“Why is my investment statement showing a loss, when the fund performance is showing a gain?”, is an all-too-common question from mutual fund investors after looking at their statements.

The answer, in many cases is because investors are evaluating the investment performance of their mutual fund by comparing two metrics that are commonly displayed on their investment statement, the current market value and the adjusted cost base (“ACB”).

What is wrong with this approach? In short, because ACB is a base characteristic for evaluating tax positioning. Performance positioning should be evaluated instead by comparing market value relative to “net invested capital” – the sum of all purchases less all withdrawals – while also including any cash distributions paid.

So, why do mutual funds pay distributions, and how do they impact the characteristics reported on investors’ statements?

WHY DO MUTUAL FUNDS MAKE DISTRIBUTIONS?

When an investor purchases an individual security such as a stock or a bond, they are responsible for paying the tax on any associated income (i.e. interest/dividend payments) and realized capital gains if held outside of registered accounts.

The same rules apply for mutual funds, however, rather than have the fund pay the tax liabilities, the more economically beneficial option is to distribute the tax liabilities to unitholders, so they can pay the tax liabilities at their individual tax rates.

HOW DO DISTRIBUTIONS IMPACT CHARACTERISTICS ON INVESTORS’ STATEMENTS?

On investors’ statements, there are generally three characteristics commonly reported: market value, ACB, and income received.

As mentioned, net invested capital is an important characteristic to determine investment performance gains, however it is not typically reported in investors’ statements.

When investors purchase a mutual fund, they elect to receive distributions in one of two ways – in cash or reinvested.

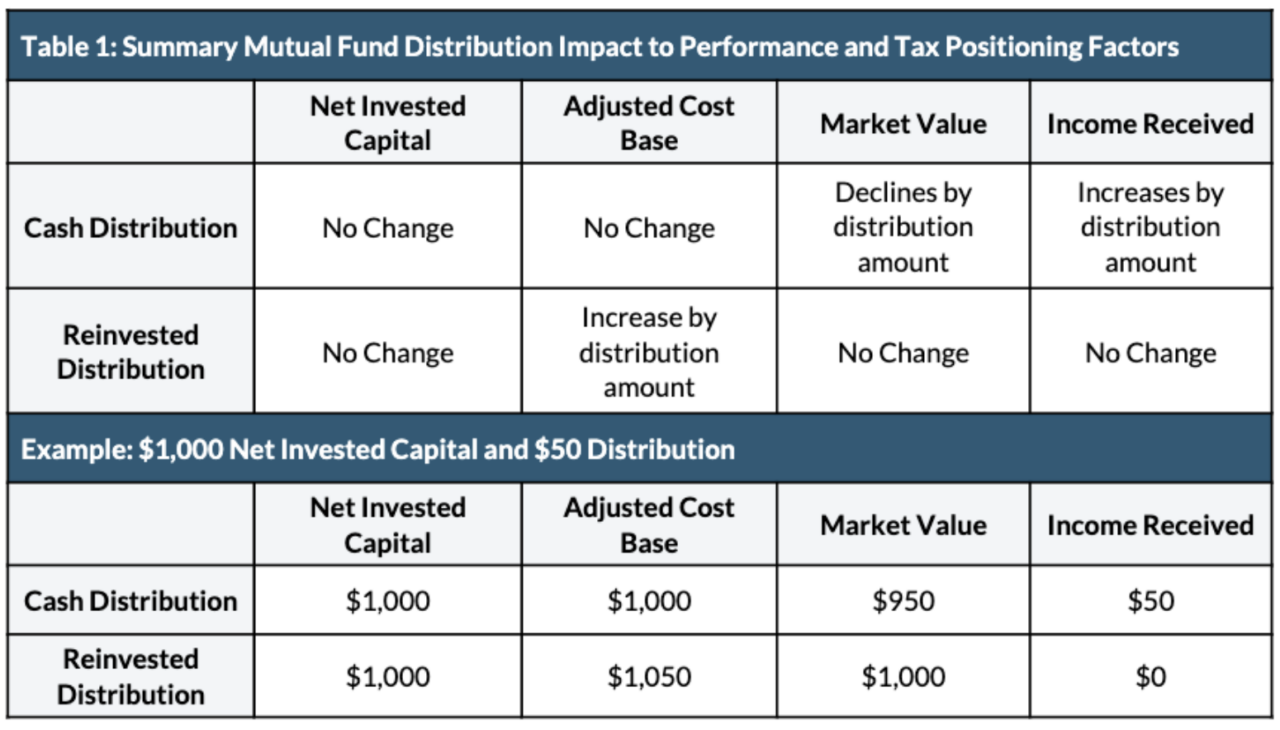

When cash distributions are paid by a mutual fund, the ACB remains constant, and the market value declines by the same amount as the distribution. When distributions are automatically reinvested, the ACB increases by the same amount as the distribution and the market value remains constant.

Table 1 further summarizes the impacts of the different distribution types to statement characteristic. It should also be noted that purchases and sales of mutual funds impact both net invested capital and ACB by the same amounts.

WHAT IS THE PURPOSE OF THE ACB?

In addition to paying tax associated with distributions, mutual fund investors may pay tax on the growth in value of the investments within the mutual fund. This type of capital gain for tax purposes is defined as the difference between market value and ACB.

The ACB adjustment associated with reinvested distributions is meant to avoid double-taxation by reducing the capital gain for tax purposes when tax is already paid on the distributions themselves. Without an ACB adjustment, investors would pay tax twice on the same capital growth (i.e. double taxation), as there is no change to market value when distributions are reinvested.

ACB does not adjust for cash distributions as they do not create opportunities for double taxation. With cash distributions, the market value of the mutual fund declines by the same amount as the distribution, thus already decreasing the reported capital gain.

CONCLUSION

Distributions are common features associated with mutual fund investments and they are ultimately a means to benefit investors. However, they also tend to be a source of confusion by sometimes showing a loss on investors’ statements when they have in fact produced performance gains.

When reading investment statements, investors may benefit by considering the following points:

- Distributions are not a source of investment performance; they are a means to allocate tax liabilities to mutual fund unitholders;

- Investments showing a loss based on ACB is in reference to tax positioning and doesn’t necessarily correspond to investment performance positioning;

- ACB does not equal net invested capital; investment performance evaluation should compare market value relative to net invested capital, also factoring in any cash distributions paid.

Investors could benefit by reviewing their investment statement with a professional financial advisor to better understand the performance and tax positioning of their investments.