Market Commentary:

At least Canada is leading the US in some things.

The Bank of Canada cut the overnight lending rate by 25bps in June, July and September before the US Federal Reserve (“Fed”) announced a 50bp rate cut on September 18th.

Interest rate expectations are likely to be a main driver of asset valuations for the next few quarters as borrowing costs decline for indebted companies, banks benefit from a “re-inversion” of the risk-free rate curve and companies with large cash balances become less incentivized to hold on to their war chests.

If this sounds like a goldilocks scenario to you, credit markets agree. US investment grade index1 credit spreads ended the third quarter in 2024 91 bps over treasuries while the US non-investment grade index2 yielded 333 bps over the government curve.

To put that into historical perspective, the 10-year average US investment grade index1 spread as at the end of the third quarter in 2024 was at +126 bps and the 10-year average US non-investment grade index2 spread was at +448 bps.

If there is one thing history has taught us it is that security price valuations follow the moods of the market participants trading these securities. There is an ever-swinging pendulum between fear and greed or “risk-off” and “risk-on”.

Patient investors can be rewarded by taking the opposite approach to the crowd when the pendulum has swung too far negatively by focusing on the underlying asset value that supports the security being observed.

Conversely, patient investors can be rewarded for not chasing a greedy market by maintaining high levels of liquidity (cash and short-term investments) and committing capital only to attractively priced unique situations.

It is important to note that sitting on high cash balances has historically been a costly proposition for investors.

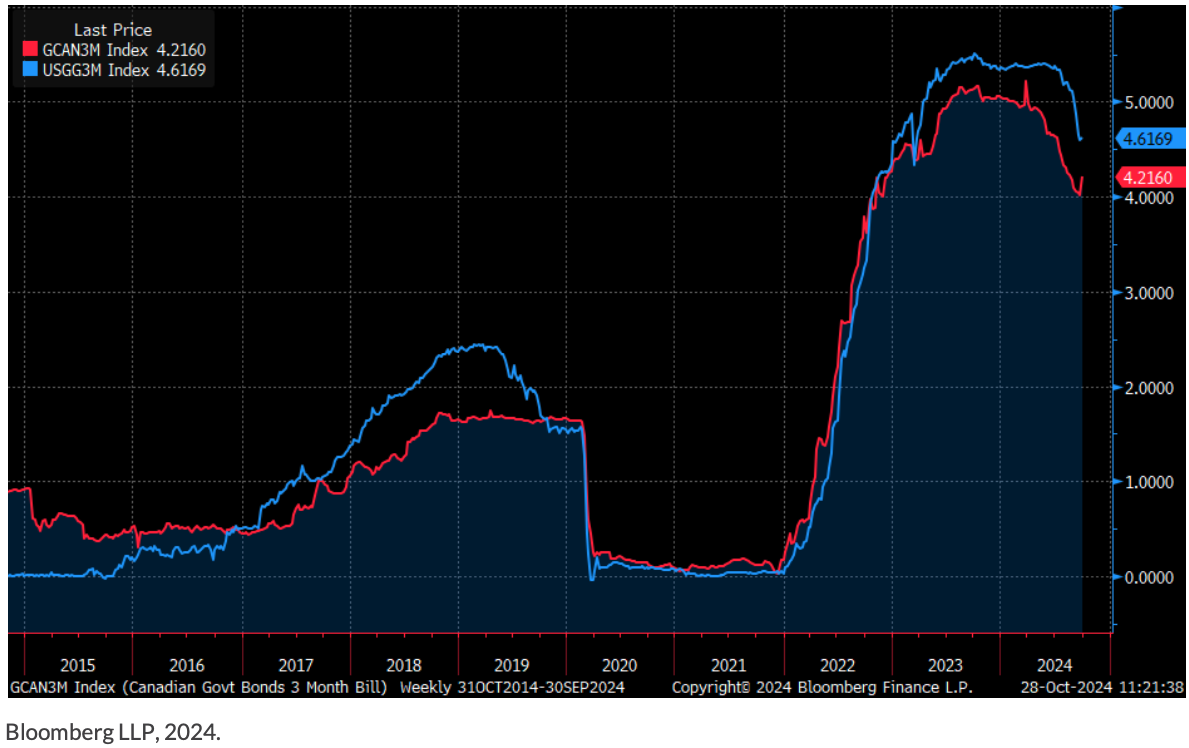

See below for historical 3m bill rates for Canada (red) and America (blue).

However, cash does pay well today. As of September 30, 2024, Canadian 3-month government bills yielded 4.2% and American 3-month bills yielded 4.6%.

Fulcra Update:

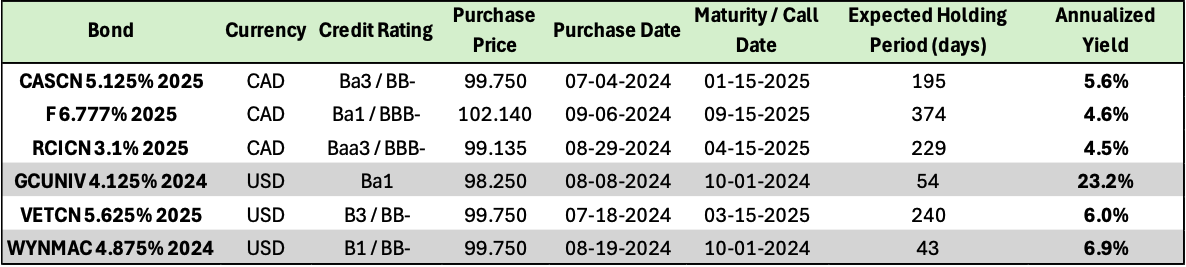

In the table below, we shed light on examples of investments Fulcra made which take advantage of the shape of the government yield curve.

These short-term bonds provide an additional yield over government bonds, the compensation for the credit risk, while allowing Fulcra to receive money back in a short period to be deployed into new opportunities.

For reference, the average yield on Canadian 3-month and 1-year government debt was (4.3% and 3.8%) and the average yield on American 3-month and 1-year government debt was (5.1% and 4.5%) from July to September 2024.

Looking Forward:

In the context of tight spreads (“rich valuations”) the Fulcra play book for the current market environment remains the same: preserve liquidity, focus on the return of investor capital, and generate alpha by investing in special situations.

The distressed companies that Fulcra have exposure to and been monitoring have experienced an extended value realization cycle this year. Nonetheless, we continue to believe in the underlying investment thesis and have opportunistically added to one position – Corus Entertainment.

Distressed debt investments can be more volatile than performing credit due to the lack of liquidity, lack of information and sensitivity to news headlines.

Throughout the history of Fulcra, distressed debt investments have been some of the top contributors to long-term performance.