- A Message to Our Clients and Readers

- Welcome to the “Raging 2020s”!

- A Microscopic Turned Macroeconomic Problem

- Lots of Drunks at the Market Party

- A Star Trek Through the Markets

- The Fall of the Machines

- Once in a Hundred Years?

- The New Abnormal

- Hail to the Spender in Chief!

- Bond and Snap!

- Floating Our Ideas

- Epistemic Advice

- Parting Wisdom

A Message To Our Clients and Readers

This is a rather melancholy Canso Market Observer to write.

We are very thankful for our investment success at Canso in 2020 but are filled with sadness at the suffering all around us. We have been able to work from home during the pandemic and have done a good job for our clients. That is not enough, as hard times call for helping those less fortunate.

Canso has made substantial charitable contributions, as a company and individuals, to United Way, FoodBanks Canada, the Salvation Army and many other charities that do the hard work of helping those who are suffering. We are proud to have helped you navigate through the turbulent markets of 2020 and encourage you to donate to worthy organizations in your communities as well.

Welcome to the “Raging 2020s”!!

We welcome you to the “Raging 2020s”. This is the best description we can come up with for what we think will happen in the year and years ahead. But you ask, why “raging” instead of “roaring” as in the “Roaring Twenties”, as the financially and economically booming 1920s were called. As is our habit in investment, with thanks to Dictionary.com, we take you back to “the basics” and the meanings of these two words:

Roaring:

- brisk or highly successful, as trade.

- characterized by noisy, disorderly behaviour; boisterous; riotous.

- very; extremely.

Raging:

- to act or speak with fury; show or feel violent anger; fulminate.

- to move, rush, dash, or surge furiously.

We’ve used “raging” on purpose. Think of a fire.

A campfire can be “roaring” but still a well-tended fire that is under control. A “raging” fire threatens to consume and burn all that surrounds it. It will spread relentlessly unless brought under control. Newspaper headlines describe fires as raging when they are spreading uncontrollably and firefighters fear them as unpredictable and very dangerous.

There is a good measure of unpredictable and dangerous in what awaits us in 2021 and some years afterwards. “Surge furiously” is appropriate for the economy and financial markets we see ahead. “Act or speak with fury”; “show or feel violent anger”; and “fulminate” come to mind for the politics we expect.

Still “Full of Bull”

Our January 2020 Market Observer was entitled “Full of Bull”, drawing on the Wall Street Journal headline at the close on New Year’s Eve 2019. We lamented the overextended and speculative markets of 2019 and worried about an unexpected problem that could throw the then ebullient financial markets into a tailspin. Our worry was that the return of ultra-loose monetary policy had engendered reckless financial behaviour and thrown investor caution aside in the haste to “get invested” and participate in the soaring markets. The financial markets extended their bullish ways into early 2020 with new records recorded in February. We had no idea of the coming COVID-19 pandemic, but we believed that it wouldn’t take much to change market ebullience into despair in very short order.

A Microscopic Turned Macroeconomic Problem

The microscopic “novel coronavirus” did just that. First identified in China in late 2019, the outside world became aware of its threat in January 2020. The financial markets still drifted higher until mid-February until the stock market collapsed on March 9th. Markets plunged and the financial mayhem that we had feared struck terror into the hearts of investors.

Even if we had known about the coming COVID pandemic, it would have been very hard to predict the eventual financial market outcome for 2020. A global pandemic with a slow and disastrous public health response resulted in a grim death toll and huge medical expense. Vast sectors of economies were shut down with an accompanying Recession and unemployment that dwarfed anything experienced since the 1930s.

The result in the financial markets for 2020? Another great year with stocks soaring to new records and bond yields holding at record lows. The Washington Post summarized the dichotomy between the economic grief, medical pain and ebullient financial markets quite well. We have added our own emphasis:

The S&P 500-stock index, the most widely watched gauge, is finishing the year up more than 16 percent. The Dow Jones industrial average and the tech-heavy Nasdaq gained 7.25 percent and 43.6 percent, respectively. The Dow and S&P 500 finished at record levels despite the public health and economic crises.

Wall Street’s resurgence has been fueled by the largest federal government stimulus ever, historic support from the Federal Reserve and optimism about how quickly the economy is likely to bounce back next year as coronavirus vaccines become widely distributed. Investors have largely ignored the pain on Main Street, including pronounced unemployment, overrun hospitals and battered small businesses. On the eve of the new year, nearly 20 million people remained on unemployment, a jobs crisis worse than during the Great Recession.

“That a pandemic-induced economic shutdown of epic proportion has been digested with stocks ending the year 15 percent higher is mind-blowing,” said Michael Farr, president of Farr, Miller & Washington, a D.C.-based money management firm, adding: “2020 has been stunning”.” The stock market is ending 2020 at record highs, even as the virus surges and millions go hungry; Hamza Shaban and Heather Long; The Washington Post; December 31st, 2020

We share Mr. Farr’s astonishment at what went on in 2020. Those of us who are lucky enough to be employed in the financial industry have seen central bank monetary stimulus and government fiscal stimulus translate into a massive boom in financial assets. The pandemic is worsening at present, but stock prices are up and a financial boom is well underway. We think the party might just be getting started, as vaccines and an end to the COVID pandemic will allow those who weren’t on the financial and economic VIP guest list to join in the celebrations.

