known as an Additional Tier 1 Capital Note (“AT1”).

Following the 2008 financial crisis regulatory authorities increased their scrutiny on financial institutions and their ability to absorb losses in the event of a financial collapse. One of the regulations adopted by many global regulatory authorities was to increase tier-one capital ratio1 requirements for banks. To manage this new liquidity requirement, a new type of debt security provision was created called non-viable contingent capital (“NVCC”). NVCC gives banks the flexibility to increase their tier-one capital in emergency situations by allowing issuers of NVCC bonds to convert them to equity under pre-determined trigger events. An NVCC trigger event is unlikely, but if triggered, an NVCC bondholder would likely face a significant loss on their investment. NVCC is also a core provision found in LRCNs/AT1s.

A Game-changer

The Big-6 Canadian banks (“Big-6”)2 have historically been regular issuers in the Canadian preferred share market and Big-6 preferred share issuances represented approximately 30% of the overall Canadian preferred share market3 as of August 31st, 2020. From the perspective of a bank, issuing preferred shares has been attractive because preferred shares can be attributed to tier-one capital and are generally a cheaper form of raising capital than issuing common stock. From the perspective of an investor, buying preferred shares has been attractive because they provide a generally predictable stream of income with attractive yields that are also tax-efficient.

There are at least two reasons that LRCNs/AT1s are game-changers for banks:

- It allows the banks to satisfy their tier-one capital requirements with regulators.

- By shifting from issuing preferred shares to LRCNs/AT1s, bank issuers can improve their net income via the tax deductibility of LRCN/AT1 interest payments and in effect claim the tax benefit that had typically gone to investors through preferred shares.

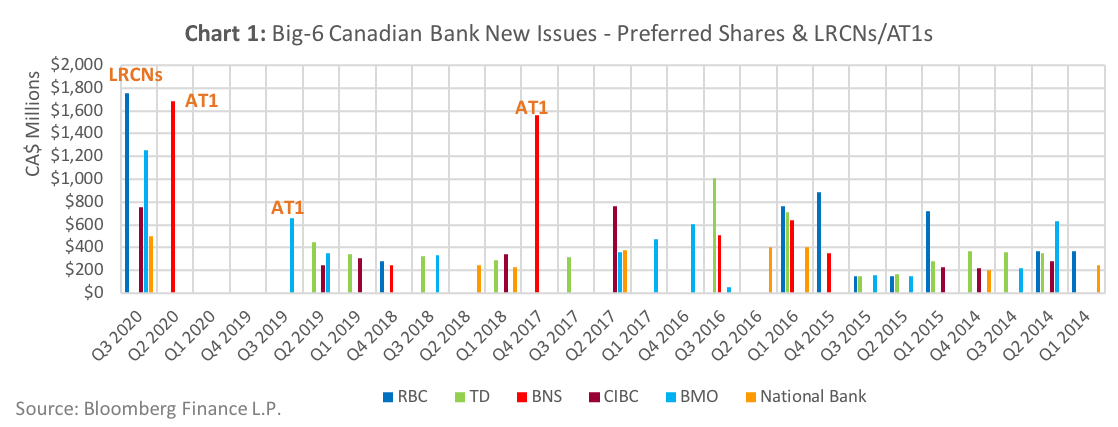

Consider Chart 1, which shows how the Big-6 have been conspicuously absent from the new issue preferred share market over the past five calendar quarters, instead favouring massive LRCN/AT1 issuances. The vast majority of Big-6 preferred shares (88%) are “fixed-reset”4 preferred shares, which means their dividend payments adjust every five years based on a pre-determined yield spread (“reset spread”) above the prevailing 5-year government bond yield; on every reset date, the issuer has the option to either call the preferred share or have the dividend reset and extend the call date another five years. LRCNs/AT1s also follow the same fixed-reset coupon structure.

