Inflating yields

There are growing concerns the Bank of Canada is falling behind in achieving its stated mandate of “using its monetary policy framework to keep inflation low and stable”1.

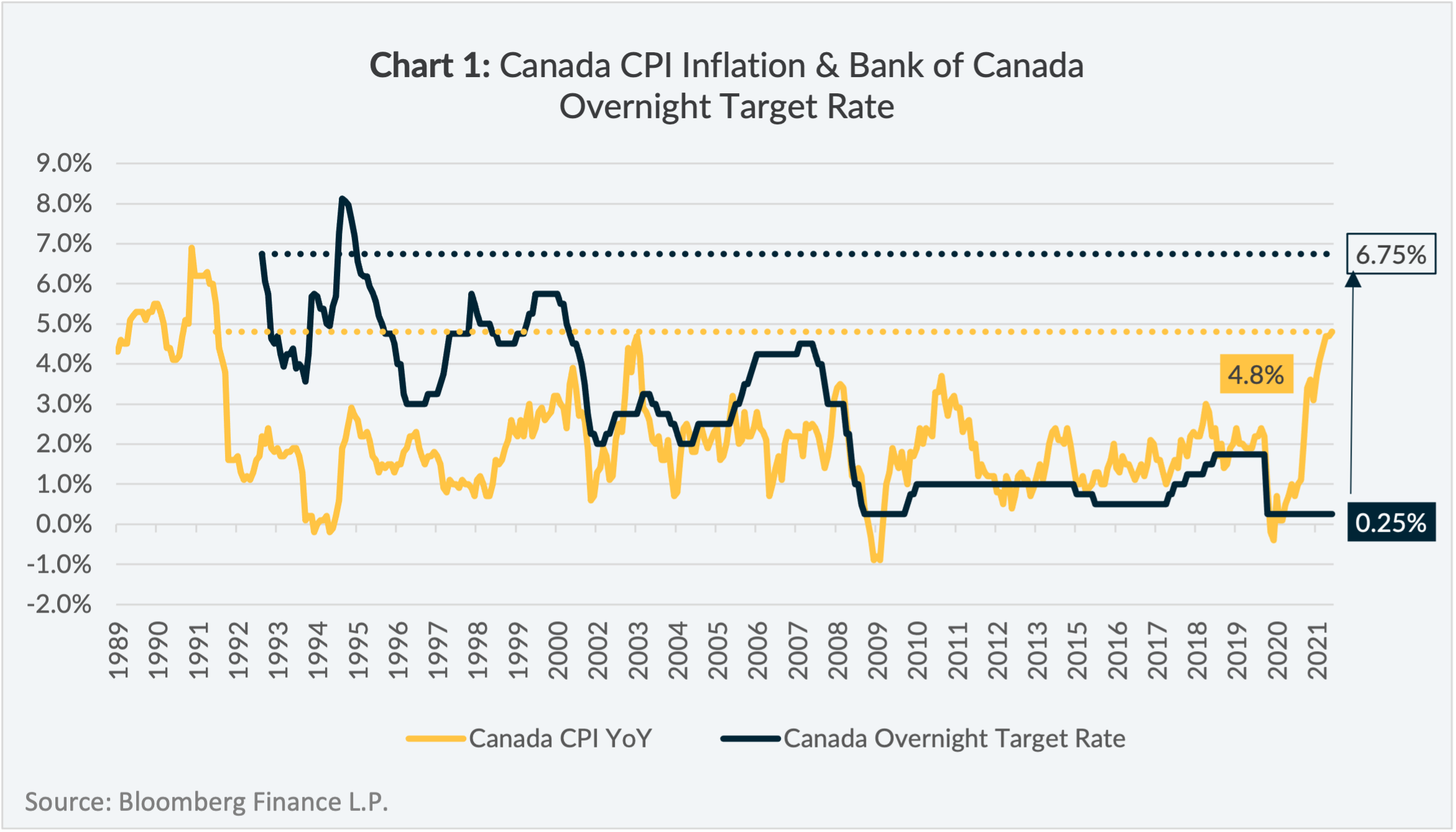

As illustrated in Chart 1, in December 2021 year-over-year Canadian CPI inflation hit 4.8%, the highest reading since 1991, which is ironic because it was in 1991 when the Bank of Canada introduced a 2% inflation target to reduce the overall level of inflation in the economy.