Boom, Bust and Repeat

As we frequently tell our clients and readers, the financial markets repeat. Boom to bust and back again. Our most recent COVID pandemic boom and bust, as we’ve told you along the way, set a market speed record for the downturn and upturn, courtesy of massive monetary and fiscal stimulus of record-setting proportions.

We believe that years 2021 and well beyond could very well be an economic and financial boom without recent historical compare. Loose monetary and fiscal policy could combine with the end of the COVID pandemic to unleash the “Animal Spirits” of economist John Maynard Keynes and the “Irrational Exuberance” of former Federal Reserve Chair Alan Greenspan.

Lots of Drunks at the Market Party

We are not talking about just market psychology. As Professor John Coates of Cambridge University has shown, financial market success sends powerful natural chemicals and hormones coursing through the human body. Investors will be literally physiologically drunk with their success and that engenders further reckless financial and even personal behaviours.

The combination of societal relief from the end of the COVID pandemic and the economic and market boom will be powerful. We are talking about economic, financial and social partying that even the fictional Jay Gatsby of the 1920s would approve of. That is, until the monetary and fiscal policy police intervene to get the market party under control and things come crashing asunder once again. By the central bankers and politicians’ own admission, this will take a long time. After what people have been through, we think it likely that there will be significant “abundance of caution” before anyone will want to take away the monetary and fiscal “punch bowls”. That means we’re all in for a wild ride through 2021 and probably into the years after.

Some Suggested Reading

To understand what we are talking about, your reading list should include Coates’ “The Hour Between the Dog and Wolf” and “The Great Crash 1929” by John Kenneth Galbraith. John Carswell, our CIO, wrote a rather prophetic review in 2019 of Galbraith’s classic book on the Financial Pipeline:

“First published in 1955, The Great Crash 1929 highlights several factors warning signs that today sound eerily familiar… The parallels are abundant, but a few stand out, such as the availability of credit in the lead up to 1929, which encouraged trading on margin and introduced the average investor to the benefits (and pitfalls) of leverage. In 2019, historically low interest rates – due in part to an unhealthy relationship between government and central bankers – are encouraging similar risk-taking behaviors and magnifying inevitable market corrections… Galbraith makes clear the speculative frenzy of the roaring 20s and the precipitous collapse of Wall Street are as much a study in market behavior as in human behavior, and notes: “This is a world inhabited not by people who have to be persuaded to believe, but by people who want an excuse to believe.” The Financial Pipeline

A Star Trek Through the Markets

“People who want an excuse to believe.” That was quite a turn of phrase for an academic economist as well as an excellent observation on the behaviour of very emotional and illogical humans. We humans are not the dispassionate Vulcans of Star Trek, as our current crop of “efficient markets” economists would have us believe. We are the emotional and very human Captain Kirk, not the logical and well-reasoned Mr. Spock when it comes to our investing. We all want to believe we can be wealthy, as Galbraith points out.

We create our own reality of the world around us. What we think is “real” is affected by the psychology and biology that makes us very emotionally human in our behaviours. Markets are not efficient collectors and processors of information. They are aggregations of the behaviours of millions of participants, all subject to their humanity.

The Fall of the Machines

A recent Bloomberg article on the failure of quantitative strategies in 2020 shows that even computers have trouble with non-logical humans that make their pattern recognition and algorithms useless:

“After years of being outgunned and outclassed by computer-driven quantitative strategies, human stock-pickers climbed back on top in 2020. The dizzying gyrations of the pandemic-stricken year humbled even the most sophisticated of quants… whose trading models were thrown off by swings their computers had never seen before… Overall, human-run funds put up some their best numbers in a decade… Whether by luck or by skill, they showed that in this most unusual of years, stock-pickers could still stand up to the seemingly inexorable rise of the machines… That same turbulence was the undoing of a whole host of quant funds, which were among the year’s biggest losers. Their computer models rely on finding patterns in historical data, and many had never encountered a once-in-a-century pandemic…” Human-Run Hedge Funds Trounce Quants in Covid Year; Bloomberg; December 30th, 2020

We have often talked in these pages on the inefficiency of the financial markets and the misuse of advanced mathematics to justify almost any theoretical conclusion or practitioner model. The Quant hedge funds, and the success of their quantitative models, depended on human market participants behaving as they had in the past.

Bad Quant Behaviours

Faced with new behaviours from the humans who make up the financial markets, the existing mathematical models failed miserably. Describing unpredictable human behaviour with mathematics is never a good idea. This reminds us of sub-prime mortgages and the Credit Crisis. The credit rating agencies misused statistical models based on very limited experience to engender a boom in sub-prime credit that resulted in the 2008 Credit Crisis.

