Dear Investors,

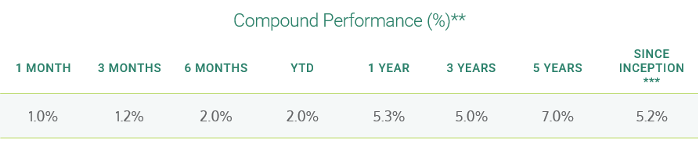

We’re now halfway through the year, and as of June 30th, the Series F units of Lysander-Fulcra Corporate Securities Fund have returned 2.0% for 2025.

***Inception: December 30, 2016

Credit markets continued to recover from the initial shock of Trump’s tariff actions. The Bloomberg US Corporate High Yield Index ended the month at an option-adjusted spread to treasuries of +292 basis points, back to levels last seen in March 2025.1

June’s primary market activity was the busiest it has been all year for sub-investment grade issuers.

Of note, commodity markets have jumped into focus for several reasons. Gold has been very strong in 2025 on US dollar weakness, copper continues to benefit from the structural trend of electrification, rare earth metals gained attention from China’s retaliatory tariffs, and energy prices rose on US military tensions with Iran.

At a sector level, high-yield bonds in metals & mining and energy rallied the most in June 2025.

Portfolio Update

On June 24th, portfolio company WW International, Inc., more commonly known as WeightWatchers, had its Chapter 11 reorganization plan put into effect. The company converted $1.15 billion of debt into $465 million of new debt, and pre-bankruptcy first lien lenders received 91% of the reorganized equity.

On July 1st, WeightWatchers and Novo Nordisk announced an expanded collaboration whereby Wegovy®, Novo Nordisk’s semaglutide injectable prescription medicine would be offered to Weightwatchers Clinic members for US$299 in July, a $200 savings offer.2

The market viewed this development as a major positive, and the valuation of the reorganized equity increased to nearly $400 million.

For reference, financial advisor PJT Partners gave a range of $103 million and $503 million as their estimate for the value of WeightWatchers’ equity at emergence from restructuring.

Outlook

Market sentiment has significantly improved as we head into the summer months.

This is now reflected in a return to expensive equity market valuations and declining corporate credit spreads.

Interest rates will continue to be a focus for investors as inflation concerns and increased US government spending, fueled by the enactment of the One Big Beautiful Bill Act, impacting the market for US treasuries.

We believe, barring a negative macro event, the summer “grind” could be on for risk assets. If sentiment remains strong and primary market demand remains high, we expect companies with high leverage will continue to actively refinance their near-term maturities.

Sincerely,

Fulcra Asset Management

Source

- Bloomberg LP.

- “WeightWatchers and Novo Nordisk Expand Collaboration to Improve Medication Access Through Trusted, Holistic Model of Care” (2025, July 01). WW International Inc. https://corporate.ww.com/news/default.aspx