As of December 1992 (the earliest data per Bloomberg), the level of the Canadian overnight target rate was 6.75%, whereas today the rate is 0.25% – a difference of 6.5%, or twenty-six 0.25% overnight rate hikes!

This would likely be concerning for those who remember inflation in the 1970s and 1980s. Year-over-year inflation in Canada during those decades peaked at levels over 12%, and the Canada 10-year bond yield peaked at a level over 16% in 1982. The fallout from this was severe, as Canadian GDP contracted for six consecutive quarters ending in Q1 1983.

Parallel Concerns

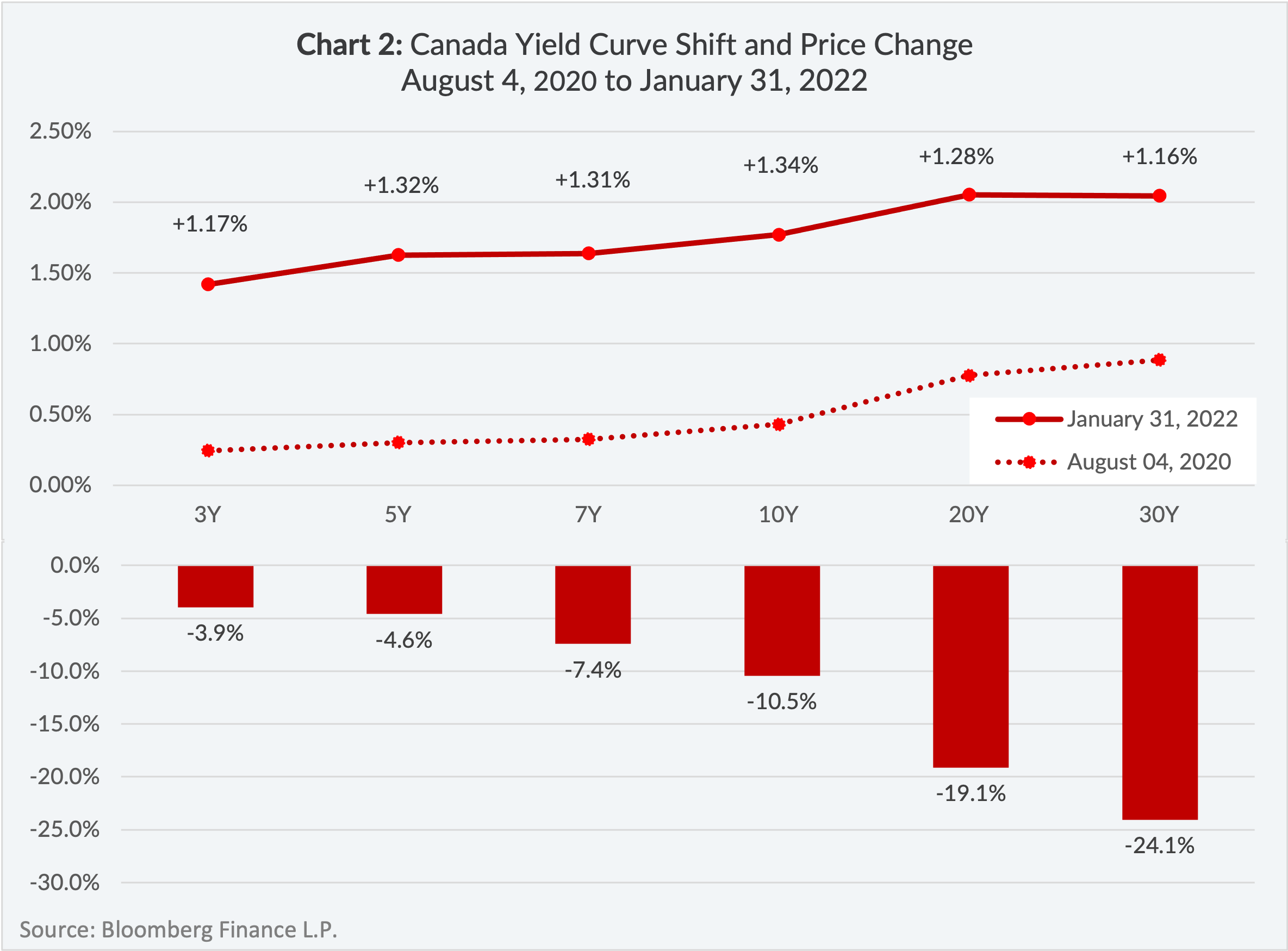

Judging by the recent movement of the Canadian yield curve it would appear the bond market is also growing cautious of inflation. On August 4, 2020, many Canadian bonds across the yield curve hit their all-time low yield levels, and as illustrated in Chart 2, by January 31, 2022, their yields had all increased by at least 1.17%. This corresponded with price declines ranging between -3.9% and -24.1%, for tenors between 3-years and 30-years – unfitting returns for securities know as “risk-free”.