Cost-Benefit

Given the trend of the Big-6 issuing LRCNs/AT1s over preferred shares, investors may be wondering if it means that Big-6 preferred shares will disappear from the market all together as, over time, the individual banks may call their outstanding preferred share issues. The short answer is maybe, although a cost-benefit analysis may give a better picture of which preferred share issues have a higher likelihood of being called and those that have a lower likelihood of being called.

For fixed-reset preferred shares and LRCNs/AT1s, a comparable cost metric between the securities are their reset spreads, as the reset spread indicates the additional yield the issuer must pay to investors. Reset spreads are determined at their time of issuance and are based on the market appetite for risk (e.g. low reset spreads are indicative of a high appetite for risk at the time of issuance and high reset spreads are generally indicative of a low appetite for risk at the time of issuance). Therefore, the decision for an issuer to call an existing preferred share and replace it with an LRCN/AT1 ultimately hinges on their relative yield spreads and factoring in the tax benefit the issuer gains from issuing an LRCN/AT1.

At-Risk Big-6 Preferred Shares

In Q3 2020, there have already been four Big-6 LRCN issuances, which gives investors a good sense of the going market rate for reset spreads – National Bank, BMO and CIBC did issues in September 2020 at reset spreads of 394.3bps (3.943%), 393.8 bps (3.938%) and 400.0 (4.000%), respectively, over the 5-year Canada bond yield, and RBC did an issue in July 2020 at a reset spread of 413.7 bps (4.137%) over the 5-year Canada bond yield.

