The first quarter of 2022 saw the violent invasion of Ukraine by Russia. This upended the peaceful order in Europe that existed after the end of the Cold War between the Soviet Union and the NATO democracies in 1989. The economic “Peace Dividend” from the reduction in NATO militaries and defence spending after the Cold War was reversed as Germany and other NATO countries rushed to support Ukraine militarily and increase their own defence spending.

Given some of our colleagues’ military backgrounds, we have been asked many questions on the military situation in Ukraine. We have deferred comment, leaving it to the many military experts on cable TV, apart from expressing our sadness at any war, which is tragic for all involved. Our hearts go out to those whose lives have been violently changed by the situation in Ukraine and mourn the losses of both civilians and soldiers.

The military situation is confused at best and will take months if not years to resolve. As military strategists say, you only create a plan to have something to deviate from. It is obvious that the Russians are deviating from their plan and severely underestimated the opposition of the Ukrainian military and the number of troops they needed to invade and then successfully occupy Ukraine.

De-Globalization and Higher Inflation

The Russian invasion of Ukraine has also quickly reordered the world economy and threatens economic globalization. The Western democracies are now wondering about the wisdom of empowering anti-democratic regimes with further economic progress and integration. Western companies have fled Russia, as it became painfully obvious that it did not want to be a peaceful member of a global capitalist community and was certainly not a champion of ESG. There are few things more inflationary than war and defence spending, as neither creates productive capital or consumer goods.

Inflation will also rise if the West moves past its addiction to cheap Russian energy and cheap Chinese manufacturing. The introduction of the productive capacity of the former Warsaw Pact countries and Communist China in 1989 into the global economy was a supply side shock that benefited the West with lower price inflation. This has all evaporated in the face of raw military power, applied brutally by Vladimir Putin to achieve his vision of restoring Russia’s stature as a great power.

A Violent Reaction in the Bond Market

The global bond market also experienced the violence of sharply rising yields, brought about by a generational increase in inflation as central banks recognized they had overcorrected with their ultra-loose monetary policy response to the COVID pandemic. Loose fiscal policy and pandemic government income supports combined increasing demand with reduced supply. This saw prices soaring to levels not seen in the over 40 years since the high inflation 1970s.

Normally, a geo-political shock like the Ukraine invasion would have seen bond yields plunge in a “flight to safety”. We saw quite the opposite as the political and military shock was subsumed by the rise in energy prices from the boycott of Russian oil that put paid to the idea that inflation was a “temporary” supply side pandemic problem. When the bond market impounded the signals of central bankers that monetary policy was going to be tightening for some time and to a substantial degree, yields soared.

The Tale of the Two Year

We had believed, as we had said many times in past Market Observer editions, that we were seeing the bottoming of interest rates that had been falling since 1981. The bond market had been impounding rising administered rates by central banks, but was shocked this quarter by the tough talk coming out of central bankers. As the graph below shows, it moved from impounding a gradual reversal of the easy monetary policy of the pandemic to a much quicker return to monetary normalcy.

As you can see from the graph, the 2-Year U.S. Treasury bond had been anchored for two years since March 2020 below the “upper bound” of administered rates at .2%. As the Federal Reserve broadcasted its intention to gradually increase rates, the 2-Year yield moved from .2% to .4% in late 2021. 2022 saw a sharp move up to 1.6% by February, but it is March’s .8% increase to almost 2.4% in a month that caused havoc in the bond market.

You can see from this chart that the Fed and other world central banks crashed-dived short term interest rates during March 2020, the early days of the pandemic. The 2-Year Treasury yield plunged from 1.5% at the start of the pandemic to .1% after the Fed’s monetary triage was applied to this medical emergency. Now the UST 2-Year is at 2.4%, almost 1% above its pre-pandemic level.

