A New Normal for Fixed Income?

Q1 2021 was a watershed moment for bond investors, as it demonstrated just how much risk there was in traditional high-quality bond portfolios such as the FTSE Canada All Corporate Bond Index and FTSE Canada Universe Bond Index (“Traditional Fixed Income”) that – in the case of some retirees – could make up half or more of investors’ total investment portfolios.

With that in mind, investors could be asking themselves the question, ‘how can I maintain asset diversification, decrease interest rate risk and still make a reasonable rate of return?’

The traditional tools used to maintain asset mix diversification have typically been equity and fixed income (i.e. the 60/40 asset mix). However, in a rising interest rate environment, investors may have to expand their asset class tool kit to effectively balance risk and return going forward, and for that reason more investors are drawn to the Alternative Credit Focused (“Alternative Fixed Income”) asset class.

Traditional Fixed Income Alternatives

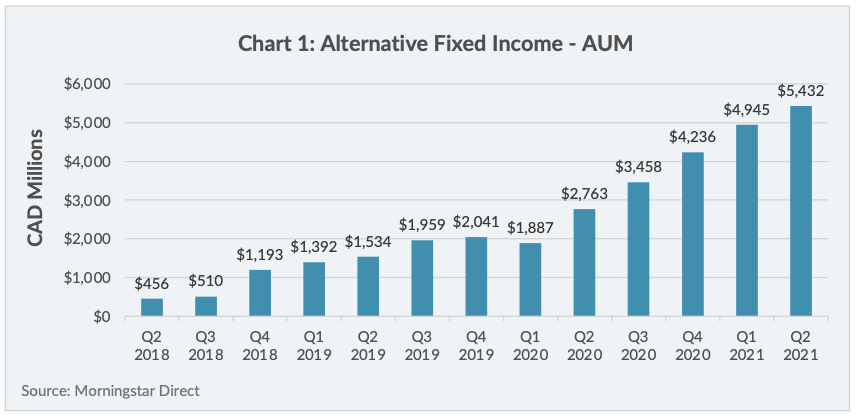

Alternative Fixed Income is still a relatively small but fast-growing asset class in Canada. As of the end of Q2 2021, assets under management (“AUM”) in the category was $5.4 billion compared to just $456 million three years earlier – a compound annual growth rate of 128%1 Referring to Chart 1, it appears as though the AUM growth of Alternative Fixed Income occurred in two-phases.

The first phase of growth was from Q4 2018 to Q1 2020, coinciding with the advent of the Canadian Alternative Mutual Fund regime in Q1 2019, also known as Liquid Alternatives or “Liquid Alts”. A result of regulatory change, the Liquid Alts regime opened the door for retail investors to access alternative investment strategies by allowing prospectus-qualified mutual funds to engage in such strategies. Previously, alternative investment strategies were only available to “accredited investors”– investors who meet certain requirements such as minimum income or investable asset thresholds.

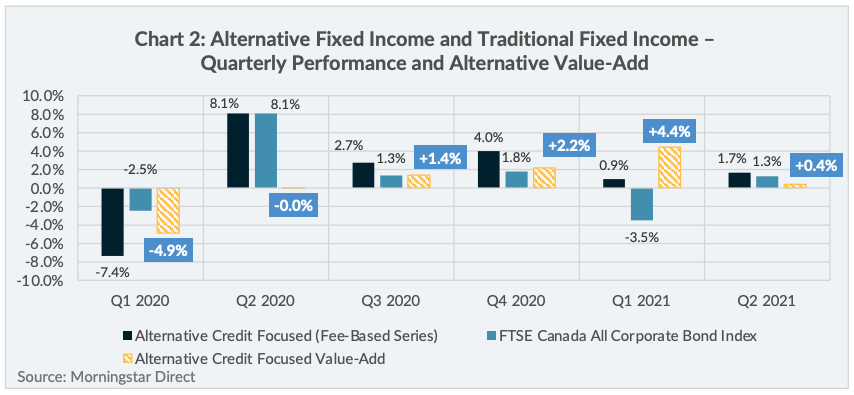

The second phase of growth followed the onset of the COVID-19 Pandemic in Q1 2020 and continues today. As illustrated in Chart 2, during this phase Alternative Fixed Income provided 8.6% of performance value-add relative to the FTSE Canada All Corporate Bond Index.

