Going Green

A growing trend in investment portfolios today is the presence of Environmental, Social and Governance (“ESG”) investments.

In the bond market, “green bonds” are investments that fall under the ESG framework, and in order to be considered a green bond, according to ICE BofAML, a bond must have a clearly designated use of proceeds that is solely applied toward projects or activities that promote climate change mitigation or adaptation or other environmental sustainability purposes as outlined by the ICMA Green Bond Principles.1 This definition is notably different than ESG frameworks for equities, which tend to be broader and common frameworks include avoiding companies that pollute the environment or companies involved in “sin sectors” (alcohol, firearms, gambling, etc.).

Green (Bonds) On The Scene

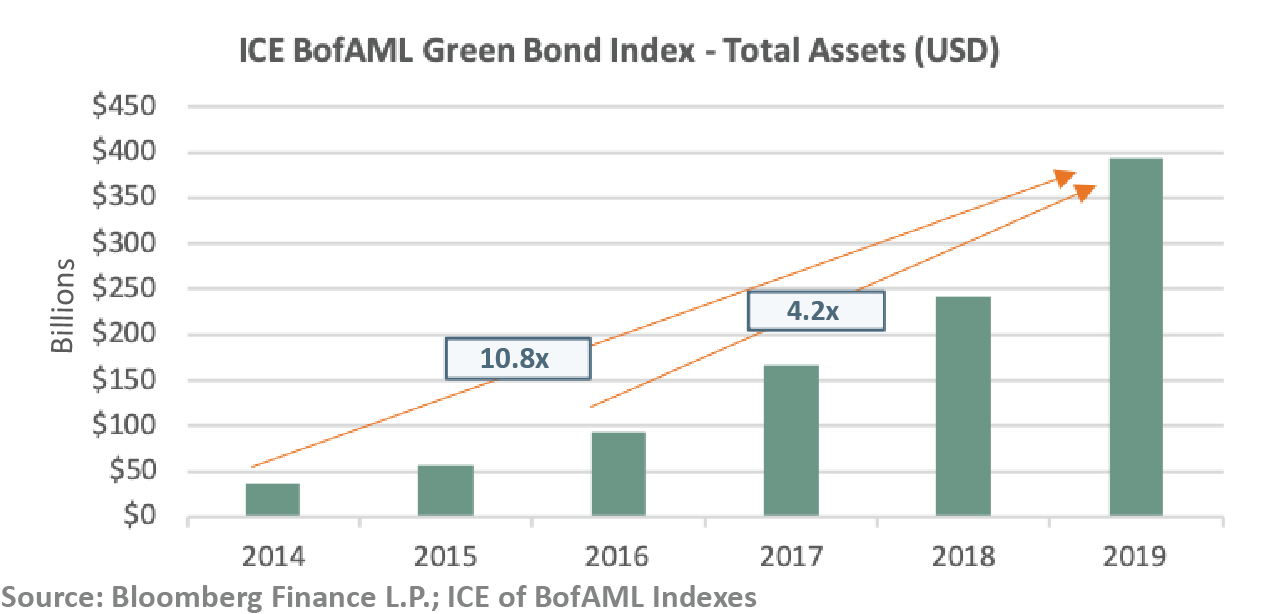

In recent years, green bonds have experienced tremendous asset growth. The market value of the ICE BofAML Green Bond Index, which tracks global green bond issuances, has grown by 4x and 10x over the past 3 and 5 years, respectively. But, with the market value of the ICE BofAML Green Bond Index representing only 0.7%, the market value of the USD$55 trillion global bond market (ICE BofAML Global Broad Market Bond Index), green bonds are far from the point of market saturation.