The recent volatility in Government of Canada bonds highlights a fundamental bond market risk that has acted as more of a reward for bond investors over the past four decades – duration.

A Simple Asset

The great thing about bonds is they are fundamentally simple securities to understand, because investors know in advance what rate of return they will receive by holding a bond until maturity, its yield-to-maturity (“yield”). Duration quantifies the expected percentage change in price of a bond given a 1% move in interest rates, up or down2.

Put differently, a bond’s yield is the annual return and investor can expect by holding it to maturity (i.e. its reward). While duration is the extent to which a bond’s return will deviate from its initial yield prior to its maturity, based on changes in interest rates (i.e. its risk).

The Canadian Bond Market “Death Cross”

Many investors have relied on passive broad market bond indices such as the ICE BofAML Canada Broad Market Index3 (“Canadian bond market” or “the Index”) to gain exposure to bonds. For many years, this strategy has worked. However, today, against the backdrop of high inflation and possibly higher interest rates, the outlook for the Canadian bond market is less attractive.

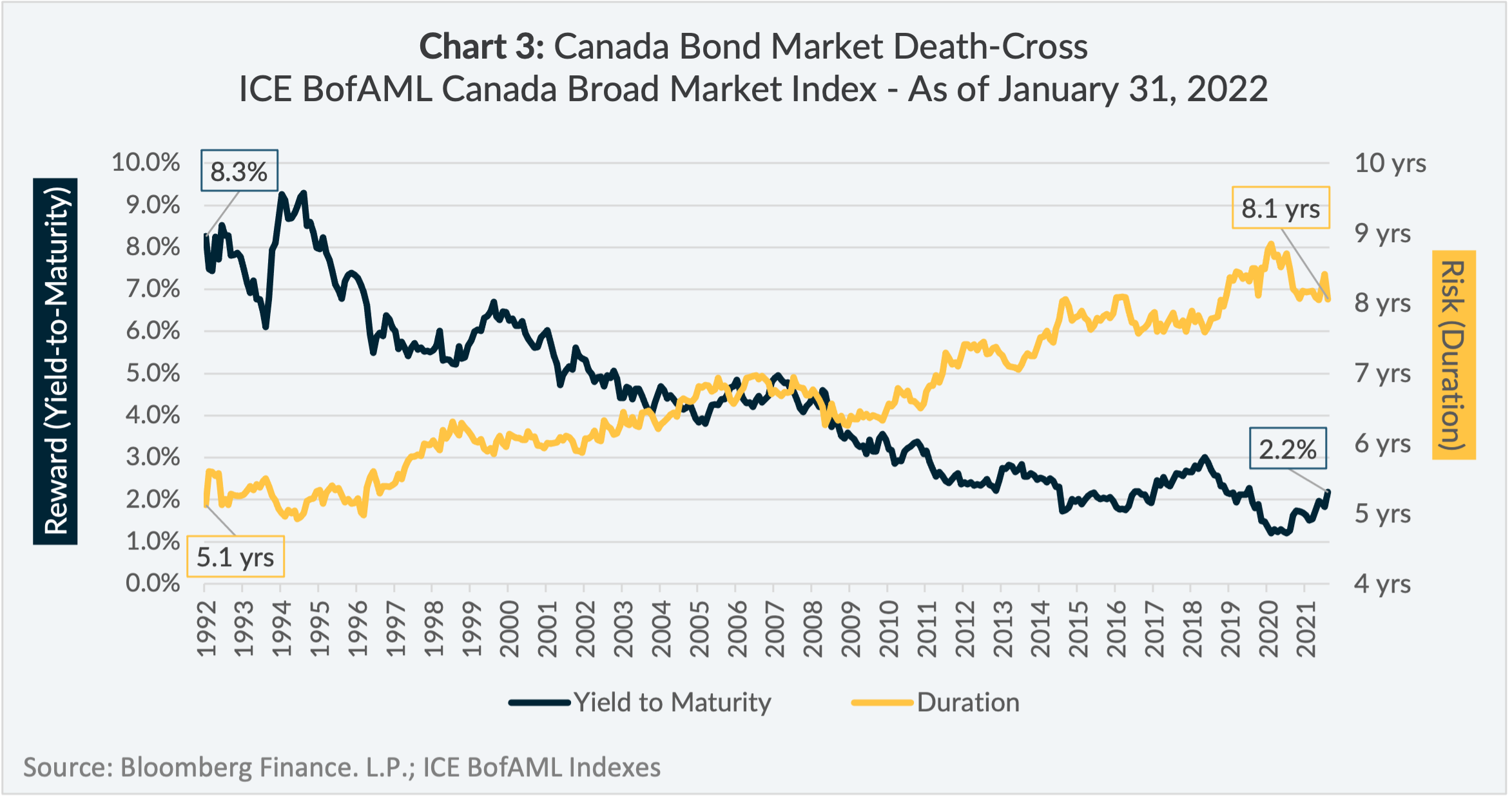

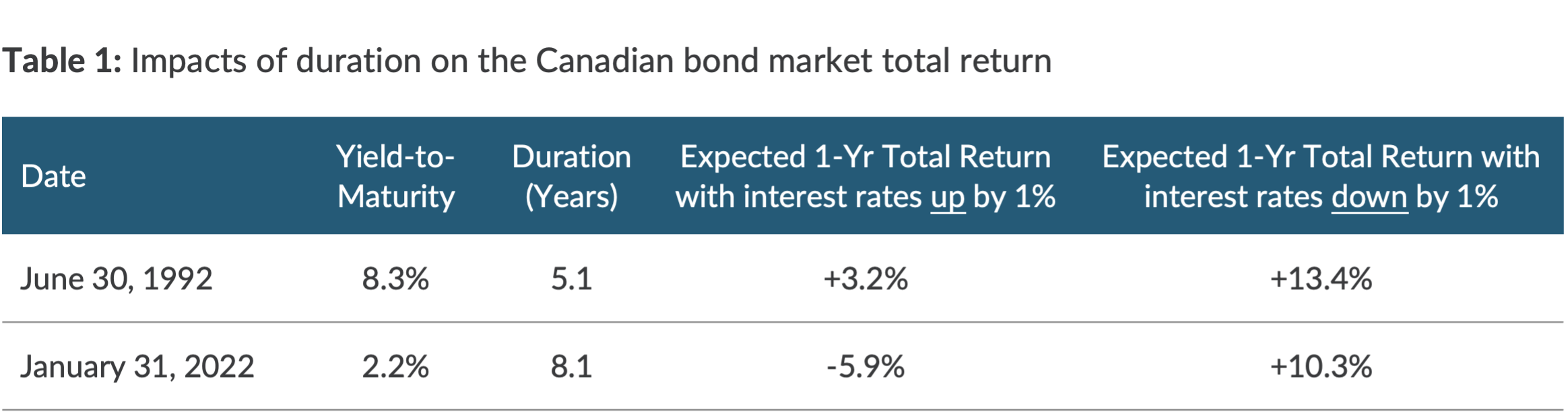

As illustrated in Chart 3, on June 30, 1992, an investment in the Index achieved yield of 8.3%, while assuming 5.1 years of duration, whereas on January 31, 2022, an investment in the Index achieved a yield of 2.2%, while assuming 8.1 years of duration.

What this means is investments in the Canadian bond market today offer very little expected return, while assuming very high levels of risk. Table 1 illustrates the practical impact a 1% change in interest rates would have on the total return expectations of the Canadian bond market in 1992 and in 2022.

The Shifting Tide

The gradual decline of interest rates has been a double edge sword for investors in the Canadian bond market over the years. On one hand, it has enhanced total returns above what would have been expected based on the initial indicated yield. On the other hand, it has gradually exposed investors to a greater risk of capital loss in a period of rising interest rates.