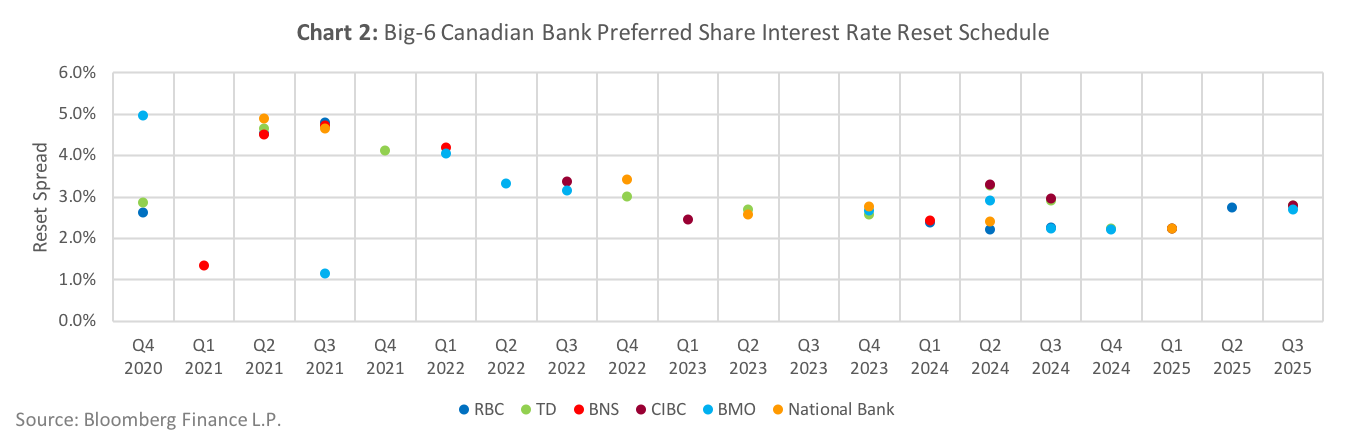

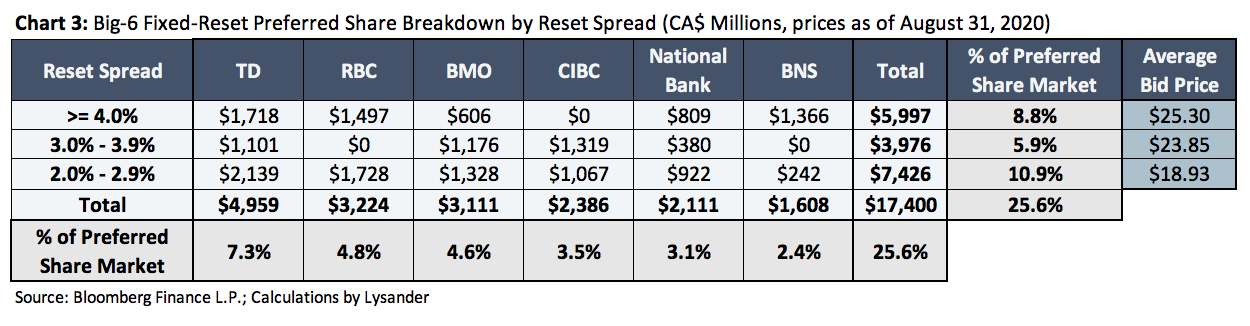

With that in mind, consider Chart 2, which shows the reset schedule and reset spreads for Big-6 fixed-reset preferred shares over the next twenty calendar quarters. Chart 3 shows the amount of Big-6 fixed-reset preferred shares outstanding broken down by bank, reset spread, percentage of the overall Canadian preferred share market and average bid price.

A key takeaway is that there is approximately $6.0 billion of Big-6 fixed-reset preferred shares (8.8% of the Canadian preferred share market) with reset spreads greater than 4% and all of those reset dates are within the next six calendar quarters. Given the average reset spread of the LRCNs recently issued by National Bank, BMO, CIBC and RBC was 400bps (4.00%), it seems the market believes these preferred shares will be called on their next reset date, which is reflected by the fact that the average price of preferred shares with reset spreads greater than 4% was $25.30 as of August 31st, 2020 (above the $25 call price). For the preferred shares with reset spreads less than 4%, issuing LRCNs/AT1s at current rates does not create the same relative yield benefits that would warrant calling those preferred shares, a sentiment that is also reflected by their current average bid price, which is below the $25 call price.

Conclusion

The introduction of LRCNs and AT1s to the Canadian marketplace has made waves in the Canadian preferred share market and will likely continue to do so in the years to come. While LRCN/AT1 issuances in Canada have been solely made by the Big-6, it is possible that other players in the Canadian preferred share market will follow-suit given the issuer tax benefits of LRCNs/AT1s over preferred shares. While this will not happen overnight, such a move could eventually lower the supply of Canadian preferred shares and could also have material consequences for the Canadian retail investors and their ability to earn tax-efficient income through their investments.

In the near-term however, investors should be aware of the reset spreads of Big-6 preferred shares and their likelihood of being called (i.e. those with reset spreads greater than 4% vs. those with reset spreads less than 4%). Both segments may have different implications for investors:

- Preferred shares more likely to be called: these preferred shares may have posted dividend yields that overstate what an investor would realize in the event they are called (i.e. investors earn the “yield-to-call” rather than the “current yield”).

- Preferred shares less likely to be called: if market demand for LRCNs/AT1s continues and Big-6 issue spreads for LRCNs/AT1s decrease, it would likely increase the prices for existing preferred shares towards their $25.00 call price, as their likelihood of being called would also increase.

To help navigate the Canadian preferred share/LRCN/AT1 markets, investors could benefit from the guidance of an active portfolio manager or a professional financial advisor. Lysander Funds has an actively managed Canadian preferred share solution, managed by Slater Asset Management, and is available to retail investors and financial advisors as a mutual fund (Lysander-Slater Preferred Share Dividend Fund) and an ETF (Lysander-Slater Preferred Share ActivETF).

1 According to Investopedia, the tier-one capital ratio = tier-one capital (equity + retained earnings) ÷ total risk weighted assets.

2 The Big-6 include: TD Bank, Royal Bank of Canada, Bank of Montreal, CIBC, Bank of Nova Scotia & National Bank

3 For the purpose of this paper, “the Canadian preferred share market” is all publicly traded preferred shares trading on the Toronto Stock Exchange based on data obtained from Bloomberg Finance L.P.

4 The three major types of Canadian preferred share coupon structure are: fixed-reset, perpetual & floater