Once in a Hundred Years?

Assurances that something can happen only “once in a hundred years” builds confidence and courage in investors. Nobody really questions why these “100 Year Events” seem to happen now every few years. When people are drunk with their financial success, very few involved in those profits question the shaky foundations that they are building their golden goose on. Those with questions are usually shunted off into a corner to be ignored into submission or fired for their candour.

The New Abnormal

We think what happened in 2020 will not be unusual for the Raging 2020s we see ahead. “Normal” will be very abnormal for many years ahead in the economy and financial markets. The pandemic really accentuated and legitimized many of the economic, financial and social trends that were well underway.

Monetary policy has been “ultra loose” for many years. Any tightening of policy has been followed by market upheaval and even looser policies. More money has always been politically more popular than less money, but the adventures of central banks into “quantitative easing” and “negative interest rates” have taken free money into the mainstream of economic and financial thought. These new monetary tools were well established before the pandemic struck and were vital in lessening the economic damage wrought by COVID but have massively distorted the financial markets. It will be a long time before anyone thinks they should be put back in the storage locker of emergency policy tools.

Debt Trumps Conservatism

The medical and economic desperation of the COVID pandemic sent policy makers around the globe into a frenzy of fiscal stimulation. The difference this time in the United States was the massive fiscal stimulus that was quickly employed due to President Trump and his iron rule of the Republican Party. Previously it was economic liberals and socialists, mocked as “Keynesians” by conservatives, who believed that government debt-financed growth was the solution to economic weakness. That was until Donald J. Trump came along and convinced his Republican friends that debt and deficits were a great thing if he was in charge.

We have believed at Canso that more money is more popular with monetary policy. This idea has now morphed into the realm of fiscal policy. It looks to us like government debt financed spending is now popular even in conservative political circles. The Republican aversion to debt and deficits is long gone. As we have said in past newsletters, the Trump Administration was running record massive deficits even before the pandemic struck. Republicans used to be the party of “work fare”, no welfare payments without effort and work involved. Their moral objection to “income redistribution” meant that they had even objected to fiscal stimulus after the 2008 Credit Crisis and the Great Recession that followed.

Hail to the Spender in Chief!

Things are sure different now. We have Republicans insisting on direct payments to all Americans. Cash with no strings attached, regardless of need. President Trump approved direct pandemic payments of $1,200 to all Americans in the CARES bill and made sure his name was on the cheques. Even on his way out of office, Trump is now arguing for a $2,000 direct pandemic payment to Americans, more than the $1,200 in the first stimulus package and well above the $600 in the current bipartisan compromise legislation. These direct payments are really unprecedented in U.S. history. We’ve come a long way since the Great Depression of the 1930s. The Republicans under Herbert Hoover resisted welfare and told everyone to “tighten their belts” and cut government spending, even with unemployment at 30%.

There really isn’t anybody left that doesn’t think it is the job of governments to keep everyone happy and give them money. A Washington Post editorial on Christmas Eve drew our attention given Trump’s unlikely ally, Nancy Pelosi:

“Mr. Trump demands direct payments of up to $8,000 for families of four earning as much as $150,000, which is far more than the $600-per-person his own negotiators agreed to and which would cost an additional $370 billion. The president’s last-minute dealbreaking was too much even for the usually Trump-compliant House Republicans. They quite rightly shot down House Speaker Nancy Pelosi’s (D-Calif.) attempt to pass the extra money by unanimous consent Thursday. We can hardly fault Ms. Pelosi for taking a free shot at the GOP after Mr. Trump embraced the politically popular idea of free money for voters…” Trump gives America chaos for Christmas; Washington Post; Editorial Board; December 24th, 2020

Cascading Trump Bucks

Without passing moral or political judgements on pandemic payments, which have been instrumental in lessening the Pandemic Recession, it is pretty clear that huge debt financed government spending and “Trump Bucks” are cascading into the U.S. economy. Consumer income has actually risen with the pandemic support payments as we showed in our October Canso Market Observer. In the middle of the deepest economic setback since the Great Depression, we have housing sales, building permits and home renovation spending soaring and car sales doing well, courtesy of direct government payments funded by very low-cost government debt issuance.

Rational Exuberance

It should also be clear that ultra-loose monetary policy will likely be here for many years to come. If the Fed and other central banks are to be taken at their word, “above trend inflation” to compensate for prior periods of low inflation will be the rule. We believe there could be a massive economic rebound with the ultra-loose monetary policy, fiscal policy and the societal relief, if not unbridled joy and excitement, that the end of the COVID will bring. This is going to be “Rational Exuberance” at the scope and scale of economic strength that we have not seen for a very long time in the developed Western economies.

