Uncertainty Breeds Market Contempt

The theme of our April 2025 Market Observer was that only a fool would try to predict what would happen to the financial markets and the global economies after Donald Trump declared his Tariff War on the World. The more expertise you possessed, the less you were probably able to forecast the actual outcome. As they say, it’s not over until it’s over but rising equity markets and tightening credit spreads weren’t most experts’ first choice, but that’s what has happened.

Beautiful Tariffs Make Beautiful Markets

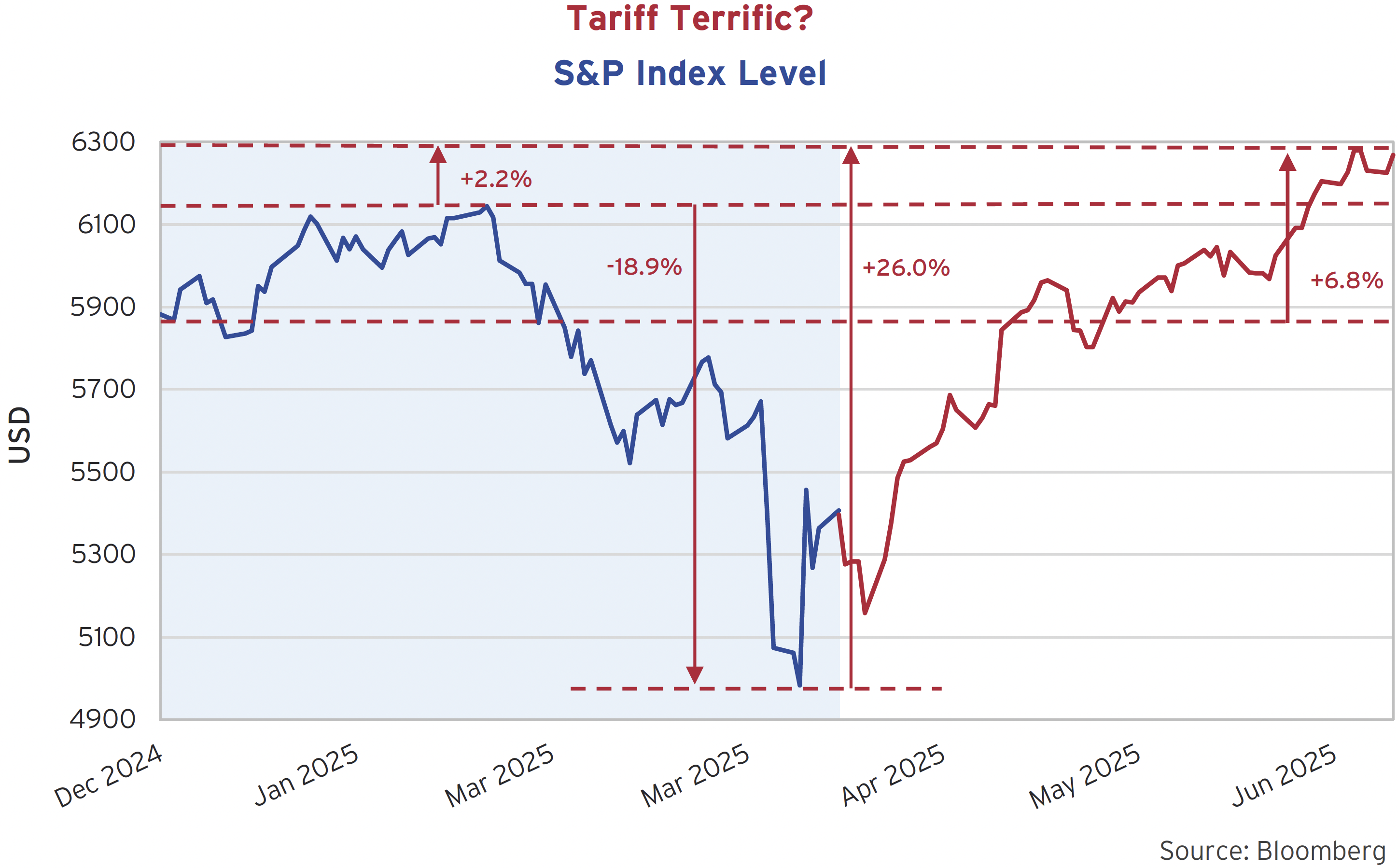

Who knew that Trump’s Beautiful Tariffs would eventually lead to today’s Beautiful Markets? It is often said that uncertainty is the enemy of the financial markets, but it now seems to feed their upwards frenzy. We’ve updated our last edition’s S&P 500 chart below.

As we said in April:

“The equity markets crashed after the Liberation Day’s tariffs went into effect on April 3rd. The tariffs were much higher than expected and the S&P closed at 4983 on April 8th down almost 20% from the post Trump inauguration high on February 19th at 6144. By Wednesday, April 9th, the markets were still going down. Despite saying the markets were “a little yippy”, Trump blinked. That afternoon, under huge pressure, he suspended his most egregious “Reciprocal” tariffs for 90 days and the stock market soared in relief.”1

And the equity markets have continued to soar ever since. The S&P 500 stock index in the U.S. has now surpassed its February all-time high by 2.2%, up 26.0% from its bottom on April 8th which puts it up 6.6% for the year. Other countries have done even better, with the Canadian TSX Index up 8% and the non-U.S. EAFE (Europe, Australasia and Far East) Index up 19.5%.

Don’t Worry, Be War Happy!!

What fascinates us is that this equity market enthusiasm is despite an unprecedented assault on the global trading order by the Trump Administration, continuing wars in Ukraine and Gaza, and a new one between Israel and Iran that the U.S. stepped into with its bombing of the Iranian nuclear facilities.

Yes, Trump backed off on his most outlandish tariffs but really only “paused” them for 90 days ending July 9th. He left many of his new tariffs in place at much higher levels than existing tariffs. He even raised his new steel and aluminum tariffs from 25% to 50%. His trade team boldly stated that they would do 90 trade deals in 90 days, but the clock ran out on July 9th. Trump, with his typical