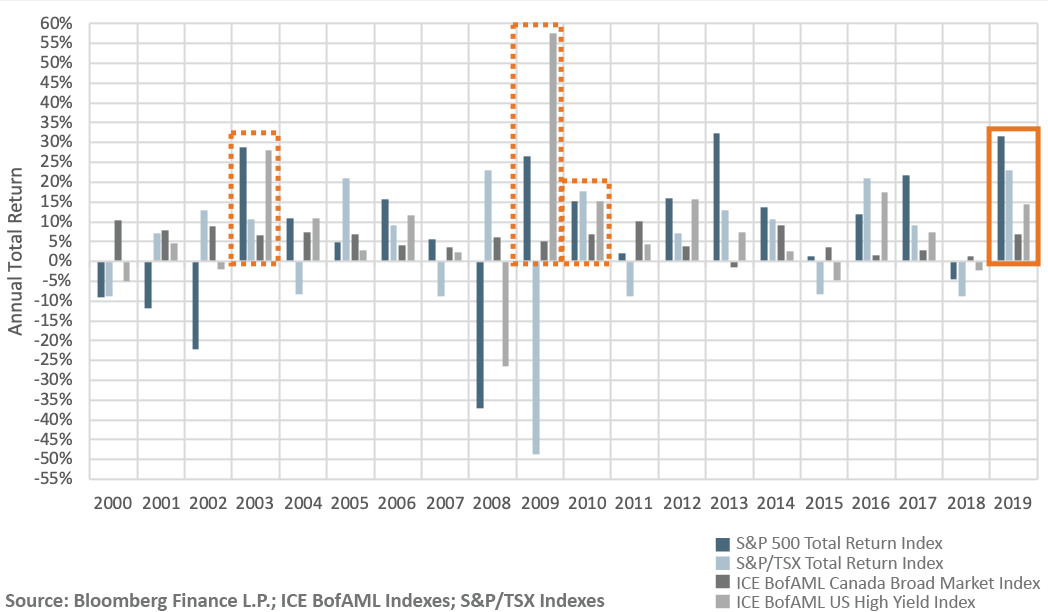

It is said that investor euphoria is the final stage of a bull market, and in 2019, investors should be feeling pretty good. Canadian equities (S&P/TSX Total Return Index), U.S. equities (S&P 500 Total Return Index), U.S. high yield bonds (ICE BofAML U.S. High Yield Index) and Canadian investment grade bonds (ICE BofAML Canada Broad Market Index) returned, 23%, 32%, 14% and 7%, respectively.

Looking back over the past 20 years, years with large (>5%), correlated gains across asset classes have typically been observed in years following recession (2003, 2009, 2010). Now ten years into the current market cycle, it is now more important than ever to consider the risks in the marketplace for portfolio positioning in 2020, especially in corporate bonds.

Investing Fast and Slow

The fall of global interest rates and the rise of negative yielding debt was a major bond market theme in 2019. In Canada, the government 10-year bond yield went from a high of 2.60% in October 2018 to a low of 1.09% in August 2019. Despite an overall low yield-to-maturity, which is the return an investor can expect by holding a bond to maturity, investors in the broad Canadian bond market (ICE BofAML Canada Broad Market Index) earned considerably more in 2019 because of the capital gain created by the decline in interest rates. This unusually large capital gain, although welcomed by some investors, can be problematic as it can also skew perceptions of future bond market returns and the potential risks to achieving those returns – behavioural finance refers to this as being a result of cognitive and emotional biases. Going into 2020, investors should be prudent in considering the yield characteristics of their bond investments along with the potential risks such as interest rate risk and credit risk.