Furthermore, in Q1 2021 alone, the Government of Canada 10-year yield rose by 0.88%, contributing to losses of 3.5% and 5.0% for the FTSE Canada All Corporate Bond Index and FTSE Canada Universe Bond Index, respectively2. Over the same period, the 0.9% gain for Alternative Fixed Income represented value-add of +4.4% and +5.9% over the FTSE Canada All Corporate Bond Index and FTSE Canada Universe Bond Index, respectively.

“Isolating the Credit Spread”

It is often said that Alternative Fixed Income investment strategies can “isolate the credit spread” of corporate bonds. This is an important distinguishing feature of Alternative Fixed Income, but it also tends to be a source of confusion for investors in terms of how it differs from Traditional Fixed Income. To illustrate the concept, it helps to break down a corporate bond into the sum of its parts.

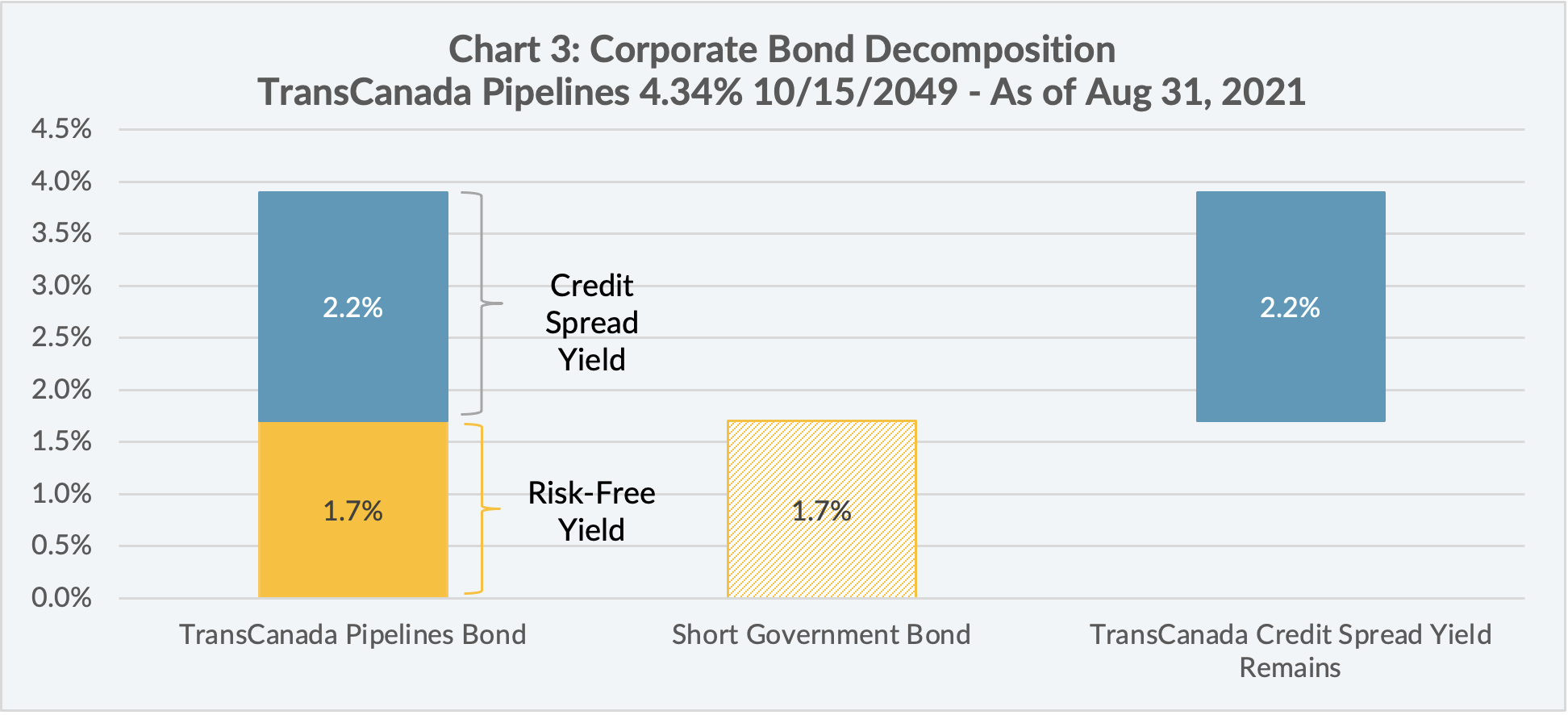

As illustrated in Chart 3, the yield of the TransCanada Pipelines bond (“TransCanada Bond”) (and any other corporate bond) can generally be decomposed into two parts:

- Risk-Free Yield: the yield of a comparable maturity government bond.

- Credit Spread Yield: the additional yield above the comparable maturity government bond that investors demand to take on the additional credit risk of lending to a risky corporation rather than the “risk-free” government.

Shorting an equal maturity government bond against the TransCanada Bond effectively neutralizes the risk-free yield component of the TransCanada Bond, thus isolating its credit spread yield.

Better Yield | Lower Interest Rate Sensitivity | Better Capital Growth Opportunity

