The Times Are a Changing

The first quarter of 2021 was a wake-up call for bond investors. Fuelled by speculation of a post-COVID economic boom and soaring inflation expectations, interest rates1 jumped and led to a quarterly loss not seen in the ICE BofAML Canada Broad Market Index (“Canada BM Index” or “the Index”) in over 25-years.

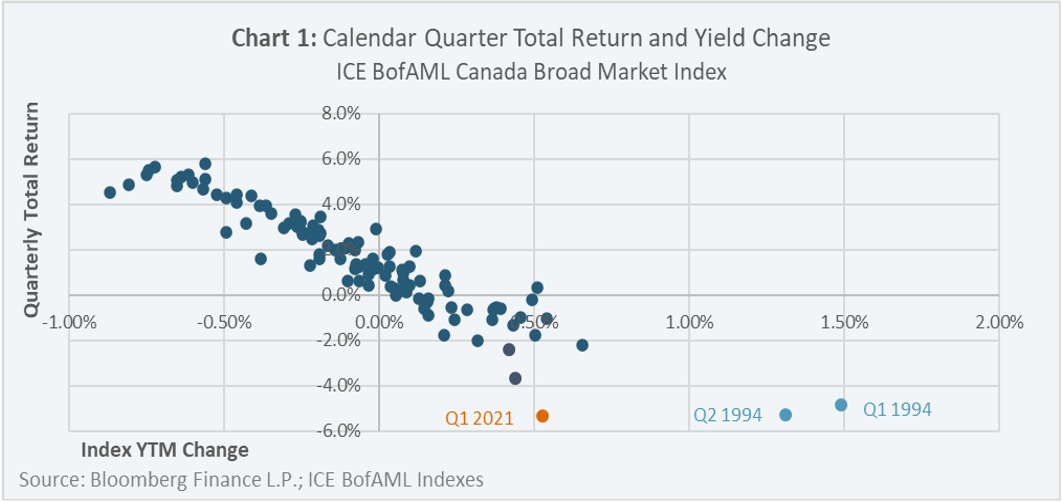

As illustrated in Chart 1, Q1 2021 produced a return of -5.3% (for those fans of extrapolation, that is an annualized loss of 19.7%), which was the largest quarterly loss for the Canada BM Index on a total return basis since its inception in June 1992. What is remarkable is not just the magnitude of the quarterly loss, but that it was also achieved off a change in yield-to-maturity (“yield”) of only +0.53%2. For context, Q1 1994 and Q2 1994 (Chart 1, annotated in light blue) were the only other calendar quarters when the Canada BM Index produced losses greater than 4.0%, however those losses were accompanied by increases in yield that were at least 2.5x greater than the increase in yield experienced in Q1 2021.

Investors may very well be confused, after all bonds are supposed to be safe, especially bonds with high credit qualities such as those included in the Canada BM Index. Furthermore, it is not as though rising yields are a new phenomenon. Referring back to Chart 1, since the inception of the Canada BM Index, out of 46 calendar quarters when the yield of the Index had risen, over half of those quarters (26) generated positive total returns – why was Q1 2021 so different?

