Following the 2022/2023 interest rate tightening cycle by central banks there has been a lot of talk about whether the U.S. economy can absorb higher interest rates and if central bankers can engineer a ‘soft-landing’ (ie. reduce inflation while maintaining growth), or if they will overtighten and create a ‘hard-landing’ (ie. reduce inflation by inducing a recession). A proxy that investors often use to determine the economic health is to assess credit conditions of the economy, that is, the dynamics between lenders and borrowers in the credit markets.

Perhaps the most often cited metric related to credit conditions is credit spread (“spread”) – the incremental yield of a corporate bond over a similar tenured government bond. Other credit condition metrics can include bank lending standards and bond structure.

Credit conditions are generally cyclical. When the economy is expanding, credit conditions tend to be loose, generally indicated by tight credit spreads, loose bank lending standards and less restrictive bond structures. Conversely, when the economy is contracting, credit conditions tend to be tight as lenders demand more in exchange for their cash, and is generally indicated by wider credit spreads, tight bank lending standards and more restrictive bond structures. Today these metrics do not agree on the state of the US economy which could point to continued volatility in investment markets, however investors could be wise to proceed with caution.

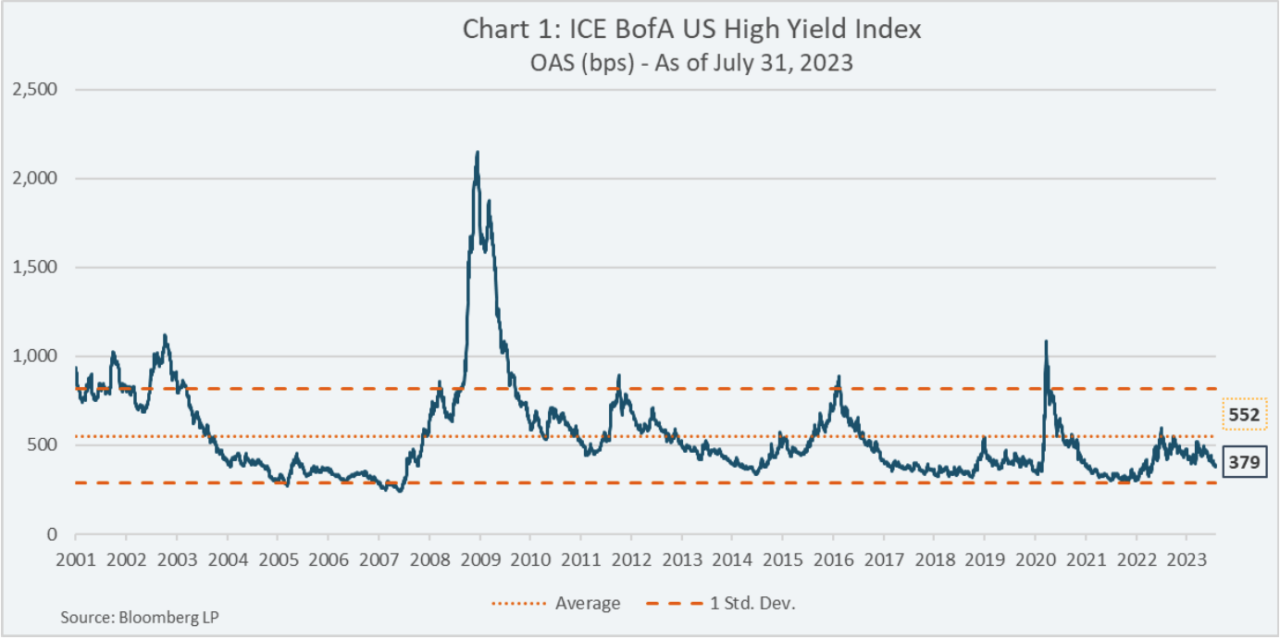

1. Credit Spreads

As illustrated in Chart 1, spreads in the U.S. high yield market are well below their long-term averages, generally indicating looser credit standards. U.S. administered rates now sit at 5.5%. Despite the stress higher interest rates have placed on the economy, including the failure of multiple US Banks, high yield bond investors may be underestimating the impact of the rapid expansion of U.S. interest rates will have on high yield issuers. One explanation for this could be the credit markets pricing a ‘soft-landing’ for the U.S. economy.