The process of isolating the credit spread helps achieve the general outcomes of better yield, lower interest rate sensitivity, and better capital growth opportunity for Alternative Fixed Income relative to Traditional Fixed Income.

Better Yield

Yield is generated in two ways when isolating the spread: 1) through the credit spread and 2) from the re-invested proceeds of the government bond shorted into other bonds. Referring to Chart 3, the credit spread of the TransCanada Bond was 2.2%. While the credit spread yield itself is notably less than the TransCanada Bond as a whole (3.9%), the isolated credit spread yield is typically enhanced by the leverage associated with the government bond short.

Leverage is a significant factor that can be increased or decreased at a portfolio manager’s discretion. From a yield standpoint, leverage is generally a good thing because it could enhance the overall portfolio yield.

Lower Interest Rate Sensitivity

The interest rate sensitivity of a corporate bond is tied to its risk-free yield component. Thus, when an equal maturity government bond is shorted in tandem with a long corporate bond, the interest rate sensitivity of the total position is effectively neutralized. However, the corporate bonds that are purchased with the proceeds from the government short are “unhedged”, and it is these bonds that tend to determine the overall duration of an Alternative Fixed Income strategy.

Better Capital Growth Opportunity

When the credit spread is isolated, price volatility due to changes in interest rates is neutralized, however there is still exposure to price volatility due to changes in credit spread yield. Leverage also plays a significant role in this aspect of Alternative Fixed Income as it can magnify the price volatility due to changes in credit spread yield.