Short Bonds Were No Refuge

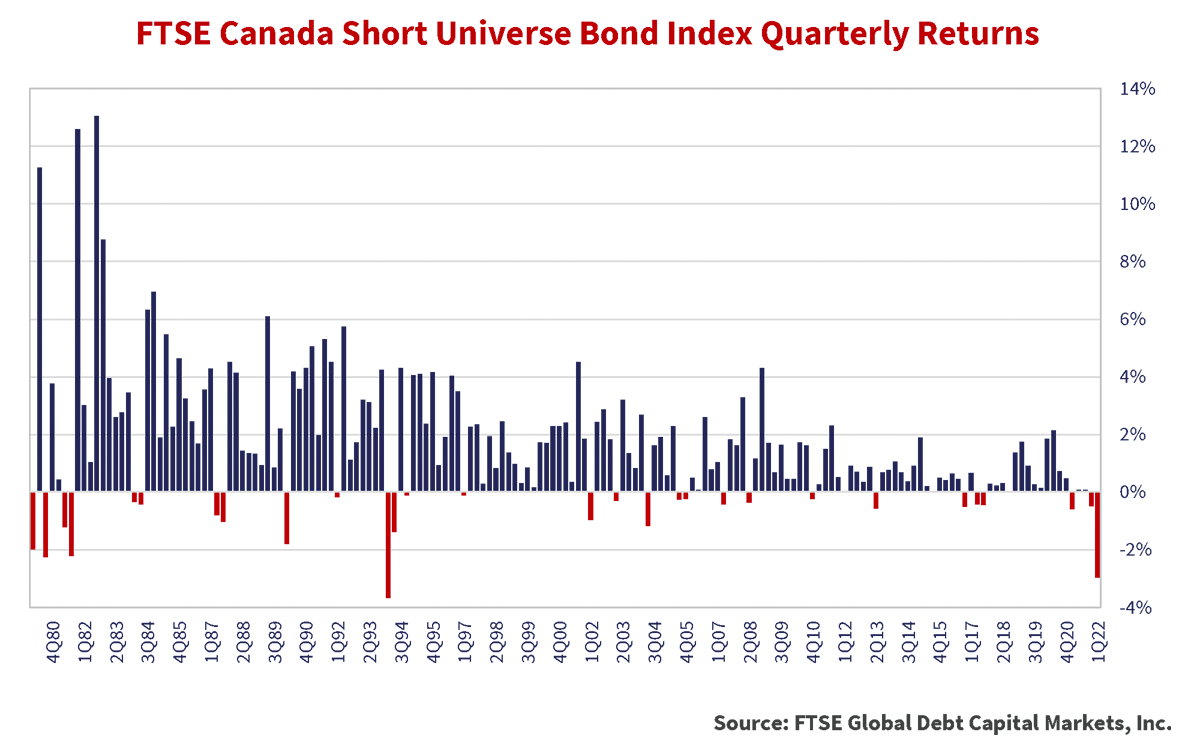

Since we are Canadian bond managers, we judge ourselves on the Canadian bond market and our relative performance to our peers. Our oldest colleagues are telling us that this market is the worst they have seen in short term bonds since the ill-fated Greenspan Fed tightening of 1994. The good news is that our older colleagues’ memories are still good. The chart below shows that the very negative -3% return of the FTSE Canada Short Universe Bond Index for the first quarter of 2022 is the worst quarter in its history, other than the -3.8% return in the first quarter of 1994. The bad news is that more negative bond market returns seem to us to be ahead.

New Script for Central Bankers

The problem for central bankers was that unleashing a tsunami of cash had been the script for their financial Superhero act since Alan Greenspan saved the financial world during the Black Monday stock market crash of October 19th, 1987. The playbook was simple: “Unleash Torrents of Cash” when financial enemies, real or imagined, threatened financial destruction.

When central banks applied these emergency monetary measures, the critics always predicted soaring inflation as a result. After the 2008 Credit Crisis, self-declared financial experts, from TV talking heads to taxi drivers, argued that all the cash stuffed into financial institutions would result in soaring inflation. The experts were wrong, and inflation stayed under control.

Then Mario Draghi started buying government bonds in his “Whatever it Takes” defence of the Euro. This became known as “Quantitative Easing” and legitimized the buying of government bonds by central banks. Until this point, the buying of government bonds by a central bank was known as “Debt Monetization” which was the purview of central banks in countries like Zimbabwe and Venezuela, which were not known for financial stability and low inflation.

Inane if Not Insane

The aftermath of the Euro Debt Crisis saw negative nominal interest rates for German and a few other European government bonds. This really resulted from the post Credit Crisis regulatory requirement for banks to hold government bonds and the European Central Bank (ECB) buying those same bonds and forcing up the price to make their yields negative. We believed this was an inane if not insane application of monetary policy, but politicians were happy at the idea of having lenders pay borrowers to take their debt. Even Donald J. Trump, then President of the United States and serial bankrupt in his business career, complained that he too should have negative interest rates. Thankfully, the Fed resisted Trump’s complaints and only took short term rates to zero.

We had sure come a long way in monetary policy. Most central banks had become doctrinaire monetarists during the 1980s and adopted “inflation targeting”. This made the primary goal of monetary policy keeping inflation in a pre-determined range. Now we had the U.S. Federal Reserve mimicking the tactics of the Reserve Bank of Zimbabwe.

Monetary Policy Kool Aid

As we’ve said many times in these pages, the central bankers of our current age have become celebrities whose careers were more about social adoration than stern monetary policy prescriptions. It’s more fun to be a Tweeting monetary Superhero than a boring backroom banker! The problem for central bankers now is that they started to drink their own monetary policy Kool Aid. They too came to believe that money didn’t matter after all the years of Milton Friedman’s “Only Money Matters” being proved wrong. The difference this time around was that the now familiar very aggressive monetary response to the economic destruction of COVID was accompanied by very aggressive fiscal policy.

Financial history repeats but the major change this time around was what happened to the cash created by central banks buying government bonds. Instead of having central banks buy government bonds with newly created cash and forcing banks to hold the cash in government bonds, cash was created and given to citizens directly by politicians.

Gushers of Cash

Former Fed Chair “Helicopter Ben” Bernanke famously said that he would drop money from helicopters if low interest rates proved impotent against an economic slowdown. This time around, the U.S. government sent cold hard cash to every living, breathing American and possibly a few dead ones too. Republican President Donald J. Trump couldn’t sign the cheques but managed to get his name on them anyways. This was quite the change for the previously fiscally conservative Republican Party, but it unleashed a flood of cash. Trump lost the 2020 election, but Joe Biden and his Democrats followed Trump’s lead with their own gusher of pandemic cash supports.