Interest Rates Have Quietly Risen

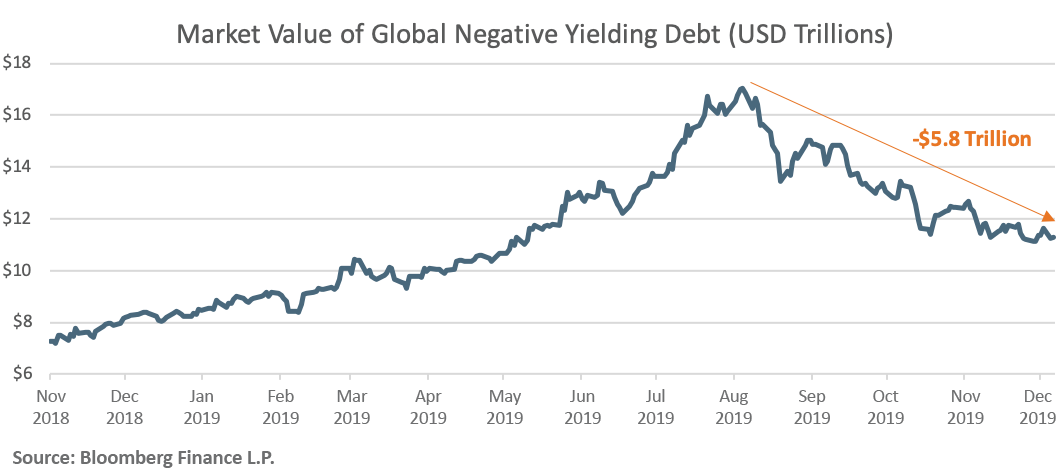

The interest rate risk in bonds has started to re-emerge. Falling global interest rates caused the market value of global negative yielding debt to top out at USD$17 trillion at the end of August 2019. However, since then global interest rates have been on the rise, and the amount of global negative yielding debt has reduced by 34%.

In North America, Canadian and U.S. government bonds with terms 7-years and greater have experienced losses large enough to offset one-year’s worth of interest payments. Furthermore, with a yield-to-maturity of 2.3% and a duration of 8.3 years (as of December 31, 2019), the ICE BofAML Canada Broad Market Index is showing poor investment fundamentals. Not only does the yield barely compensate investors for the rate of inflation, investors would incur 2.3% capital loss if interest rates were to increase by only 28 basis points (0.28%).

Corporate Credit Has Disconnected From Corporate Leverage

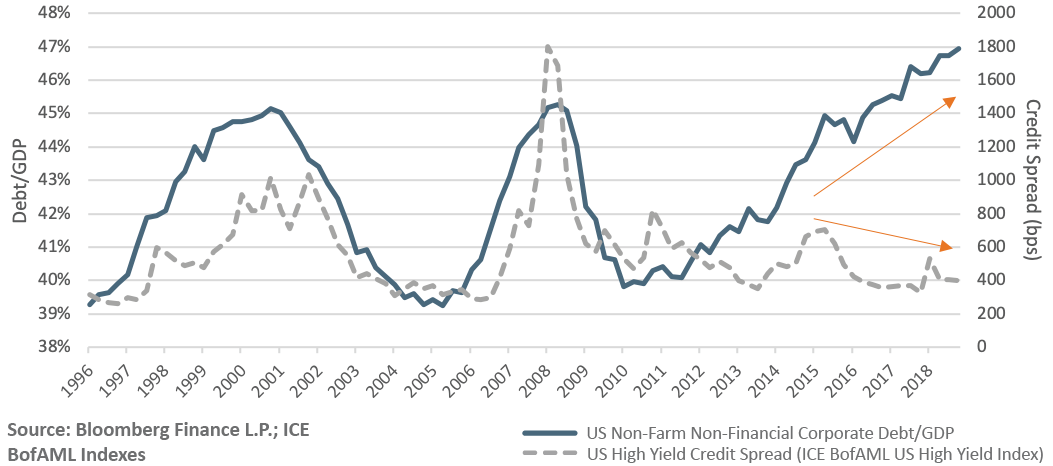

The investor appetite for risk assets that was seen in equity prices was also reflected in credit markets. Declining interest rates in 2019 saw a continuation of the “easy credit” theme for corporations issuing debt. Relative to GDP, U.S. corporations have now issued more debt outstanding than any other time over the past 25 years.

As corporations increase their debt levels it generally increases their chances of default, which then gets reflected in the value of the debt in the form of higher credit spreads (lower prices). This relationship between corporate debt levels and the value of debt has shown a strong correlation over the past 25 years, except for the past 4 years, where corporate debt has increased to all-time high levels and credit spreads have declined! The market is not assigning the same risk premium it typically has in the past. Using history as a guide, the current level of corporate debt would correspond with credit spreads of U.S. high yield bonds being at least 600bps higher than they are currently. For context, in the first three quarters of 2008, the credit spread of the ICE BofAML U.S. High Yield Index rose by 502bps and produced a total return of -10.6% over the same time period.

Conclusion

After a year of dramatic gains in 2019, investors should pause to consider the yield they are getting for the risks they are assuming in their bond portfolios. For corporate bonds, rising interest rates and rising credit spreads are risks that could erode investor capital in what is largely considered to be a safe asset class. This is a market for those who are loss-averse to be more selective in terms of interest rate and credit exposure assumed in their bond portfolios. Broad market bond exposure should be treated with caution.