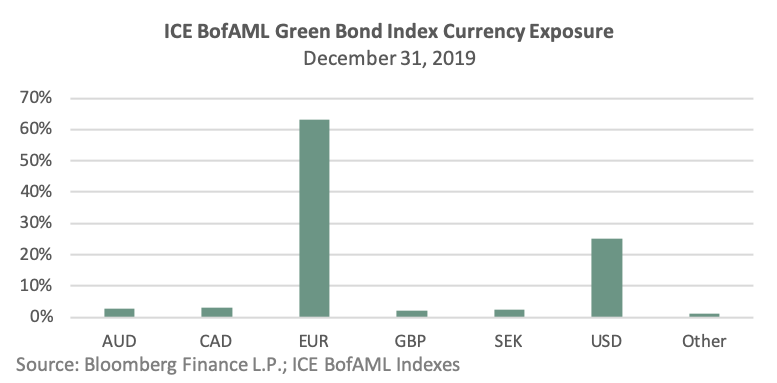

Increased global attention on ESG issues and multinational “green” initiatives can be pointed to as catalysts for the growth in green bond issuance. One such multinational green initiative is the Paris Agreement, which was signed in 2015 by 195 countries, and in-part seeks annual commitments of at least USD$100 billion from developed countries to go towards climate finance.2 The global scope of ESG is also reflected in the composition of the green bond index, which itself is globally broad based with a large skew towards bonds issued in euro and U.S. Dollars, 63% and 25%, respectively; Canadian Dollar issuance represents 3% of the green bond index.

Value Driver or Value Tax?