That cash was spent on lots of things, from houses and home renovations to pleasure boats and Meme stocks. Prices soared despite the hammering the economy took from COVID lockdowns. The central bankers were initially confident that money still didn’t matter and wisely counselled that temporary “supply chain disruptions” were the culprit for this transient rise in inflation. That was not to be.

The Rambo Mambo

There’s only one thing worse than being a backroom anonymous central banker and that’s bad social media for a monetary celebrity. When Jerome Powell and his fellow central bankers were being mocked for their inflation stupidity and being asleep at the switch, they decided that money did indeed matter. The Fed moved from “measured increases” of .25% in Fed Funds to reprising Rambo with their pronouncements of .5% or 1% rate hikes in a flurry of comments by Fed Governors. The bond market, as we showed in the chart above, noticed.

Galluping Inflation

Bond investors moved from impounding a “kinder, gentler” Fed grudgingly moving rates up slightly, if at all, to a Fed embarrassed by charges that it has lost control of inflation. The 7.9% year-over-increase in U.S. consumer prices for February was the highest since 1982. Consumers agree with the bond market that the Fed has lost control of inflation as major polls show that rising prices is the major problem identified by voters:

Note that 17% of Americans think that inflation is a bigger problem than the Russian invasion of Ukraine, global warming or any other issue. That makes inflation a problem for politicians and the Federal Reserve, alike.

Financial Glitterati

Now that central bankers are out of their back rooms and are financial glitterati, they crave the affections of their public, like all performers beholden to personal stardom and media attention. As we’ve pointed out in these pages before, the only thing less popular than high inflation is high interest rates so it will be interesting to see how central bankers fare with the downside to their societal fame and fortunes.

The Non-Spoken Word

The Fed’s messaging is quickly changing. The Fed had officially believed that inflation was a “transitory” supply chain issue. Chair Jerome Powell decided to retire that word from the official Fed Speak vocabulary early in 2022, as we pointed out in our January Market Observer. Now that consumers, who are also voters, are upset at inflation, Powell and other Fed Governors are delivering a rebranding that promotes how tough they will be. This “Whatever It Takes” campaign to defeat inflation sounds good for now but translates into less money and capital with significantly higher interest rates. That might also not be that popular with voters.

The Trillion Dollar Question

As perverse as it sounds, rising interest rates and bond yields make existing bonds fall in the secondary bond market. That’s what’s going on now. The 2-Year U.S. Treasury note yielded .7% at December 31st, 2021. At March 31st, 2022, it yielded 2.3%. That meant an existing 2-Year Treasury had fallen 3.0% in price. Longer bonds have fallen much more in price.

The literal “Trillion Dollar Question”, given the $52.9 trillion size of the U.S. bond market, is how high will interest rates need to go to lower inflation to the Fed’s 2% target? The U.S. Broad Index was down -6.4% year-to-date, so rising yields have evaporated approximately $3.4 trillion in bond investor wealth.

As we’ve often stated in these pages, interest rates are the price of money and capital and “tightening monetary policy” means there will be less available than there is now. The Fed must remove its “accommodation” to have less money available to consumers and businesses alike. Interest rates will rise as creditors seek to borrow a decreasing supply of money and capital.

Sloppier Than You Think

Many financial strategists and investors talk about interest rates as if they are directly controlled by someone at the Federal Reserve with a large accelerator lever and a large braking lever. They think things are “targeted” with precision. The truth is rather more sloppy than you think. The Fed doesn’t really know before hand when it “removes accommodation”, how much it will take to get interest rates to their target, so they just start removing money from the financial system in various ways called “Open Market Operations”. These range from directly selling securities that raise cash to doing “reverse repos”, which they lend their securities to other parties to get cash.