The Growing Risks in High-Quality Bonds

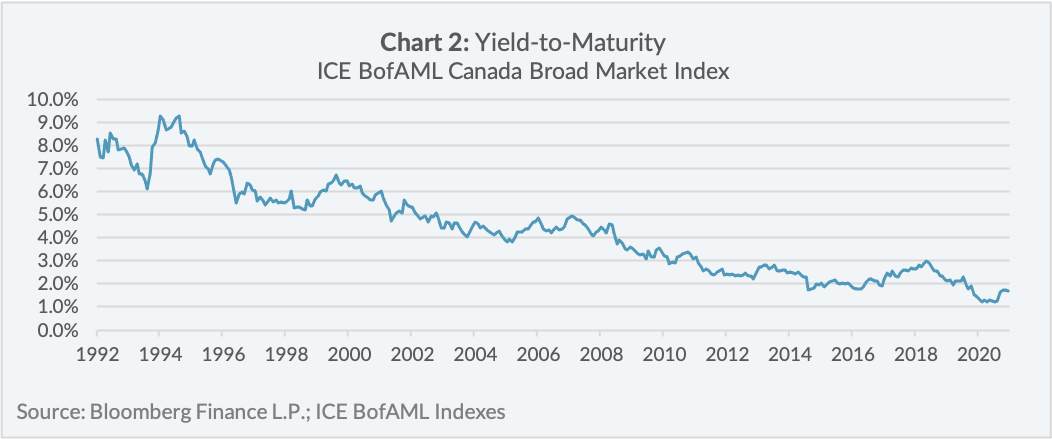

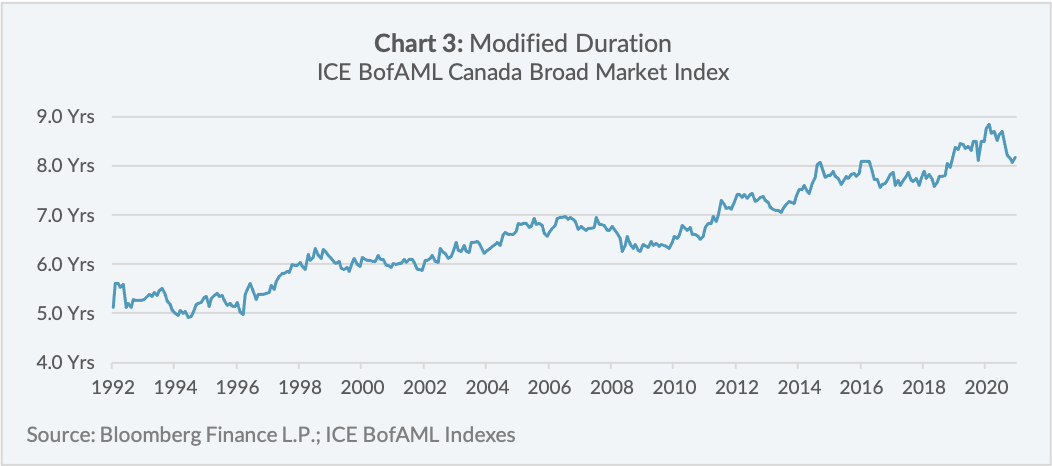

As illustrated in Chart 2 and Chart 3, over the past 27-years there has been a gradual transition in the yield-to-maturity3 and modified duration4 (“duration”) characteristics of the Canada BM Index. These shifts have had meaningful impacts on the ability of the Index to preserve investors’ capital during periods of rising interest rates.

Consider the different outcomes available from investing in the Canada BM Index over time. On June 30, 1994, an investor would have achieved a yield of 9.3% while assuming a duration of 5.0 years, whereas on May 31, 2021, the yield achieved was only 1.7% while assuming a duration of 8.2 years. Simply put, where the Canada BM Index once offered investors ample yield for assuming a relatively low level of duration, the Index now offers investors near record-low yield for assuming near record-high levels of duration.

“Double or Nothing”