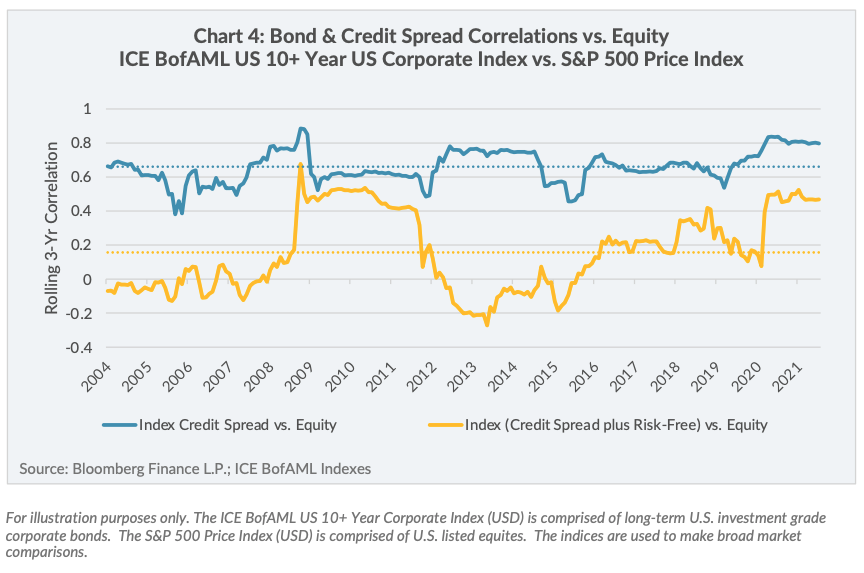

An important factor to keep in mind with Alternative Fixed Income is that it tends to be more correlated to equity than Traditional Fixed Income. This is because the credit spread yield is a market-based risk premium that changes based on market expectations of a bond issuer’s future creditworthiness, which is similar to how the price-earnings ratio of a stock is impacted by the market expectations of the company’s future earnings.

Consider Chart 4, which shows twenty years of rolling 3-year correlations between long-term US corporate credit spreads versus the S&P 500 Price Index, and long-term US corporate bonds versus the S&P 500 Price Index – clearly, the US corporate credit spreads have had consistently greater correlation to the S&P 500 Price Index than traditional US corporate bonds (rolling 3-year correlation averages over 20-years of 0.66 and 0.16, respectively).

Thoughts on Positioning

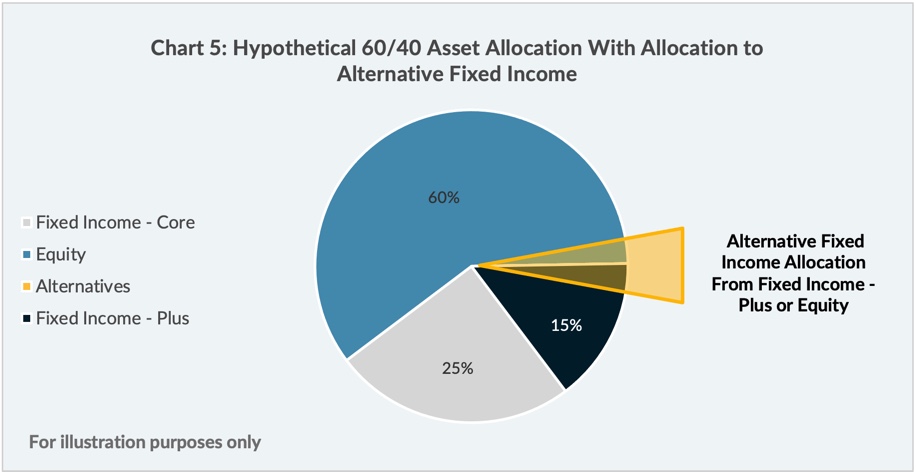

In an environment of low and rising interest rates, Alternative Fixed Income could be an attractive solution to investors due to its superior yield, lower interest rate sensitivity and better capital growth opportunity compared to Traditional Fixed Income. However, these characteristics come with the trade-off that Alternative Fixed Income tends to be more correlated to equity price movements, which can increase overall portfolio volatility. This could pose a challenge in terms of positioning Alternative Fixed Income within an investor’s asset mix. While it should be stressed that any decision to include Alternative Fixed Income in an investment portfolio should be done based on the unique requirements of the individual investor, two possible ways to think about positioning Alternative Fixed Income strategies in an investment portfolio, and as illustrated in Chart 5, are:

- as a complement to a fixed income allocation – part of the “plus” allocation from a core-plus approach; or

- as a conservative complement to an equity allocation.