The Fed’s Un-Balanced Sheet

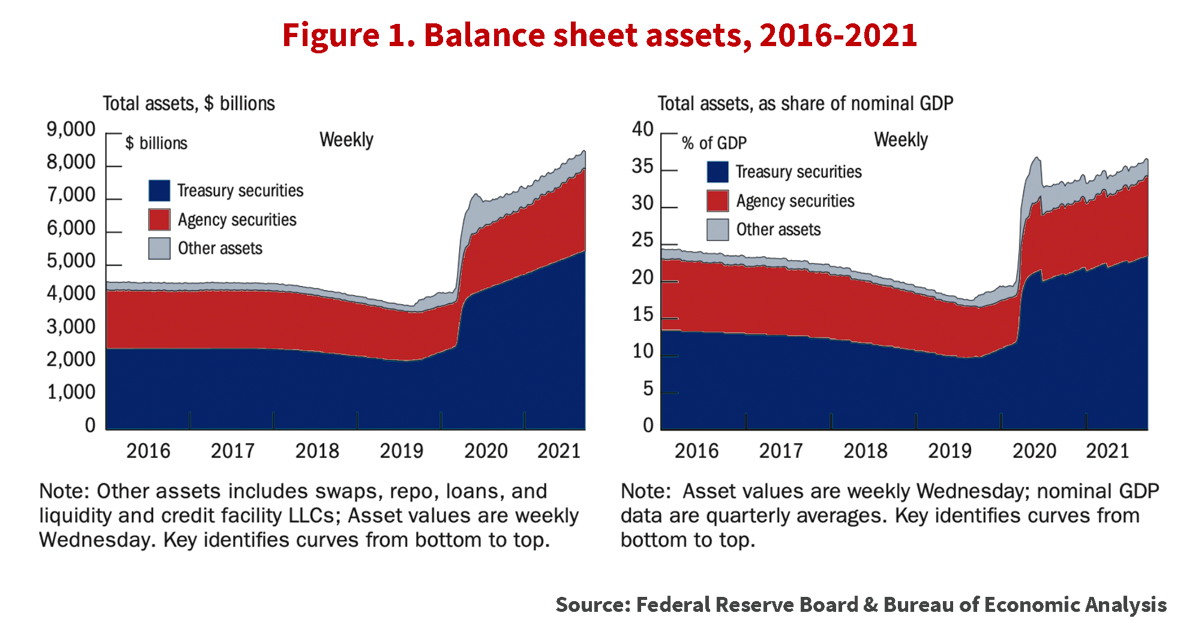

The Fed now has the largest balance sheet in its history, due to its “Quantitative Easing” since the Credit Crisis of 2008. It bought huge amounts of U.S. Treasury, MBS and then even extended to corporate bonds, ETFs and other securities during its pandemic response of 2020, as you can see from the table below. That jump in March is telling of the huge Fed response to the COVID pandemic. We quote the Fed’s rather dry explanation of this table:

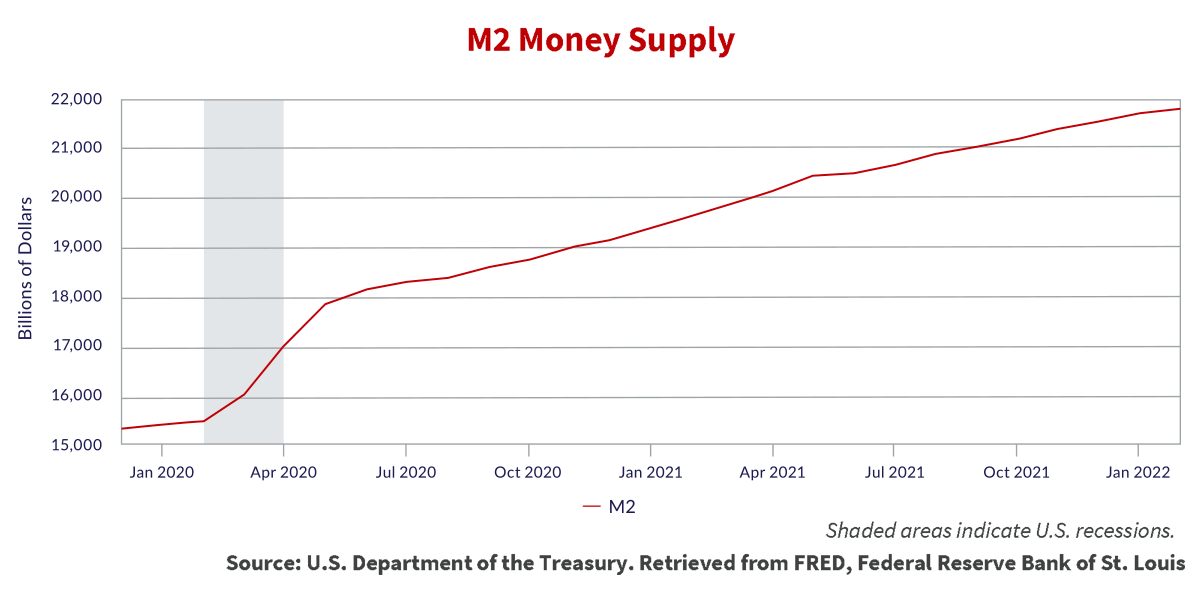

A Lot of Financial Firepower

That $8.5 Trillion securities portfolio is a lot of firepower for the Fed’s open market operations. The Fed buying all those securities increased money in circulation as can be seen in the chart below from the St. Louis Federal Reserve. Note the jump up from $15.4 Trillion to $17.1 Trillion during the short two months of the Pandemic Recession of March and April 2020. Simply put, the Fed bought $1.7 trillion of securities to get cash into the system. This included buying bonds directly from the U.S. Treasury to fund the $1 Trillion in pandemic “Trump Bucks”, given to all U.S. citizens for nothing in return, as we pointed out at the time.

When rates get around their target, the traders at the Federal Reserve stop and see what happens. They don’t know what will happen the next day. If companies have debt maturing and need cash to pay that they don’t have on account with a bank, they either borrow from their bank or issue a new bond. Removing money sets interest rates on a higher course but the traders at the Fed don’t know what they need to do the next day. If rates go up above their target because of a high demand for cash in the system, then they add money by buying Treasury Bills, Commercial Paper or short-term bonds.

Monetary Area Bombing

The Fed’s traders aren’t using “Precision Guided Weapons”, they are really “Area Bombing” to get the result they want. They overcorrect and under correct like any human being working with imperfect information. And there’s many other human beings in the credit markets doing what they need to do for their own selfish purposes. This affects what the Fed’s traders are trying to do. For example, if even a small fraction of bondholders in the $52.9 trillion U.S. bond market decide to convert their bonds to cash, then interest rates would soar above the Fed’s targets. All we really know at this point is that the Fed virtually always over corrects on the way up in rates, as inflation doesn’t slow as fast as desired.