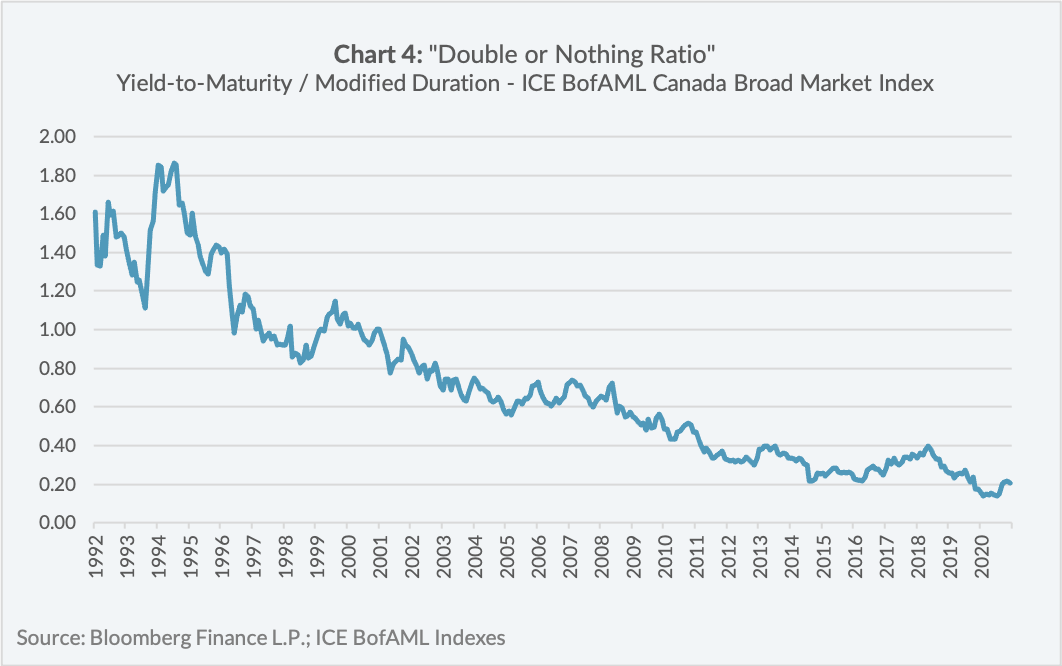

A helpful metric that can be used to assess the ability of the Canada BM Index to protect investors’ capital from rising interest rates is calculated by dividing yield-to-maturity by duration and is illustrated in Chart 4. This metric is commonly referred to as the “Sherman Ratio”; however, perhaps a more fitting title is the “double or nothing ratio” – that is because the ratio (when expressed as a percentage) describes the approximate amount of interest rate change (up or down) that would either double the return an investor would expect to earn from a bond’s yield-to-maturity or wipe it out entirely.

For example, the double or nothing ratio for the Canada BM Index was 1.85 on June 30, 1994, which means interest rates would have had to rise by approximately 1.85% for the Index to experience a capital loss large enough to offset its initial yield of 9.3% – at which point an investor’s return would be “nothing”. On May 31, 2021, the double or nothing ratio was 0.21, which means interest rates would have to increase only by 0.21% before investors would start experiencing losses on a total return basis.

Do Your Bonds have High-Quality Yield?

With these risks in mind, it comes as no surprise that there is growing consternation over bonds amongst investors, or that Warren Buffett recently warned against owning bonds in his annual letter to shareholders, or that there are ongoing debates over the effectiveness of the 60/40 asset allocation.

At Lysander Funds, it is our contention that bonds still play a vital role in investment portfolios as risk diversifying instruments. However, for investors who value short-term capital preservation they may need to reframe their expectations of what bond characteristics might best achieve that objective going forward, and it may not necessarily be the bonds with the highest credit quality.

In an environment of low yields and the spectre of rising interest rates looming over the markets, investors may experience better capital preservation by owning bonds with higher-quality yield – that is, bonds with greater double or nothing ratios (higher yield, lower duration, or both!).

