A Tale of Two Markets

There is much that can be said about the year 2020. The COVID-19 pandemic was a truly unprecedented event in recent history that plunged global economies and capital markets into turmoil. Governments and central banks reacted quickly to provide massive amounts of stimulus to restore liquidity and confidence in the financial system. The result of these events provided a narrative for 2020 that can best be summed up by Charles Dickens – “it was the best of times; it was the worst of times”.

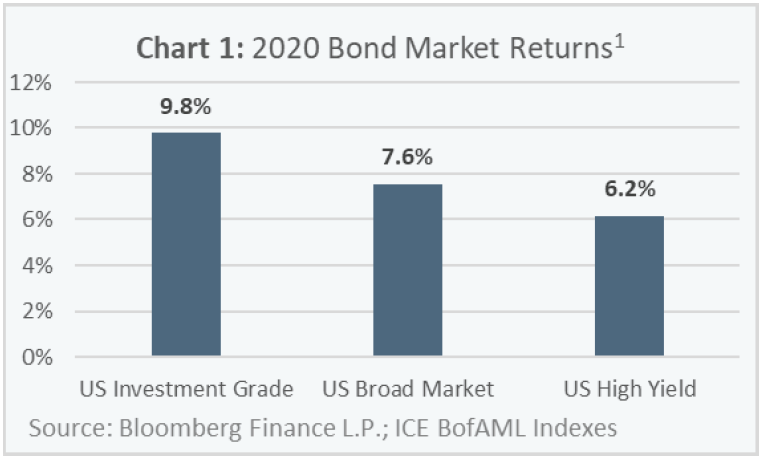

2020 was a year of gains across different bond indices (Chart 1). Furthermore, investment grade bonds (bonds that are generally considered “safe”) handily outperformed high yield bonds (bonds that are generally considered “risky”) – more return for taking less risk, what could be better?!

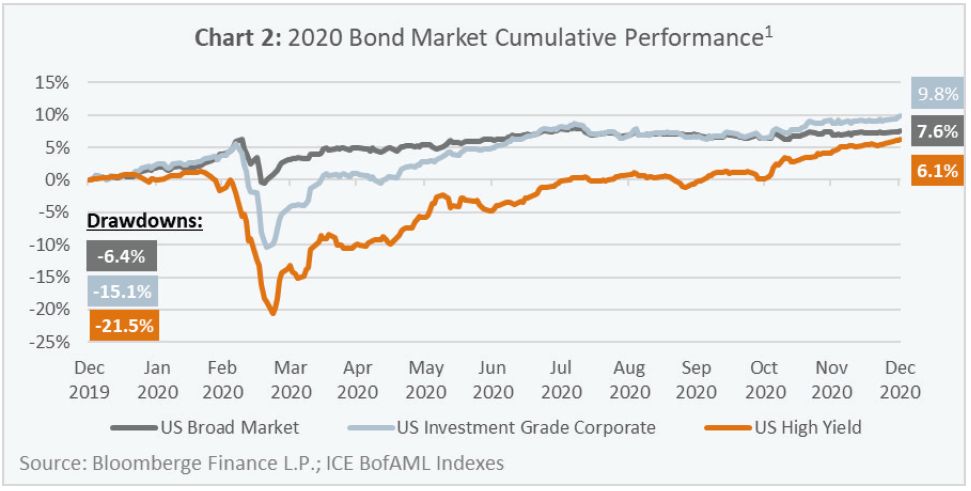

Looking past the veneer of the calendar year returns and instead looking at the cumulative returns (Chart 2) gives a better sense of the gut-wrenching draw downs and strong recoveries experienced in 2020.

