The bond Bear

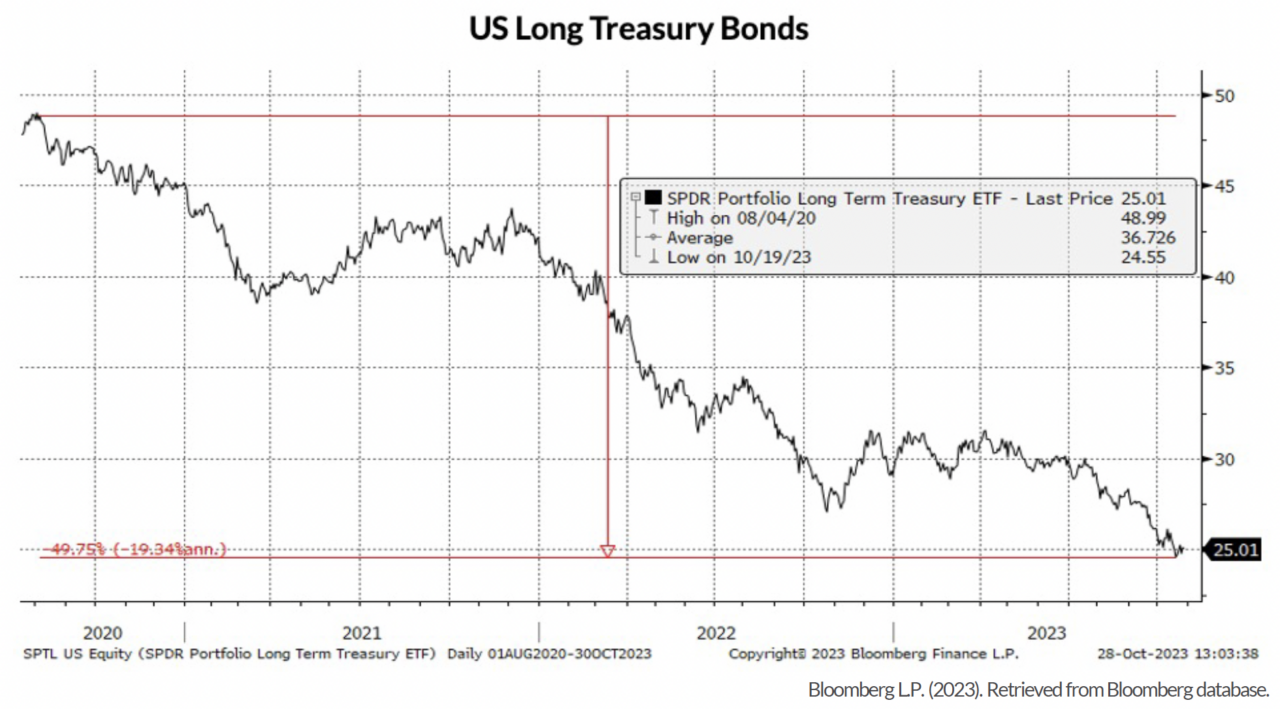

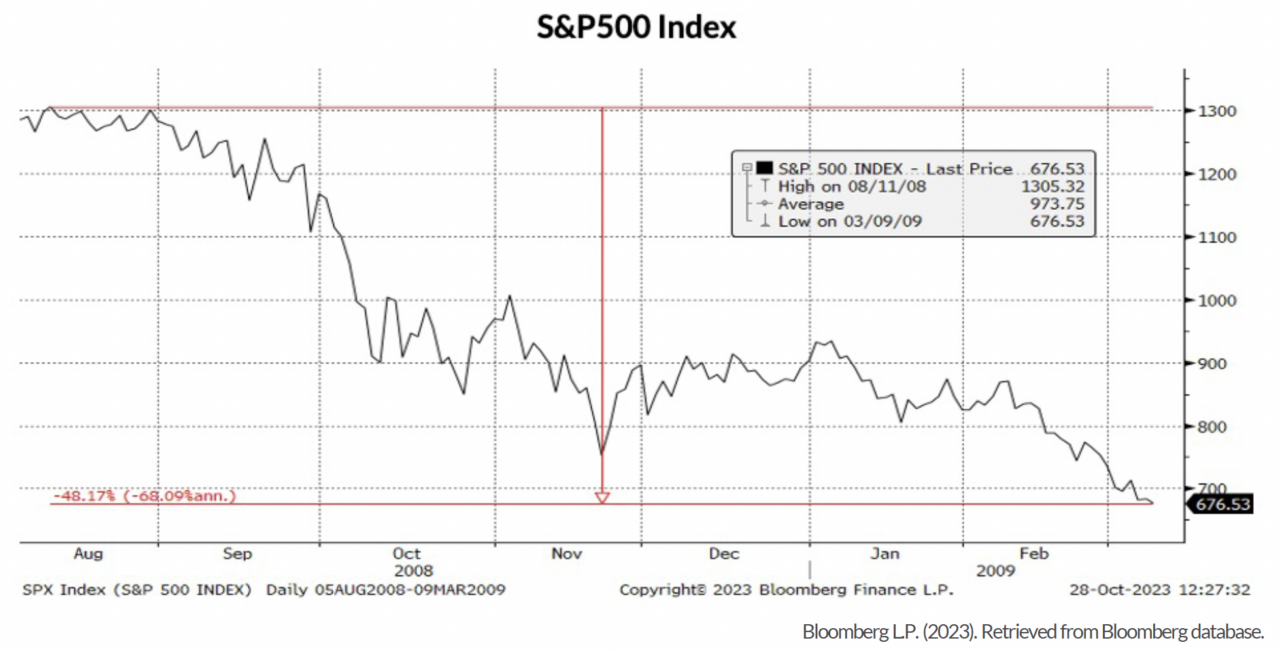

The weekends after the end of Q3, the bear market in US Treasury long duration bonds surpassed the cumulative peak-to-trough declines in the S&P 500 index during the 2008-2009 financial crisis. While it took US Treasury long bonds two and a half years longer to reach this nadir, it is cold comfort for investors that looked to government bonds for safety.