“Awe Shocks” Monetary Policy

That is why we’re forecasting the “Raging” 2020s, more “raging” out of control and unpredictable than merely “roaring”. Alan Greenspan famously said that it is hard to tell if you’re in a bubble if you’re inside it, but we beg to differ. The pandemic is nowhere close to over and we are already seeing extreme speculative behaviour and valuations in some parts of the markets. “You Can’t Fight the Fed” and the Fed is practicing “shock and awe” in the forceful application of its monetary policy.

That means the current soaring and speculative markets should continue for some time, until they implode from sheer exhaustion or an eventual tightening of monetary policy. Day trading and margin debt are back in vogue. Options use is at all time highs. Bitcoin is soaring to record levels. Bankrupt company stocks are trading at incredible prices, even though they are likely not worth anything after bankruptcy.

The only real downside is in the bond market. The stock market is already looking through to normal days after COVID, but the bond market is mired in its closet indexing ways. There are few bond managers left that don’t hug the market duration for their dear professional lives. Any bond manager who has shortened term and duration in the past 10 years, even the past 40 years, has been humiliated and probably lost their job as yields plunged ever lower and proved them wrong.

Bond and Snap!

When we’re through COVID, we think the yield curve will steepen and long yields could very well snap back to pre-crisis levels, despite the central bankers’ hopes that they won’t. From that point on, yields could likely be rising for the rest of our lives.

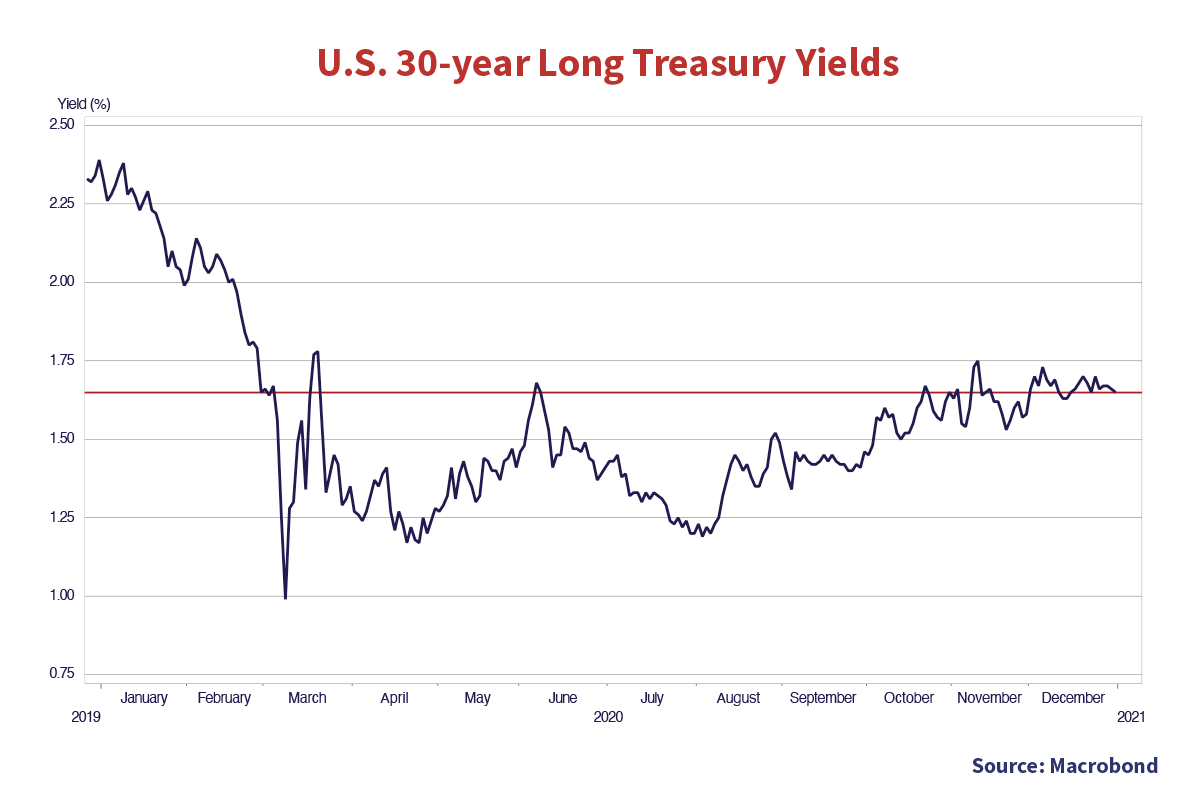

This seems radical at present, but bond yields are creeping up stealthily. The chart above of 30-year U.S. Treasury Bond shows its current yield at 1.65%. This is exactly where it was at the end of February, before the start of the pandemic markets and well above the low yield of .82% recorded on March 9th when the equity market plunged.

