In the fourth quarter of 2025, North American equity markets extended gains, but Canada notably outpaced the U.S. The S&P/TSX Composite Total Return Index continued to benefit from its heavier exposure to cyclical and commodity-linked areas. Strength in mining shares and energy helped the index.

Monetary policy was supportive into year-end adding to the positive sentiment. The Federal Reserve cut rates in December 2025, lowering the target range for the federal funds rate by twenty-five basis points to 3.5%–3.75%. In Canada, the Bank of Canada held its policy rate at 2.25% in its December 10, 2025, decision, maintaining a stance that was broadly consistent with inflation being under better control.

The U.S. economy in the fourth quarter of 2025 continued to look resilient but cooling strong enough to support corporate fundamentals, yet soft enough to justify easing. Inflation data at year-end showed headline CPI up 2.7% year over year in December 2025, indicating that inflation remained materially lower than peak levels and relatively stable heading into 2026. Canada’s economic picture in the fourth quarter was mixed. While inflation was near target levels, unemployment levels remined high and growth slowed.

As the Chart below indicates, the price of gold has risen dramatically in the past year and is at all time highs.

Investors typically jump into gold in times of uncertainty. Geopolitical risks are elevated compared with recent years. The threat of a broader European war arising out of the Ukraine/Russia conflict, and concerns over China’s possible invasion of Taiwan have all been well reported. More recently, the invasion of Venezuela and protests in Tehran have added to geopolitical tensions.

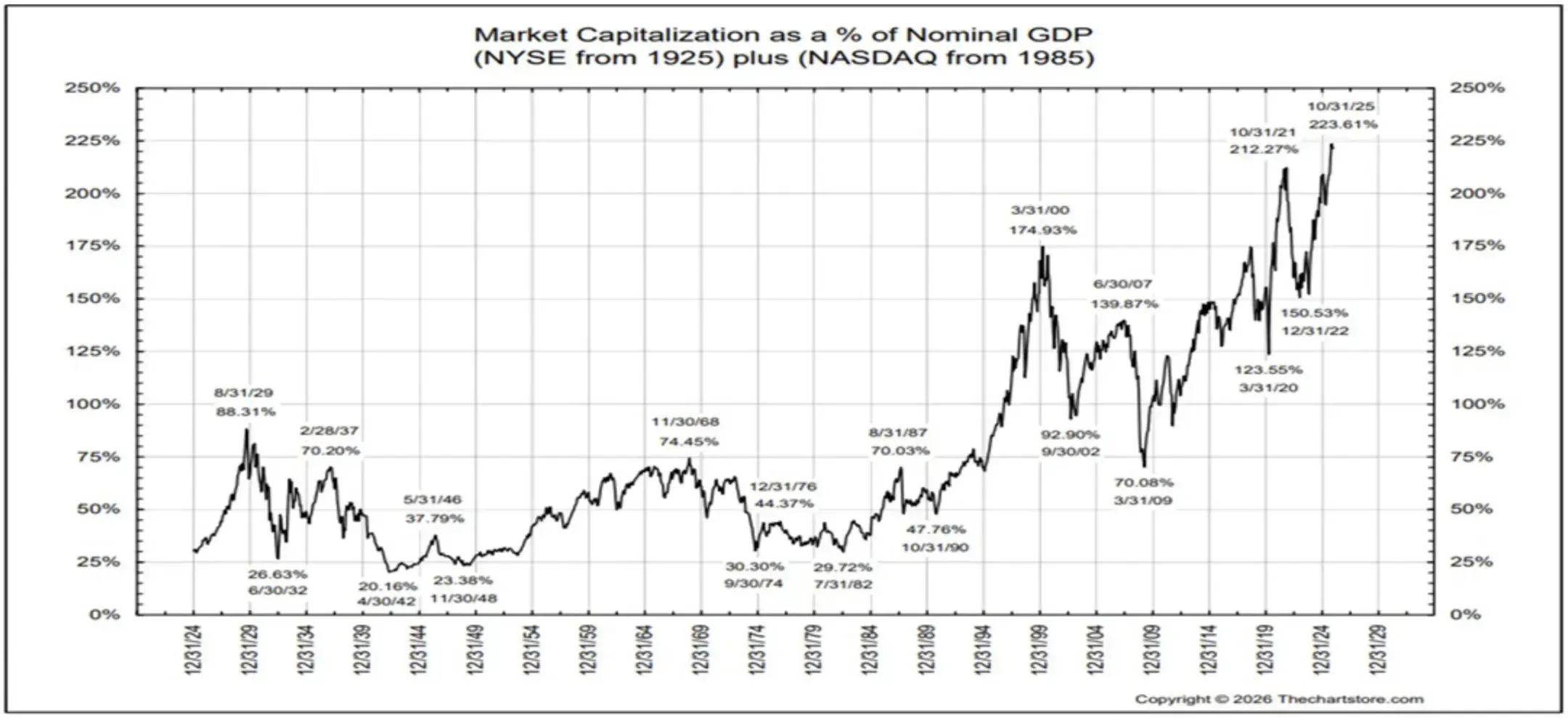

Typically, major indices fall as investors flee to gold as protection against the aforementioned risks. However, during the past year, North American markets have reached record highs. This situation is highly unusual and intellectually inconsistent. Intellectual inconsistencies eventually correct themselves. In this case, the geopolitical concern(s) materialize and impact equity markets negatively, or they pass without major incident(s) and the price of gold falls.

We believe Lysander Patient Capital Equity Fund (the “Fund”) continues to be positioned for current market conditions. As of December 31, 2025, the Fund’s total portfolio yield was 4.2% and the portfolio’s overall characteristics continue to compare favorably to major equity indexes such as the S&P 500 Index, and the S&P/TSX Composite. Relative performance versus the S&P 500 and the S&P/TSX Composite Total Return Index in 2025 was influenced by a lack of exposure to mega-cap technology and precious metals and materials companies in the United States and Canada, respectively. The Fund’s value-based investment philosophy remains disciplined and, in our view, is designed to compound through cycles by emphasizing fundamentals and valuation rather than chasing momentum, especially in years when index returns are driven by narrow leadership.