Why You May Want to Buy Bonds Through a Fund Rather Than Doing it Yourself

There are many decisions when building an investment portfolio, from selecting the asset mix, down to choosing the individual securities within each asset class. While some investors prefer the do-it-yourself approach of selecting individual securities, investment fund structures (“Funds”) can also be helpful solutions for building robust investment portfolios.

Commonly cited benefits of Funds in general are their ability to provide simple broad diversification across different asset classes, sectors and/or specific investment themes. Funds may also provide access to professional portfolio management that is either passive (i.e. aims to replicate an investment index) or active (i.e. aims to outperform an investment index).

In addition to the cross-asset class benefits, Funds also offer benefits specific to bond investors, as opposed to the do-it-yourself approach of selecting individual securities by:

- Reducing cash-drag;

- Providing better access to bond issues;

- Reducing implicit fees.

1. Funds reduce cash-drag

Cash-drag can be defined as the underperformance of an investment portfolio relative to the return of the portfolio’s underlying assets because of the portfolio’s cash holdings.

One of the most important bond characteristics to consider is its yield-to-maturity (“YTM”) because it represents the rate of return an investor can expect by holding a bond to its maturity. One of the key assumptions of YTM is that its cash coupon payments are reinvested at an equivalent YTM. If coupon payments are not reinvested, the actual rate of return realized by the investor over the life of the bond will be less than the initial stated YTM, a form of cash-drag on the portfolio.

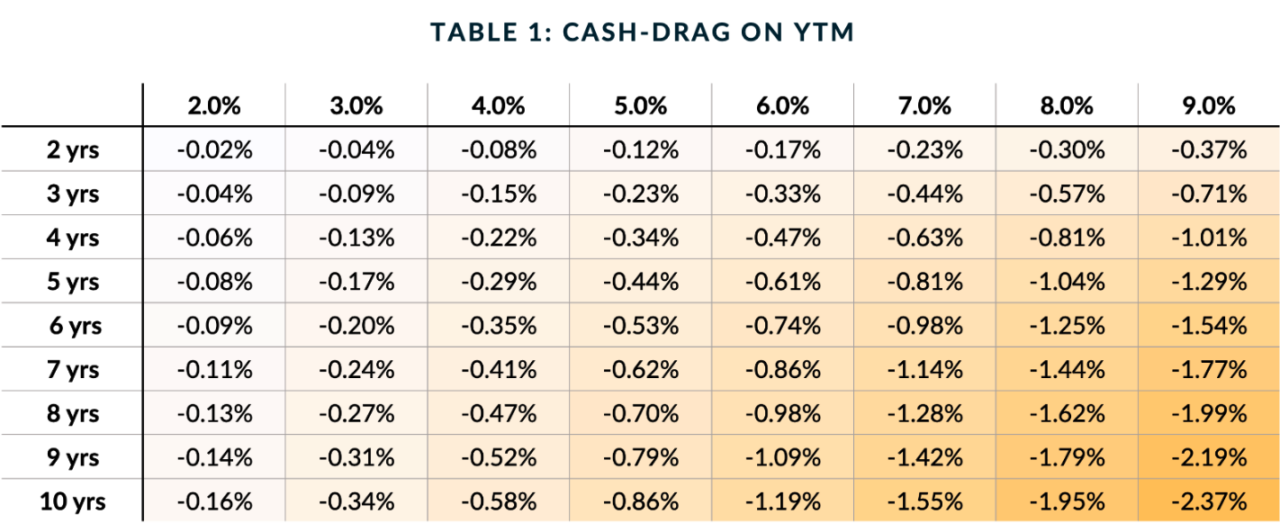

The amount that cash-drag impacts YTM from not reinvesting coupon payments is illustrated in Table 1. The X-axis represents the coupon rate/YTM at issuance and the Y-axis represents the original tenor of the bond. The result – all things being equal, the higher the coupon and the longer the term, the greater the cash-drag impact on YTM.

Individual Bonds

Individual bonds can pose at least two challenges for investors regarding cash-drag: administrative burden and minimum reinvestment capital.

When bond coupons are paid in cash, the investor is responsible for reinvesting the cash into other securities. Coupons payments of different bonds are paid at different intervals, so investors need to stay aware of when their coupons are paid.

Bond coupons are typically paid semi-annually, so the annual coupon amount is split between two payments throughout the year. For some investors it means an individual coupon payment may not provide enough capital to purchase additional bonds, as the minimum purchase amount is usually $1,000.