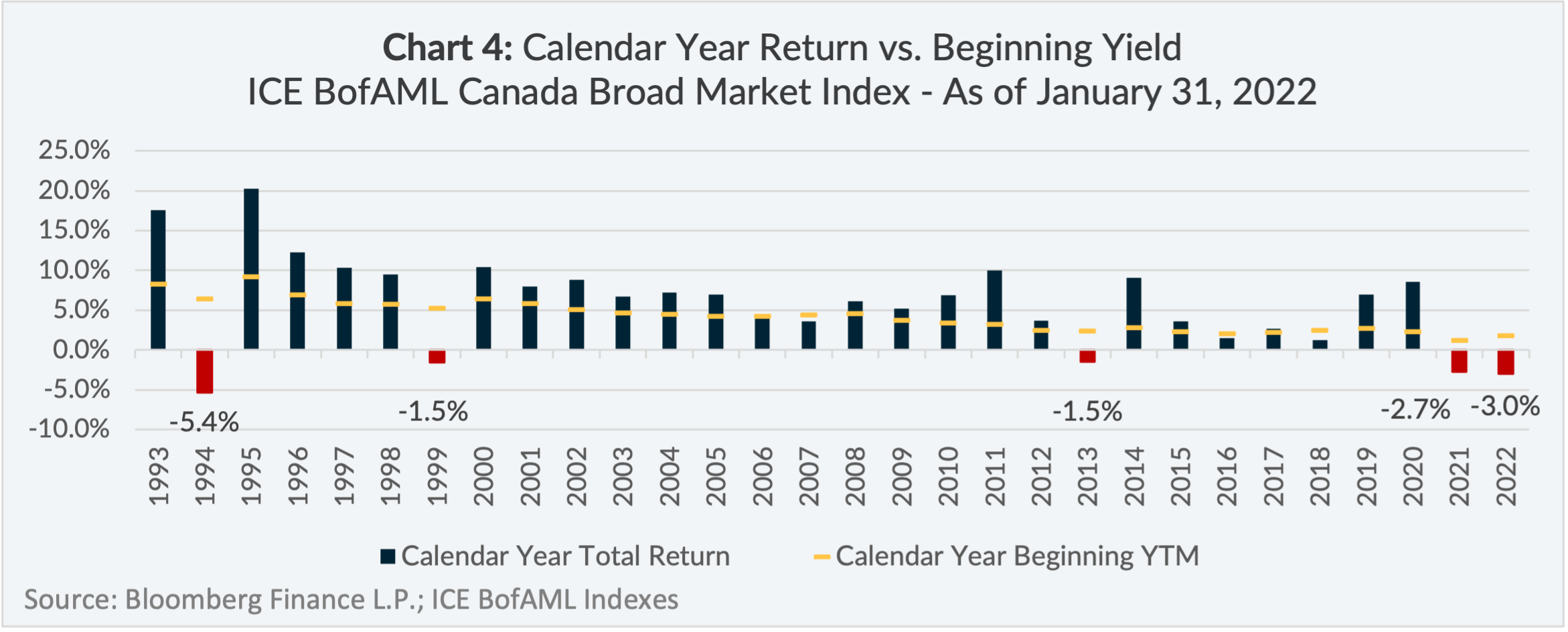

Chart 4 illustrates how this dynamic has played out out in real life. Over the 29-year period between 1993 and 2021, there were 21 times when the Index calendar year total return exceeded its yield indicated at the beginning of the year. Furthermore, there were only 4 times when the Index produced negative calendar year total returns.