braggadocio, announced that he will “assign” 70% tariffs to countries that don’t negotiate with him. On July 7th, Trump announced tariffs on 14 countries, publicizing the letters he wrote to each country, with strategic allies and major trading partners Japan and Korea given 25% tariffs. This was combined with a pushback of the deadline for completing negotiations from July 9th to August 1st. Perhaps wondering if he would be accused of backing off once again by extending his deadline, Trump then placed a new 50% tariff on copper imports on July 8th and threatened a 200% tariff on pharmaceutical imports.

The stock markets seem to have taken this all in stride, perhaps realizing that Trump’s trade bark is worse than his trade bite. Indeed, Trump bristled at a reporter asking him about investors making the Trump Always Chickens Out (TACO) trade. Now investors seem to very much expect that Trump will back off from his extreme trade policies if it causes market disruption. This is despite Trump’s preference for disruption and blowing through established norms and systems. The Globe and Mail wondered if uncertainty is now fueling a rising market, despite the obvious risks:

“The policy chaos from U.S. President Donald Trump’s second term, most notably from tariffs, has led some companies to delay capital expenditures and hiring, and even to stop issuing guidance. It’s held clients back from making major life decisions. It’s forced countries to rethink supply chains, global alliances and defence spending, and led the Federal Reserve Board to hold interest rates.

So, does uncertainty even matter?

Bank of Montreal chief economist, Douglas Porter, highlighted the logic-defying nature of the past six months in a report published last week. Among the lessons investors can glean from stock performance this year is that “markets love uncertainty,” he wrote.

“What makes the rapid return to all-time highs especially notable is that many of the sources of uncertainty remain unresolved, including the reciprocal tariff deadline of July 9.””2

Not Bonding with Trump

The one financial market not jumping for joy over Trump is the U.S. Treasury (UST) bond market. As we pointed out in our April 2025 Market Observer, the bond market seems to be cautious on Trump’s trade and fiscal policy goals. The self-proclaimed “King of Debt” very much will deserve that title, after ramming through his One Big Beautiful Bill Act (OBBBA) that will substantially increase U.S. deficits and debt financing.