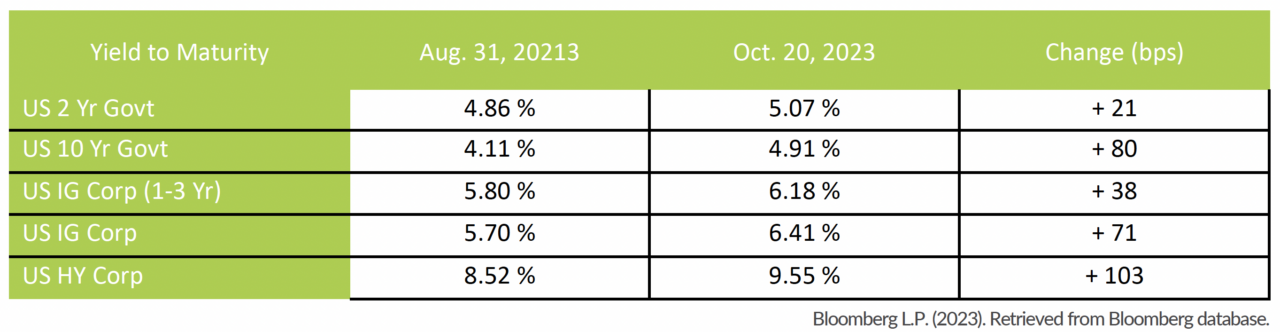

Of course, with lower bond prices typically comes higher yields, which is great for investors but directly less so for governments and corporate bond issuers. To this point, October 2023 has been one of the slowest months for corporate bond issuance in the last decade. The spike in yields since the end of the summer has been particularly dramatic, as shown in table below.