Bond Solutions at Lysander Funds

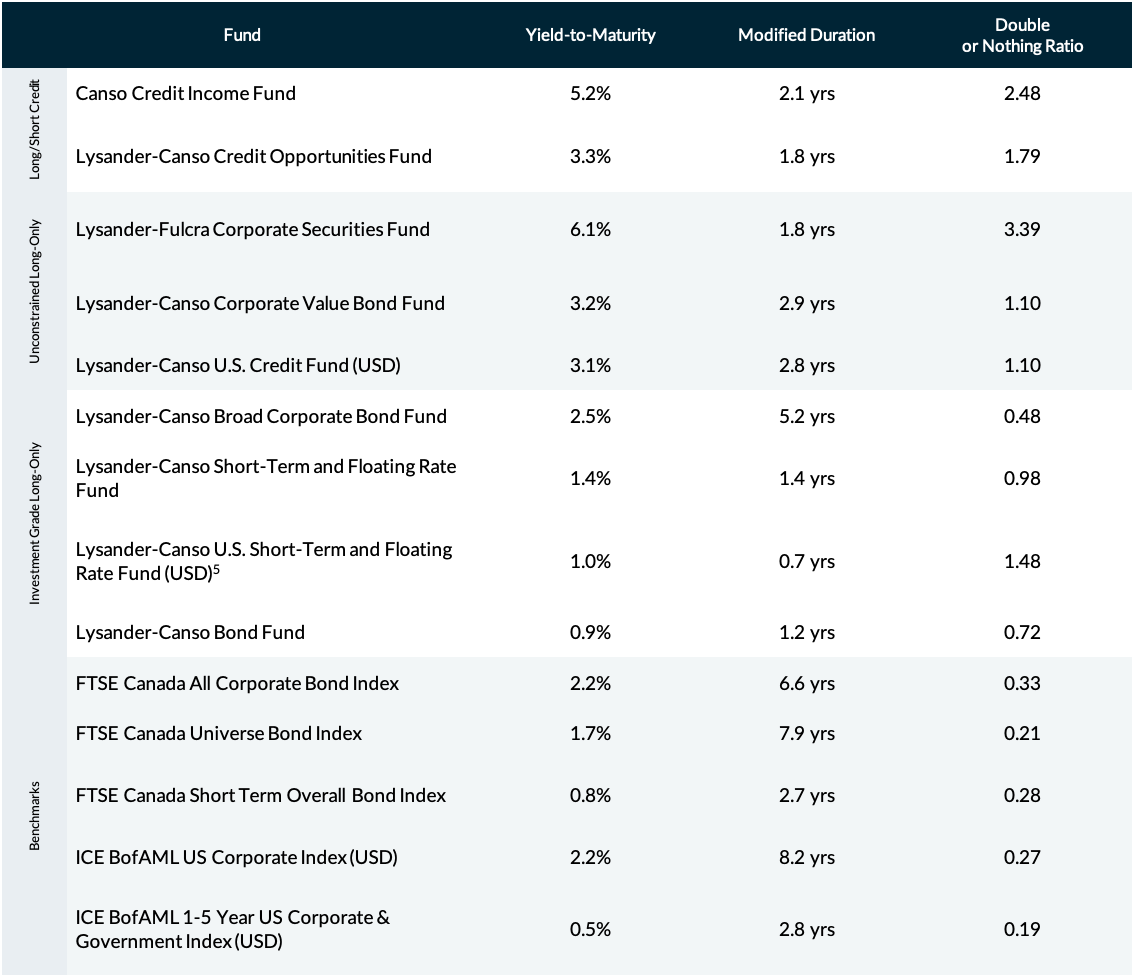

Lysander Funds offers a suite of bond funds to investment professionals to match the different return and risk objectives of their clients. Our two portfolio managers in the bond arena, Canso Investment Counsel Ltd. and Fulcra Asset Management Inc., both apply bottom-up (or company-first) approaches towards portfolio construction, which generally tend to produce overall portfolio characteristics with higher-quality yields than their benchmarks. As of May 31, 2021, the yield-to-maturity, duration and double or nothing ratios of the bond funds offered by Lysander Funds are noted in Table 1 below:

Table 1: Lysander Bond Funds Characteristics

1 “Interest rates” in this paper refers to the risk-free rate.

2 The ICE BofAML Canada Broad Market Index is composed of government bonds and high-quality corporate bonds in Canada. As such, there is a small component of credit spread; however, the greatest component of its yield-to-maturity is attributed to the risk-free rate.

3 Yield-to-maturity is a function of a bond’s coupon and price. It represents the annual return an investor will achieve by holding the bond to maturity, assuming the bond does not default.

4 Modified duration measures the price sensitivity of the bond’s price to changes in the risk-free interest rate. Duration is quoted in “years” and can be interpreted as the percentage price change of a bond for a 1% change in the risk-free rate.

5 The inception date of Lysander-Canso U.S. Short-Term and Floating Rate Fund (USD) was May 12, 2021.