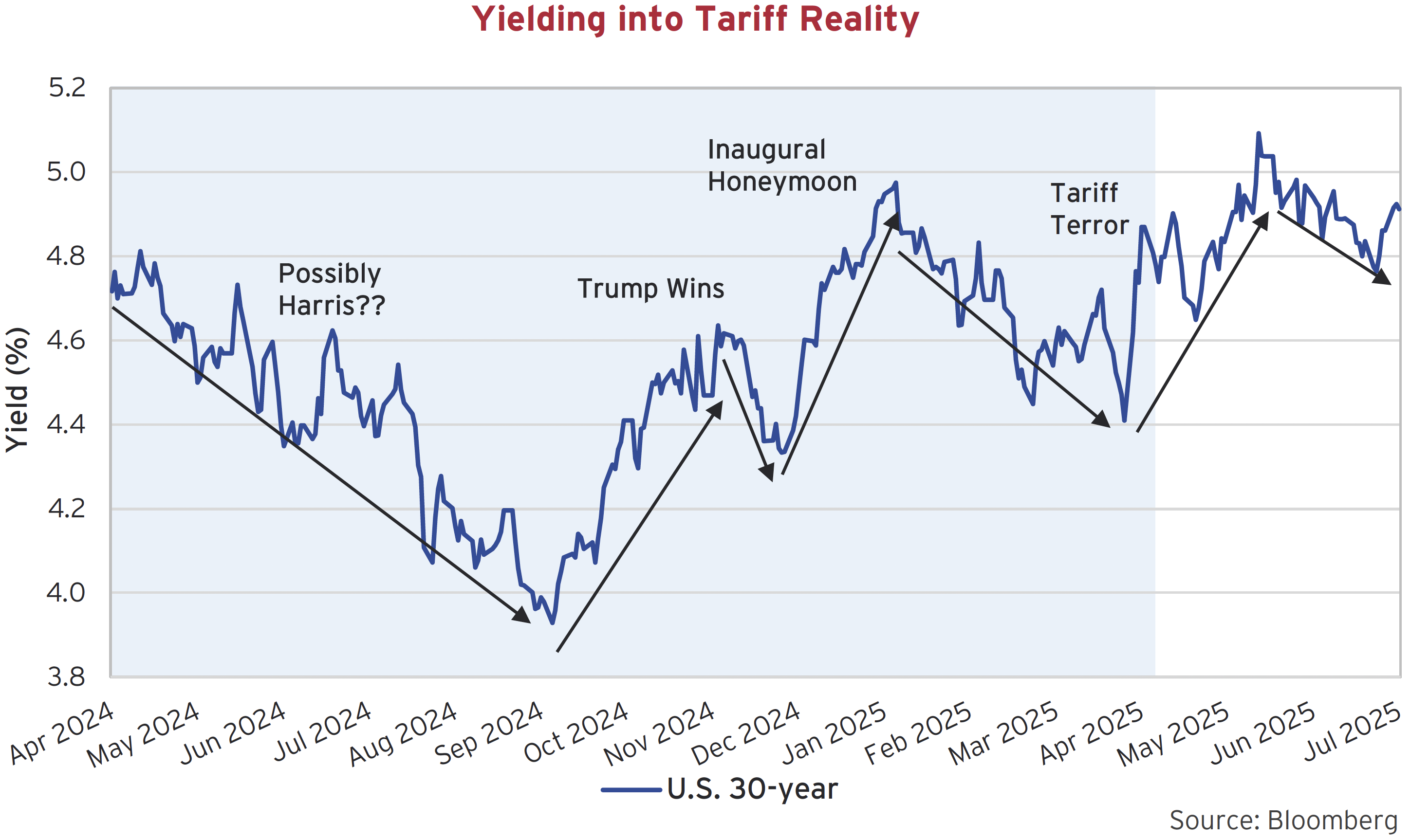

We again have updated our April 2025 Market Observer graph and repeat our commentary to give you a sense of what’s going on in the bond market:

“The long Treasury yield was declining in early 2024, following post-pandemic inflation down. Once Kamala Harris replaced Joe Biden as the Democratic Presidential nominee and the prospects of a Democrat President improved, that yield decline accelerated, with the long Treasury bottoming at just under 4% on September 1st. When the electoral prospects of Trump improved, the yield increased into the election and then dropped before again increasing to nearly 5% at year end 2024. Every President has an inaugural honeymoon, and Trump had his second. People gave him the benefit of not believing he would actually apply the “BEAUTIFUL TARIFFS” he campaigned on, with yields falling to 4.5%. Yields then soared on “Liberation Day” towards 5% and are only down slightly in the continuing tariff turmoil afterwards. In normal Trump fashion, he has declared victory:

“The bond market’s going good. It had a little moment but I solved that problem very quickly,” he said.”1

Trump’s bond problem solving proved to be temporary, as yields fell from their 4.9% peak to 4.7% before rising above 5% on China trade war angst. They have drifted down in June and so far in July to 4.91%, where they were when Trump was inaugurated but still far above the sub 4% level when it looked like Harris might win the election.

Fed Bashing Trumps Tariffs?

Certainly, the tumult and uncertainty caused by Trump’s trade policies are not helping but we also think Trump’s tirades and overt threats to the Federal Reserve have added to the bond market upset. Trump recently has written a very public note to Powell demanding lower interest rates from the Federal Reserve.

Trump recognizes that the U.S. Federal debt interest payments will increase with the OBBBA tax cuts and higher spending so he has now decided that he, as the “Decider in Chief”, will also control interest rates. Where Trump cajoled Powell publicly during Trump’s first term, contravening the unwritten tradition against that, he is now publicly and directly arguing for lower interest rates. It is a first for a President to overtly suggest replacing a Federal Reserve chair, but he’s also done that. Trump has followed that shocker with other insults and leaks about appointing someone early to make Powell a lame duck. Trump’s only prerequisite for a Fed Chair: “Lower Interest Rates!!” No wonder people holding USTs are wondering what their money will be worth!

Made for Television Trump Theatre??

We find it hard to understand where this all will end up. The U.S. economy has not weakened substantially, nor has inflation climbed on Trump’s policies. At least so far, since he’s suspended and changed up his tariffs faster than investors and businesspeople can incorporate into their decision making. One school of thought, as reported by Politico and MSN is that this is all just part of the plot for Trump’s White House reality show:

“According to a White House insider who is deeply involved in talks with U.S. trading partners, Donald Trump’s tariff threats are not to be taken seriously because they are just a “theatrical show” being put on by the attention-obsessed president…

After noting Trump himself was wavering this past week when he told reporters, “We could extend it, we could make it shorter. I’d like to make it shorter,” one insider offered a candid assessment about what is really going on.

“Trump knows the most interesting part of his presidency is the tariff conversation,” they admitted. “I find it hard to believe he’s going to surrender it that easily. It’s all fake. There’s no deadline. It’s a self-imposed landmark in this theatrical show, and that’s where we are.””3

Could it be true that the President of the United States just wants all the tariff drama for attention? Well, after President Trump and company excoriated President Zelensky of Ukraine in the Oval Office, Trump said “This is going to be great television.”4

Say Goodbye to Globalism and Free Trade

Perhaps it is all about an aging reality star looking to recreate his signature show on the global stage with his new catchphrase: “You’re Tariffed!” Whatever it is, the multilateral global trading and monetary order created by the U.S. in the aftermath of WW2 is now over. We think the tide of free trade and globalism is receding quickly. Quantitative economics and finance had created the efficient markets thinking that “assumed away” things like patriotism, religion and the human need for social interaction and identification. The political side of the old subject of Political Economy is again demonstrating that people are not the rational actors of modern economic theories. “Economic agents” of theory are people, neither dispassionate nor efficient in their economic thought and downright human in their real-life behaviour.

