We are pleased to announce that, in the 12-month period ending August 31, 2024, Series F of Lysander-Slater Preferred Share Dividend Fund (the “Fund”) and Lysander-Slater Preferred Share ActivETF (Ticker: “PR”) (the “ETF”) were up 30% and 29.8%, respectively, on a total return basis. This very strong performance is attributable to active redemption activity and relatively high coupon resets in the preferred shares market, as described below:

Active Redemption Activity

Redemption activity has been active during the past 12 months, with 26 Preferred Shares called for redemption at par value. As the majority of these issues were trading at a discount to par when they were called in, the redemption events resulted in significant capital gains, which, in some cases, exceeded 50%.

A large percentage of the Preferred Shares that were called for redemption were Canadian bank issues. Over the past several years, OSFI has made it known that it wants to see Tier 1 capital instruments in the hands of institutions rather than individual (“retail”) investors. To that end, it has encouraged the Canadian banks to redeem their listed $25 par value issues, and replace them with $1000 par value Preferred Shares (“1Ks”) and Limited Recourse Capital Notes (“LRCNs”). These relatively new Tier 1 capital alternatives trade over the counter (OTC), and can only be purchased by registered investment professionals.

High Coupon Resets

The largest segment of the Canadian Preferred Share market is the Fixed Reset subsector. Fixed Reset issues that have recently experienced a coupon reset have seen a dramatic increase in their dividend yield, reflecting a 5-year Canada bond yield that was 200 bps – 300 bps higher on the reset date than it was when the coupon was last reset.

Our Strategy

With both the Bank of Canada and Federal Reserve expected to cut interest rates over the coming quarters, our strategy has been to position our portfolios in higher-yielding securities that will benefit from interest rate cuts. Specifically, our breakdown is as follows:

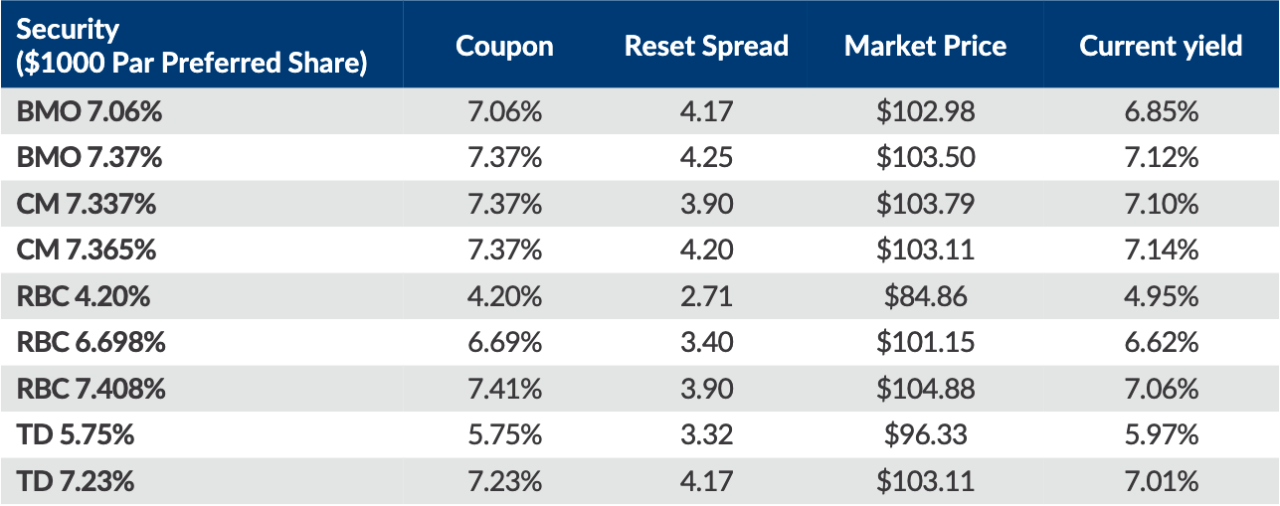

$1000 Preferred Shares (Current fund weighting as of August 31, 2024: 29.3%)

The $1000 Preferred Share structure was introduced to the market in October 2021 and has since grown to approximately $6 billion in size. We particularly like these issues because of their attractive coupon rates (over 7% for the most part) and relatively high reset spreads (a weighted average of 377 bps). We believe these securities resemble the post-financial crisis bank Preferred Shares (issued between 2009 and 2015), which also bore high coupons and reset spreads. Recall that those issues performed well and experienced low volatility. We believe the “1Ks” have and will continue to perform well, especially in the wake of interest rate cuts.