Now, we haven’t even talked about “Quantitative Tightening”, the reversal of “Quantitative Easing”. The Fed now owns $8.4 trillion or 16% of all outstanding U.S. dollar bonds. The chart of M2 money supply above shows it was $21.9 trillion at the end of February 2022. If the Fed sold all their $8.4 trillion in bonds quickly, it would remove 40% of all money in circulation! Interest rates would soar and the economy would stop dead, as it did under the Volcker Fed’s aggressive tightening in 1981. Clearly, the Fed is not going to do this.

The Data Mines of the Fed

Economists like to think they are “scientific”, but the reality is they deal with imperfect human behaviour. Economists “postulate”, but they don’t conduct actual experiments like natural scientists. Economists statistically “mine their data” to prove their point, looking at historical economic data series. Until now.

The Fed and other world central banks have been conducting real world “experimental economics” in their haste to do anything that works. They literally had no idea what the actual outcomes would be when they launched all their new policies like Quantitative Easing and the U.S. government had no idea what its fiscal pandemic policies would bring about in terms of outcomes.

Not Real Wizards, Not Real Jobs

Yes, we all want to believe that there is somewhere a group of all-knowing and all-powerful human beings that dictate economic outcomes. The reality is that central bankers are like the Wizard of Oz, hiding behind the curtain and acting all-knowing and all-powerful with a thunderous voice. Before our age of Superhero central bankers, they were boring bankers and economists who came up internally within the central banks, like Paul Volcker.

That changed after Alan Greenspan. He was an economic forecaster on Wall Street before becoming Fed Chair. His real job was playing the saxophone in the Woody Herman’s big band before completing a BA and MA in economics and working at Townsend-Greenspan as a Wall Street forecaster. Ben Bernanke and Janet Yellen were university professors before heading the Fed. They never held a real job in the real economy before deciding policy as Federal Reserve Chair. Even worse, Jerome Powell, current Fed Chair, and Christine Lagarde, current President of the European Central Bank, were lawyers and polished financial bureaucrats before taking up their posts. We’ll leave it up to you to decide if being a lawyer or financial bureaucrat is a real job.

Seeing What Sticks

Our current crop of central bankers has just been throwing things monetary at the wall of the real economy to see what sticks. That is the grim reality. They really don’t know the long-term effects of that they have wrought with their policies but we’re just about to find out.

Financial strategists and economists are musing about “inverting yield curves” forecasting recession. We have been telling you for some time that the Fed has been the largest buyer of U.S. government debt, and this has distorted what the bond market implies about the economy. The Fed now owns 25% of outstanding U.S. government bonds, and that makes the yield curve virtually useless in predicting anything.

In terms of Quantitative Tightening, the jury certainly is out. Bernanke and Yellen in their time as Chair started to gingerly stop buying government bonds and very quickly had their heads handed to them by the markets. Simply not investing the interest coupons and maturing debt of the then much smaller Fed portfolio of U.S. Treasury and MBS caused tremors and then earthquakes in the bond market, so they stopped.

Trump Tweeted and Powell Quaked

Fed Chair Powell tried quantitative tightening in 2018 but was stopped dead in his tracks by market tremors and a Twitter storm from then President Trump, complaining that the U.S. should have more negative interest rates than the hapless Europeans. A more jaded appreciation would be that Powell did Trump’s bidding to avoid a weak economy or financial calamity before the 2020 Presidential election.

The Powell Fed didn’t sell any bonds, they just stopped reinvesting the interest payments and maturing bonds. The bond market couldn’t take even that small amount of change in the supply and demand for Treasuries. It shuddered and its conniptions caused Jerome Powell to flee the bond battlefield in terror. He stopped his Quantitative Tightening and even lowered Fed Funds to escape President Trump’s Twitter bombardments. Now we are supposed to believe he is Rambo?

Inelegant Canso Laws of Financial Motion

What is Canso’s take on the sophisticated problem of how much monetary tightening is needed to stop our current high level of inflation? We turn to Isaac Newton and his Laws of Motion for our simplistic view of what will happen. Newton’s First Law of Motion is that an object in motion will maintain its inertia unless sufficient force is applied to it to change its motion. Newton’s Third Law states that when two objects interact, they apply forces to one another that are equal in magnitude and opposite in direction.

The inelegant Canso Law of Monetary Policy states that it is going to take a lot of “equal and opposite” monetary action to get the inflation reaction that the central banks want. More simply stated: “What goes up, must come down”. As we’ve said many times before on these pages in the past two years since the pandemic started, the monetary and fiscal stimulation applied to the U.S. economy was unprecedented. It’s going to take quite a lot in the opposite direction to get things back to normal.

Far from the Maddening Crowds

This was a rather quaint and inexpert view by a bunch of hicks from the suburbs of Toronto, “Far from the Maddening Crowd” of Wall Street and even Bay Street. But now it looks to be not so stupid. It looks to the inexperts at Canso, as we’ve said many times to you, that the Fed cheapened the price of money and capital so much, that investors were wasting their costless capital. We now believe that it will take at least an equal and opposite policy force to get inflation under control.