Not Great Inflation Expectations

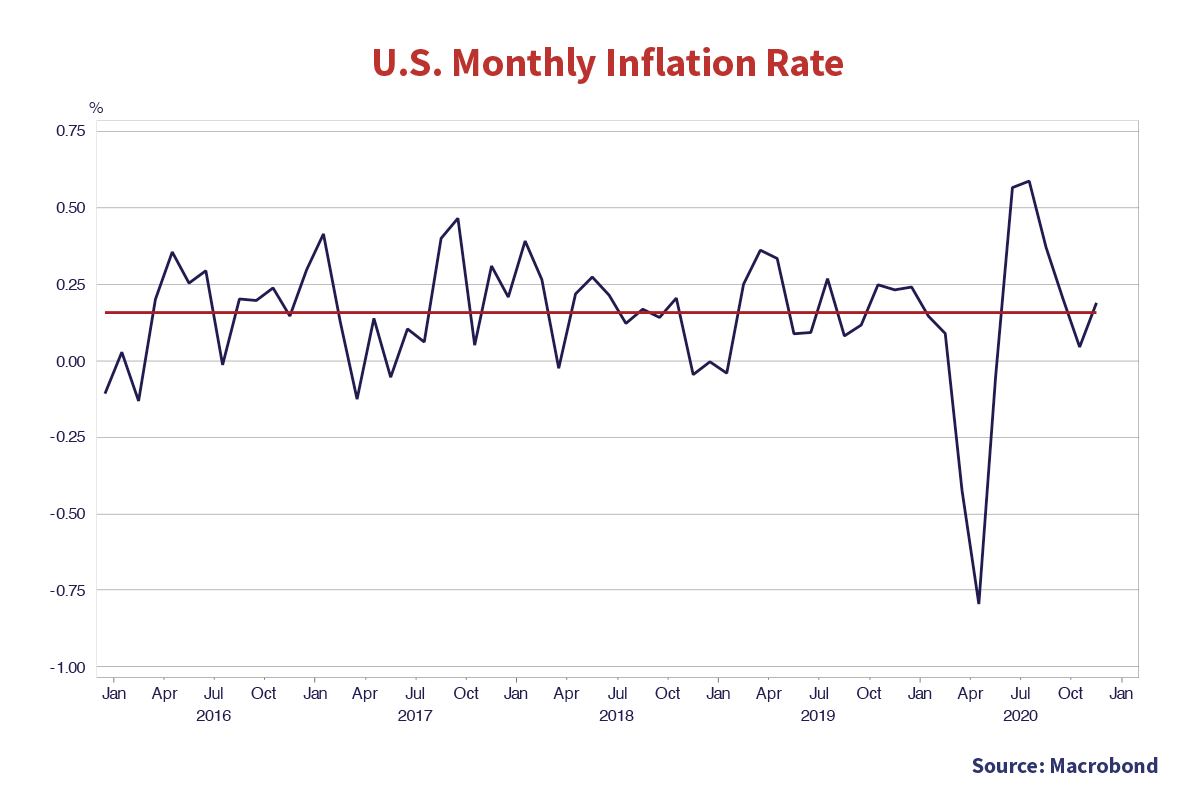

There is good reason for this. The lows of price deflation from COVID are behind us as the chart below shows. Monthly U.S. CPI was .2% in November, which annualizes out to 2.4%. That is not too far off the average monthly inflation rate for the past 5 years of .15%, which annualizes to 1.8%. So we’re now looking at somewhere around 2% for inflation going forward, and possibly more if the economy improves substantially and sees prices rising. If investors believe that U.S. inflation will be above the yield on their long U.S. T-Bonds, then they probably will not settle for the current 1.7% yield, despite the massive Fed buying of U.S. T-Bonds.

