The Macro

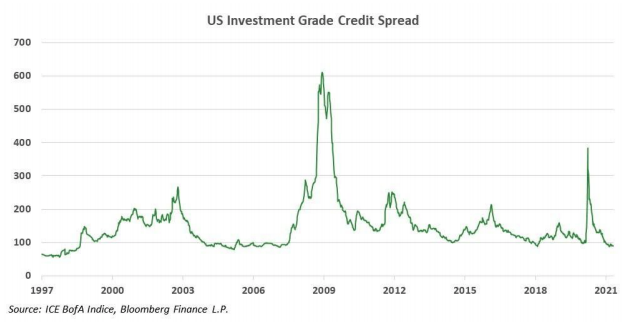

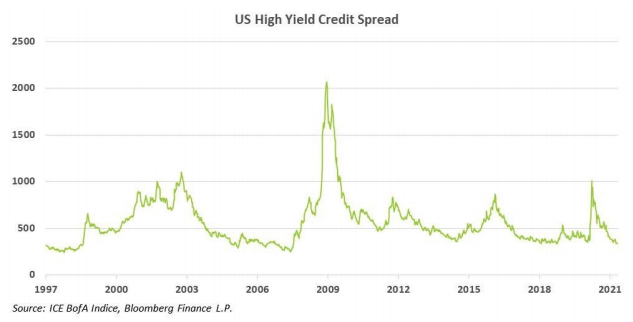

Corporate bond strategists say that while credit spreads are at all-time lows, they see no reason for them to rise. They say GDP growth forecasts are very strong which supports robust corporate cash flow generation. Here we do not disagree.

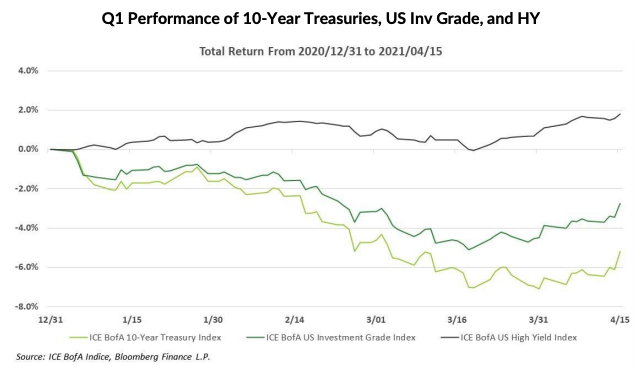

Most economists are calling for strong GDP growth in 2021 and 10-year Treasury yields to be above 2 percent by year-end versus approximately 1.6 percent today. It would seem, therefore, further spread tightening would be unable to halt a continuation of the below…

Many institutional and retail investor portfolios are mandated to hold bonds for safety, dictated by the traditional 60/40 (equity/bond) portfolio doctrine. While traditional risk mitigating bonds (treasuries and investment grade corporates) are down year to date, investors should recognize and prepare, if they haven’t already, for it to get worse. While it may be different this time (did we just say that!?), it didn’t seem long ago we were buying floating rate term loans when LIBOR was 5.00%.

The Micro

The recognition that stocks (S&P 500) are expensive based on traditional measures (i.e., P/E, CAPE, etc.) appears to be picking up. So too does the acknowledgement that bubbles can last longer than investors think. Is the stock market predicting a wave of earnings growth? Yes. Will it prove to be accurate? Maybe.

This financial example of the precise uncertainty of an oxymoron is why we are passionate about credit. Corporate bonds and loans possess a terminal date (call/tender/maturity date) and determinable value that allow us to plan for a defined return profile of a targeted investment and assess the adequacy of it based on the risk profile. While credit markets are at historic low yields and spreads, the observable risk of interest rates rising dramatically can be offset by buying floating rating instruments and loans/bonds/preferreds that possess a high probability of being called or tendered. Below are some examples of this latter category that we purchased over the last couple quarters.

- ► Advanz Pharma Corp 8% 09/06/24

- ► Ferrellgas 6.5% 05/01/21

- ► Ford Motor Credit Co. 2.58% 5/10/21

- ► GameStop 6% 3/4 03/15/21

- ► GEO Group 5.875% 01/15/2022

- ► Great Canadian Gaming 5.25% 12/31/26

- ► Ladder Capital Corp 5.875% 8/1/2021

- ► Montage Resource 8.875% 07/15/23

- ► Seven Generation Energy 6.875% 06/30/23

Quelling the Oxymoron

Term Loans, due to their natural interest rate hedge characteristics, continue to be a key focus at Fulcra during this point in the economic cycle when the risk of a mandated increase in interest rates, while not imminent, seems more plausible.

As it is springtime, we would describe investing in term loans as the equivalent, in baseball parlance, as hitting a single or double. Singles are clipping the 350 to 600 basis points plus LIBOR coupons, doubles, the same but with an additional 2 to 6 points of discount to par.

Loans are not always efficiently priced. Among the reasons, CLO’s being the dominant participant, the prevalence of smaller issues (USD$300-$500mln), a high number of private issuers, and the absence of broad participation.

Preferred More

Preferred shares, like term loans, provide floating rate payments. However, unlike a term loan, when a preferred share is issued it is generally viewed, by the issuer, as a permanent piece of the firm’s capital structure. Declining interest rates, deterioration of an issuers credit worthiness, and trading illiquidity are reasons why some preferred shares lose their way and trade at a deep discount to their implied $25 dollar par value.

The surprise rate cut by the Bank of Canada in January of 2015 and the decline of WTI through that year combined to set off an almost 30 percent sell off in the preferred market leaving small issues from Atlantic Power and Shaw languishing. Over the following years, fundamentally being happy to own at 30 to 50 percent discounts to par, we bought an Atlantic Power preferred and both Shaw issues. Coincidentally, in the first quarter of this year, both companies announced their intention to pursue a material corporate transaction.

While the Rogers/Shaw mash up hasn’t reached the voting stage, the Atlantic Power stakeholder vote has passed. Despite the successful return outcome of the Atlantic Power preferred investment, we voted against (unsuccessfully) the $22 redemption offer from the company and I Squared Capital. Like the precedent setting transaction involving Lowes’ successful take under of Rona preferreds, the Atlantic Power outcome sends the wrong message to future suitors of Canadian companies with preferred shares outstanding.

Industrial Please

Year to date performance in Lysander-Fulcra Corporate Securities Fund (the “Fund”) has also benefitted from the Fund’s position in the 9.375 percent bonds of Ferroglobe, one of the largest silicon metal producers in the world. While we added to the bond as low as $25 in the spring of last year versus the current price of $96 today, we see lots of potential for continued performance contribution. The company is currently finalizing the process of extending the maturity of the bonds by 3 years to December 2025. In return, bondholders are receiving a 2nd lien on all the company’s assets and a small equity stake in the company. As overall global industrial production continues to pick up, this hybrid convertible bond stands to benefit from a pickup in material goods inflation. Not many bonds can say that.