Not So Soft Landings

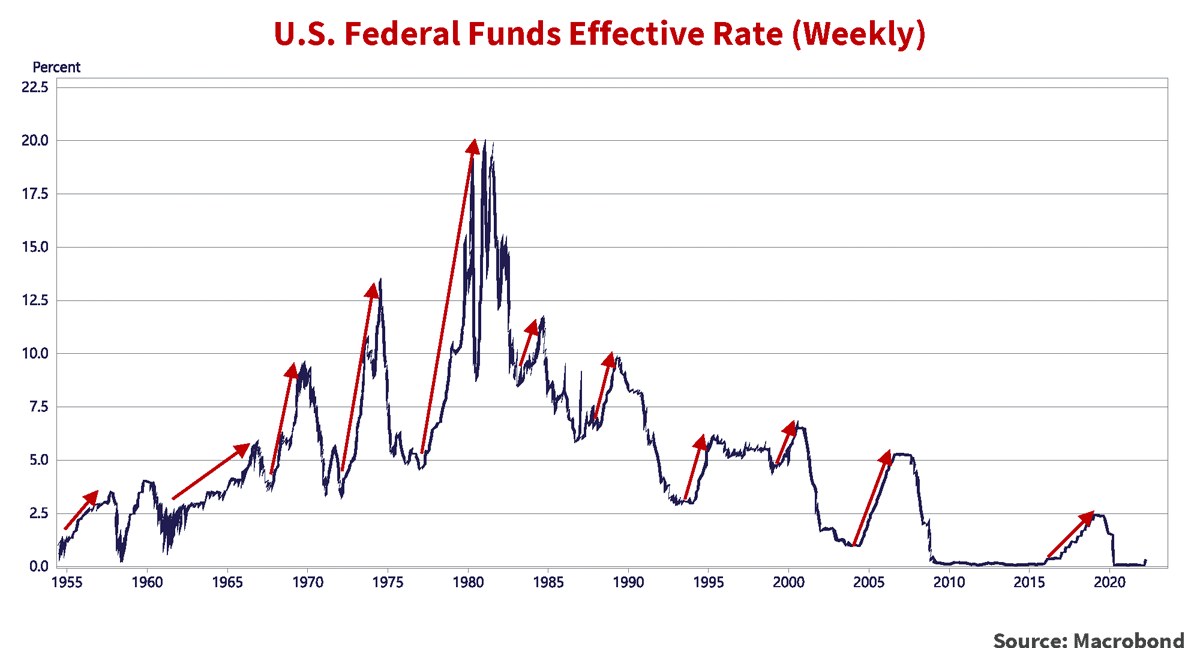

You probably still believe, or want to believe, that the Fed will achieve a soft landing. Sadly, this will likely not be the case. The chart below of the U.S. Fed fund rates since 1975 shows the historical skill of the very human humans who work at the Fed to “Eff Things Up”. Note that a period of steadily rising administered rates is usually followed by an emergency crash dive to clean up the financial market mess caused by the Fed’s Financial Wizards of Oz.

The simple job of the Fed is to raise the price of money and capital enough to slow things down. We know from long experience that this is not so simple, and the Fed has an amazing propensity to overcorrect. Those undertaking this seemingly simple job have no idea beforehand on what will be necessary to slow the economy down enough to cause inflation to hit their professed target.