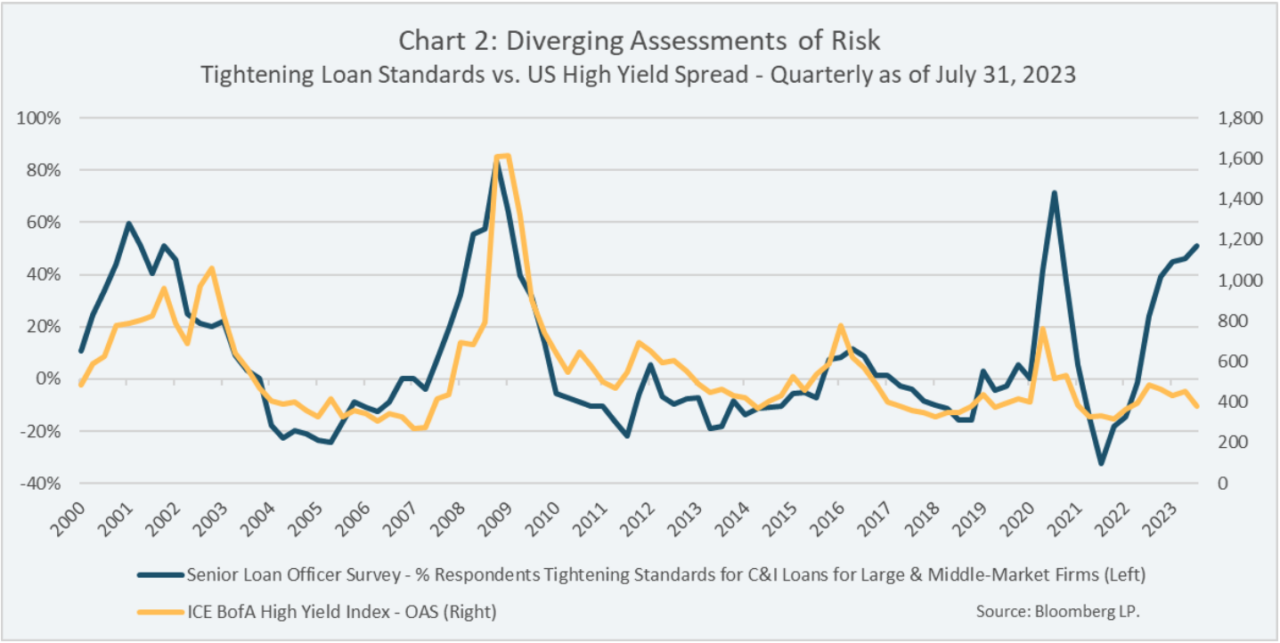

2. Bank Lending Standards

The Senior Loan Officer Survey is a quarterly survey conducted by the Federal Reserve of U.S. banks and changes in their standards, terms of lending, and demand for loans. As illustrated in Chart 2, since 2022, banks have been tightening their standards for offering loans to mid and large market firms.

When overlayed with a historical time series of U.S. high yield spreads, a positive relationship can be seen – when loan conditions tighten at banks, spreads typically widen and vice versa. Said differently, access to capital for mid and large firms has been tightening, but the high yield bond market has not yet reacted via wider spreads.

If bank lenders are tightening their wallets, it is because they see repayment risk rising and are demanding more for their money. One would expect the same trend to be reflected in corporate bond markets, however it is not currently being reflected in the general level of high yield bond spreads.