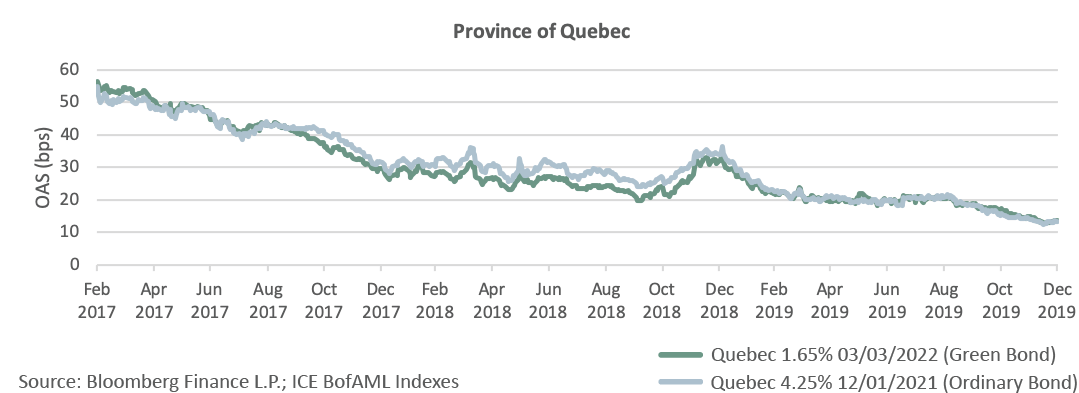

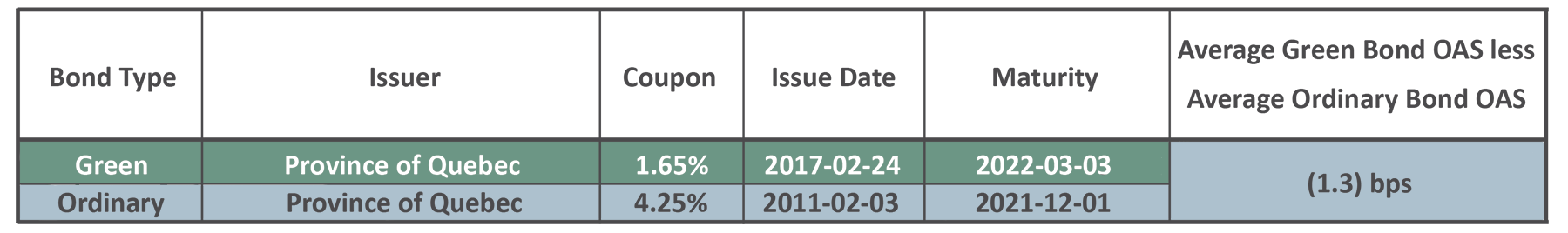

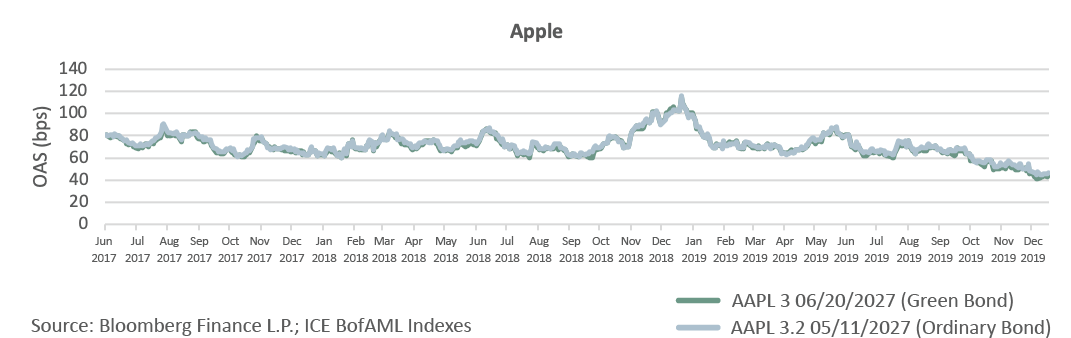

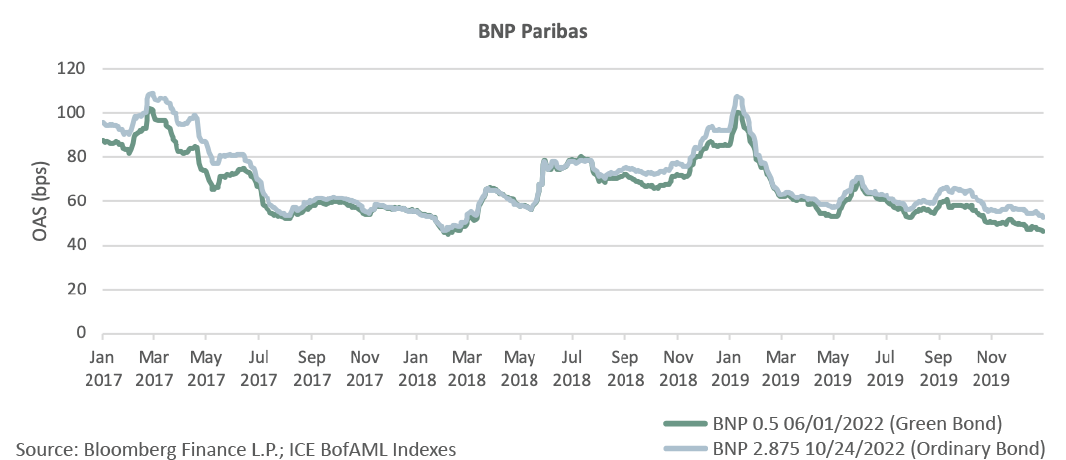

Valuation can come into question for any asset class or sector that experiences rapid growth. With respect to green bonds, investors may be asking themselves, are they more or less attractive investments than comparable ordinary bonds (non-green bonds)? To test this question, three different green bonds were examined by different issuers and in different geographic areas: Province of Quebec (Canada), Apple (U.S.) and BNP Paribas (Europe); each green bond was then compared to a similar ordinary bond from the same issuer, in the same currency and matching the maturity as closely as possible (see the charts in the following pages). For the purpose of the analysis, the metric to assess attractiveness is the option adjusted spread (“OAS”); a higher OAS indicates a more attractive investment and a lower OAS indicates a less attractive investment.

The results show that over the 2 years reviewed green bonds rarely offered a higher OAS compared to ordinary bonds, and on average offered a lower OAS compared to ordinary bonds. In other words, on average, green bonds were less attractive investments compared to ordinary bonds.

Province of Quebec

Apple

BNP Paribas

Conclusion

ESG is certainly a positive development in the investment industry. However, when considering green bonds for their portfolios, investors should always consider basic return and risk fundamentals such as yield and duration. Investors should also be comfortable paying a small value tax for the option to go green compared to similar ordinary bonds.

1 Source: Bloomberg L.P.; ICE BofAML Indexes

2 https://www.canada.ca/en/environment-climate-change/services/climate-change/paris-agreement.html