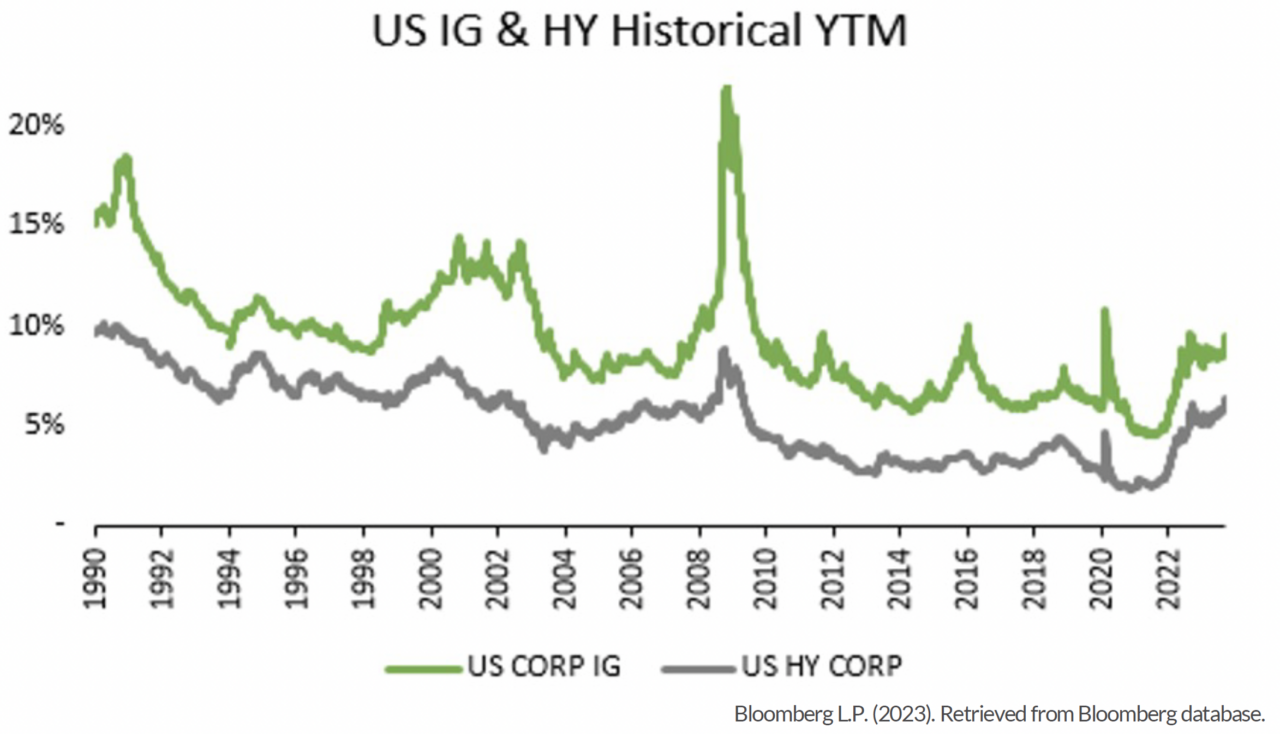

As we have alluded to in our commentaries over the last two years, investors need to be mindful of the implications that higher interest rates may have on asset values. We aren’t in the business of predicting where interest rates are going but as one can see in the graph below, we are clearly not in unprecedented times as far as the absolute level of interest rates is concerned.

As a discerning credit investor, this presents the best of opportunity sets. On one hand, as indicated in the table above, there are attractive yields from investment grade, short duration bonds – which in the summer, even provided higher yields than their longer duration sibling. On the other, higher total return opportunities in companies whose balance sheets are not prepared for this higher cost of capital environment see the transfer of corporate direction / ownership to creditors the most prudent path forward.

Notably, in between the high-quality short duration corporate bond opportunities of today and the potential distressed opportunity on the horizon lies billions of dollars of longer duration (5 to 15 years), investment grade bonds and upper-tier, high yield corporate bonds. As a result of the low interest rate environment of years past, the prices of these issuers low coupon bonds have been taken out to the woodshed along with government bonds. Depending on each bonds’ duration and the size of coupon, these bonds have dropped between $5 and $30 in price. In Fulcra’s opinion, this subset of corporate bonds is particularly sensitive to positive event risk.

Higher interest rates will likely increase default rates. This can cast a shadow over high yield bonds generally, depressing the price of all bonds, some unnecessarily so, creating shorter term trading opportunities. In addition, attractive investment opportunities can result from a liquidation or balance sheet restructuring for price patient / sensitive investors. If executed properly, an investor can benefit from a more immediate return of capital through the liquidation of a company’s assets or the future economic benefits that can result from a de-levered balance sheet and streamlined operations.

In the world of investing, we’re inevitably faced with the cyclical nature of markets. Having the flexibility to shift, where there is the greatest opportunity is critical to long term performance. Not only does this apply to specific areas of credit markets but also to specific parts of companies’ balance sheets.

For example, Rite Aid filed for bankruptcy earlier in October and Fulcra’s investment in the secured bonds represents an opportunity to benefit from the possible liquidation of the business’s assets. Furthermore, the restructuring process could create some competitive tension as the company has in the past had suitors (Walgreens and Albertsons) pursue a purchase of their whole business. While the Federal Trade Commission (FTC) rejected these bids at the time, the retail pharmacy business has since experienced increase in competition. While the bankruptcy process can be difficult to predict, precedent cases and transactions as well as asset values can provide the guideposts for recoveries. With Rite Aid’s secured bonds marked at $71, we like the risk reward trade off.

While a decline in distressed opportunities may emerge, our current focus is on short duration; higher quality duration corporates as we look to see how the current rate of interest rates affects broader corporate performance.