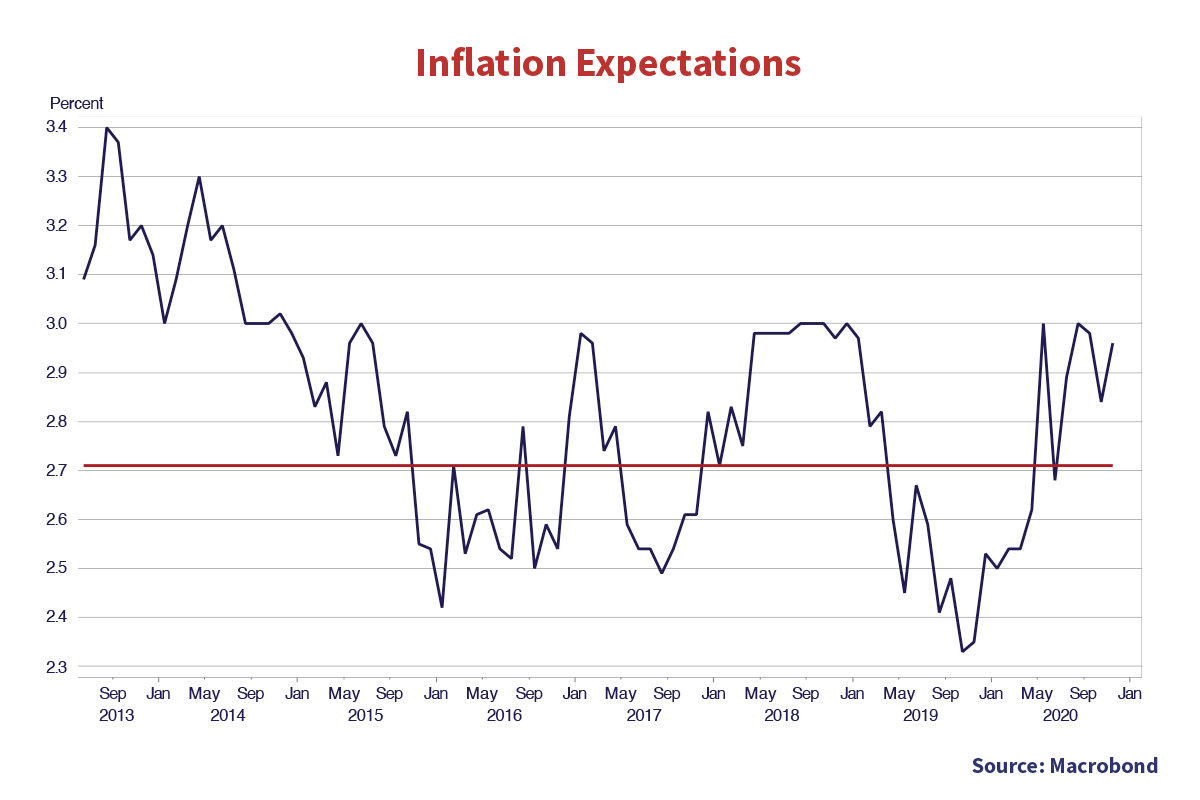

Inflation expectations are also showing a steep rise of late, as shown in the chart below. They have averaged 2.7% since 2016 but dropped down sharply in the first wave of the pandemic before recovering to almost 3%.

Floating Our Ideas

Floating rate debt is currently very attractive to us, as the potential capital gains from falling fixed rate bond yields is far outweighed by the downside of potential capital losses if yields move higher. Look to hear much more about floating rate bonds in our upcoming newsletters. If bond yields do rise, investors will prefer to receive the higher income from the increased coupon on floating rate bonds compared to the capital losses they will receive on their fixed rate bonds.

Give Credit Its Due

Credit is not expensive, with corporate bond spreads only modestly through long term averages. In today’s market with very weak structures and protections for lenders, this is probably generous. That said, we think credit will be the only game in town for “Fixed Income” in a rising yield environment. We look for credit spreads to tighten well through fair value. We think that a considerable coupon spread will develop between the high and low coupon issues of the same issuer, as discount issues are sought by taxable investors.

Yield to Dividends

Equities are expensive by historical standards, but pale in comparison to very overvalued bonds. Since bond coupons are “Fixed” and don’t increase, a 1.7% 30-year T-Bond yield equates to a 59 times earning multiple on a stock, with no prospect of earnings growth. At the current 1.2%, a 30-year Canada bond has an “earnings multiple” of 83 times its earnings. As we have pointed out in previous newsletters, more and more investors are questioning the wisdom of locking in yields on bonds at much less than prevailing inflation.

Dividend yields are now higher than bond yields for many investment grade issuers. TC Energy long bond yields are 3.5% with a dividend yield on their common stock of 6.2%. A Loblaws’ long bond has a yield of 3.2%, compared to its common stock dividend yield of 2.0%. Even though the investor takes a lower cash yield, the Loblaws dividend has grown at more than 4% over the past 5 years and the bond coupon is fixed. The dividend tax credit makes dividends even more compelling to a taxable investor.