Whoa Canada!

This has important implications for Canada. We said in our April 2025 Market Observer that nobody could really predict what the outcome of Trump’s trade war would be, and we still think that is the case. Canadians have re-elected the Liberals under PM Mark Carney, who ran on a “Fight” and “Elbows Up” campaign to do battle with Trump that resonated with Canadians.

So far, Carney has quietly suspended many of his predecessor Trudeau’s tariffs and not responded to the U.S. increase on aluminum and steel tariffs from 25% to 50%. Carney also dropped the Digital Services Tax just before it went into effect, after Trump suspended all trade talks with Canada. The White House said that Canada and Carney “caved”:

“White House spokesperson Karoline Leavitt claimed at a press briefing Monday that it was the direct result of Trump’s Friday threat to end all trade negotiations with Canada if it went forward with the tax…

…“It’s very simple. Prime Minister Carney in Canada caved to President Trump and the United States of America,” Leavitt told reporters. “President Trump knows how to negotiate, and he knows that he is governing the best country and the best economy in this world, on this planet, and every country on the planet needs to have good trade relationships with the United States.””5

It’s something for the White House to trash talk Carney even if it were true. Of course, the Carney government couldn’t let the “caved” comment stand, so it spun that this was a masterstroke of a shrewd negotiator, who gave Trump a minor win to get a deal on what was really important.

Elbows Up or Turtling?

Carney seems to want to avoid angering Trump and save Canadians from the higher cost and inflation of retaliatory tariffs. We point out that a trade war is indeed a war and cannot be without pain and casualties unless one side unilaterally surrenders. If “Elbows Up” degenerates into “Turtling” (hockey for refusing to fight an opponent), which seems to be the current strategy, then we think Canada will be in a very weak position.

Canada will always be in a weak position in negotiations with our neighbour to the south. It was Justin Trudeau’s father Pierre who explained Canada’s relationship to the United States in a very understandable way:

“Living next to you (the U.S.) is in some ways like sleeping with an elephant. No matter how friendly and even-tempered the beast, one is affected by every twitch and grunt.”6

When Pierre Trudeau was PM, he tried to diversify trade away from the U.S. and build internal Canadian trade, as Carney is now considering. The reality of economic geography and provincial politics won out. It was the Conservatives under Mulroney that created the Free Trade Agreement (FTA) with the U.S. that really started economic integration with the U.S.

The problem now is that Canada is only 10% of the U.S. market and therefore it is very easy for American companies to scale to serve our Canadian market. Canadian companies that have scaled to serve the U.S. now send 90% of their production to American customers. That makes Trump’s “manufacture it in America” a major issue for Canadian exporters, as they are far more exposed to Trump’s tariff “twitches and grunts”. As we see it, Trump respects power. His take on Canada seems to be that we are not even a real country, so Carney has a very difficult job ahead of him. If Canada is worth fighting for, then you probably need to actually fight at some point.

Deficit and Debt Strong?

Carney and the Liberals are hampered by their minority government status and deficit financing. The Canadian economy is very exposed to manufacturing weakness from the Trump tariffs and its housing market dependency. There’s a reason the Liberals raised the maximum Canada Mortgage and Housing Corporation (CMHC) insurable house to $1.5 million, and Housing Minister Gregor Robertson thinks housing prices don’t need to come down:

“Canada’s new Housing and Infrastructure Minister Gregor Robertson says he doesn’t think housing prices need to come down, and that the federal government should focus on building more homes.