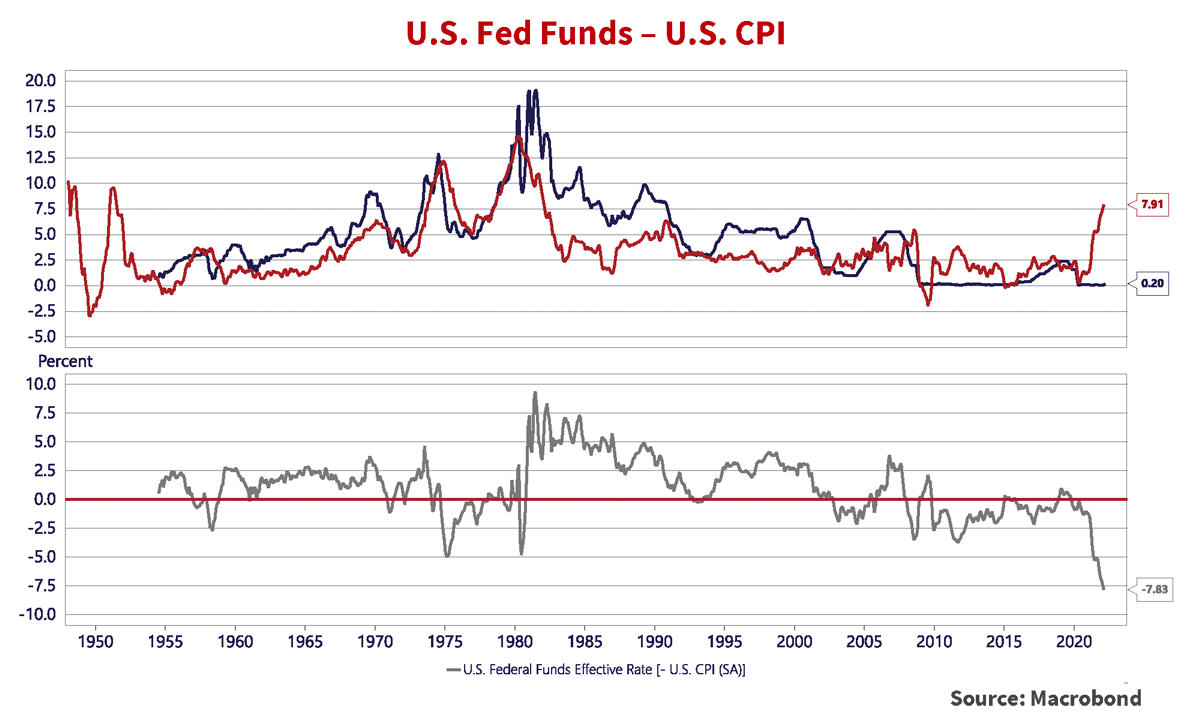

Not Fun Fed Funds

For an idea of how much the Fed might raise interest rates, we have created the two charts below. The first chart below shows the CPI as the red line and Fed Funds as the blue line. This shows that it has been very unusual for the CPI to be above Fed Funds, except for the recent period since the Credit Crisis. The second chart, with the “Real” Fed Funds rate, Fed Funds minus year-over-year CPI, confirms this. We observe that the period of high inflation from 1975 to 1980 experienced a protracted period of low and negative real Fed Funds. It also shows that the period from 2003 to now had a low level of inflation with an even lower level of Fed Funds. The 2008 financial crisis saw Fed Funds left at zero in nominal terms and mostly negative.

This is the period where we believed capital became so cheapened by the Fed that investors learned to discount any possibility of an increase in short term interest rates. In 2007, the real Fed Funds rate was +2.5%, after a period where the Fed raised its benchmark rate from 1.0% to 5.25%. That was enough of a rate increase to cause the Credit Crisis and Great Recession of 2008.

The Fed soon dropped Fed Funds from 5% to 0% to save the credit markets and stimulate the economy. Inflation dropped to -2.0% in the Great Recession but returned to more normal positive levels that kept the real rate at very negative levels as the Euro Debt Crisis of 2011-2012 caused the Fed to err on the side of too much ease and leave Fed Funds at zero until Janet Yellen began to move rates above zero in December 2016 with a .5% increase. She had moved them up to 1.5% by the time she handed over to the new Chair, Jerome Powell, in February 2018.

Powell increased rates to 2.5% by December 2019 when he caved to President Trump’s Twitter attacks and promised to stop raising rates. The Powell Fed then started lowering Fed Funds, stopping at 1.75% in October 2019. This was despite a decent economy and very much looked to be a sop to President Trump’s 2020 election ambitions.

When COVID struck in early 2020, the Powell Fed moved Fed Funds once again to effectively zero. The maintenance of Fed Funds at zero when inflation spiked up to 7.9%, meant a -7.4%, even after Fed Funds was finally moved to .5% on March 16 of this year.

Getting Real on Real Rates

So how can the Fed be thought to be tightening monetary policy when the real Fed Funds rate is -7.7%? That’s the problem for the Fed. Since T-Bills are normally 1% higher than inflation, the bond market at present yield levels is currently impounding a return to 2% inflation with its pricing of bonds. The bond market’s move from a 2% to 3% terminal Fed Funds rate caused the havoc we spoke of earlier, when Fed governors switched to their Rambo act. Consider if inflation expectations increase to a 4% eventual Fed Funds rate. That would mean 5% on T-Bills and 6% and more on longer term bonds.