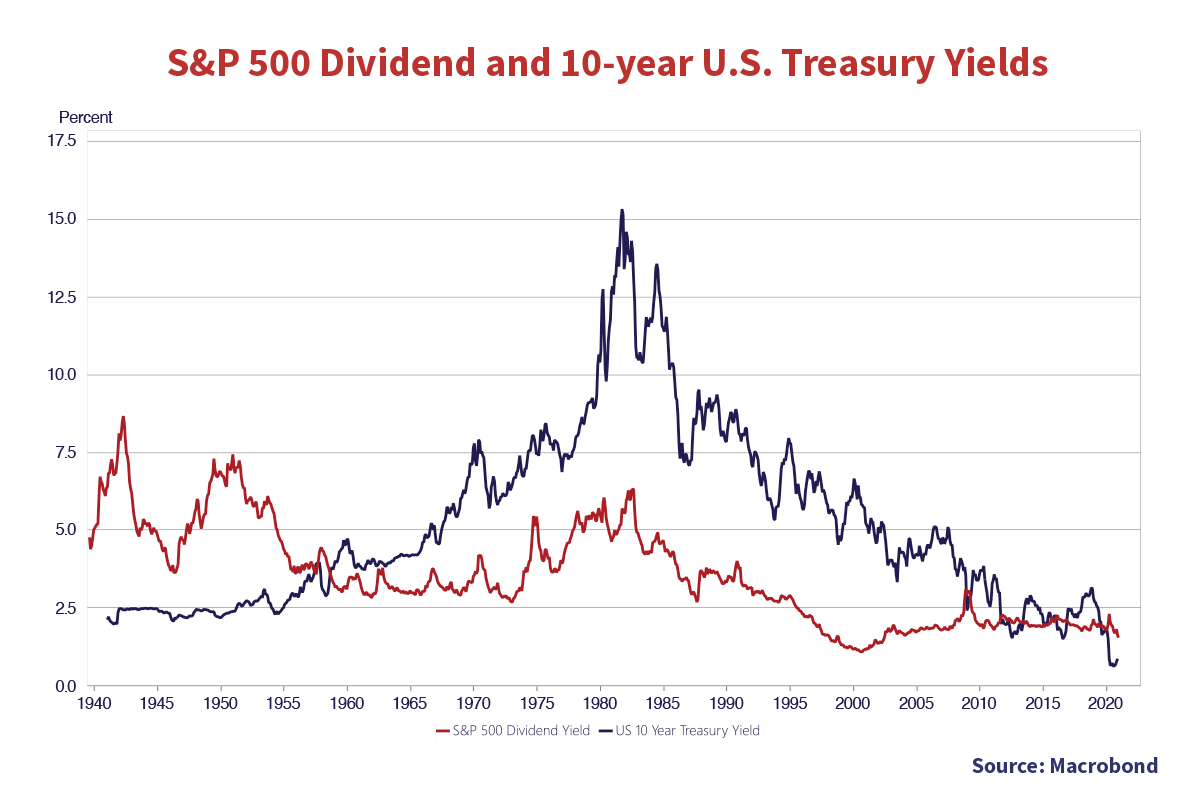

We think this will turn income investors towards high dividend stocks, in a return to the period from 1929 to 1958 when investors demanded a higher yield on common stocks than government bonds after a period of deflation and corporate bankruptcy. As you can see from our chart below of the dividend yield on the S&P 500 versus the 10-year Treasury yield, investors were more interested in the safety of their capital after the Great Depression of the 1930s and paid up for the certainty and safety of bonds.

Dividend yields remained above the 10-year Treasury yields until 1958. At that point dividend yields fell below bond yields, reflecting economic reflation and the growing revenues and dividends of companies. At the peak of inflation during the late 1980s, 10% inflation made for strong nominal GDP growth and this was passed through to the cash flows of issuers. Fixed coupon government bonds were avoided as “certificates of confiscation”.

Bond yields stayed above dividend yields for a 50-year period from 1958 until the Credit Crisis in 2008. As can be seen in the chart, dividends have not been as attractive as this compared to bonds since the mid-1950s.

Raging Politics

In terms of politics, we think the start of 2021 speaks to the “raging” we see ahead. It is very likely that the polarization and anger we have seen over the 2020 U.S. Presidential election will continue for some time. President Trump is still denying that he lost the election, despite losing all his legal challenges and recounts, and will probably never admit he actually lost. Now it looks like the perfunctory Electoral College Voting on January 6th will be more political theatre by the Republicans not willing to admit to Trump’s loss. Constitutional legal scholars aren’t impressed but 140 Republicans and some Senators in the House have expressed their support that speaks to the current raging politics.

Epistemic Advice

We agree with many experts that today’s Internet and social media world is increasingly reinforcing divisions and the anger and acrimony of today’s politics. An excellent ethics advice column in the New York Times Magazine by Kwame Anthony Appiah on December 1st dealt with the aftermath of Mr. Trump’s strident populist and nationalist presidency. A reader asked how to ethically deal with friends who support President Trump and we found Appiah’s answer fascinating. Appiah shares John Kenneth Galbraith’s view that people want “an excuse to believe”. With computer algorithms in social media reinforcing our pre-existing social and political biases, it is not surprising that our realities differ with our selected news and information sources.

“The polarized state of our politics, alas, means that people are so taken up with their political identities that they’re unable or unwilling to consider the views of those outside their political tribe… But perhaps the gulf between you and these friends’ differences in your epistemic capacities — the ability to gain reliable information. Our beliefs depend not just on our own brains but also on the social worlds we live in. Our minds don’t simply repose between our ears (the argument goes) but extend into the world around us, a world that may or may not include Fox News, Parler, talk radio, a voluble workplace colleague who has always seemed marvelously in the know, filtered Twitter feeds and the like. What’s obvious is that people can be epistemically disadvantaged by gaining their beliefs from social networks that are radically unreliable…” Should I Stop Speaking to My Trump-Supporting Friends?; Kwame Anthony Appiah; The Ethicist; New York Times Magazine; December 1st, 2020

We agree with Appiah that our “beliefs” depend on the news and information sources we choose and trust. While editorial slant has always been a feature of the professional news media, Fox News and its very opinionated “Opinion Hosts” took their very fervent support for President Trump to previously unseen levels. In opposition, other cable channels followed suit with their attacks on President Trump. One doesn’t even need to watch cable news to be selectively informed. There are many who now use social media as their prime news source.