“No. I think that we need to deliver more supply, make sure the market is stable. It’s a huge part of our economy,” said Robertson on his way to the first meeting of Prime Minister Mark Carney’s new cabinet, when asked specifically if he thinks home prices needed to go down.”7

Interestingly, Minister Robertson has since come under criticism in Parliament for having a large personal real estate portfolio:

““After telling Canadians he didn’t want home prices to go down, we now learn the Liberal housing minister, Gregor Robertson, holds a $10-million real estate empire,” Davidson said in the House of Commons. “Canadians struggling to afford a home have every reason not to trust the Liberals on housing.”” 7

On the financing front, the Liberals have promised much in new spending to help Canadian exporters struggling with tariffs. They have also just promised to raise Canadian defence spending by $9 billion to bring it up to 2% of GDP by the end of this year. That will actually be the largest increase in the Canadian defence spending since the Cold War ended in 1989. In the 1970s Canada was spending 2.8% of GDP on our military that declined to a 1.2% low in 2006. A Washington Post report in 2023 said that PM Justin Trudeau told North Atlantic Treaty Organization (NATO) officials that Canadian defence spending would never reach the 2% target. The recent drive by the Carney Liberals to increase defence spending might seem patriotic on the part of the formerly “post-national” Liberals, but defence spending is probably the largest economic multiplier of any government spending. That makes it a pretty good way to offset tariff and housing market weakness.

There’s a good reason that the Carney Liberals have postponed a formal Budget and don’t really want to talk about the cost of their promises. They’ve obviously blown through the Trudeau budget that then Finance Minister Freeland resigned over. To quote from her resignation letter: “That means eschewing costly political gimmicks, which we can ill afford and which make Canadians doubt that we recognize the gravity of the moment.”8 A slowing economy and vastly increased defence spending make for a very difficult balancing act between social spending and the necessary support programs to tariff affected industries. That is even without the proposed increase in defence spending to 5% of GDP. This is perhaps why PM Carney has asked all government departments to look for cost saving measures.

Caution Required

All the delays and suspensions in Trump’s tariff wars are now taken as evidence by the markets that he’s not really serious about his “beautiful tariffs”. We point out that the cataclysmic WW2 started out with the “Phony War” that ended with huge loss of life and economic carnage. Can this trade war be fought with no losses? We doubt that will be the case.

In any event, we have continued to upgrade our portfolios, carrying on our post-pandemic sales of securities that we bought very cheaply. Yes, things sold off quickly after Trump’s declaration of trade war but then rallied hard after he quickly faded on his most preposterous positions. The expensive starting point made that sell off not that attractive to us. Our take was and is that Trump’s “sleight of hand” tactics have focused observers on his most ludicrous tariffs but obscured the actual reality. The 10% global tariffs, the 25% new automobile, the 50% steel and aluminum and the fentanyl tariffs are still there, as well as the brand new 50% copper tariff. They represent a complete repudiation of General Agreement on Tariffs and Trade (GATT) global trading rules and make a mockery of his so-called trade negotiations. Just the 10% “Base Tariff” on all countries is going to cause immense damage to international trade and the U.S. and other economies if they stay in force.

The Trump Tariff end game remains impossible to figure out, given the “Decider in Chief” can decide on anything at any time. How can one price in this uncertainty into the valuation of a security? Who knows, but when things are very expensive with this much uncertainty, then it is time to take profits and watch cautiously from the sidelines.

Footnotes:

- Source: Canso Investment Counsel Ltd. (2025, April). April 2025 Market Observer.

- Source: Burgess, Mark. (2025, July 4). Who cares about uncertainty anyway?

- Source: Boggioni, Tom. (2025, July 5). ‘It’s all fake’: White House insider admits Trump’s trade war is just for show.

- Source: McCreesh, Shawn. (2025, Feb 28). ‘This is going to be great television’: Trump sums up his showdown with Zelensky.

- Source: Blanchfield, Mike and Hawkins, Ari. (July 6, 2025). In tech tax ‘cave,’ Trump and Carney may have both gotten what they wanted.

- Source: Rjoseph1. (June 3, 2018). Trudeau calls tariffs ‘insulting’ while Trump aide labels it as ‘family quarrel’.

- Source: Aiello, Rachel. (May 14, 2025). Canada’s new housing minister doesn’t think prices need to come down.

- Source: CNC News. (Dec 16, 2024). Read Chrystia Freeland’s letter of resignation from Trudeau’s cabinet.