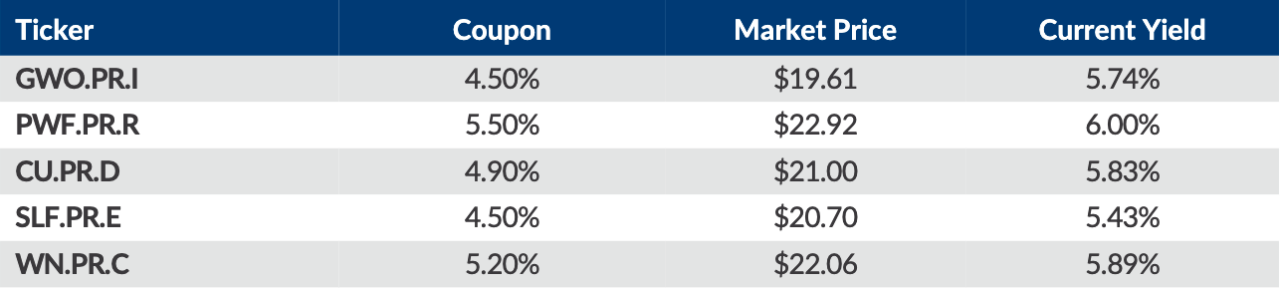

Straight Perpetuals (non-bank) (Current fund weighting as of August 31, 2024: 17.6%)

These issues currently trade at a discount to par and offer relatively high running yields. We believe they will perform well if the Bank of Canada continues to cut rates.

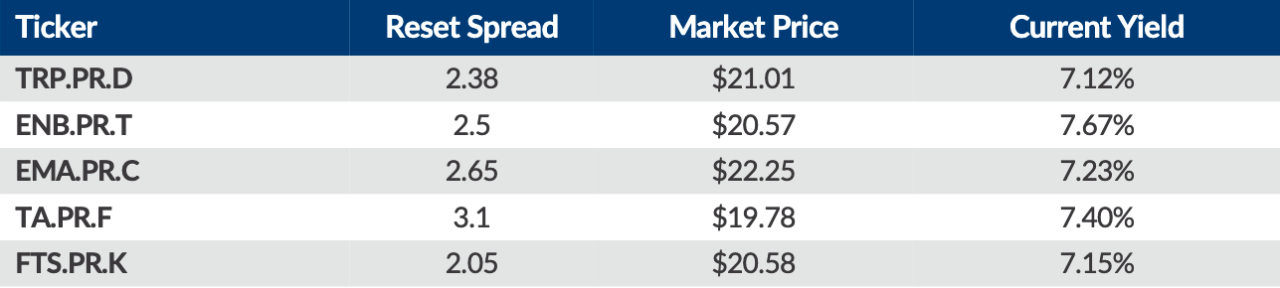

Fixed Resets that have recently reset (non-bank) (Current fund weighting as of August 31, 2024: 20.2%)

The coupon rates on these issues were recently reset in a relatively high interest rate environment. Current yields are compelling. This group should do well in the next couple of years as we expect interest rates to be cut several times.

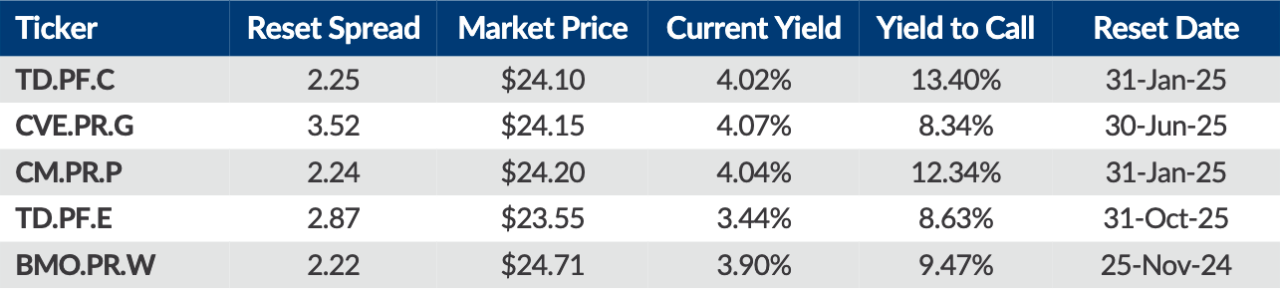

Fixed Resets that we expect to be redeemed on next reset date (Current fund weighting as of August 31, 2024: 12.5%)