After such a spectacular year, a question often asked is “where do we go from here?”. A helpful framework to help dig deeper into that question is to analyze the bond markets based on three primary sources of risk and return:

- Interest Rate Risk

- Credit Risk

- Liquidity Risk

Interest Rate Risk

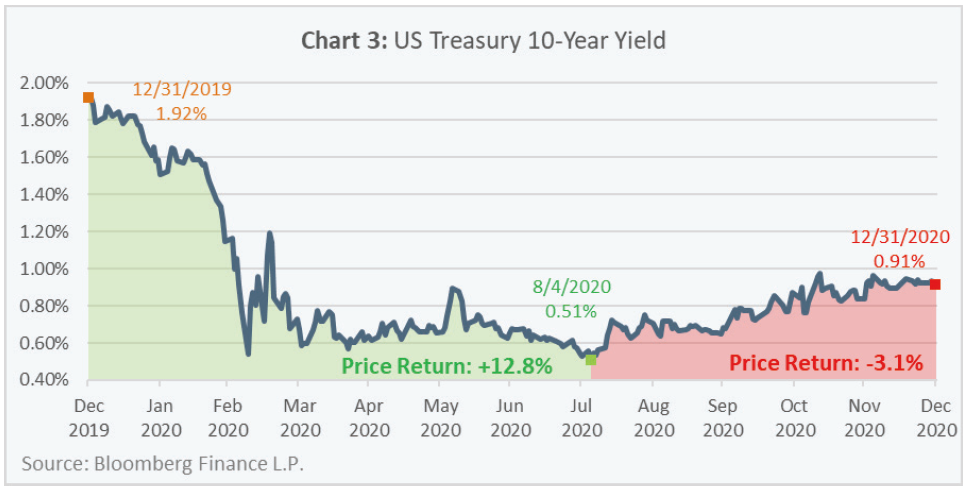

Chart 3 shows the movement of the US Treasury 10-year yield over the course of 2020. Its initial significant decline and corresponding price gain (+12.8%), followed by its steady rise and corresponding price loss (-3.1%) through the end of the year, played out reminiscent to the words of Dickens.

Understanding how the Treasury yield moved throughout the year gives helpful context to the overall return accrued to investors in 2020 – especially for investors in strategies mirroring the US investment grade corporate index and US broad market index, as each sported yield-to-maturities of 2.9% and 2.3%, respectively, at the end of 2019. It also gives context to the risk to bond investors moving forward. After all, interest rate risk is a double-edged sword and rising interest rates certainly cut into bond returns from August 2020 through the end of the year – a trend that could continue in 2021.

Credit Risk

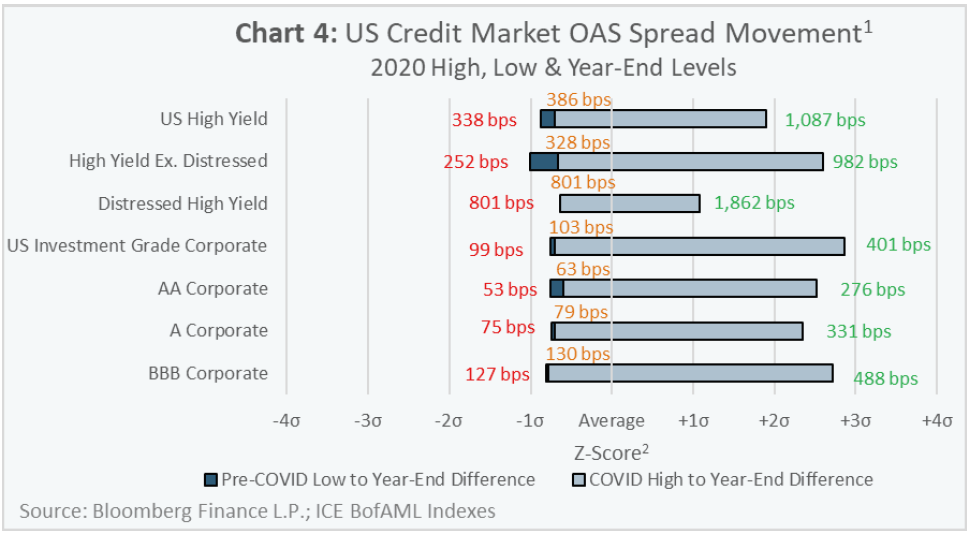

Chart 4 shows the range of credit spread movement in 2020 and the levels where credit spreads closed the year for different indices across the credit sprectrum1. For comparability, the scale of the credit spread ranges are normalized using their Z-scores2.