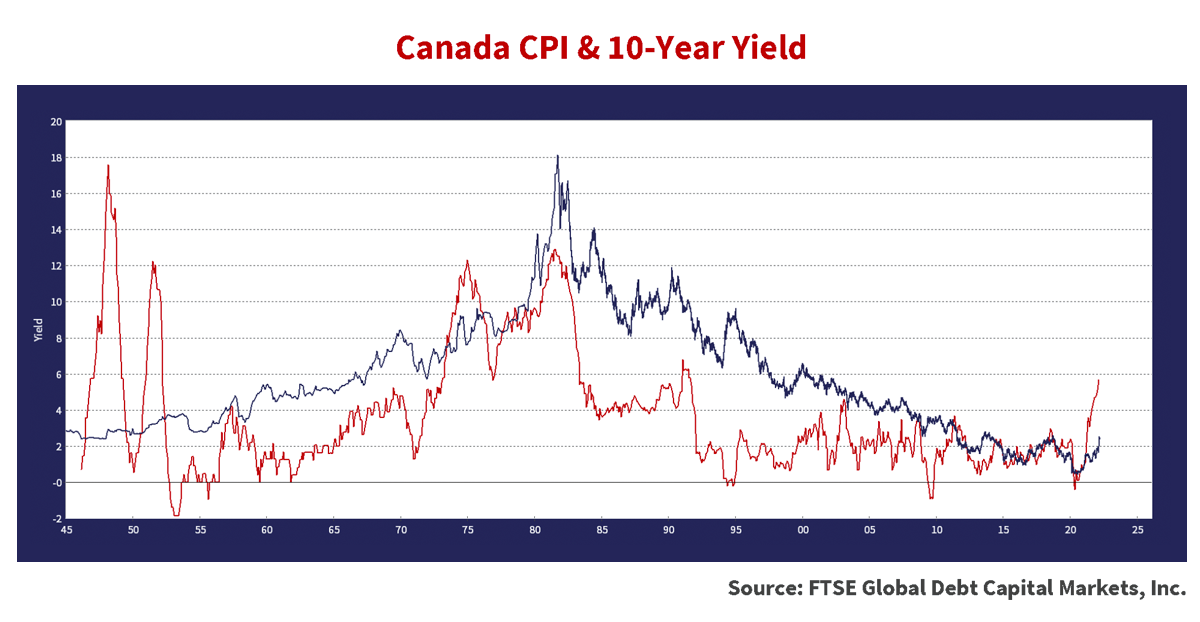

A Canadian Bond Tale

We turn to Canadian history and our 10-Year government bond to demonstrate how long it takes to get inflation under control. The chart below shows the yield on the Canada 10-Year government bond (blue line) plotted with the Canadian year-over-year CPI since 1947. Note there are very few periods in the last 75 years when the CPI exceeded the 10-Year Canada yield.

We have taken a look at what happened in each of these periods and outline what transpired below:

June 1946 to June 1949: The 3.6% CPI moved above the 2.4% 10-Year Canada yield in June 1946 and remained above for the next 3 years. Canada had just removed the WW2 price and wage controls. During the war, consumer good rationing resulted in a reduction in the supply and demand from consumers. Consumers, both civilian and military, were also forced to save their wages above their artificially low spending and invested in War Savings Bonds. After the war, a return to a normal economy resulted in soaring demand and reduced supply as companies moved from wartime production of military goods. The CPI peaked at 14% in February 1948 and then fell to 2.8% in June 1949, when it fell below the 2.9% 10-Year yield. Notably, the 10-Year yield increased by .5% over this period, even though CPI was .8% less than at the start of the period.

September 1950 to August 1953: The CPI moved up to 3.8% above the 10-Year yield of 2.8% after the start of the Korean War in June 1950, which brought about sharply increased defence spending for the Cold War with the Soviet Union. Inflation peaked at 12.3% in June 1951 before falling to 0% in August 1953. The 10-Year Canada yield moved up 1% over this period.

June 1973 to March 1976: The CPI at 8.2% had already been rising in 1973 and moved above the 10-Year yield of 7.5% in June 1973. The October 1973 Yom Kippur War and subsequent Arab Oil embargo raised the CPI even further with a peak of 12.3% in December 1974. The CPI at 9.1% moved below the 10-Year yield at 9.4% in March 1976. The CPI moved up .9% over the period while the 10-Year Canada yield moved up 1.9%.

March 2021 to ????: Last March, the CPI at 2.2% moved above the 10-Year yield of 1.6%. Currently the CPI has risen to 5.7%, an increase of 3.5%, but the 10-Year Canada has only risen to 1.8%, an increase of .2%.

Inflation History is not Kind

Clearly, there is quite an increase waiting if history is our guide, with the increase in historical 10-Year Canada yields rising between .5% to 1.9% when the CPI inflation moves sharply above the 10-Year Canada yield. Will this time be different???

We’re about to find out! Our best take is that we’re in a situation similar to 1973-1976 where increasing oil prices from an exogenous geo-political shock are making an already inflationary situation worse. The interest rate increases needed to get inflation back to 2% are severe, but we doubt there is the political or central bank fortitude necessary for this. We are likely to have too little, too late and we could have inflation at much higher levels for another few years at least. If investors start to impound even a 3-4% inflation rate, then bond yields will be up substantially from where they are now.

Bonds are Too Sensitive

The problem is that low bond yields have increased the sensitivity of bonds to changes in interest rates and there is not very much interest coupon to offset a drop in price. A long-term bond will fall over 20% in price for a 1% increase in bond yields and a 5-Year bond will fall almost 5%.

Tentative monetary policy will make things even worse. Rising bond yields and rising inflation will eventually result in worse monetary medicine, as in the huge hikes of the Volcker Fed in 1980-1981. Higher rates mean less money available for everything, even equity investments. That means the stock market will eventually be affected, but at least equities have a claim on rising cash flows. The very popular “Private” financial assets will eventually have to be marked down as well. A private debt fund paying its unit holders 2.5% in interest income makes sense when short term rates are zero but doesn’t compare well to a T-Bill at 3%. Its price will receive a mark to market haircut and redemptions will rise if the manager doesn’t suspend them.

Elmer Fudd on the Markets

What is an investor to do? As Elmer Fudd from the Bugs Bunny cartoon might say… “Be Vewy, Vewy Worried!” Caution is very important in the markets we see ahead. Liquidity does not matter until it is the only thing that matters. It will take a lot of potential upside for us to exchange the large portfolio positions that we are building in very short, safe and liquid securities.

Investment patience and discipline are required. When liquidity wanes with the monetary tightening and prices fall substantially, we will be ready to buy. Until then, we are still happy to watch from the sidelines.