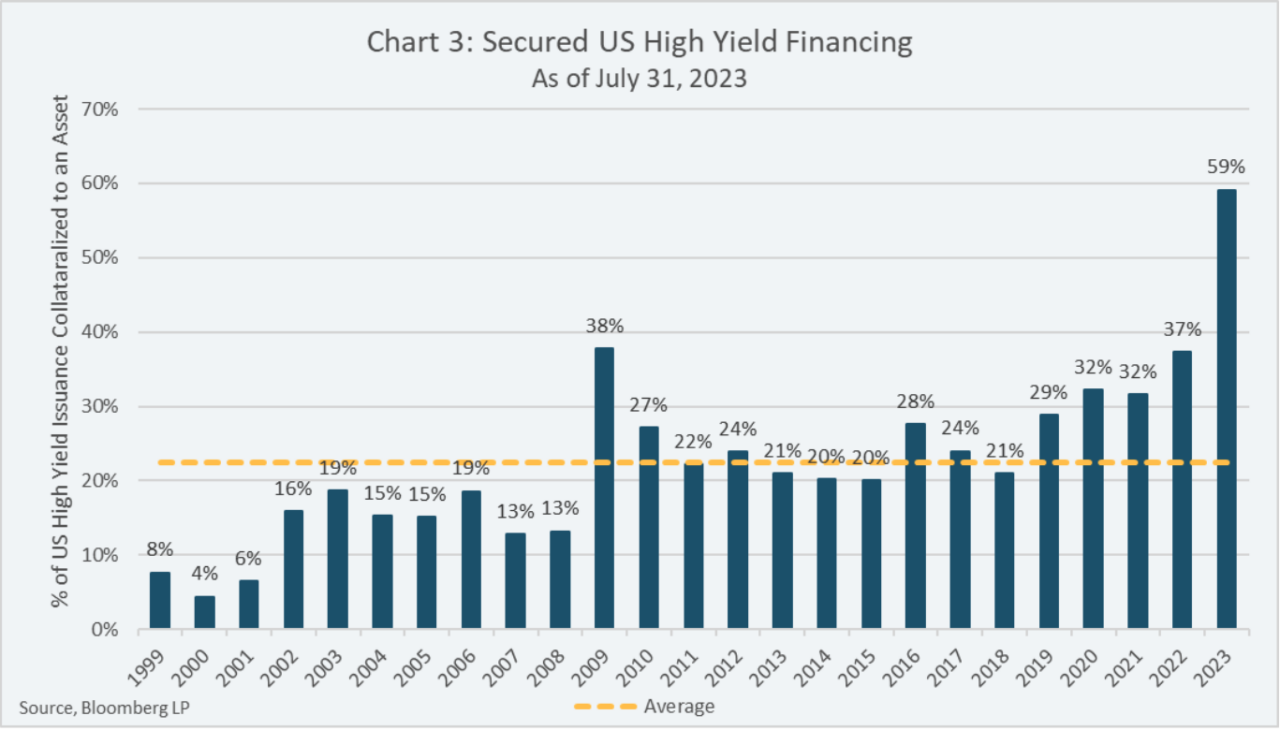

3. Secured vs. Unsecured Financing

Since 1999, the bulk of U.S. high yield bond issuance has been unsecured, ie. bonds are not collateralized by a specific asset. From a lending standpoint, this is deemed as more risky because repayment is less certain in the event of default and dependent on a restructuring or liquidation of corporate assets. As a result, these bonds typically offer a higher yield to compensate investors.

In 2023, there has been a drastic reversal in the trend of unsecured issuance as almost 60% of U.S. high yield bonds issued were secured in structure (as of July 31), eclipsing the previous high of 38% in 2009, and the average of 22% since 1999. A possible explanation of this trend reversal could be issuers preferring to make concessions on structure rather than spread.

Conclusion: A Catalyst for Higher Spreads?

Based on the factors examined, on balance it would appear that overall credit conditions are tightening, which increases the risk of a hard-landing. If this were to play out, spreads could possibly react by widening materially. Furthermore, the increased level of secured high yield bond issuance suggests issuers could have less flexibility to restructure their business to avoid a potential default. If this were to arise with enough issuers, it could have a material impact on the aggregate spreads in the US high yield market if the market anticipates distress.

Given the current level of uncertainty around credit conditions, investors could be wise to limit their exposure to the most risky credit issues. Active fixed income management could help investors navigate the current environment and find the best value in a fractured market.