Average Yield-to-Call: 10.7%

These issues are candidates to be called in by the end of 2025, and since they are trading at a discount to par, we value them on a yield-to-call basis. The table below highlights selected issues’ high yield-to-call.

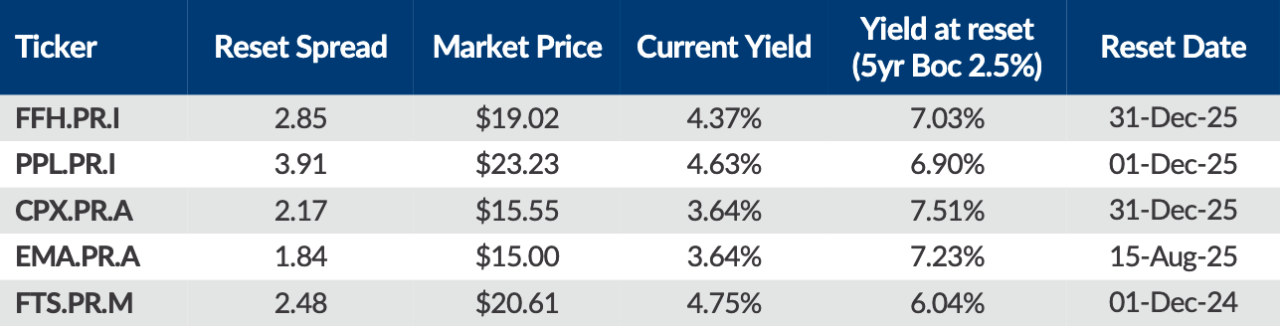

Fixed Resets that we expect to be reset (Current fund weighting as of August 31, 2024: 14.7%)

Average yield: 6.50% post reset

Even if the 5-year Canada bond yield were to fall to 2.5%, we believe these securities offer an attractive post-reset running yield and the potential for capital appreciation.

Summary

The landscape of the Canadian Preferred Share market is changing, and will continue to do so as the number of traditional Canadian bank Preferred Shares declines in favour of alternatives like LRCNs and $1000 par value Preferred Shares. We are excited by the new direction the market is taking, and expect it to have a lasting positive impact on the performance of the Canadian Preferred Share marketplace.

We have seen volatility fall since the introduction of the new Tier 1 capital instruments. OTC trading of these instruments, combined with relatively high coupons and reset spreads is positive for volatility going forward. In particular, we have embraced the $1000 Preferred Shares, which now represent a significant weighting in each of the Fund and the ETF.

Ultimately, we look forward to offering access to an alternative to conventional Preferred Shares with attractive tax efficient income and considerably lower volatility compared to years past.

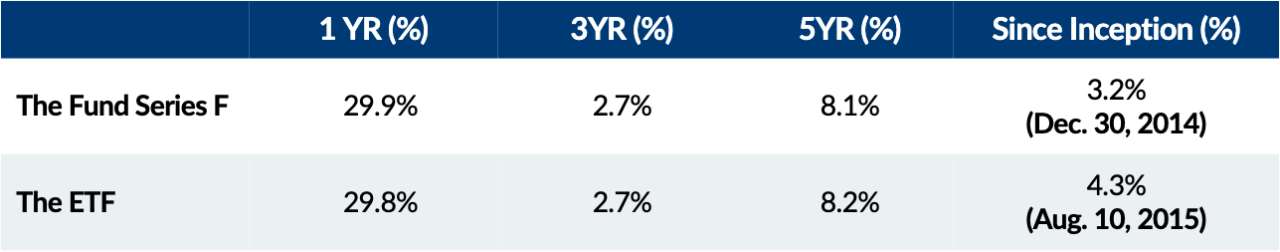

Standard Performance (As of August 31, 2024)