The idea of the global economy landing softly or abruptly or somewhere in between is a strange narrative. After landing, does the economy stop? The obvious answer is no.

Like passengers that may never return to the skies after experiencing an emergency door fly off a Boeing 737 Max 9, companies rocked by a bumpy economy may never return to cruising altitude and may fall prey to competitors.

Economies are continuous and evolving for better or worse. The idea that central banks can engineer economic perfection comes from those with their head in the clouds.

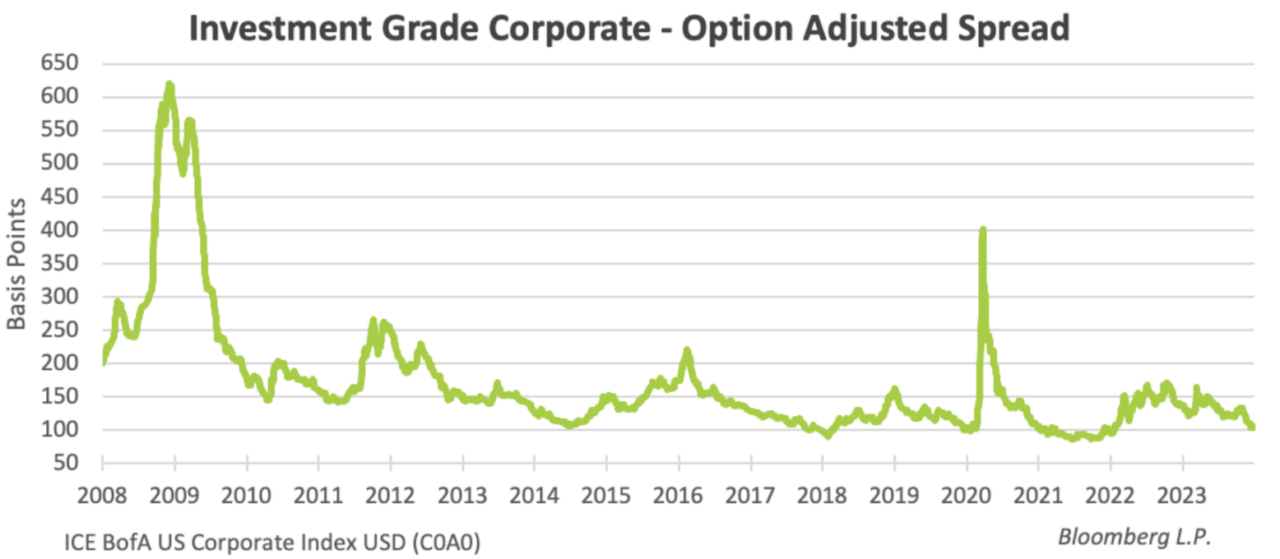

The soothing phrases that lure investors to believe we are in midst of a goldilocks economy has the potential to sow the seeds of bubble-like valuations. Currently, the additional yield (or “spread”) that high-yield and investment grade corporate bonds provide over government bonds is trending towards historic lows. We believe that the current data does not suggest a drop in economic activity; however, valuations appear to be approaching expensive levels. Important to remember that price is what you pay; value is what you get.

We are treading cautiously.

Despite market valuations flying closer to the sun, there are always event-driven opportunities to study for potential investment.

Whether it’s the announcement of an acquisition one day or an abnormally large drop in a company’s security prices another, these are catalysts for due diligence. This may not always lead to an investment but, at a minimum, a learning has been tapped.

We did, however, recently find two event-driven opportunities that warranted investment. In the last quarter of 2023, Fulcra purchased the bonds of Hawaiian Airlines (HA-Q) and First Quantum Minerals (FM-T).

In the case of HA, the catalyst for purchase was Alaska Airlines’ formal offer to buy HA. While a previously announced merger in the airlines space (Jet Blue to buy Spirit Airlines) has yet and may never receive regulatory approval, the smaller size of Hawaiian Airlines with minimal penetration into the continental United States improves the chances of a regulatory blessing in our opinion. Importantly, even if the transaction isn’t approved, we like the company’s recently improved operational trajectory of its business, which should limit downside risk.

With FM, the catalyst was the Panamanian government expropriating a prized copper mine. Quickly and correctly, this led to market assumptions that the company would breach a cash flow-to-debt covenant, which weighed on the price of its bonds. However, those investors selling the bonds seemed to underestimate, in our opinion, the ability of FM, with producing and prospective assets elsewhere, to navigate a path to manage its debt load. While overturning the expropriation or receiving compensation is probable, this is not part of our thesis, as it may take many years of litigation in international courts.

We are still of the mind that the sharp spike in interest rates over the last two years has yet to fully play its way through the economy and expect that this will lead to the market repricing risk assets lower in the near to medium term. Whether through the realization that rates may stay higher than expectations and/or an earnings recession it would appear the potential for market disruption is quite high.