Alternative Fixed Income at Lysander Funds

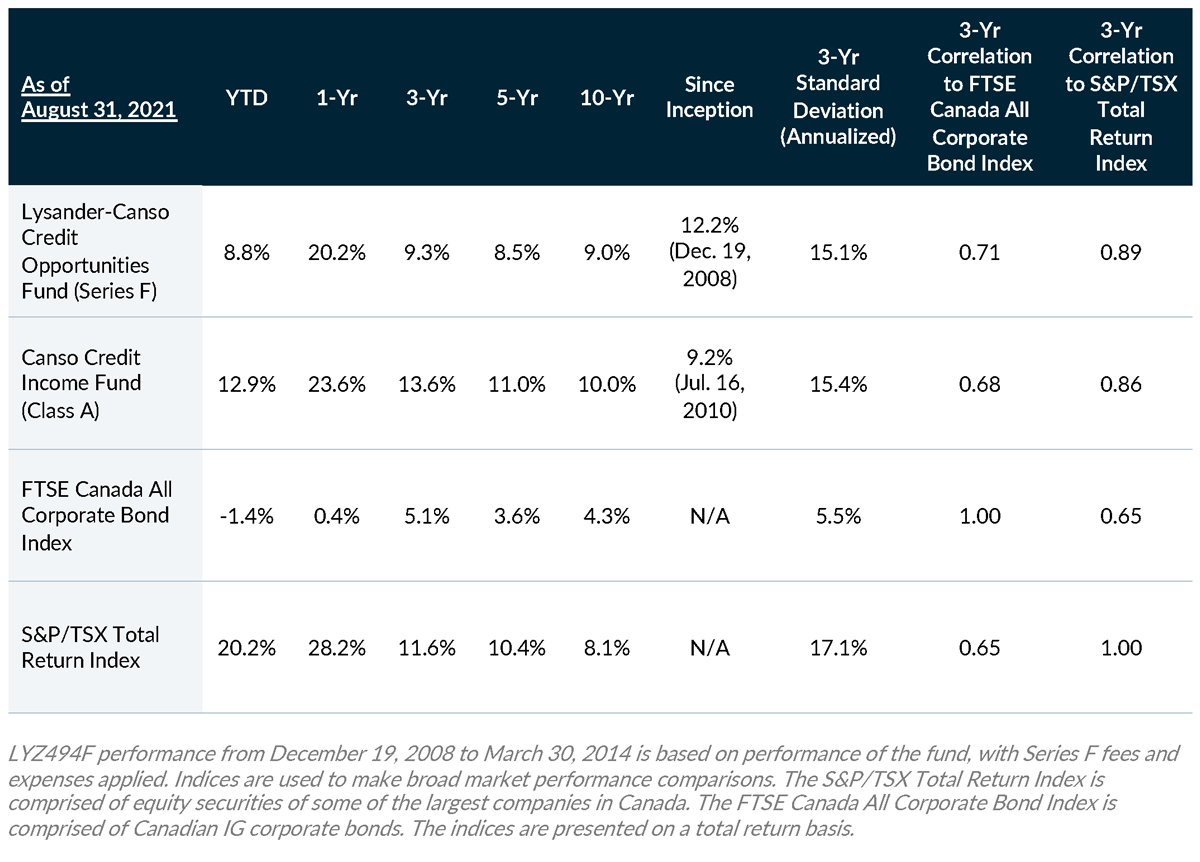

Lysander Funds offers two Alternative Fixed Income strategies: Lysander-Canso Credit Opportunities Fund, an alternative mutual fund; and Canso Credit Income Fund, a closed-end fund trading on the Toronto Stock Exchange. Both funds are managed by Canso Investment Counsel, and both aim to isolate the credit spreads of long-dated corporate bonds. The leverage profile of these funds also tends to be more conservative, as leverage is typically only utilized in conjunction with hedging risk-free yield.

1 Morningstar Direct. “Alternative Credit Focused” (or “Alternative Fixed Income”) in this article refers to the category of mutual funds tagged by Morningstar as “Alternative Credit Focused”.

2 For illustration purposes only. Indices are used to make broad asset class performance comparisons. The FTSE Canada All Corporate Bond Index is comprised of Canadian investment grade corporate bonds. The FTSE Canada Universe Bond Index is comprised of Canadian investment grade corporate bonds and government bonds. Performance of both indices is on a total return basis.