What really stands out is the magnitude of the credit spread volatility that occurred in both directions over the course of the year. Credit spreads across the board widened to levels not seen since the financial crisis after they had entered 2020 at generally tight levels. Furthermore, when 2020 came to a close, credit spreads were in spitting distance of where they were at their lowest points during the year or had made a new year-to-date low. What this tells us is that the broad credit markets are again generally expensive, however it doesn’t mean that all individual credit issues are expensive.

Liquidity Risk

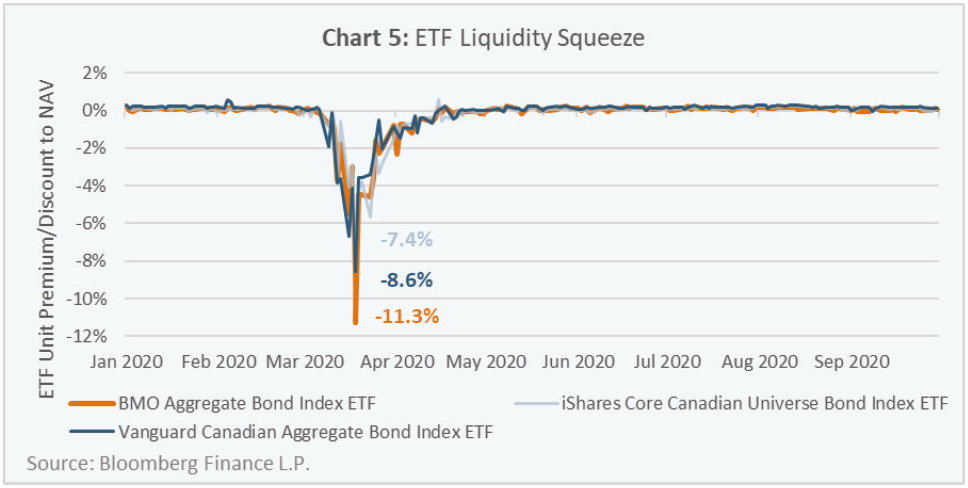

Liquidity risk can have different meanings depending on the topic, and in this case it is in reference to the ability to sell a security without it materially affecting its price. One of the continuing themes in the fixed income market is the proliferation of index ETFs. As investments in these ETFs are generally the “safe money” of an investment portfolio, liquidity is important, especially during challenging markets.

Chart 5 shows the discount to NAV of the three largest Canadian bond ETFs by assets under management. Surprisingly, during the period of peak volatility in Q1 2020, liquidity in these ETFs was lacking when it was most needed. The ETF units traded at levels that were significantly below their respective net asset values, meaning that if investors wanted to sell the ETFs they would receive less cash than the fair market value of their investments.

Where do we go from here?

In 2021, some key implications around each one of the before-mentioned risks are as follows:

INTEREST RATE RISK

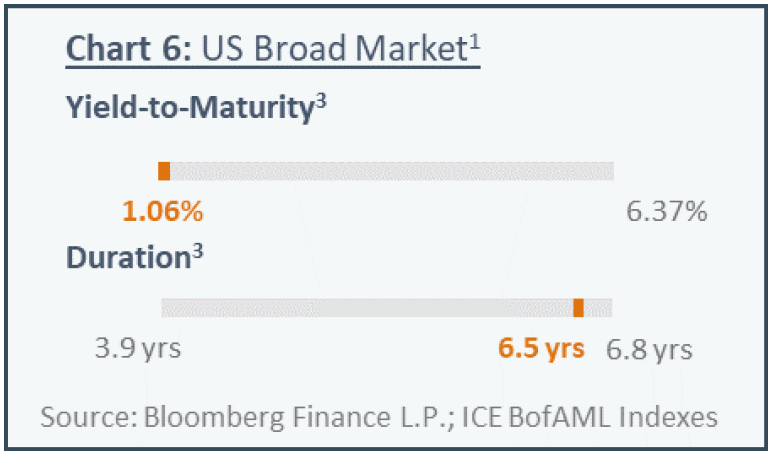

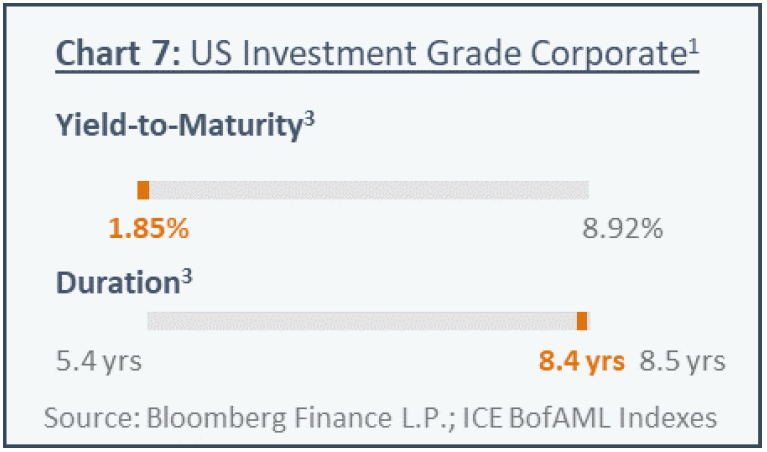

The broad bond markets are providing near record low compensation to investors for assuming near-record high risk (Chart 6 & Chart 7). Investors should be aware of the amount of interest rate risk they are assuming in their bond portfolio, while also looking to carefully increase the yield of their bond portfolios.

CREDIT RISK

Credit spreads across the credit quality spectrum are at levels that are generally considered expensive. They are not, however, at their all-time tight levels, which suggests that there could be more room for spread tightening in 2021, especially if the economy improves. In this environment, investors should be more selective on which credit issues they participate in rather than relying on broad market indices, especially if they want to participate in sectors lower in the credit quality spectrum.

LIQUIDITY RISK

Liquidity is one of the more challenging risks to mitigate. To quote Howard Marks, “usually an asset isn’t “liquid” or “illiquid” by its nature. Liquidity is ephemeral: it can come and go.” Investors should consider the vehicles they are invested in (such as index ETFs) and consider whether those vehicles are susceptible to herd investment flows that could lead to a liquidity squeeze in another market dislocation.

Final Thoughts

As we step into the new year, we are optimistic that we will see better times ahead. While there is much to be optimistic about in general, there are also unique challenges that the bond market will likely face in 2021.

From a macro-perspective, the Federal Reserve has reaffirmed its commitment to accommodative monetary policy until its goals of full employment and inflation are reached; and in the US government, a Democrat-controlled House of Representatives and Senate along with the Biden Administration could lead to additional fiscal stimulus. As a result, we could see inflation expectations continue to rise, which could be a catalyst for higher interest rates. Credit spreads could also continue to tighten in tandem with ongoing fiscal stimulous.

We believe in challenging environments like these, investors could benefit from an active bond manager who is judicious in their bond selection and nimble to adapt to a rapidly changing economic landscape.

As always, it is also important for any investment strategy to be considered in relation to the unique requirements of the individual investor. For this, consultation with a professional financial advisor can be a valuable resource for investors.

1 The bond market labels and corresponding indices are as follows:

– US Broad Market – ICE BofAML US Broad Market Index

– US Investment Grade Corporate – ICE BofAML US Corporate Index

– US High Yield – ICE BofAML US High Yield Index

– US High Yield Ex. Distressed – ICE BofAML BB-B US High Yield Index

– Distressed High Yield – ICE BofAML CCC and Lower US High Yield Constrained Index

– AA Corporate – ICE BofAML AA US Corporate Index

– A Corporate – ICE BofAML Single-A US Corporate Index

– BBB Corporate – ICE BofAML BBB US Corporate Index

2 Z-Score is a statistical measure of where a d ata point is within a n ormal distribution – Z S core of “0” is the average; Z-Score of “1”

is 1 standard deviation above from the mean. Z-Scores in Chart 4 a re calculated using daily outcome from January 1st, 2000 to

December 31st, 2020.

3 The characteristic scales reference monthly data for the 20-year period ending December 31st, 2020.