Funds

Funds can address the issues of administrative burden and minimum reinvestment capital as the reinvestment of coupon payments within a Fund is the responsibility of the portfolio manager, and Funds will almost always have appropriate scale to reinvest coupon payments into additional bonds.

2. Funds provide better access to bond issues

In general, bond trading is more complex than trading stock.

For starters, a stock of a company is uniform (ignoring stocks with multiple share classes), whereas a company may have many different bonds issues outstanding with different possible characteristics such as coupon, term, and security.

Furthermore, individual stocks trade on electronic exchanges, whereas in many cases bonds trade over-the-counter (“OTC”), meaning more human touch is required.

Individual bonds

Bond trading is facilitated by investment dealers who typically trade with large institutional investors given their larger scale. It is for this reason institutional investors tend to have preferential access to individual bond issues.

For individual investors it means the bond issues they can access through investment dealers can be “table scraps”, that is, bonds that are commonly issued, or bonds that institutional investors have already decided not to purchase.

Funds

Funds on the other hand are managed by institutional investors with scale, which means relative to individual investors, Funds can improve bond diversification through better access to specific bond issues.

3. Funds reduce implicit fees

Whether buying an individual bond or Fund, both have an associated cost or fee, however one fee is explicit while the other fee is implicit.

Individual bonds

A commonly cited advantage to trading bonds individually is that there is no fee [or isn’t there?]. While there may not be explicit fees associated with owning individual bonds, there can be implicit fees known as a bid/ask spread (“spread”) – the difference between the price an investment dealer sells a bond to an investor versus the price the dealer will buy the bond from an investor.

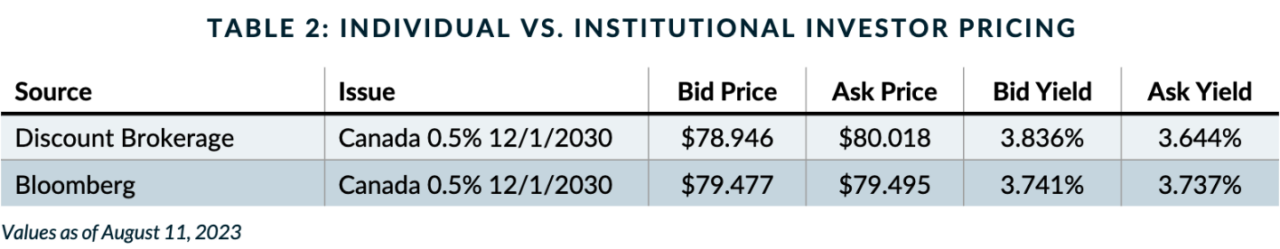

To provide context to how much of a spread is charged by dealers, consider Table 2 below. Both charts illustrate quotes on the same Government of Canada bond at the same time on the same day from a Discount Brokerage platform, which represents the quote an individual investor would receive on the bond and the Bloomberg Terminal, which represents the quote an institutional investor would receive on the bond.

A key takeaway is that there was a $0.523 (0.66%) difference between the Ask Price for the bond between the Discount Brokerage quote and Bloomberg quote. That is to say, the additional fee an individual investor would pay over what an institutional investor would pay to buy the Canada bond was 0.66%.

Funds

Perhaps the most common knock against Funds are their management fees – the explicit fee investors pay for the institutional management of the Fund. While lower or no fees are always preferable, investors should also consider the extent to which a Fund reduces implicit fees – the spread paid to trade the underlying bonds.

Institutional investors tend to receive better pricing on bonds from investment dealers by virtue of their larger scale compared to individual investors. This means the explicit management fees charged by Funds are partly offset by their cost savings on bonds they purchase at an institutional spread.

Another consideration is a Fund’s “value-for-fee”, a subjective concept which evaluates the benefits investors receive from a Fund’s professional portfolio management. At least two factors related to value-for-fee can be a Fund’s current positioning and/or its past performance relative to an index. In general, the greater the difference in positioning relative to an index and the greater the outperformance relative to an index are both indicators of higher value-for-fee.

Conclusion

Bonds are a key part of an investor’s asset mix and bond Funds can be helpful solutions for building investment portfolios that reduce cash-drag, provide better access to bond issues, and reduce implicit fees. Benefits that bond Funds can potentially offer to investors include saving them time, reducing risk, and increasing return.

Lysander Funds offers actively managed bond funds from two different asset managers: Canso Investment Counsel Ltd. and Fulcra Asset Management. To learn more about how bond funds from Lysander Funds can help investors, please visit www.lysanderfunds.com.