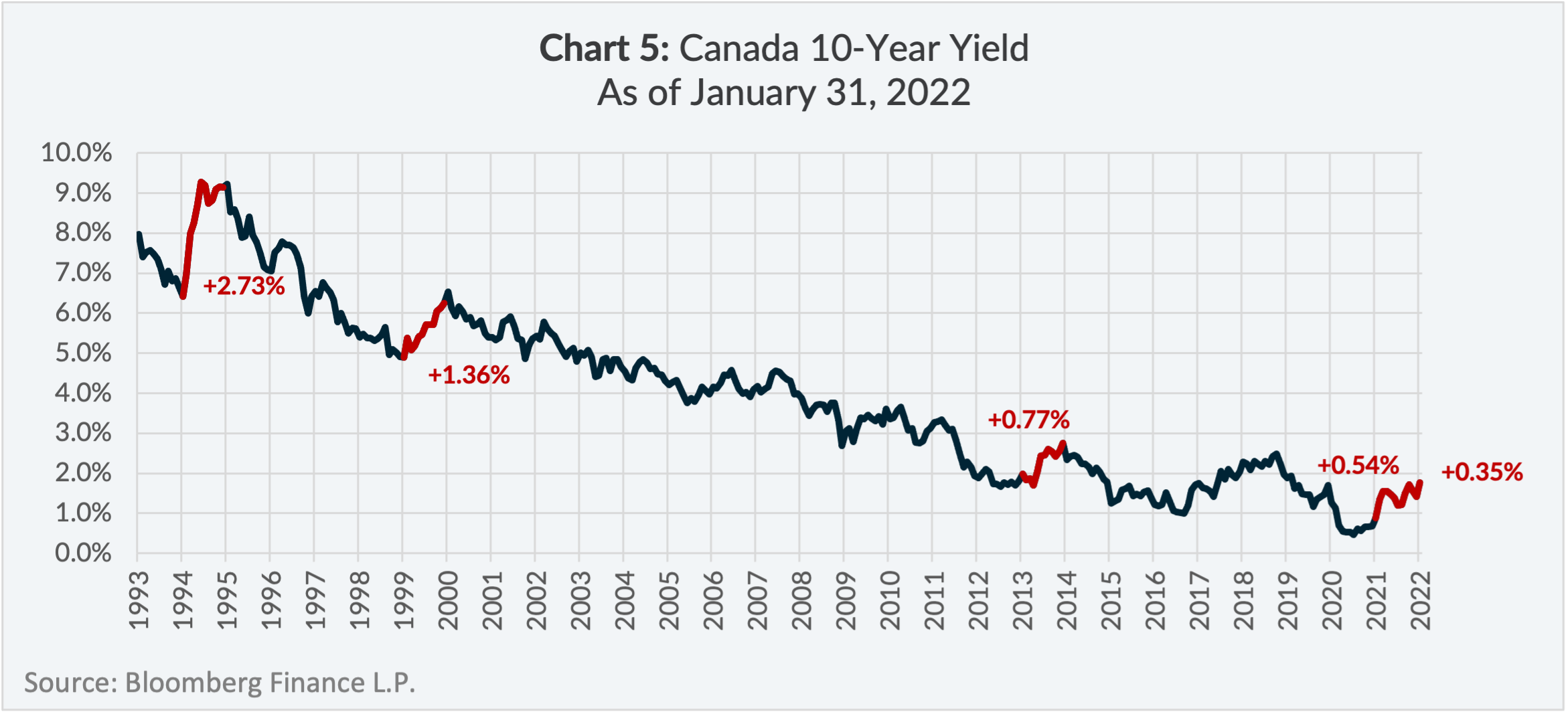

As highlighted in Chart 5, in the years when the Index produced negative total returns, indicated by the red empahsis lines, it has more recently taken smaller increases in interest rates for the Index to produce negative total returns.

Conclusion

As the saying goes, “when the tide goes out, you can see who was swimming naked”. Well, the tide of duration started moving out in 2020 and the trend has continued into 2022.

This may only be the beginning of this trend. Inflation continues to be stimulated by an unprecedented combination of demand (i.e. monetary and fiscal stimulus) and supply factors (i.e. broken supply chains). Furthermore, if inflation in the Canadian economy remains persistent it could start to creep into broad based wage adjustments, which could cause inflation to spiral even higher. In this scenario, Canadian interest rates would likely move higher and at a likely significant cost for bond investors in passive broad market bond indices.

A solution for bond investors in the current environment is to structure their bond portfolios to have yields that are greater than or more closely aligned to their durations. This may not be easily achievable through passive broad market bond indices, but could be done through actively managed bond solutions.

Finding the right bond strategy depends on the unique risk and return requirements of the individual investor, which could be aided in consultation with a financial advisor. A good starting point is to assess the total risk of a bond portfolio by understanding both its duration and average credit quality. A higher level of risk is not necessarily a bad thing, so long as investors are adequately compensated for assuming it, and it falls within the boundaries of their return and risk objectives.