Boys Just Want to Have Fun!

In the age of social media, it is pretty easy to find a source that agrees with whatever viewpoint, even if it is “epistemically disadvantaged”. It is pretty easy to make an “epistemic error” from relying on social media, as Twitter power user Donald J. Trump found out. You’ll never know if it is a Russian Intelligence disinformation campaign or a 21-year-old delivery driver!!

“Last month, between tweets disputing his election loss, President Trump posted an article from a conservative website that said his sister Elizabeth Trump Grau had just joined Twitter to publicly back her brother’s fight to overturn the vote… But the Twitter account that prompted the article was not his sister’s. It was a fake profile run by Josh Hall, a 21-year-old food-delivery driver in Mechanicsburg, Pa.

“I was like, “Oh, my goodness. He actually thinks it’s his sister” … Since February, he had posed as political figures and their families on Twitter, including five of the president’s relatives… The accounts collectively amassed more than 160,000 followers… “There was no nefarious intention behind it,” Mr. Hall said. “I was just trying to rally up MAGA supporters and have fun.” He Pretended to Be Trump’s Family. Then Trump Fell for It; Jack Nicas; New York Times: December 8th, 2020

Trumped Up International Relations

We have often said over the past years that the tide is turning against “globalism”. Trump’s election as U.S. President, the vote for Brexit in the UK and the growing populist movements in many other countries showed that average people felt overlooked. Growing international trade, immigration and the movement of manufacturing to China benefitted the global elites, but not many of the average citizens who turned to populism to express their anger.

On the international political front, there is raging as well. Trump leaves office after damaging many of the international alliances and treaties that served the world very well after WW2. Russia has just hacked the U.S. government; China is growing more assertive and the UK has finally left the European Union. COVID has vividly shown that it was still every country for itself and global conglomerates couldn’t be relied on for vital Personal Protective Equipment, ventilators and medicines.

In Canada, it is painfully apparent that the privatization of our formerly thriving vaccine companies took away our domestic ability to manufacture our own COVID vaccine. International acquirers decided to close their Canadian production and produce their vaccines for the Canadian market offshore, despite our advanced medical and pharmaceutical research capabilities. It looks to us like Canada and many more countries will invoke national security to protect what they see as their vital industries and national interests.

Parting Wisdom

Our parting conclusion is that there are some economic, political and financial fires burning that are threatening to rage out of control in 2021. A wise investor sells into strength and doesn’t buy into speculative overvaluation, but the raging markets could go on for a very long time. The monetary and fiscal stimulus has been unprecedented so we believe the responding economic rebound will be of the same size and scale.

Thankfully, we don’t have to make grand market strategy calls. Our valuation discipline drives our portfolio positioning and we need to be compensated for the risks we assume in our portfolios. We are still fully invested in our portfolios. The valuations of what we have purchased have risen considerably but are still attractive.

Some people questioned the wisdom of our conservative positioning in 2019, as portfolio managers loading their portfolios with very risky positions had better performance. We then had questions on the wisdom of buying into the pandemic markets when things were as cheap as we had ever seen them.

Train Hard to Prepare for Battle

We moved quickly and decisively to lock in these values. In the military we used to say that you had to train very hard and realistically to make yourself ready for war and going into battle. We did this at Canso. We put into place the people and systems to exploit opportunity when it was available. We trained and educated ourselves to go into investment battle quickly when it was necessary. We spent March, April and May at “battle stations” and were rewarded much more quickly than we ever thought possible.

We have been through periods like this before:

- The Asian Contagion and Dot.com Bust from 1998 to 2002;

- The Credit Crisis from 2008 to 2009; and

- The Euro Debt Crisis from 2012 to 2016.

After all of these market implosions, the question was asked of us: “How will you make money, now that all the opportunity is gone.”

Each time we have replied, “Don’t worry, we’ll keep your money as safe as we possibly can until there’s a reason to risk it.”

We do not follow the seductive sirens of investment fashion. We take great care to tell our new clients that they will likely be the most upset with us when other people are throwing investment caution to the winds and assuming great risks for modest compensation. We do not worry about short-term performance at the expense of safety of capital. Our valuation discipline assures that the potential returns are appropriate given the risks we assume in our portfolios.

We are now back to our plodding ways, looking at values and judging risks in our orderly, boring and disciplined fashion. We will leave the uninformed risk taking and speculation to others who want to make a “quick buck”.

There will be bumps along the way but ultimately a restored economy and rising inflation will steepen the yield curve as long-term bonds reflect the long-term prospects for normalized inflation. Central banks have promised “accommodation” to continue for many years to come but even they will ultimately have to normalize the price of money.

Happy New Year and a prosperous 2021 to all our clients and readers!