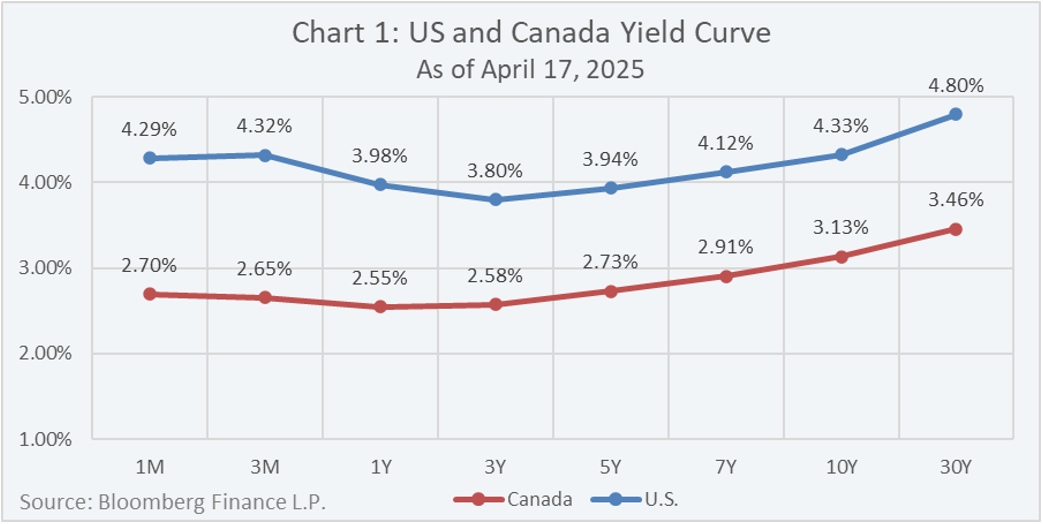

Why would anyone invest in Government of Canada bonds when they could achieve greater yields by investing in the US Treasuries?

Based on the US and Canada yield curves illustrated in Chart 1, investors could achieve attractive yield premiums, greater than 1.0%, by investing in US Treasuries instead of Government of Canada bonds at different tenors.

Is investing in US Treasuries an obvious “free lunch” for Canadian investors?

Two Investment Decisions

When investing in a security based in another country, Canadian investors must consider the currency of their target investment. For example, Canadian investors’ home currency is Canadian dollars, while US Treasuries are issued in US dollars; therefore, a Canadian investment in US Treasuries can be viewed as making two separate investments:

1) the US Treasury asset, and

2) the US dollar currency.

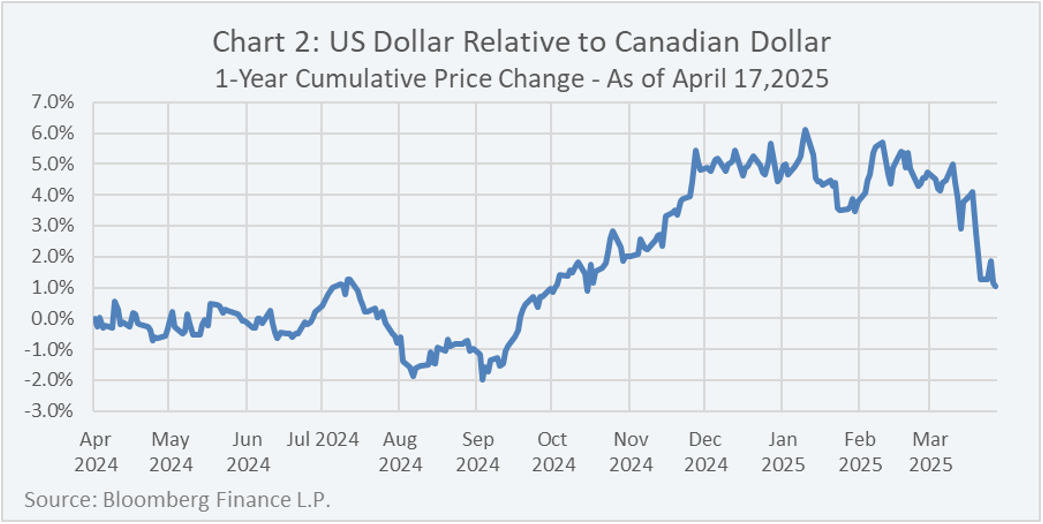

Currency is notoriously volatile, and their movements are difficult to predict. Chart 2 shows the 1-year cumulative price change of the US dollar relative to the Canadian dollar. The key implication of the chart is currency movements greater than 1.0% (the approximate US Treasury yield premium) were a relatively common occurrence over the 1-year period. So, for Canadian investors, the yield advantage of a US Treasury over a Government of Canada bond could easily be offset from the depreciation of the US dollar – this is commonly known as “currency risk”.

Note: The US dollar could also appreciate, thereby enhancing Canadian investors’ returns, however the higher volatility profile of currency does not generally align with an investment in bonds, where investors are usually seeking a lower volatility profile.

Hedging Considerations

Investors may remove the impact of currency fluctuation through a process known as “hedging”. Currency hedging is often implemented using a derivative security known as a “forward”.

What is key for investors to understand with respect to currency forwards is they reduce the impact of currency fluctuations by setting a fixed exchange rate in the future. The future exchange rate is determined by the interest rate differential between the two currencies.

For example:

A Canadian investor wants to invest in a 1-Year US Treasury while hedging the currency.

Key information from Chart 1, as of April 17, 2025 – Note: for illustration purposes only:

1-Year US Treasury yield: 3.98%

1-Year Canada yield: 2.55%

USD/CAD Spot Rate: $0.72578

USD/CAD 1-Year Forward Exchange Rate: (1+1Yr US Yield) ÷ (1+1Yr Canada Yield) x USD/CAD Spot Rate = (1+0.398) ÷ (1+0.0255) x 0.72578 = $0.7359

Therefore, the expected hedged return of the Canadian investor in the 1-Year US Treasury is approximately 2.55% (i.e. 3.98% from the 1-Year US Treasury yield, while also factoring a 1.375% decline in the US dollar forward rate from the current spot rate).

Conclusion

With US bonds currently offering attractive yield premiums over Canadian bonds, it may be tempting for Canadian investors to take advantage of the apparent “free lunch” south of the border.

Investing in US Treasuries without hedging the currency exposes the investor to the volatility of the currency, which may add more risk to the investment than the investor intended. However, by hedging the currency, it mostly negates the yield advantage the Canadian investor was looking to capture.

The bottom line, Canadian investors do not achieve a material yield advantage by investing in foreign government bonds after hedging the currency. However, Canadian investors could potentially achieve an after-hedge yield advantage by investing in foreign corporate bonds, as the yield spread of a corporate bond over a government bond is not factored into currency hedging calculations.