Lysander Funds

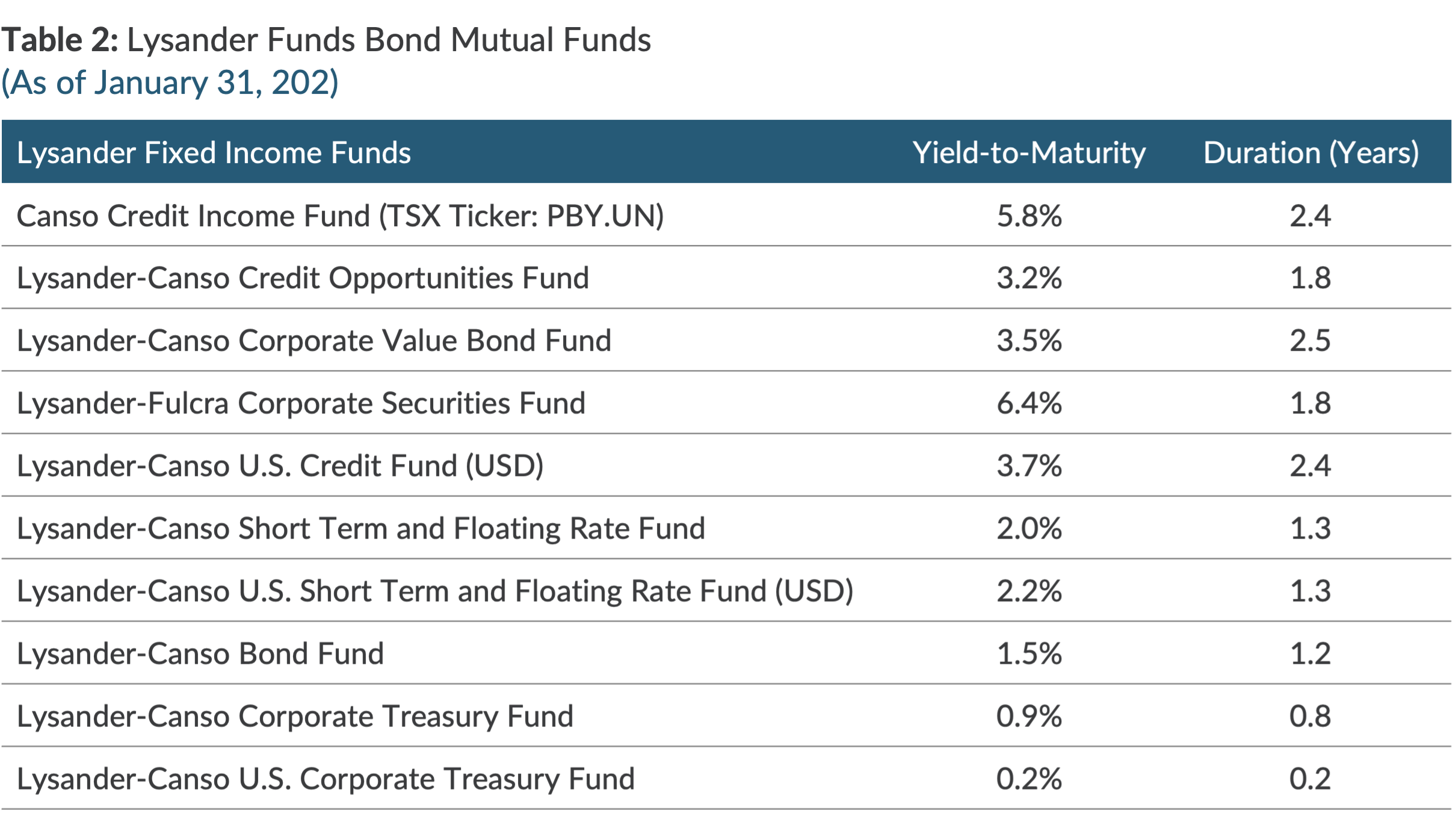

Lysander Funds offers a variety of bond mutual funds to meet the needs of investors with different return and risk requirements. As of January 31, 2022, each offers attractive yield and duration characteristics to mitigate the risk of rising interest rates.

1 https://www.bankofcanada.ca/about/

2 Duration is quoted in units of “years”. The duration figure represents the approximate percentage price change up or down for a 1% change in interest rates – i.e. a duration of 8 years can be interpreted as if interest rates increase by 1%, the price of the bond will fall by approximately 8%, and vice versa if interest rates fall.

3 The ICE BofAML Canada Broad Market Index is comprised of government and corporate bonds with investment grade credit ratings issued in Canadian dollars.